Search Market Research Report

Agricultural Testing Market Size, Share Global Analysis Report, 2022 – 2028

Agricultural Testing Market Size, Share, Growth Analysis Report By Sample (Soil, Water, Seed, Compost, Manure, Biosolids, Plant Tissue), By Application (Safety Testing, Quality Assurance), By Technology (Conventional, Rapid), and By Region - Global and Regional Industry Insights, Overview, Comprehensive Analysis, Trends, Statistical Research, Market Intelligence, Historical Data and Forecast 2022 – 2028

Industry Insights

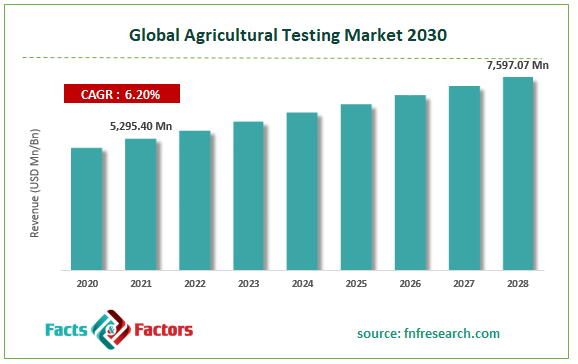

[202+ Pages Report] According to Facts and Factors, the global agricultural testing market size was worth USD 5,295.40 million in 2021 and is estimated to grow to USD 7,597.07 million by 2028, with a compound annual growth rate (CAGR) of approximately 6.20% over the forecast period. The report analyzes the agricultural testing market's drivers, restraints/challenges, and their effect on the demands during the projection period. In addition, the report explores emerging opportunities in the agricultural testing market.

Market Overview

Market Overview

Agricultural testing analyzes numerous samples of water, soil, seed, and other substances to ascertain their quality and degree of contamination. It assists in determining the best resources and inputs to complement the best plant development. In addition, it helps in figuring out the composition and other pertinent details of the provided sample. Farmers and the agriculture industry as a whole have benefited from agricultural testing. Increased cases of contamination of agricultural products, food, and feed at the beginning of the supply chain are to blame for disease outbreaks and poisoning in both livestock and humans. This is due to the growing complexity of the supply chain, lack of adoption of good agricultural practices, and lack of proper sanitation and hygiene. Consumers, farmers, producers of hay animals, and regulatory bodies are becoming more concerned about this.

Furthermore, many procedures have been established in industrialized economies, and a suitable framework for motoring policies is in place. The supply chain now has more transparency because of this tight enforcement. This policy and framework are in place to ensure that contaminated food and agricultural goods are rejected at the border and quarantined appropriately. In addition to this framework, those who violate it have faced penalties and had their licenses taken away. Therefore, adhering to the strict safety and quality standards established by the government is increasingly being used as a preventative approach. However, testing other samples, such as water, seed, soil, and composition, needs a good link between the market's shareholders and the infrastructure that supports them, in addition to the regulatory authorities. Furthermore, during the forecast period, factors like the high cost of Sample preparation may restrain the growth of the global agricultural testing market.

Covid-19 Impact:

Covid-19 Impact:

COVID-19 will probably only have a short-term impact on the soil testing industry. The global pandemic has very little of an effect on the market because agricultural testing is dominated by quality assurance, which helps to solve major issues with soil fertility, the quality of the water available for irrigational facilities, and identifying the necessary nutrients for more robust growth and development of crops and other agricultural products.

Key Insights

Key Insights

- As per the analysis shared by our research analyst, the global agricultural testing market value is expected to grow at a CAGR of 6.20% over the forecast period.

- In terms of revenue, the global agricultural testing market size was valued at around USD 5,295.40 million in 2021 and is projected to reach USD 7,597.07 million by 2028.

- The growing demand for sustainable agriculture methods and the strict safety and quality requirements are driving the expansion of the agricultural testing market, which has been encouraging the growth of the worldwide agricultural testing market.

- By sample, the soil category dominated the market in 2021.

- By application, the quality assurance category dominated the market in 2021.

- The Asia-Pacific dominated the global agricultural testing market in 2021.

Growth Drivers

Growth Drivers

- The development of new soil testing methods drives the market growth

Farmers are starting to use soil testing techniques more often. This is mostly because wastewater and industrial effluents are contaminating soil more often. For instance, it is believed that there are 80,000 soil contamination sites in Australia, that 16% of China's total soils and 19% of its agricultural soils are contaminated, and that there are over 3 million sites that may be affected in the European Economic Area and the West Balkans. So, the relevance of soil testing has increased due to the rising soil pollution worldwide. By identifying the soil's texture, composition, and fertility level, agricultural soil testing aids in soil analysis.

Restraints

Restraints

- Lack of technical knowledge or competence among farmers may hinder the market growth

Due to several adverse variables, the revenue growth of the worldwide agricultural testing market is severely constrained. Over the projected period, it is anticipated that factors such as a lack of technical knowledge or competence among farmers, particularly in rural or undeveloped areas, and a lack of awareness of agricultural testing techniques and their long-term advantages would restrain market revenue development. Inadequate agricultural infrastructure, particularly in emerging nations, and growing prices of modern agricultural testing services and equipment are further reasons that limit market revenue development.

Opportunity

Opportunity

- Leading companies in the global agricultural testing industry present market opportunities

Leading players in the global agricultural testing market are experiencing significant opportunities for revenue growth as a result of factors such as the increasing focus of agrotech (agricultural technology) companies on developing next-generation agricultural soil testing & analysis services and the expansion of research programs combining high-quality science, cutting-edge technology, and practical knowledge to develop advanced soil testing solutions. As an illustration, element materials technology, a top provider of material testing solutions, offers thorough, sophisticated agricultural soil testing services, such as soil quality testing, macronutrient and micronutrient analysis, manure analysis, water analysis, plant tissue analysis, carbon analysis, clubroot quantification, and analysis of other crucial variables like electrical conductivity, cation exchange capacity (CEC), base saturation, and organic matter.

Challenges

Challenges

- Poor quality agricultural testing procedures in emerging nations may hinder the market growth

The production and distribution of fake agricultural testing equipment are anticipated to pose a significant challenge to firms already active in the organized agriculture testing sector. The manufacture and trading of fake and inferior testing kits are made easier by the accessibility of technology and regulatory framework flaws. Farmers in developing nations like India, China, Indonesia, and South Africa suffer financial losses due to the disorganized agriculture testing industry's production of subpar quality tests. This aspect will restrain the market's expansion for agricultural testing during the anticipated time.

Segmentation Analysis

Segmentation Analysis

The global agricultural testing market is segregated based on the sample, application, and technology.

Based on the sample, the market is classified into soil, water, seed, compost, manure, biosolids, and plant tissue. The soil sector dominated the agricultural testing market in 2021. By identifying nutrient inadequacies, possible toxicities from excessive fertility, and inhibitions brought on by the presence of non-essential trace elements, soil testing aids in determining the fertility or predicted improvement of the soil. The detailed tests are intended to help towns, farmers, environmental organizations, and others create soil management plans that are ecologically friendly. These tests aid in monitoring soils modified with biosolids or other materials for major and trace elements.

The market is classified into safety testing and quality assurance based on application. In 2021, the agricultural testing market's quality assurance sector had the greatest market share. Because it assists in proactively resolving significant issues related to soil fertility, available water quality for irrigational facilities, and identifies required nutrients essential for more robust growth and development of crops and other agricultural produce, quality assurance has become predominant in agricultural testing. All the planned and systematic actions carried out under the quality system can assure customers that a product will meet quality criteria.

Based on technology, the market is classified into conventional and rapid. The rapid category dominated the market for agricultural testing in 2021. The rapid technology market is driven by quick turnaround times, increased accuracy and sensitivity, and the ability to test for various pollutants. The polymerase chain reaction has the biggest market share in the fast technology sector. A polymerase chain reaction is a typical laboratory approach for producing several copies of a specific DNA sequence. Any DNA region the experimenter is interested in can be this one.

Recent Development:

Recent Development:

- March 2022: Australian Precision Ag Laboratory (APAL), a business that does agricultural testing in Australia, was bought by Eurofins Agro Testing, a major subsidiary of Eurofins Scientific SE. A famous commercial legal firm with offices in Australia, Mills Oakley, helped the business with the purchase process. The most recent purchase, according to Eurofins, represents the company's entry into the Australian farming and agricultural testing industry.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2021 |

USD 5,295.40 Million |

Projected Market Size in 2028 |

USD 7,597.07 Million |

CAGR Growth Rate |

6.20% CAGR |

Base Year |

2021 |

Forecast Years |

2022-2028 |

Key Market Players |

SGS, Bureau Veritas, Intertek, Eurofins, TÜV Nord Group, Merieux, AsureQuality, RJ Hill Laboratories and Agrifood Technology, Apal Agricultural Laboratory, SCS Global, ALS Limited., and Others |

Key Segment |

By Sample, Application, Technology, and Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East &, Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Regional Landscape

Regional Landscape

- Asia-Pacific dominated the agricultural testing market in 2021

Throughout the forecast period, the Asia-Pacific agricultural testing market is anticipated to grow at the quickest rate in revenue in 2021. Major drivers of the Asia-Pacific market revenue growth include the region's rapidly expanding population, increasing demand for food and agricultural products, increasing agricultural activity—mostly in developing nations like China and India—increasing use of advanced agricultural testing techniques, and rising producer awareness of the advantages of agricultural testing. The region's market revenue is anticipated to continue to grow due to rapid industrialization, rising levels of environmental pollution, an increase in the demand for agricultural testing services to prevent soil degradation or over-fertilization, and rising government investments in the agriculture sector.

Competitive Landscape

Competitive Landscape

- SGS

- Bureau Veritas

- Intertek

- Eurofins

- TÜV Nord Group

- Merieux

- AsureQuality

- RJ Hill Laboratories

- Agrifood Technology

- Apal Agricultural Laboratory

- SCS Global

- ALS Limited.

Global Agricultural Testing Market is segmented as follows:

By Sample

By Sample

- Soil

- Water

- Seed

- Compost

- Manure

- Biosolids

- Plant tissue

By Application

By Application

- Safety testing

- Quality assurance

By Technology

By Technology

- Conventional

- Rapid

By Regional Segment Analysis

By Regional Segment Analysis

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Nordic Countries

- Denmark

- Sweden

- Norway

- Benelux Union

- Belgium

- The Netherlands

- Luxembourg

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Southeast Asia

- Indonesia

- Thailand

- Malaysia

- Singapore

- Rest of Southeast Asia

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Industry Major Market Players

- SGS

- Bureau Veritas

- Intertek

- Eurofins

- TÜV Nord Group

- Merieux

- AsureQuality

- RJ Hill Laboratories

- Agrifood Technology

- Apal Agricultural Laboratory

- SCS Global

- ALS Limited.

Frequently Asked Questions

Copyright © 2024 - 2025, All Rights Reserved, Facts and Factors