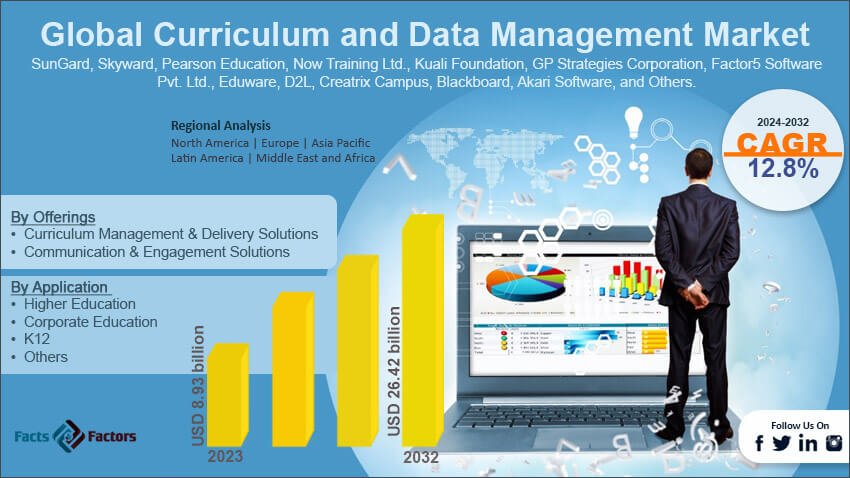

The analysis-intensive report provides key insights into companies and organizations operating in the global Curriculum and Data Management market. The study further makes a relative examination of the organizations highlighting essential business parameters such as geographic presence, company overviews, strengths, recent developments, competitive strategies, and market trends. Recent enterprise developments including novel product launches, joint ventures, partnerships, strategic alliances, mergers & acquisitions, and product development are elaborated upon in the report. The in-depth study thus facilitates a comprehensive analysis of market competition.

For More Information or Query, Visit @ https://www.fnfresearch.com/curriculum-and-data-management-market

Competitive Landscape of Top 10 Key Players in the Curriculum and Data Management Market

- PowerSchool

- Origin: Folsom, California, U.S.

- Headquarters: Folsom, California, U.S.

- Year of Foundation: 1997

- Number of Employees: 3,000+ (estimated)

- Revenue: Undisclosed (privately held)

- Company Overview: PowerSchool is a leading provider of K-12 education technology solutions, offering a comprehensive suite of products, including student information systems (SIS), learning management systems (LMS), and curriculum management tools.

- Strengths: Comprehensive product suite, large customer base, strong brand recognition in the K-12 market, and a focus on data-driven decision-making.

- Recent Developments: PowerSchool has been actively acquiring other companies to expand its product offerings and market reach. They are also focusing on cloud-based solutions and improving data analytics capabilities.

- Competitive Strategies: Aggressive acquisitions, a focus on product integration, and strong customer support are key to their strategy.

- Market Trends Impacting: The increasing demand for personalized learning, the growing use of data analytics in education, and the shift to cloud-based solutions are all impacting PowerSchool’s development.

- Blackboard Inc. (now part of Anthology)

- Origin: Washington, D.C., U.S.

- Headquarters: Boca Raton, Florida, U.S.

- Year of Foundation: 1997

- Number of Employees: (Part of Anthology; combined figures difficult to isolate)

- Revenue: (Part of Anthology; combined figures difficult to isolate)

- Company Overview: Blackboard was a major player in the LMS market, particularly in higher education. It was acquired by Anthology.

- Strengths: Strong brand recognition in higher education, a comprehensive LMS platform, and a large user base.

- Recent Developments: Blackboard is now integrated into Anthology’s offerings. The focus is on combining the strengths of both platforms.

- Competitive Strategies: Anthology/Blackboard is focusing on providing a unified platform for student engagement, learning, and administrative tasks.

- Market Trends Impacting: The increasing demand for online and blended learning, the growing importance of student success metrics, and the need for interoperability between different systems are shaping Anthology’s strategy.

- Canvas by Instructure

- Origin: Salt Lake City, Utah, U.S.

- Headquarters: Salt Lake City, Utah, U.S.

- Year of Foundation: 2008

- Number of Employees: 1,000+ (estimated)

- Revenue: Undisclosed (privately held)

- Company Overview: Instructure is the creator of Canvas, a popular LMS, and Bridge, a corporate training platform.

- Strengths: Modern and user-friendly interface, strong focus on pedagogy, and a growing user base.

- Recent Developments: Instructure continues to enhance Canvas with new features and integrations. They are also focusing on accessibility and mobile learning.

- Competitive Strategies: Focus on user experience, open APIs for integrations, and a strong focus on the educational community are key to their strategy.

- Market Trends Impacting: The increasing demand for personalized learning, the growing use of learning analytics, and the need for flexible and scalable learning platforms are impacting Canvas’s development.

- Moodle

- Origin: Perth, Western Australia, Australia

- Headquarters: Perth, Western Australia, Australia

- Year of Foundation: 2002

- Number of Employees: 100+ (estimated)

- Revenue: Undisclosed (open-source model with commercial services)

- Company Overview: Moodle is a popular open-source LMS used by educational institutions and organizations around the world.

- Strengths: Open-source and highly customizable, large community support, and a wide range of plugins and extensions.

- Recent Developments: Moodle is continuously being updated with new features and improvements by its community.

- Competitive Strategies: Open-source model, strong community support, and a focus on flexibility and customization are key to Moodle’s success.

- Market Trends Impacting: The increasing demand for affordable and customizable learning solutions, the growing importance of open educational resources, and the need for accessible learning platforms are driving Moodle’s adoption.

- Skyward

- Origin: Stevens Point, Wisconsin, U.S.

- Headquarters: Stevens Point, Wisconsin, U.S.

- Year of Foundation: 1980

- Number of Employees: 1,000+ (estimated)

- Revenue: Undisclosed (privately held)

- Company Overview: Skyward provides a suite of K-12 administrative software, including SIS, financial management, and human resources solutions.

- Strengths: Strong focus on K-12 administration, a comprehensive product suite, and a long history in the market.

- Recent Developments: Skyward is focusing on cloud-based solutions and improving its data analytics capabilities.

- Competitive Strategies: Focus on K-12 market, product integration, and strong customer support are key to their strategy.

- Market Trends Impacting: The increasing demand for data-driven decision-making in K-12 education, the growing use of cloud-based solutions, and the need for streamlined administrative processes are impacting Skyward’s development.

- Infinite Campus

- Origin: Blaine, Minnesota, U.S.

- Headquarters: Blaine, Minnesota, U.S.

- Year of Foundation: 1993

- Number of Employees: 1,000+ (estimated)

- Revenue: Undisclosed (privately held)

- Company Overview: Infinite Campus provides a comprehensive SIS for K-12 schools, offering features for student management, attendance, grading, and more.

- Strengths: Comprehensive SIS functionality, a focus on data security and privacy, and a strong customer base.

- Recent Developments: Infinite Campus is focusing on mobile access and improving its analytics and reporting capabilities.

- Competitive Strategies: Focus on K-12 SIS market, strong customer support, and a focus on data security are key to their strategy.

- Market Trends Impacting: The increasing demand for mobile access to student data, the growing importance of data privacy and security, and the need for interoperability with other systems are impacting Infinite Campus’s development.

- Follett Corporation

- Origin: Chicago, Illinois, U.S.

- Headquarters: Westchester, Illinois, U.S.

- Year of Foundation: 1873

- Number of Employees: 2,000+ (estimated)

- Revenue: Undisclosed (privately held)

- Company Overview: Follett offers a range of educational resources and technology solutions, including SIS, library management systems, and digital content.

- Strengths: Broad range of educational products and services, strong brand recognition, and a long history in the education market.

- Recent Developments: Follett is focusing on digital content and integrating its various products and services.

- Competitive Strategies: Offering a comprehensive suite of educational solutions, strong customer relationships, and a focus on digital learning are key to their strategy.

- Market Trends Impacting: The increasing demand for digital content, the growing importance of personalized learning, and the need for integrated educational solutions are impacting Follett’s development.

- Pearson Education

- Origin: London, England

- Headquarters: London, England

- Year of Foundation: 1844

- Number of Employees: 20,000+ (estimated)

- Revenue: £3.8 Billion (2022)

- Company Overview: Pearson is a global learning company offering a wide range of educational products and services, including curriculum materials, assessments, and technology solutions.

- Strengths: Global reach, a broad range of educational products and services, and strong brand recognition.

- Recent Developments: Pearson is focusing on digital learning and developing new technologies for assessment and personalized learning.

- Competitive Strategies: Offering a comprehensive suite of educational solutions, strong brand recognition, and a focus on innovation are key to their strategy.

- Market Trends Impacting: The increasing demand for digital learning, the growing importance of personalized learning, and the need for effective assessment

- Ellucian

- Origin: Reston, Virginia, U.S.

- Headquarters: Reston, Virginia, U.S.

- Year of Foundation: 1968

- Number of Employees: 2,500+ (estimated)

- Revenue: Undisclosed (privately held)

- Company Overview: Ellucian focuses specifically on higher education, providing a comprehensive suite of software solutions, including SIS, ERP, CRM, and student success tools.

- Strengths: Deep expertise in higher education administration, a comprehensive product suite tailored for colleges and universities, and a large customer base in this sector.

- Recent Developments: Ellucian is investing heavily in cloud-based solutions (Ellucian Cloud) and focusing on data analytics and student engagement tools. They are also actively acquiring other higher-ed tech companies to expand their offerings.

- Competitive Strategies: Focus on the higher education market, a comprehensive and integrated product suite, strong customer relationships within colleges and universities, and a move towards cloud-based deployments.

- Market Trends Impacting: The increasing demand for student success solutions, the growing adoption of cloud computing in higher education, and the need for integrated administrative systems are key drivers for Ellucian.

- OpenEdu

- Origin: San Francisco, California, U.S.

- Headquarters: San Francisco, California, U.S.

- Year of Foundation: 2012

- Number of Employees: 50-200 (estimated)

- Revenue: Undisclosed (privately held)

- Company Overview: OpenEdu offers a cloud-based platform specifically designed for K-12 schools, focusing on curriculum management, assessment, and personalized learning. They emphasize a more open and flexible approach.

- Strengths: Modern, user-friendly interface, focus on curriculum alignment and personalized learning, and a cloud-native architecture. They often position themselves as a more agile alternative to some of the larger, more established players.

- Recent Developments: OpenEdu is continuously adding new features and integrations to its platform, often focusing on specific pedagogical needs and curriculum standards.

- Competitive Strategies: Emphasis on ease of use and modern technology, a focus on personalized learning and curriculum alignment, and a more flexible and open approach compared to some legacy systems.

- Market Trends Impacting: The growing demand for personalized learning solutions, the increasing need for curriculum management tools that align with standards, and the shift towards cloud-based platforms are all impacting OpenEdu’s growth.

Read More:

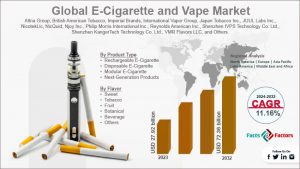

Top 10 Companies in E-Cigarette and Vape Market: A Competitive Landscape Review, Revenue Share