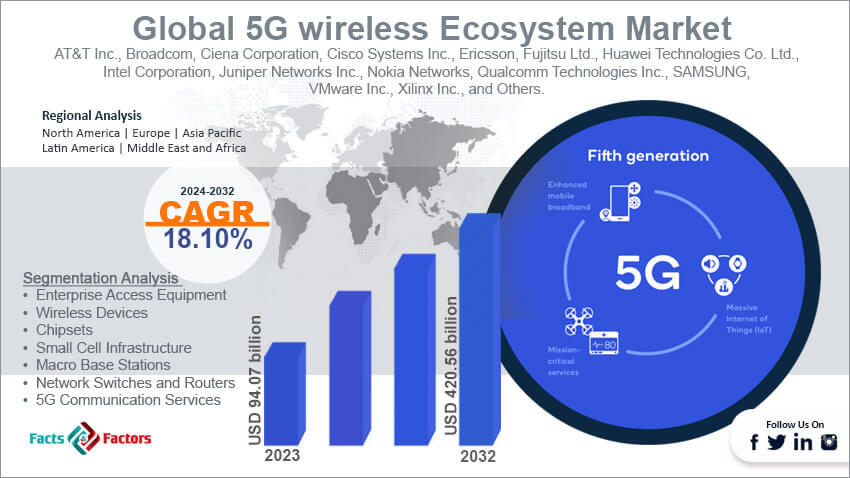

The analysis-intensive report provides key insights into companies and organizations operating in the global 5G Wireless Ecosystem market. The study further makes a relative examination of the organizations highlighting essential business parameters such as geographic presence, company overviews, strengths, recent developments, competitive strategies, and market trends. Recent enterprise developments including novel product launches, joint ventures, partnerships, strategic alliances, mergers & acquisitions, and product development are elaborated upon in the report. The in-depth study thus facilitates a comprehensive analysis of market competition.

Browse Complete Report: https://www.fnfresearch.com/5g-wireless-ecosystem-market

Competitive Landscape of Top 10 Key Players in the 5G Wireless Ecosystem Market

The 5G Wireless Ecosystem Market is a rapidly expanding sector, driven by the global demand for faster and more reliable connectivity. Here is a detailed overview of the top 10 key players, including their company backgrounds, strengths, recent developments, and strategies, along with insights into recent market trends.

- Qualcomm

- Origin: USA

- Headquarters: San Diego, California, USA

- Founded: 1985

- Employees: ~45,000

- Revenue: $44 billion (2022)

Company Overview: Qualcomm is a leader in semiconductor technology, particularly in 5G chipsets and modem solutions. It has played a pivotal role in developing the 5G standard.

Strengths: Strong R&D in semiconductor innovation; broad partnerships with device manufacturers.

Recent Developments: Continuous advancements in 5G modem technology, including the Snapdragon 5G chipset, which supports devices worldwide.

Strategies: Focus on innovation and partnerships to expand the 5G infrastructure and enhance connectivity across multiple industries

- Nokia

- Origin: Finland

- Headquarters: Espoo, Finland

- Founded: 1865

- Employees: ~87,000

- Revenue: €22.2 billion (2022)

Company Overview: Nokia is a key provider of telecommunications infrastructure, offering comprehensive 5G solutions, including hardware and software.

Strengths: Deep expertise in telecommunications; strong global presence and partnerships with mobile network operators.

Recent Developments: Collaboration with operators to deploy 5G networks across Europe and Asia.

Strategies: Invest in R&D for 5G advancements and build strategic alliances with network operators to expand global reach.

- Huawei Technologies

- Origin: China

- Headquarters: Shenzhen, China

- Founded: 1987

- Employees: ~197,000

- Revenue: $93 billion (2022)

Company Overview: Huawei is a global leader in ICT solutions and has been a front-runner in 5G technology development, offering complete 5G infrastructure solutions.

Strengths: Comprehensive 5G solutions portfolio; robust R&D capabilities.

Recent Developments: Expansion into emerging markets and continued innovation despite facing regulatory challenges in the West.

Strategies: Strengthen global presence by investing in emerging markets and diversifying its technology portfolio.

- Samsung Electronics

- Origin: South Korea

- Headquarters: Suwon, South Korea

- Founded: 1938

- Employees: ~266,000

- Revenue: $233 billion (2022)

Company Overview: Samsung is not only a leading smartphone manufacturer but also a key player in the 5G infrastructure sector, providing end-to-end 5G solutions.

Strengths: Strong device integration; leadership in semiconductor technology.

Recent Developments: Launch of new 5G chipsets and expansion of 5G network solutions to telecom operators worldwide.

Strategies: Leverage device and infrastructure synergy to drive 5G adoption.

- Ericsson

- Origin: Sweden

- Headquarters: Stockholm, Sweden

- Founded: 1876

- Employees: ~101,000

- Revenue: $26.4 billion (2022)

Company Overview: Ericsson is one of the leading global providers of 5G infrastructure, offering advanced software and hardware solutions for telecommunications.

Strengths: Strong R&D investment; strategic partnerships with major telecom operators.

Recent Developments: Expansion of 5G trials and networks in Europe, North America, and Asia.

Strategies: Innovate through software-based solutions and expand partnerships to capture a broader market.

- ZTE Corporation

- Origin: China

- Headquarters: Shenzhen, China

- Founded: 1985

- Employees: ~90,000

- Revenue: $15.7 billion (2022)

Company Overview: ZTE is a leading provider of telecommunications equipment and is heavily involved in 5G network development, including infrastructure and IoT solutions.

Strengths: Comprehensive product range; cost-effective solutions.

Recent Developments: Partnerships to deploy 5G networks in developing regions.

Strategies: Focus on cost leadership and expand into emerging markets.

- Intel Corporation

- Origin: USA

- Headquarters: Santa Clara, California, USA

- Founded: 1968

- Employees: ~121,000

- Revenue: $63 billion (2022)

Company Overview: Intel is a key player in the semiconductor industry, providing chipsets and infrastructure for 5G networks.

Strengths: Strong semiconductor manufacturing capabilities; R&D in advanced processing technology.

Recent Developments: Development of 5G modems and partnerships to integrate 5G across various devices.

Strategies: Drive innovation in 5G chipsets and expand into new verticals like autonomous vehicles and smart cities.

- Cisco Systems

- Origin: USA

- Headquarters: San Jose, California, USA

- Founded: 1984

- Employees: ~83,000

- Revenue: $51.6 billion (2022)

Company Overview: Cisco specializes in networking hardware and software, playing a significant role in building the 5G infrastructure.

Strengths: Expertise in networking; strong product portfolio in cloud and edge computing.

Recent Developments: Introduction of new 5G-ready routers and software solutions to optimize network performance.

Strategies: Leverage cloud and edge solutions to enhance 5G network management.

- AT&T

- Origin: USA

- Headquarters: Dallas, Texas, USA

- Founded: 1983

- Employees: ~160,000

- Revenue: $120.7 billion (2022)

Company Overview: A major telecommunications operator, AT&T is actively deploying 5G networks across the USA, focusing on enhancing network coverage and capacity.

Strengths: Strong network infrastructure and customer base.

Recent Developments: Expansion of 5G coverage to more U.S. cities and investment in edge computing.

Strategies: Focus on 5G network expansion and enterprise solutions like smart cities.

- Vodafone

- Origin: UK

- Headquarters: London, UK

- Founded: 1984

- Employees: ~95,000

- Revenue: $49.5 billion (2022)

Company Overview: Vodafone is a global telecommunications company, leading 5G network deployments across Europe and other regions.

Strengths: Extensive global network; strong presence in multiple markets.

Recent Developments: Expansion of 5G services across Europe and collaborations for 5G-enabled solutions in smart industries.

Strategies: Focus on cross-industry collaborations to drive 5G adoption across sectors.

Recent Market Trends:

- Increased Investment in Infrastructure: Telecom companies are heavily investing in R&D and infrastructure to support widespread 5G deployment.

- Focus on IoT and Smart Cities: 5G enables better connectivity for IoT devices, supporting growth in sectors like autonomous vehicles, healthcare, and industrial automation.

- Emerging Markets Expansion: Growth opportunities are high in emerging regions where 5G is still in its early deployment phase

The 5G wireless ecosystem continues to evolve, with major players focusing on innovation, strategic partnerships, and global expansion to secure their positions in this rapidly growing market.

Read More Articles:

https://www.fnfresearch.com/precision-farming-market

https://www.fnfresearch.com/big-data-security-market