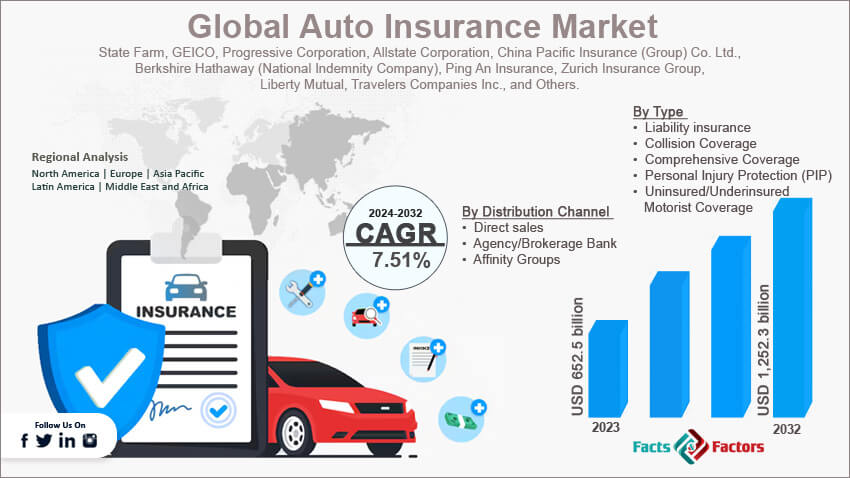

The analysis-intensive report provides key insights into companies and organizations operating in the global Auto Insurance market. The study further makes a relative examination of the organizations highlighting essential business parameters such as geographic presence, company overviews, strengths, recent developments, competitive strategies, and market trends. Recent enterprise developments including novel product launches, joint ventures, partnerships, strategic alliances, mergers & acquisitions, and product development are elaborated upon in the report. The in-depth study thus facilitates a comprehensive analysis of market competition.

Competitive Landscape of Top 10 Key Players in the Auto Insurance Market

Click Here to access The Full market Report: https://www.fnfresearch.com/auto-insurance-market

- State Farm

- Origin: United States

- Headquarters: Bloomington, Illinois, USA

- Year of Foundation: 1922

- Employees: Approximately 58,000

- Revenue: $89.3 billion (2022)

Overview: State Farm is the largest auto insurer in the U.S., offering a wide range of insurance and financial services.

Strengths: Extensive agent network, strong customer service, and comprehensive coverage options.

Recent Developments: Expansion of digital services and telematics programs to enhance customer experience.

Competitive Strategies: Focus on personalized service through agents and investment in technology to streamline operations.

Market Trends: Increased adoption of telematics and usage-based insurance models.

- Progressive

- Origin: United States

- Headquarters: Mayfield Village, Ohio, USA

- Year of Foundation: 1937

- Employees: Approximately 49,000

- Revenue: $47.7 billion (2022)

Overview: Progressive is known for its innovative approach, including usage-based insurance and a strong online presence.

Strengths: Advanced technology integration, competitive pricing, and diverse product offerings.

Recent Developments: Expansion of telematics programs and AI-driven claims processing.

Competitive Strategies: Emphasis on direct-to-consumer sales and leveraging technology for customer engagement.

Market Trends: Growth in digital insurance platforms and personalized insurance products.

Top 10 Companies in E-Cigarette and Vape Market: A Competitive Landscape Review, Revenue Share

- GEICO

- Origin: United States

- Headquarters: Chevy Chase, Maryland, USA

- Year of Foundation: 1936

- Employees: Approximately 40,000

- Revenue: $35.1 billion (2022)

Overview: GEICO is a subsidiary of Berkshire Hathaway, offering auto insurance primarily through direct sales channels.

Strengths: Competitive pricing, strong brand recognition, and efficient online services.

Recent Developments: Implementation of advanced analytics for risk assessment and customer service enhancements.

Competitive Strategies: Focus on cost leadership and leveraging digital platforms for customer acquisition.

Market Trends: Increased competition in online insurance sales and emphasis on customer experience.

- Allstate

- Origin: United States

- Headquarters: Northbrook, Illinois, USA

- Year of Foundation: 1931

- Employees: Approximately 45,000

- Revenue: $50.6 billion (2022)

Overview: Allstate offers a broad range of insurance products, including auto insurance, with a focus on personalized service.

Strengths: Extensive agent network, strong financial stability, and comprehensive coverage options.

Recent Developments: Investment in digital transformation and expansion of telematics-based insurance programs.

Competitive Strategies: Balancing traditional agent-based sales with digital channels to reach a wider customer base.

Market Trends: Integration of technology in insurance services and growing demand for personalized insurance solutions.

- USAA

- Origin: United States

- Headquarters: San Antonio, Texas, USA

- Year of Foundation: 1922

- Employees: Approximately 35,000

- Revenue: $36.3 billion (2022)

Overview: USAA provides insurance and financial services to military members and their families, known for high customer satisfaction.

Strengths: Exceptional customer service, competitive rates, and tailored products for military personnel.

Recent Developments: Enhancement of digital platforms and introduction of new financial products.

Competitive Strategies: Focus on niche market of military members and continuous improvement of customer experience.

Market Trends: Growing importance of customer-centric services and digital engagement.

- Liberty Mutual

- Origin: United States

- Headquarters: Boston, Massachusetts, USA

- Year of Foundation: 1912

- Employees: Approximately 45,000

- Revenue: $48.2 billion (2022)

Overview: Liberty Mutual offers a wide range of insurance products, including auto insurance, with a global presence.

Strengths: Diverse product portfolio, strong financial stability, and global reach.

Recent Developments: Adoption of digital tools for claims processing and customer service enhancements.

Competitive Strategies: Leveraging technology to improve efficiency and expanding product offerings to meet diverse customer needs.

Market Trends: Increased focus on digital transformation and customer experience optimization.

- Farmers Insurance

- Origin: United States

- Headquarters: Woodland Hills, California, USA

- Year of Foundation: 1928

- Employees: Approximately 21,000

- Revenue: $12.5 billion (2022)

Overview: Farmers Insurance offers a variety of insurance products, including auto insurance, with a focus on personalized service through agents.

Strengths: Strong agent network, customizable coverage options, and customer education initiatives.

Recent Developments: Implementation of usage-based insurance programs and digital tools for policy management.

Competitive Strategies: Emphasis on agent-customer relationships and adoption of technology to enhance service delivery.

Market Trends: Shift towards digital insurance solutions and personalized insurance products.

- Nationwide

- Origin: USA

- Headquarters: Columbus, Ohio, USA

- Year of Foundation: 1926

- Employees: ~25,000

- Revenue: $46.9 billion (2022)

Overview: Nationwide offers auto insurance with a focus on financial products and customer solutions.

Strengths: Financial strength and diverse offerings.

Recent Developments: Introduced enhanced telematics-based policies.

Competitive Strategies: Expanding product flexibility and digital reach.

- Travelers

- Origin: USA

- Headquarters: New York City, New York, USA

- Year of Foundation: 1853

- Employees: ~30,000

- Revenue: $36 billion (2022)

Overview: Travelers offers a variety of insurance products, with auto insurance being a core offering.

Strengths: Strong underwriting expertise and risk management.

Recent Developments: Advanced AI-driven analytics for better pricing.

Competitive Strategies: Focus on tailored policies for customer needs.

- American Family Insurance

- Origin: USA

- Headquarters: Madison, Wisconsin, USA

- Year of Foundation: 1927

- Employees: ~13,500

- Revenue: $14 billion (2022)

Overview: American Family provides auto insurance with an emphasis on community and personalized service.

Strengths: Strong customer relationships and regional focus.

Recent Developments: Expanded digital tools for policy management.

Competitive Strategies: Community engagement and innovative coverage options.

Latest Industry Trends

- Telematics Growth: Usage-based insurance gaining traction.

- Digital Transformation: Increasing reliance on digital channels for claims and policy management.

- Customer-Centric Models: Focus on personalization and convenience.

- Sustainability: Incorporation of eco-friendly initiatives in operations and products.

These companies dominate the auto insurance market with their strong financial performance, technological innovations, and customer-centric strategies.