The analysis-intensive report provides key insights into companies and organizations operating in the global Arterial Stent market. The study further makes a relative examination of the organizations highlighting essential business parameters such as geographic presence, company overviews, strengths, recent developments, competitive strategies, and market trends. Recent enterprise developments including novel product launches, joint ventures, partnerships, strategic alliances, mergers & acquisitions, and product development are elaborated upon in the report. The in-depth study thus facilitates a comprehensive analysis of market competition.

Click here to read the complete article: https://www.fnfresearch.com/arterial-stent-market

Competitive Landscape of Top 10 Key Players in the Arterial Stent Market

The Arterial Stent Market is a critical component of the global cardiovascular treatment landscape, with rapid advancements in stent technology and rising demand due to the increasing incidence of heart-related disorders. Below is an overview of the top 10 key players in the arterial stent market, including details about their origins, headquarters, year of foundation, employee numbers, revenue, strengths, recent developments, competitive strategies, and market trends:

- Abbott Laboratories

- Origin: USA

- Headquarters: Abbott Park, Illinois, USA

- Year of Foundation: 1888

- Employees: 113,000 (2023)

- Revenue: $43 billion (2022)

Overview: Abbott is a global healthcare leader offering a wide range of coronary and peripheral stents, including drug-eluting stents like the Xience series.

Strengths: Innovation in stent technology, strong R&D capabilities, and a focus on patient-centric solutions.

Recent Developments: Launched the AI-powered Ultreon 1.0 software to enhance stent procedures.

Competitive Strategies: Focus on digital solutions and expanding into emerging markets.

- Boston Scientific Corporation

- Origin: USA

- Headquarters: Marlborough, Massachusetts, USA

- Year of Foundation: 1979

- Employees: 41,000+ (2023)

- Revenue: $12.7 billion (2022)

Overview: Known for its innovative medical devices, Boston Scientific leads in the arterial stent market with its Synergy and Promus stents.

Strengths: Strong clinical data supporting product efficacy, broad portfolio of drug-eluting and bioabsorbable stents.

Recent Developments: Focus on developing bioresorbable stents and expansion into digital healthcare solutions.

Competitive Strategies: Continuous product innovation and strategic acquisitions.

- Medtronic

- Origin: USA

- Headquarters: Dublin, Ireland

- Year of Foundation: 1949

- Employees: 95,000 (2023)

- Revenue: $31.7 billion (2022)

Overview: Medtronic is a major player in the cardiovascular space, offering stents like Resolute Onyx drug-eluting stent.

Strengths: Extensive global presence, strong focus on innovation and clinical trials.

Recent Developments: Significant progress in bioresorbable stents and data-driven healthcare solutions.

Competitive Strategies: Leverages clinical trial results and R&D to maintain its leadership in the stent market.

- BIOTRONIK SE & Co. KG

- Origin: Germany

- Headquarters: Berlin, Germany

- Year of Foundation: 1963

- Employees: 11,000+

- Revenue: $866 million (2022)

Overview: BIOTRONIK offers advanced cardiovascular devices, including drug-eluting stents and innovative resorbable technologies.

Strengths: Focus on high-quality, reliable medical devices with patient-centric designs.

Recent Developments: Expansion of drug-eluting stent platforms and partnerships with global medical institutions.

Competitive Strategies: Focus on innovation and clinical excellence in cardiovascular treatments.

- Cook Medical

- Origin: USA

- Headquarters: Bloomington, Indiana, USA

- Year of Foundation: 1963

- Employees: 12,000 (2023)

- Revenue: $2.03 billion (2022)

Overview: Known for its Zilver PTX drug-eluting stents, Cook Medical is a leader in minimally invasive vascular solutions.

Strengths: Pioneer in drug-eluting technology, extensive clinical research backing product efficacy.

Recent Developments: Product line expansion and collaborations with global healthcare providers.

Competitive Strategies: Focus on patient outcomes and expanding presence in emerging markets.

- MicroPort Scientific Corporation

- Origin: China

- Headquarters: Shanghai, China

- Year of Foundation: 1998

- Employees: 5,000+ (2023)

- Revenue: $951 million (2022)

Overview: MicroPort specializes in coronary stents, offering innovative solutions for coronary artery disease.

Strengths: Strong R&D focus, especially in drug-eluting stents, and a growing global footprint.

Recent Developments: Introduction of advanced stent technologies and strategic partnerships.

Competitive Strategies: Targeting global markets through technological advancements and acquisitions.

- Terumo Corporation

- Origin: Japan

- Headquarters: Tokyo, Japan

- Year of Foundation: 1921

- Employees: 25,000+ (2023)

- Revenue: $7.2 billion (2022)

Overview: Terumo is known for its Misago peripheral stents and Ultimaster drug-eluting stents, focusing on both coronary and peripheral artery disease.

Strengths: Innovation in stent design and global distribution networks.

Recent Developments: Increased focus on digital health and enhanced patient outcomes through minimally invasive treatments.

Competitive Strategies: Product diversification and clinical excellence.

- B. Braun Melsungen AG

- Origin: Germany

- Headquarters: Melsungen, Germany

- Year of Foundation: 1839

- Employees: 64,000 (2022)

- Revenue: $9.7 billion (2022)

Overview: Known for a range of medical products, including stents for coronary and peripheral arteries.

Strengths: Strong market presence in Europe with quality stent products.

Recent Developments: Product expansion in biodegradable stents.

Competitive Strategy: Focus on high-quality, reliable stent technologies in the European market.

- Cordis (a Cardinal Health company)

- Origin: USA

- Headquarters: Milpitas, California, USA

- Year of Foundation: 1959

- Employees: 4,000+ (2022)

- Revenue: Integrated into Cardinal Health’s $162 billion annual revenue (2022)

Overview: Cordis is known for its coronary and vascular stents, including both bare-metal and drug-eluting stents.

Strengths: Strong focus on vascular health and stent durability.

Recent Developments: Expansion in minimally invasive technologies for stenting.

Competitive Strategy: Focus on expanding stent technologies for coronary and peripheral arteries.

- C. R. Bard (acquired by BD)

- Origin: USA

- Headquarters: Franklin Lakes, New Jersey, USA

- Year of Foundation: 1907 (Acquired by BD in 2017)

- Employees: Integrated under BD’s 75,000+ workforce (2022)

- Revenue: Part of BD’s $20.2 billion annual revenue (2022)

Overview: Known for its innovations in vascular stents, including DES and bare-metal stents.

Strengths: Integration of advanced stenting technologies with BD’s broader medical device portfolio.

Recent Developments: Focus on improving stent durability and delivery mechanisms.

Competitive Strategy: Integration of stent products into BD’s broad medical device offerings, with a focus on advanced materials and drug delivery systems.

Global Industry Trends:

- Technological Advancements: Innovations in drug-eluting stents (DES) and bioresorbable stents are driving the market forward. New technologies aim to reduce restenosis and improve long-term patient outcomes.

- Emerging Markets: Significant growth is seen in Asia-Pacific, particularly in China and India, due to rising healthcare access and government initiatives to reduce stent prices.

- Sustainability and Biodegradability: There is increasing demand for bioresorbable and biodegradable stents, which dissolve over time, reducing the risk of complications.

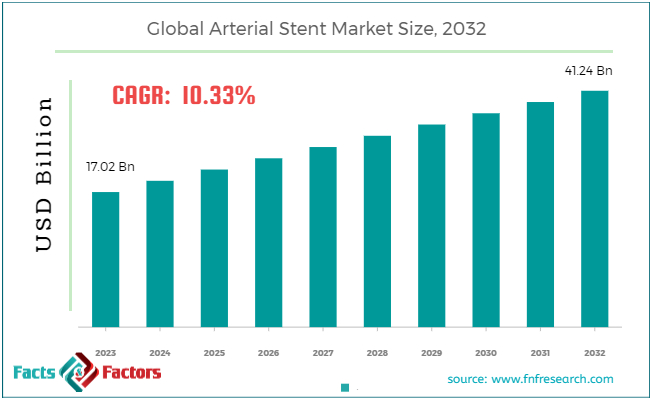

These companies dominate the global arterial stent market by leveraging innovative stent technologies, expanding into emerging markets, and addressing unmet clinical needs through research and development. The market is expected to grow significantly due to the increasing global burden of cardiovascular diseases.

Read More Related Articles:

https://www.fnfresearch.com/telehealth-and-telemedicine-market