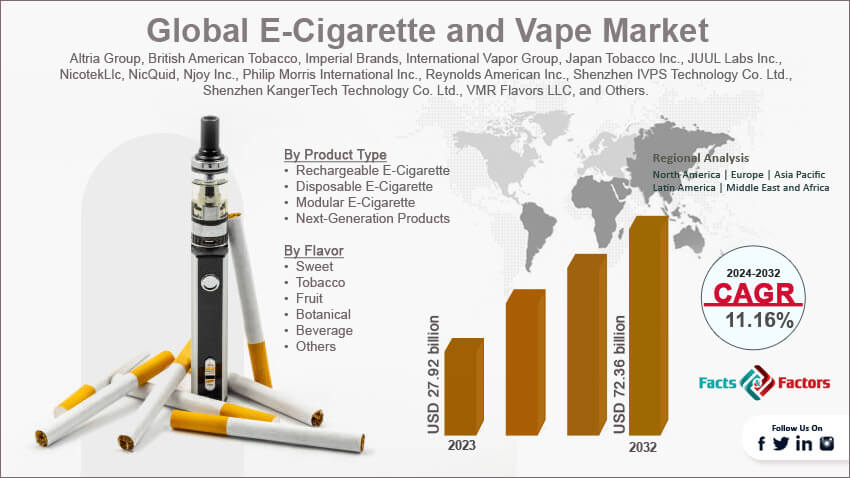

The analysis-intensive report provides key insights into companies and organizations operating in the global E-Cigarette and Vape market. The study further makes a relative examination of the organizations highlighting essential business parameters such as geographic presence, company overviews, strengths, recent developments, competitive strategies, and market trends. Recent enterprise developments including novel product launches, joint ventures, partnerships, strategic alliances, mergers & acquisitions, and product development are elaborated upon in the report. The in-depth study thus facilitates a comprehensive analysis of market competition.

𝙁𝙤𝙧 𝙈𝙤𝙧𝙚 𝙍𝙚𝙨𝙚𝙖𝙧𝙘𝙝 𝙄𝙣𝙨𝙞𝙜𝙝𝙩𝙨 𝙑𝙞𝙨𝙞𝙩: https://www.fnfresearch.com/e-cigarette-and-vape-market

Competitive Landscape of Top 10 Key Players in the E-Cigarette and Vape Market

- Philip Morris International Inc. (PMI)

- Origin: United States

- Headquarters: New York City, New York, USA

- Year of Foundation: 1847

- Employees: Approximately 69,600 (2023)

- Revenue: $31.7 billion (2022)

Overview: PMI is a leading international tobacco company, focusing on the development and commercialization of smoke-free products, including the IQOS heated tobacco system.

Strengths: Extensive research and development capabilities, strong global distribution network, and a commitment to transitioning smokers to reduced-risk products.

Recent Developments: Launched IQOS ILUMA, an advanced version of their heated tobacco system, and expanded its presence in new markets.

Competitive Strategies: Investing heavily in smoke-free product development, strategic acquisitions, and partnerships to enhance product offerings.

Market Trends: Growing consumer preference for heated tobacco products and regulatory shifts favoring reduced-risk alternatives.

Top 10 Companies in Baby Wipes Market: Innovation, Trends, and Market Opportunities

- Altria Group, Inc.

- Origin: United States

- Headquarters: Richmond, Virginia, USA

- Year of Foundation: 1985

- Employees: Approximately 6,000 (2023)

- Revenue: $20.7 billion (2022)

Overview: Altria is a prominent tobacco company with a diversified portfolio, including investments in e-vapor products and heated tobacco devices.

Strengths: Strong brand portfolio, significant market share in the U.S., and strategic investments in alternative tobacco products.

Recent Developments: Completed the acquisition of NJOY Holdings, Inc., to expand its presence in the e-vapor market.

Competitive Strategies: Focusing on harm reduction through innovative products, strategic partnerships, and regulatory compliance.

Market Trends: Increased focus on smoke-free products and navigating regulatory challenges in the e-vapor segment.

- British American Tobacco plc (BAT)

- Origin: United Kingdom

- Headquarters: London, England, UK

- Year of Foundation: 1902

- Employees: Approximately 55,000 (2023)

- Revenue: £25.7 billion (2022)

Overview: BAT is a leading multinational tobacco company, offering a range of products, including e-cigarettes under the Vuse brand and heated tobacco products.

Strengths: Diverse product portfolio, strong global presence, and commitment to developing reduced-risk products.

Recent Developments: Expanded the Vuse brand into new markets and invested in next-generation product development.

Competitive Strategies: Accelerating the growth of new category products, leveraging digital platforms for consumer engagement, and focusing on sustainability.

Market Trends: Rising demand for nicotine alternatives and increased competition in the e-cigarette segment.

- Japan Tobacco Inc. (JT)

- Origin: Japan

- Headquarters: Tokyo, Japan

- Year of Foundation: 1985

- Employees: Approximately 58,000 (2023)

- Revenue: ¥2.2 trillion (2022)

Overview: JT is a global tobacco company offering a range of products, including e-cigarettes and heated tobacco devices under the Ploom brand.

Strengths: Strong research and development capabilities, extensive market presence in Asia, and a focus on innovation.

Recent Developments: Launched Ploom X, an advanced heated tobacco device, and expanded its market reach.

Competitive Strategies: Investing in product innovation, strategic collaborations, and expanding into new markets.

Market Trends: Growing acceptance of heated tobacco products and regulatory developments influencing market dynamics.

- Imperial Brands plc

- Origin: United Kingdom

- Headquarters: Bristol, England, UK

- Year of Foundation: 1901

- Employees: Approximately 27,500 (2023)

- Revenue: £15.6 billion (2022)

Overview: Imperial Brands is a global tobacco company offering e-cigarettes under the blu brand and heated tobacco products.

Strengths: Diverse product portfolio, strong distribution channels, and a focus on harm reduction.

Recent Developments: Invested in next-generation product development and expanded the blu brand into new markets.

Competitive Strategies: Focusing on product innovation, strategic acquisitions, and enhancing consumer engagement.

Market Trends: Increased competition in the e-cigarette market and evolving consumer preferences towards reduced-risk products.

- NJOY LLC

- Origin: United States

- Headquarters: Scottsdale, Arizona, USA

- Year of Foundation: 2006

- Employees: Approximately 200 (2023)

- Revenue: Not publicly disclosed

Overview: NJOY is an independent e-cigarette company offering a range of vaping products, including disposable and rechargeable devices.

Strengths: Focus on innovation, compliance with regulatory standards, and a commitment to harm reduction.

Recent Developments: Acquired by Altria Group, Inc., to enhance its product portfolio and market reach.

Competitive Strategies: Emphasizing product quality, regulatory compliance, and expanding distribution channels.

Market Trends: Growing demand for disposable e-cigarettes and increased regulatory scrutiny.

- JUUL Labs, Inc.

- Origin: United States

- Headquarters: San Francisco, California, USA

- Year of Foundation: 2015

- Employees: Approximately 1,200 (2023)

- Revenue: Estimated $1.3 billion (2022)

- Overview: JUUL is a leading e-cigarette company known for its sleek design and nicotine salt-based e-liquids.

- Strengths: Strong brand recognition, innovative product design, and a significant share of the U.S. e-cigarette market.

- Recent Developments: Refined product formulations to meet regulatory standards.

- Competitive Strategies: Focused on navigating regulatory environments and expanding global footprint.

- VaporFi

- Origin: USA

- Headquarters: Miami, Florida, USA

- Year of Foundation: 2013

- Employees: ~200

- Revenue: Not publicly disclosed

Overview: Focuses on customizable vaping devices and e-liquids.

Strengths: Customization and high-quality ingredients.

Recent Developments: Expanded product offerings with organic and nicotine-free options.

Competitive Strategies: Targeting niche markets and personalized experiences.

- RELX Technology

- Origin: China

- Headquarters: Shenzhen, China

- Year of Foundation: 2018

- Employees: ~2,000

- Revenue: $1.5 billion (2022)

Overview: Dominates the Chinese e-cigarette market with sleek devices.

Strengths: Advanced technology and significant market share in Asia.

Recent Developments: Expanded globally into Europe and the Middle East.

Competitive Strategies: Focus on design and accessibility.

- SMOK (Shenzhen IVPS Technology Co., Ltd.)

- Origin: China

- Headquarters: Shenzhen, China

- Year of Foundation: 2010

- Employees: ~3,500

- Revenue: Not publicly disclosed

Overview: Known for advanced vaping devices and mods.

Strengths: Cutting-edge technology and diverse product lines.

Recent Developments: Launched high-wattage and customizable devices.

Competitive Strategies: Continuous product innovation and strong global distribution.

Recent Industry Trends

- Increased Regulatory Scrutiny: Companies are focusing on compliance with evolving global regulations.

- Sustainability: Growing demand for recyclable and eco-friendly vaping products.

- Technological Advancements: Rising interest in smart and connected vaping devices.

- Expansion in Emerging Markets: Companies are tapping into Asia-Pacific and the Middle East for growth.

- Personalization: Demand for customizable devices and diverse flavors is on the rise.

These companies lead the market through innovative products, strong branding, and a commitment to harm reduction and sustainability.