The analysis-intensive report provides key insights into companies and organizations operating in the global Flexible Office market. The study further makes a relative examination of the organizations highlighting essential business parameters such as geographic presence, company overviews, strengths, recent developments, competitive strategies, and market trends. Recent enterprise developments including novel product launches, joint ventures, partnerships, strategic alliances, mergers & acquisitions, and product development are elaborated upon in the report. The in-depth study thus facilitates a comprehensive analysis of market competition.

👉 Click here to read the complete article: https://www.fnfresearch.com/flexible-office-market

Competitive Landscape of Top 10 Key Players in the Flexible Office Market

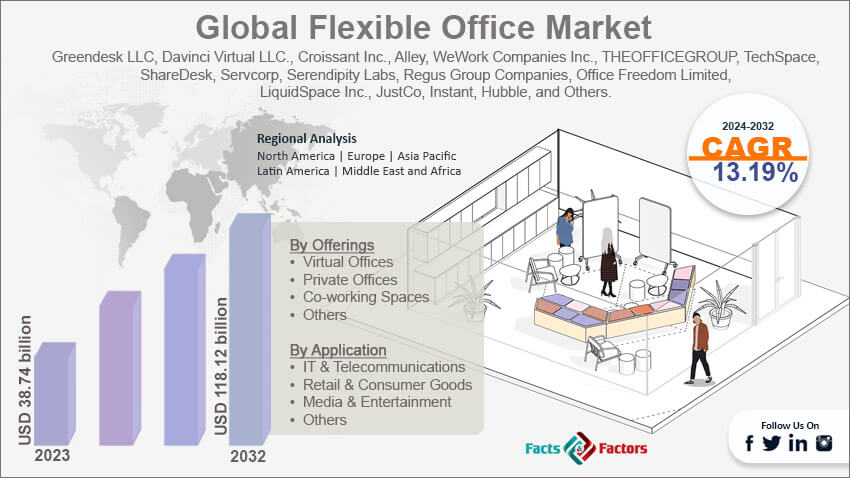

The Flexible Office Market has been growing rapidly, driven by shifts towards remote and hybrid work models, as well as the demand for cost-effective, adaptable workspaces. Below is an overview of the competitive landscape featuring the top 10 key players, along with insights on their strengths, recent developments, and market trends.

- WeWork

- Origin: USA

- Headquarters: New York City, USA

- Foundation Year: 2010

- Employees: ~3,000 (2022)

- Revenue: $3.25 billion (2022)

Company Overview: WeWork is a prominent global provider of co-working spaces, known for its vibrant, community-driven work environments.

Strengths: Extensive network and focus on community-building.

Recent Developments: Expansion into offering flexible office solutions for larger enterprises, amidst restructuring to stabilize finances.

Competitive Strategies: Diversification into technology and digital platforms to enhance the user experience, focusing on hybrid work solutions.

- Regus (IWG)

- Origin: Belgium

- Headquarters: Zug, Switzerland

- Foundation Year: 1989

- Employees: ~10,000

- Revenue: $2.7 billion (2022)

Company Overview: Regus, part of IWG, offers flexible office spaces worldwide, including serviced offices, virtual offices, and co-working areas.

Strengths: Wide global presence with over 3,000 locations across 120 countries.

Recent Developments: Launched new service models to support hybrid work setups and introduced flexible lease terms.

Competitive Strategies: Continue global expansion and collaboration with local businesses, focusing on scalable solutions for enterprises.

- Spaces (IWG)

- Origin: Netherlands

- Headquarters: Amsterdam, Netherlands

- Foundation Year: 2008

- Employees: ~1,500

- Revenue: Part of IWG Group

Company Overview: Spaces specializes in providing creative, open workspace environments suitable for freelancers, startups, and large corporations.

Strengths: Collaborative and stylish office environments that cater to the needs of modern businesses.

Recent Developments: Expansion into new urban locations in Europe and Asia.

Competitive Strategies: Focus on creative office layouts and community-centric spaces.

5G Wireless Ecosystem Industry Analysis: The Top 10 Players and Their Strategies

- Servcorp

- Origin: Australia

- Headquarters: Sydney, Australia

- Foundation Year: 1978

- Employees: ~600

- Revenue: $250 million (2022)

Company Overview: Servcorp provides premium office spaces, including serviced offices and virtual office solutions.

Strengths: High-end office spaces with a focus on professional services and executive clientele.

Recent Developments: Expansion into new markets, including North America and the Middle East.

Competitive Strategies: Offer premium, scalable solutions with a focus on virtual office services and advanced tech integration.

- Knotel

- Origin: USA

- Headquarters: New York City, USA

- Foundation Year: 2016

- Employees: ~500

- Revenue: Private

Company Overview: Knotel offers flexible office spaces, primarily catering to enterprises looking for bespoke workspace solutions.

Strengths: Customizable office spaces designed to meet specific company needs.

Recent Developments: Acquisition by Newmark Group to stabilize finances and expand its footprint.

Competitive Strategies: Focus on flexibility and bespoke office layouts, catering to large enterprises.

- Industrious

- Origin: USA

- Headquarters: New York City, USA

- Foundation Year: 2013

- Employees: ~1,000

- Revenue: Private

Company Overview: Industrious offers co-working and flexible office spaces, with an emphasis on high-quality service.

Strengths: Strong focus on creating comfortable, well-designed workspaces with a hospitality-driven approach.

Recent Developments: Partnerships with major landlords to increase its portfolio across North America.

Competitive Strategies: Expand through strategic partnerships, focusing on premium services.

- The Office Group (TOG)

- Origin: UK

- Headquarters: London, UK

- Foundation Year: 2003

- Employees: ~700

- Revenue: Private

Company Overview: TOG offers stylish, flexible office solutions primarily across the UK and Europe.

Strengths: Unique, design-focused spaces that attract creative industries and startups.

Recent Developments: Expansion in key European cities, tapping into tech and media hubs.

Competitive Strategies: Continue investing in design and aesthetics to appeal to creative sectors.

- Mindspace

- Origin: Israel

- Headquarters: Tel Aviv, Israel

- Foundation Year: 2014

- Employees: ~300

- Revenue: Private

Company Overview: Mindspace provides boutique, high-end co-working spaces across Europe and the USA.

Strengths: Elegant design and a focus on premium office experiences.

Recent Developments: Entered the North American market and expanded its presence in Europe.

Competitive Strategies: Maintain a premium positioning and expand into key metropolitan areas.

- Convene

- Origin: USA

- Headquarters: New York City, USA

- Foundation Year: 2009

- Employees: ~500

- Revenue: Private

Company Overview: Specializes in providing flexible meeting and event spaces, as well as co-working spaces.

Strengths: Expertise in hosting events and meetings; versatile spaces.

Recent Developments: Expanded partnerships to include corporate clients looking for flexible workspace solutions.

Competitive Strategies: Leverage event expertise to offer comprehensive workspace solutions.

- Hana (A CBRE Company)

- Origin: USA

- Headquarters: Dallas, Texas, USA

- Foundation Year: 2018

- Employees: ~200

- Revenue: Part of CBRE Group

Company Overview: Hana, operated by CBRE, focuses on flexible office spaces for corporate clients.

Strengths: Backed by CBRE’s real estate expertise, offering scalable office solutions.

Recent Developments: Expanding services to major metropolitan areas in the USA and UK.

Competitive Strategies: Utilize CBRE’s extensive real estate network to provide strategic locations for clients.

Recent Market Trends:

- Rise of Hybrid Work Models: Companies are increasingly adopting flexible office solutions to accommodate remote and in-office work.

- Sustainability Initiatives: Flexible office providers are integrating eco-friendly practices to attract environmentally conscious businesses.

- Technology Integration: Enhanced digital platforms for booking, management, and connectivity are critical for providers to streamline operations and improve user experience.

- Community Focus: Emphasis on creating vibrant, community-oriented workspaces to enhance networking and collaboration.

The flexible office market continues to grow as businesses seek adaptable and cost-efficient workspace solutions, especially with the shift towards hybrid work arrangements. Key players like WeWork, Regus, and Industrious are leading this evolution, focusing on technology, community, and sustainability to stay competitive.

Read More;

https://www.fnfresearch.com/esports-market

https://www.fnfresearch.com/digital-banking-platform-market