Search Market Research Report

Crop Protection Chemicals Market Size, Share Global Analysis Report, 2022 – 2028

Crop Protection Chemicals Market Size, Share, Growth Analysis Report By Type (Herbicides, Insecticides, Fungicides, Others (Rodenticides, Disinfectants, Fumigants, Plant Growth Regulators, And Mineral Oils )), By Source (Natural, Biopesticide), By Form (Dry And Liquid), By Mode Of Application (Foliar Spray, Seed Treatment, Soil Treatment, Others (Chemigation And Fumigation)), By Crop Type (Cereals & Grains, Oilseeds & Pulses, Fruits & Vegetables, Other Crops (Turfs & Ornamentals, Forage, And Plantation Crops)), and By Region - Global and Regional Industry Insights, Overview, Comprehensive Analysis, Trends, Statistical Research, Market Intelligence, Historical Data and Forecast 2022 – 2028

Industry Insights

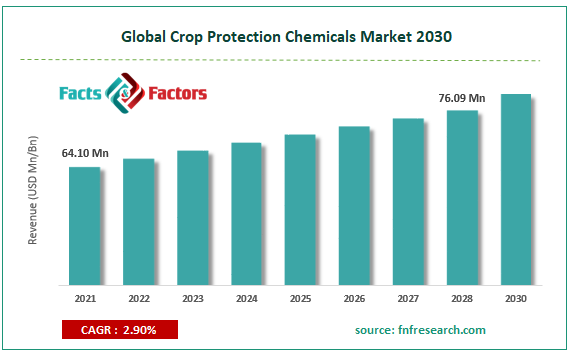

[221+ Pages Report] According to the report published by Facts Factors, the global crop protection chemicals market size was worth USD 64.10 million in 2021 and is estimated to grow to USD 76.09 million by 2028, with a compound annual growth rate (CAGR) of approximately 2.90 percent over the forecast period. The report analyzes the crop protection chemicals market's drivers, restraints/challenges, and their effect on the demands during the projection period. In addition, the report explores emerging opportunities in the crop protection chemicals market.

Market Overview

Market Overview

Weeds, pests, and other plant diseases that destroy crops can be reduced and controlled with the help of crop protection chemicals. Additionally, these elements support the long-term growth and maintenance of crop output. The three main types of crop protection chemicals are herbicides, insecticides, and fungicides. Farmers used inorganic compounds like mercury salts and arsenic to control fungus and insect infestations. There are currently hundreds of pesticides on the market to protect crops against animals, birds, insects, rodents, and viruses. Due to the necessity to boost agricultural output and provide a sustainable food supply for the growing world population, crop protection chemicals have become more and more significant over the past few decades. One of the key market factors supporting this expansion is the target audience's growing demand for food security and safer alternatives to consumption, which will benefit market operations. Additionally, a sharp increase in the global population is boosting market demand among the target audience dispersed across numerous global places.

COVID-19 Impact:

COVID-19 Impact:

Most sectors anticipated a drop in demand during the pandemic year of 2020, and due to minimal investments, many closed their doors during the first and second waves of the epidemic. However, people changed lifestyles and increased interest in leading healthy lives in the hopes of a better and disease-free future. Since the pandemic's first instances were discovered, crop protection agents have seen low to moderately negative effects. Numerous disruptions to the crop protection chemicals market's supply chain mechanism have affected the distribution channels' ability to transport powerful pesticides across several nations.

Key Insights

Key Insights

- As per the analysis shared by our research analyst, the global crop protection chemicals market is expected to grow at a CAGR of 2.90% over the forecast period.

- In terms of revenue, the global crop protection chemicals market size was valued at around USD 64.10 million in 2021 and is projected to reach USD 76.09 million by 2028.

- One of the key market factors supporting this expansion is the target audience's growing demand for food security and safer alternatives to consumption, which will benefit market operations.

- By type, the herbicides category dominated the market in 2021.

- By source, biopesticide dominated the market in 2021.

- The Asia Pacific dominated the crop protection chemicals market in 2021.

Growth Drivers

Growth Drivers

- Greater demand for food security as a result of population growth drives the market expansion

The need for food security is growing due to the world's growing population, and other important factors that will likely contribute to this growth include heavy crop loss from pest infestations, rising use of environmentally friendly insecticides, an increase in government initiatives to promote the use of protection chemicals, and growth in agricultural production. On the other hand, the development of biopesticides and organic farming, coupled with the adoption of integrated pest management, will further contribute by creating several chances that will drive the global crop protection chemicals market's growth over the above period.

Restraints

Restraints

- Stringent government regulations regarding pesticides residue likely to hamper the market growth

Strict government restrictions, concerns about pesticide residue, and a scarcity of acreage are projected to restrain the global crop protection chemicals market growth. The biggest obstacle to the market's expansion will be a lack of public knowledge and chemical price volatility.

Segmentation Analysis

Segmentation Analysis

The global crop protection chemicals market is segregated based on type, source, form, mode of application, crop type, and region.

Based on type, the market is divided into herbicides, insecticides, fungicides, and others (rodenticides, disinfectants, fumigants, plant growth regulators, and mineral oils). Among these, the herbicides segment led the market in 2021 and is expected to maintain its dominance throughout the forecast period. Herbicides are compounds that prevent the growth of undesirable plants or destroy them (weeds). They are frequently used to suppress weeds, improving agricultural yield and product quality. Herbicides improve soil fertility, lessen erosion, and increase crop output. They are frequently referred to as weed killers and are used to manage or eliminate undesirable vegetation. Herbicide usage in agroecosystems may alter the makeup of weed populations.

Based on form, the market is divided into dry and liquid. Between these, the liquid segment led the market in 2021 and is expected to maintain its dominance throughout the forecast period. The market for liquid forms of crop protection chemicals is driven by the rising demand for these products, particularly in the foliar spray and seed treatment application modes. Their demand is increased because they are less expensive than solid formulations and can be combined with any other crop enhancer or crop protection product.

Based on the source, the market is divided into natural and biopesticide. Between these, the biopesticide segment led the market in 2021 and is expected to maintain its dominance throughout the forecast period. Chemical mixes called biopesticide crop protection chemicals are created in labs to prevent, eliminate, repel, or destroy pests. Biopesticide crop protection agents are poisonous and harmful if the right chemicals are not applied.

Based on the mode of application, the market is divided into foliar spraying, seed treatment, soil treatment, and others (chemigation and fumigation). Among these, the foliar spray segment led the market in 2021 and is expected to maintain its dominance throughout the forecast period. Herbicides, insecticides, and fungicides can all be used with it. However, because of manpower scarcity for manually removing undesired weeds and preventing insect assaults on crops, it is primarily utilized for spraying herbicides and insecticides.

Based on crop type, the market is divided into cereals & grains, oilseeds & pulses, fruits & vegetables, and other crops (turfs & ornamentals, forage, and plantation crops). Among these, the cereals & grains segment led the market in 2021 and is expected to maintain its dominance throughout the forecast period.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2021 |

USD 64.10 Million |

Projected Market Size in 2028 |

USD 76.09 Million |

CAGR Growth Rate |

2.90% CAGR |

Base Year |

2021 |

Forecast Years |

2022-2028 |

Key Market Players |

BASF SE, The Dow Chemical Company, Dupont, Sumitomo Chemical Co. Ltd, Syngenta AG, Bayer Cropscience AG, FMC Corporation, NufarmLimited, Adama Agricultural Solutions Ltd., Verdesian LIfescineces, Bioworks Inc., Valent, Arysta Lifesciences Corporation, America Vanguard Corporation, Chr. Hansen, Corteva Agriscience, UPL Limited, Jiangsu Yangnong Chemical Group Co Ltd, Agrolac, Lianyungang Liben Crop Science Co. Ltd., Nanjing red sun co. Ltd, Kumiai Chemicals, Wynca Chemical, Lier Chemicals, Simpcam Oxon., and others. |

Key Segment |

By Type, Source, Form, Mode of Application, Crop Type, and Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East &, Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Regional Landscape

Regional Landscape

- Asia Pacific dominated the crop protection chemicals market in 2021

In 2021, Asia Pacific was the fastest-growing market for crop protection chemicals globally. All nations in the Asia-Pacific area practice rice farming, and small-scale manufacturers predominate. This industry is expanding due to rising consumer awareness of pesticides and ongoing technical improvements. Agribusiness firms have also been pushed to expand their supplier and production bases in the region due to the increased cultivation and growing demand for crops in the Asia-Pacific region.

Competitive Landscape

Competitive Landscape

- BASF SE

- The Dow Chemical Company

- Dupont

- Sumitomo Chemical Co. Ltd

- Syngenta AG

- Bayer Cropscience AG

- FMC Corporation

- NufarmLimited

- Adama Agricultural Solutions Ltd.

- Verdesian LIfescineces

- Bioworks Inc.

- Valent

- Arysta Lifesciences Corporation

- America Vanguard Corporation

- Chr. Hansen

- Corteva Agriscience

- UPL Limited

- Jiangsu Yangnong Chemical Group Co Ltd

- Agrolac

- Lianyungang Liben Crop Science Co. Ltd.

- Nanjing red sun co. Ltd

- Kumiai Chemicals

- Wynca Chemical

- Lier Chemicals

- Simpcam Oxon.

Global Crop Protection Chemicals Market is segmented as follows:

By Type

By Type

- Herbicides

- Insecticides

- Fungicides

- Others (rodenticides, disinfectants, fumigants, plant growth regulators, and mineral oils )

By Source

By Source

- Natural

- Biopesticide

By Form

By Form

- Dry

- Liquid

By Mode of Application

By Mode of Application

- Foliar spray

- Seed treatment

- Soil treatment

- Others (chemigation and fumigation)

By Crop Type

By Crop Type

- Cereals & grains

- Oilseeds & pulses

- Fruits & vegetables

- Other crops (turfs & ornamentals, forage, and plantation crops)

By Regional Segment Analysis

By Regional Segment Analysis

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Nordic Countries

- Denmark

- Sweden

- Norway

- Benelux Union

- Belgium

- The Netherlands

- Luxembourg

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Southeast Asia

- Indonesia

- Thailand

- Malaysia

- Singapore

- Rest of Southeast Asia

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Industry Major Market Players

- BASF SE

- The Dow Chemical Company

- Dupont

- Sumitomo Chemical Co. Ltd

- Syngenta AG

- Bayer Cropscience AG

- FMC Corporation

- NufarmLimited

- Adama Agricultural Solutions Ltd.

- Verdesian LIfescineces

- Bioworks Inc.

- Valent

- Arysta Lifesciences Corporation

- America Vanguard Corporation

- Chr. Hansen

- Corteva Agriscience

- UPL Limited

- Jiangsu Yangnong Chemical Group Co Ltd

- Agrolac

- Lianyungang Liben Crop Science Co. Ltd.

- Nanjing red sun co. Ltd

- Kumiai Chemicals

- Wynca Chemical

- Lier Chemicals

- Simpcam Oxon.

Frequently Asked Questions

Copyright © 2024 - 2025, All Rights Reserved, Facts and Factors