Search Market Research Report

Cell and Gene Therapy Consumables Market Size, Share Global Analysis Report, 2022 – 2028

Cell and Gene Therapy Consumables Market Size, Share, Growth Analysis Report By Product (Cell Therapy, Gene Therapy), By Application (Oncology, Dermatology, Musculoskeletal, Others), By Fleet Type (Commercial Fleet, Non-Commercial Fleet ), and By Region - Global and Regional Industry Insights, Overview, Comprehensive Analysis, Trends, Statistical Research, Market Intelligence, Historical Data and Forecast 2022 – 2028

Industry Insights

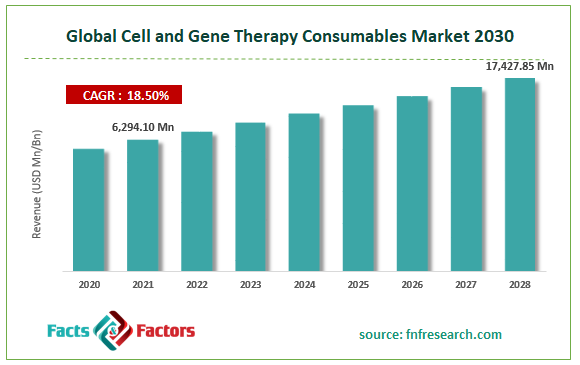

[216+ Pages Report] According to Facts and Factors, the global cell and gene therapy consumables market was worth USD 6,294.10 million in 2021 and is estimated to grow to USD 17,427.85 million by 2028, with a compound annual growth rate (CAGR) of approximately 18.50% over the forecast period. The report analyzes the cell and gene therapy consumables market's drivers, restraints/challenges, and their effect on the demands during the projection period. In addition, the report explores emerging opportunities in the cell and gene therapy consumables market.

Market Overview

Market Overview

Cell and gene therapy (CGT) is a rapidly growing field that creates effective novel treatments for autoimmune, cardiovascular, musculoskeletal, and many other diseases and hereditary and malignant illnesses. The cell and gene therapy industry has garnered great interest from researchers, patient organizations, and regulators, leading to a considerable investment in R&D. Many countries and regulatory organizations have created rules and patent settings to support the expansion of cell and gene therapy. According to the U.S. Food and Drug Administration, many more early-stage cell and gene therapy items are being evaluated (FDA). Additional evidence for this can be seen in the apparent rise in the number of applications for investigational novel drugs (INDs).

o produce high-quality cellular and gene therapies, some drug developers rely on third-party service providers to deliver raw materials such as cell culture mediums, cell isolation kits, and cell separation reagents. More than 60 service providers are actively involved in providing consumables and raw materials to create cell and gene therapies. Large firms, which control a sizable market share, are primarily dominant in the current consolidated market structure. The demand for cell therapies is undeniably growing. Over the coming ten years, there will be a consistent increase in the opportunity for companies that provide cell and gene therapy consumables. The cell and gene consumables market is anticipated to expand throughout the projection period due to the increased prevalence of chronic diseases, including cancer and heart problems.

COVID-19 Impact:

COVID-19 Impact:

As the majority of research was devoted to treating and diagnosing COVID-19, the COVID-19 pandemic decreased the number of cells and gene therapy clinical trials in the early 2020s, which impacted the market for consumables used in cell and gene therapy. The COVID-19 problem, on the other hand, gave innovation a boost. Gene therapy is advancing with some CGTs more quickly due to coordinated efforts to produce RNA-based COVID-19 vaccines, fueling the cell and gene therapy consumables market expansion.

Key Insights

Key Insights

- As per the analysis shared by our research analyst, the global cell and gene therapy consumables market value is expected to grow at a CAGR of 18.50% over the forecast period.

- In terms of revenue, the global cell and gene therapy consumables market size was valued at around USD 6,294.10 million in 2021 and is projected to reach USD 17427.85 million by 2028.

- The demand for cell therapies is undeniably growing. Over the coming ten years, there will be a consistent increase in the opportunity for companies that provide cell and gene therapy consumables.

- By product, the gene therapy category dominated the market in 2021.

- By application, the dermatology category dominated the market in 2021.

- North America dominated the global cell and gene therapy consumables market in 2021.

Growth Drivers

Growth Drivers

- Increasing investments in cell and gene therapies to drive market growth

The growth is mostly attributable to an increase in investments in cell and gene therapies and the expansion of cell and gene therapy research & development. Rising government investments aided the rise of the global market for cell and gene therapy consumables in cell-based research. Governments are investing more money in research initiatives to develop novel treatments for conditions including cancer, CVD, and others. In the market for consumables for cell and gene therapy, strategic alliances and collaborations between industry players are becoming more common. Major corporations are working together to create new technologies in cell and gene therapy to treat a range of ailments.

Restraints

Restraints

- High costs of cell and gene therapy may hinder the market growth

In the future, high costs of cell and gene therapy are anticipated to hinder the market. The sustainability of public health care funding is threatened by global political unpredictability and ongoing economic strain. The absence of affordable cancer treatments in less developed nations has impacted population health and decreased average life expectancy.

Segmentation Analysis

Segmentation Analysis

The global Cell and gene therapy consumables market has been segmented into product, application, and end-user.

Based on product, the market is segregated into cell and gene therapy. In 2021, the gene therapy segment dominated the global cell and gene therapy consumables. In the future, a new market space will be created by the expanding use of gene therapies in diagnosing diseases and the quickly expanding use of novel pharmaceuticals. It was estimated that only private firms supported gene treatments to the tune of USD 2.3 billion. The FDA is anticipated to approve 10 to 20 products annually by 2025, fueling the global market for the manufacture of cell and gene therapies.

Based on the application, the market is segregated into oncology, dermatology, musculoskeletal and others. In 2021, the dermatology category dominated the global cell and gene therapy consumables. The market for cell and gene therapy consumables will be driven by increased target gene treatments for dermatological illnesses, increasing demand for wound healing, and rising demand for burnt skin treatment. The Alliance Regenerative Medicine Report from 2021 indicated that manufacturers were becoming more interested in CGTs for skin conditions. According to the research, about 27 new dermatological products will be available in 2021.

Based on the end-user, the market is segmented into hospitals, ambulatory surgical centers, cancer care centers, wound care centers and others. In 2021, the hospital's segment dominated the global cell and gene therapy consumables. The primary drivers of the development of the hospital's segment in the cell and gene therapy consumables market are the rising demand for advanced therapy medicinal products relative to conventional medicine, revenue generation opportunities for healthcare systems and hospitals, including cell and gene therapy manufacturers with their capital, and expanding partnerships between biotech companies and hospitals.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2021 |

USD 6,294.10 Million |

Projected Market Size in 2028 |

USD 17,427.85 Million |

CAGR Growth Rate |

18.50% CAGR |

Base Year |

2021 |

Forecast Years |

2022-2028 |

Key Market Players |

Novartis AG, Amgen, Merck, Gilead Sciences, Bristol-Myers Squibb, Organogenesis Holdings, Dendreon, Vericel, Bluebird Bio, Fibrocell Science, and Others |

Key Segment |

By Product, Application, Fleet Type, and Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Regional Landscape

Regional Landscape

- North America dominated the cell and gene therapy consumables market in 2021

In 2021, North America held a disproportionately large share of the global market for cell and gene therapy consumables. Every year, 135 million new cases of Parkinson's disease and traumatic brain injuries are reported in the U.S. Additionally, 1.2 million adults are diagnosed with early-stage brain diseases, with Alzheimer's disease accounting for 11% of these cases. With more research and development happening, the need for cell and gene therapy would also be expected to expand. The regulatory approval procedure, which is expanding and becoming more advantageous for vendors providing products for cell and gene therapy, is driving the expansion of cell and gene therapy consumables in the U.S.

Competitive Landscape

Competitive Landscape

Key players within the Global Cell and Gene Therapy Consumables market include

- Novartis AG

- Amgen

- Merck

- Gilead Sciences

- Bristol-Myers Squibb

- Organogenesis Holdings

- Dendreon

- Vericel

- Bluebird Bio

- Fibrocell Science

Global Cell and Gene Therapy Consumables Market are segmented as follows:

By Product

By Product

- Cell Therapy

- Gene Therapy

By Application

By Application

- Oncology

- Dermatology

- Musculoskeletal

- Others

By Fleet Type

By Fleet Type

- Commercial Fleet

- Non-Commercial Fleet

By Region

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Nordic Countries

- Denmark

- Sweden

- Norway

- Benelux Union

- Belgium

- The Netherlands

- Luxembourg

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Southeast Asia

- Indonesia

- Thailand

- Malaysia

- Singapore

- Rest of Southeast Asia

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Industry Major Market Players

- Novartis AG

- Amgen

- Merck

- Gilead Sciences

- Bristol-Myers Squibb

- Organogenesis Holdings

- Dendreon

- Vericel

- Bluebird Bio

- Fibrocell Science

Frequently Asked Questions

Copyright © 2024 - 2025, All Rights Reserved, Facts and Factors