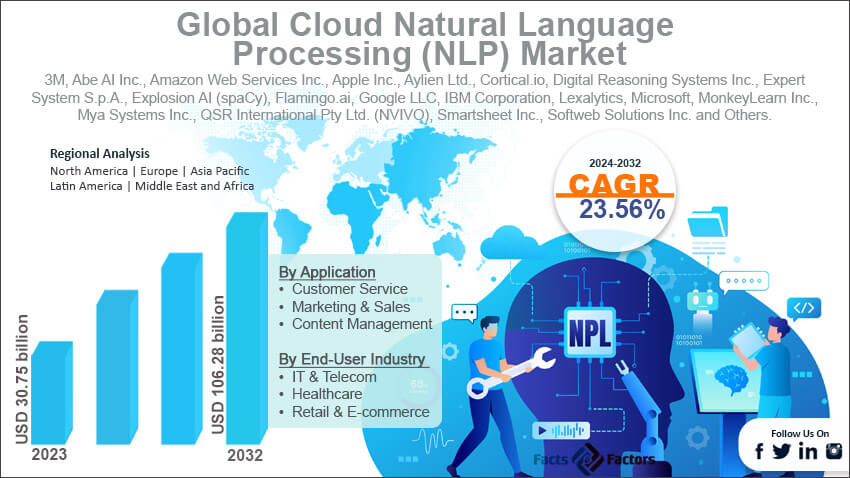

The analysis-intensive report provides key insights into companies and organizations operating in the global Cloud Natural Language Processing (NLP) market. The study further makes a relative examination of the organizations highlighting essential business parameters such as geographic presence, company overviews, strengths, recent developments, competitive strategies, and market trends. Recent enterprise developments including novel product launches, joint ventures, partnerships, strategic alliances, mergers & acquisitions, and product development are elaborated upon in the report. The in-depth study thus facilitates a comprehensive analysis of market competition.

Click Here to access The Full market Report: https://www.fnfresearch.com/cloud-natural-language-processing-nlp-market

Competitive Landscape of Top 10 Key Players in the Cloud Natural Language Processing (NLP) Market

- Amazon Web Services (AWS)

- Origin: Seattle, Washington, U.S.

- Headquarters: Seattle, Washington, U.S.

- Year of Foundation: 2006

- Number of Employees: 1,541,000 (as of December 31, 2023)

- Revenue: $574.7 billion (2023)

- Company Overview: AWS is the dominant cloud provider globally, offering a massive range of services, including compute, storage, database, and, of course, AI/ML. Their NLP offerings are a key part of their AI/ML suite.

- Strengths: Extensive infrastructure, a comprehensive suite of services, strong brand recognition, a mature ecosystem, and competitive pricing. AWS’s NLP services are deeply integrated with other AWS offerings, making it easy for customers to build and deploy NLP applications.

- Recent Developments: AWS continuously improves its NLP services like Comprehend (for sentiment analysis, entity recognition, etc.), Translate, and Polly (text-to-speech). They are also investing in serverless NLP solutions for easier deployment and adding industry-specific NLP capabilities (e.g., for healthcare and finance).

- Competitive Strategies: Aggressive pricing, extensive documentation and support, a focus on enterprise customers, and tight integration with other AWS services are key to their strategy.

- Market Trends Impacting: The rise of generative AI and the increasing demand for multilingual NLP solutions are key trends impacting AWS, leading them to enhance their offerings in these areas.

- Google LLC

- Origin: Menlo Park, California, U.S.

- Headquarters: Mountain View, California, U.S.

- Year of Foundation: 1998

- Number of Employees: 186,779 (as of December 31, 2023)

- Revenue: $282.84 billion (2023)

- Company Overview: Google’s dominance in search and language processing makes them a natural leader in NLP. Google Cloud Platform (GCP) offers a wide array of NLP APIs, leveraging Google’s cutting-edge AI research.

- Strengths: World-class AI/ML research, deep integration with other Google services (e.g., Search, Assistant), excellent developer tools, and advanced language models like BERT and PaLM.

- Recent Developments: Google is focused on pre-trained models and AutoML capabilities to make NLP development easier. They are also investing heavily in conversational AI and dialogue management and enhancing their Cloud Natural Language API for improved entity recognition and sentiment analysis.

- Competitive Strategies: Leveraging Google’s AI leadership, providing developer-friendly tools, offering competitive pricing, and maintaining a strong focus on innovation are core to their strategy.

- Market Trends Impacting: The growing importance of contextual understanding in NLP and the increasing use of NLP in contact centers are key trends influencing Google’s NLP development.

- Microsoft Corporation

- Origin: Redmond, Washington, U.S.

- Headquarters: Redmond, Washington, U.S.

- Year of Foundation: 1975

- Number of Employees: 221,000 (as of June 30, 2023)

- Revenue: $211.91 billion (fiscal year 2023)

- Company Overview: Microsoft Azure provides a robust cloud platform with a strong set of NLP services within its Azure Cognitive Services.

- Strengths: A strong enterprise focus, seamless integration with Microsoft products (e.g., Office, Teams), robust AI/ML capabilities, and a comprehensive set of developer tools.

- Recent Developments: Microsoft continues to enhance Azure Cognitive Services for Language, improving sentiment analysis, key phrase extraction, and language detection. They are also investing in conversational AI through the Bot Framework and emphasizing responsible AI principles.

- Competitive Strategies: Providing enterprise-grade solutions, deep integration with existing Microsoft infrastructure, competitive pricing, and a focus on specific industry verticals are key to their strategy.

- Market Trends Impacting: The increasing demand for NLP in business applications (e.g., document processing) and the growing focus on data privacy and security are driving Microsoft’s NLP advancements.

- IBM Corporation

- Origin: Endicott, New York, U.S.

- Headquarters: Armonk, New York, U.S.

- Year of Foundation: 1911

- Number of Employees: 300,000 (approximately, as of 2023)

- Revenue: $60.5 billion (2023)

- Company Overview: IBM has a long history in AI, and IBM Watson offers a mature suite of AI and NLP services, with a strong focus on enterprise use cases.

- Strengths: Deep industry expertise, a focus on enterprise-grade solutions, strong brand recognition in the AI space, and the mature Watson platform.

- Recent Developments: IBM is emphasizing AI governance and explainable AI. They are also enhancing Watson Natural Language Understanding and Watson Assistant and investing in hybrid cloud deployments.

- Competitive Strategies: Focusing on specific industry solutions, providing enterprise-grade support, offering hybrid cloud options, and maintaining a strong focus on trust and transparency in AI are central to their strategy.

- Market Trends Impacting: The increasing demand for AI ethics and responsible AI practices, along with the growing complexity of enterprise NLP deployments, are key trends shaping IBM’s NLP offerings.

- Apple Inc.

- Origin: Cupertino, California, U.S.

- Headquarters: Cupertino, California, U.S.

- Year of Foundation: 1976

- Number of Employees: 164,000 (as of September 30, 2023)

- Revenue: $394.33 billion (fiscal year 2023)

- Company Overview: Apple is known for its tight integration of hardware and software. While they don’t offer a standalone cloud NLP platform, they deeply integrate NLP into their devices and operating systems (e.g., Siri, Apple Translate).

- Strengths: Strong brand loyalty, a massive and engaged user base, tight integration of hardware and software, and a strong focus on user privacy.

- Recent Developments: Apple is continuously improving Siri and Apple Translate. They are also investing in on-device NLP processing to enhance privacy and performance.

- Competitive Strategies: Tight integration with the Apple ecosystem, a focus on user experience, a strong emphasis on privacy, and continuous improvement of existing features are key to their strategy.

- Market Trends Impacting: The growing importance of on-device AI and NLP and increased user expectations for conversational AI are influencing Apple’s NLP development, particularly with Siri.

- Intel Corporation

- Origin: Santa Clara, California, U.S.

- Headquarters: Santa Clara, California, U.S.

- Year of Foundation: 1968

- Number of Employees: 121,100 (as of December 31, 2023)

- Revenue: $63.1 billion (2023)

- Company Overview: Intel is a leading provider of the hardware that underpins cloud computing, including the processors that power many cloud NLP solutions.

- Strengths: Dominant market share in CPUs, strong expertise in hardware optimization for AI workloads, and a broad range of hardware offerings.

- Recent Developments: Intel is developing specialized AI chips (e.g., Habana Gaudi) to accelerate NLP workloads and optimizing software libraries and frameworks for Intel hardware.

- Competitive Strategies: Focusing on hardware performance and efficiency, building partnerships with cloud providers and software vendors, and investing in AI-specific hardware are key to their strategy.

- Market Trends Impacting: The increasing demand for AI hardware, including for NLP, and the rise of specialized AI chips are major trends impacting Intel’s development in this space.

- SAS Institute Inc.

- Origin: Cary, North Carolina, U.S.

- Headquarters: Cary, North Carolina, U.S.

- Year of Foundation: 1976

- Number of Employees: 13,000+ (approximately, as of 2023)

- Revenue: $3.29 billion (2022)

- Company Overview: SAS is a well-established player in the analytics and business intelligence space, offering a range of solutions that include NLP capabilities.

- Strengths: Strong analytics capabilities, deep industry expertise, a focus on enterprise solutions, and a robust platform.

- Recent Developments: SAS is integrating NLP into its SAS Viya platform and focusing on real-time NLP processing for streaming data.

- Competitive Strategies: A focus on industry-specific analytics solutions, strong customer relationships, a robust and scalable platform, and an emphasis on data visualization and reporting are central to their strategy.

- Market Trends Impacting: The increasing demand for NLP in business intelligence and analytics and the growing importance of real-time data analysis are key trends influencing SAS’s NLP development.

- SAP SE

- Origin: Walldorf, Germany

- Headquarters: Walldorf, Germany

- Year of Foundation: 1972

- Number of Employees: 107,000+ (approximately, as of 2023)

- Revenue: €30.87 billion (fiscal year 2022)

- Company Overview: SAP is a major enterprise software provider, offering a wide range of business applications. They are integrating NLP capabilities into their solutions for areas like customer experience and HR.

- Strengths: A large enterprise customer base, deep industry expertise, a broad range of business applications, and tight integration with other SAP products.

- Recent Developments: SAP is integrating NLP into SAP S/4HANA and other business applications and focusing on conversational AI for business processes.

- Competitive Strategies: Focusing on enterprise solutions, deep integration with existing SAP infrastructure, strong customer relationships, and industry-specific solutions are key to their strategy.

- Market Trends Impacting: The increasing demand for NLP in enterprise applications like CRM and HR and the growing importance of automation in business processes are driving SAP’s NLP development.

- Oracle Corporation

- Origin: Redwood Shores, California, U.S.

- Headquarters: Austin, Texas, U.S.

- Year of Foundation: 1977

- Number of Employees: 143,000+ (approximately, as of 2023)

- Revenue: $49.95 billion (fiscal year 2023)

- Company Overview: Oracle is a major player in the enterprise software and cloud market. They offer a broad range of cloud services, including NLP capabilities within their Oracle Cloud Infrastructure.

- Strengths: A strong enterprise focus, a wide range of cloud services, robust database technologies, and a strong emphasis on security.

- Recent Developments: Oracle is enhancing the NLP services on its Oracle Cloud Infrastructure and focusing on AI-powered applications for enterprise use cases.

- Competitive Strategies: Providing enterprise-grade solutions, deep integration with Oracle databases and applications, competitive pricing, and a focus on security and reliability are key to their strategy.

- Market Trends Impacting: The increasing demand for NLP in enterprise applications and the growing importance of data security and compliance are key trends impacting Oracle’s NLP development.

- Hewlett Packard Enterprise (HPE)

- Origin: Palo Alto, California, U.S.

- Headquarters: Spring, Texas, U.S.

- Year of Foundation: 2015 (spun off from Hewlett-Packard)

- Number of Employees: 60,000+ (approximately, as of 2023)

- Revenue: $29.1 billion (fiscal year 2023)

- Company Overview: HPE is a leading provider of enterprise IT solutions, with a strong focus on hybrid IT and edge computing. They are incorporating NLP capabilities into their offerings.

- Strengths: Deep expertise in hybrid IT and edge computing, a focus on enterprise-grade solutions, strong customer relationships, and a broad range of hardware and software offerings.

- Recent Developments: HPE is integrating NLP into HPE GreenLake and other hybrid IT solutions and focusing on AI at the edge.

- Competitive Strategies: Focusing on hybrid IT and edge computing, providing enterprise-grade solutions, maintaining strong customer relationships, and offering a wide range of hardware and software are key to their strategy.

- Market Trends Impacting: The growing importance of edge computing and AI at the edge and the increasing demand for hybrid IT solutions are key trends influencing HPE’s NLP development.