Search Market Research Report

Food Allergy Treatment Market Size, Share Global Analysis Report, 2024 – 2032

Food Allergy Treatment Market By Allergen Type (Dairy Products, Poultry Product, Tree Nuts, Peanuts, Shellfish, Wheat, Soy, and Others), By Drug Type (Antihistamines, Epinephrine, Immunotherapy), By Route of Administration (Oral, Parenteral, and Other), By End-Use (Hospital Pharmacies, Retail Pharmacies, and Others), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2024 – 2032

Industry Insights

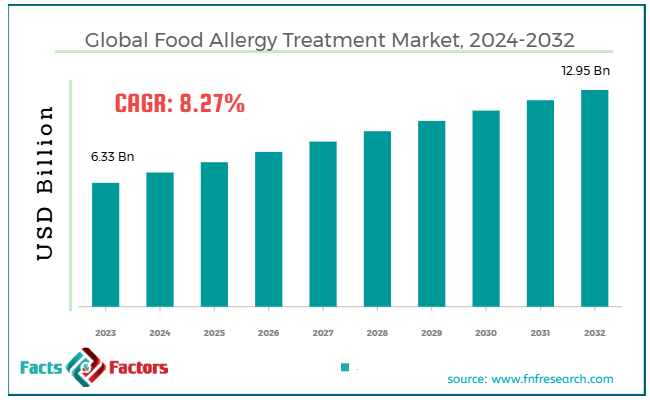

[221+ Pages Report] According to Facts & Factors, the global food allergy treatment market size was around USD 6.33 billion in 2023 and is predicted to grow to around USD 12.95 billion by 2032, with a compound annual growth rate (CAGR) of roughly 8.27% between 2024 and 2032.

Market Overview

Market Overview

Food allergy treatment emphasizes the management of allergic reactions, avoiding exposure to allergens, and offering emergency care when needed. It includes avoidance, antihistamines, epinephrine, immunotherapy, and emergency care. The food allergy treatment market is projected to witness substantial growth over the forecast period owing to factors like rising cases of food allergies, improvements in immunotherapy and treatment, and growing awareness and diagnosis. The worldwide prevalence of food allergies, especially in kids, has been steadily rising. Environmental influences, genetics, and dietary changes fuel this growth.

For example, food allergies impact 4% of adults and 5-8% of children, thus increasing the need for better treatments. The emergence of treatments like sublingual immunotherapy (SLIT), oral immunotherapy (OIT), and epinephrine injectors has propelled the overall treatment landscape.

Also, rising awareness of food allergies among patients, healthcare providers, and parents has resulted in enhanced diagnosis and improved treatment adoption. Early diagnosis aids in managing allergies before worsening and offering severe reactions.

However, factors like significant treatment costs and lack of remedial treatment will hinder the growth of the global market. Food allergy treatments, mainly immunotherapy, are expensive for most patients. Not all treatments are covered by insurance, and this cost pressure is concerning for healthcare systems and patients, thus restricting access, mainly in developing economies.

Moreover, despite improvements in preventing reactions and managing symptoms, there are, at present, no ultimate cures for these allergies. Several treatments only emphasize symptom management or desensitization, which could be a restraining factor for patients desiring long-term solutions.

Nevertheless, the global food allergy treatment industry is opportune for innovative drug development and specific therapies for food allergies. The current research for novel immunotherapy techniques, like monoclonal antibodies and biologics, provides key opportunities.

Hence, businesses investing in developing novel biologic drugs for the immune system and avoiding allergies may satisfy the massive need. The said industry is shifting towards developing allergy-specific immunotherapies that are comparably precise.

Key Insights:

Key Insights:

- As per the analysis shared by our research analyst, the global food allergy treatment market is estimated to grow annually at a CAGR of around 8.27% over the forecast period (2024-2032)

- In terms of revenue, the global food allergy treatment market size was valued at around USD 6.33 billion in 2023 and is projected to reach USD 12.95 billion by 2032.

- The food allergy treatment market is projected to grow significantly, owing to the growing inclination toward personalized medicine, growing consciousness and diagnosis, and increasing healthcare expenditure.

- Based on allergen type, the peanuts segment is expected to lead the market, while the tree nuts segment is expected to register considerable growth.

- Based on drug type, the immunotherapy segment is the dominating segment among others, while the epinephrine segment is projected to witness sizeable revenue over the forecast period.

- Based on the route of administration, the oral segment is the leading segment, while the parenteral segment is projected to witness a notable share in the future.

- Based on end-use, the hospital pharmacies segment is expected to lead the market compared to the retail pharmacies segment.

- Based on region, North America is projected to dominate the global market during the estimated period, followed by Europe.

Growth Drivers

Growth Drivers

- Growing incidences of food allergies drive the food allergy treatment market growth

The cases of food allergies have been rising, mainly in developing economies, over the past few decades. This rising incidence is among the leading propellers for the growth of the global food allergy treatment market. The more patients diagnosed with food allergies, the more effective therapeutic options are needed.

In the United States, 1 in 13 kids (8%), at least one child is diagnosed with food allergy, while nearly 4% of adults report suffering from food allergies.

As per the study in 2022, the incidences of food allergies in Asian economies are increasing, especially in Japan and China. This denotes a global rise in food allergies, mainly in the metro areas, where lifestyle changes majorly impact the immune systems.

- Improvements in immunotherapy treatments fuel the market growth

Immunotherapy treatments like OIT, epicutaneous immunotherapy (EPIT), and sublingual immunotherapy are transforming food allergy management. These treatments aim to desensitize individuals by progressively exposing them to the allergen. This decreases the severity of the reaction over time.

In January 2020, the FDA approved the first oral immunotherapy treatment, Palforzia, for peanut allergies. This breakthrough marked a significant step in developing immunotherapy for allergies. Palforzia is the first approved treatment that targets the source of the reactions instead of just handling symptoms.

The latest clinical experiments by companies like Aimmune Therapeutics and DBV Technologies are discovering the use of EPIT and SLIT to cure peanut allergies, including other forms of allergies, thus denoting a positive impact on the desensitization process.

Restraints

Restraints

- The absence of a permanent treatment for allergies adversely impacts the progress of the food allergy treatment market

At present, there is no ultimate cure for food allergies. The presently available options like epinephrine or immunotherapy only desensitize or manage allergic reactions but do not remove the allergy. This unavailability of a cure is still a key challenge for medical providers and patients.

The worldwide food allergy immunotherapy industry is anticipated to reach USD 8.3 billion by 2027, denoting development but highlighting that therapies only reduce symptoms and do not remove the allergy.

As per a report, despite improvements in treatments like OIT, nearly 70-80% of individuals still face reactions to the food they are undergoing treatment for, which focuses on the need for long-term and more effective solutions.

Opportunities

Opportunities

- The emergence of allergen-specific and personalized therapies impacts the food allergy treatment market growth

One of the thrilling opportunities in the global food allergy treatment industry is the emergence of personalized treatments modified to specific allergens. Biologics and immunotherapy treatments are gaining popularity and becoming specific, aiming at the origin of the allergy in a less risky and more efficient manner.

The worldwide allergy immunotherapy market is anticipated to reach USD 8.3 billion with a 12.9% CAGR, impacted by the growing need for effective and targeted treatments.

The growth of allergen-specific treatments might enhance immunotherapy results as reports signify that 50-70% of individuals taking immunotherapies for peanut or other allergies showcased progress in tolerance levels.

Challenges

Challenges

- The slow pace of R&D may limit the growth of the food allergy treatment market

While key progress and advancements have been made in the global market, the speed of R&D is still sluggish, mainly for severe and complex allergies like shellfish, milk, and tree nut allergies. Several therapies and treatments today emphasize peanut allergies, which affect a tiny segment of the population. The shortage of targeted treatments for other prominent allergens challenges the food allergy treatment market.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2023 |

USD 6.33 Billion |

Projected Market Size in 2032 |

USD 12.95 Billion |

CAGR Growth Rate |

8.27% CAGR |

Base Year |

2023 |

Forecast Years |

2024-2032 |

Key Market Players |

Aimmune Therapeutics, DBV Technologies, Teva Pharmaceuticals, Sanofi, Novartis, Regeneron Pharmaceuticals, MedImmune (AstraZeneca), Stallergenes Greer, Kendle International, Bausch Health, Amgen, Eli Lilly and Company, Merck & Co., Purdue Pharma, Bayer Healthcare, and others. |

Key Segment |

By Allergen Type, By Drug Type, By Route of Administration, By End Use, and Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East &, Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Segmentation Analysis

Segmentation Analysis

The global food allergy treatment market is segmented based on allergen type, drug type, route of administration, end use, and region.

Based on allergen type, the global food allergy treatment industry is divided into dairy products, poultry products, tree nuts, peanuts, shellfish, wheat, soy, and others. Peanut allergies are the leading type of food allergy globally, and they are widely seen in Western nations. These allergies have gained huge traction regarding treatment development, research, and industry growth owing to their severity of reactions and growing prevalence. The rise of OIT or oral immunotherapy treatments like Palforzia and the emphasis on biologic treatments have significantly driven the need to cure peanut allergies.

Based on drug type, the global food allergy treatment industry is segmented as antihistamines, epinephrine, and immunotherapy. The immunotherapy segment is the dominating segment, among others, fueled by the rising use of OIT, sublingual immunotherapy, and subcutaneous immunotherapy. These treatments are targeted to desensitize the immune system to certain allergens. This provides a long-term solution as compared to simply symptom management. Oral immunotherapy, mainly for peanut allergies, has shown promise, thus increasing the focus on immunotherapy in the global market.

Based on end-use, the global market is segmented as hospital pharmacies, retail pharmacies, and others. The hospital pharmacies segment held a notable share of the market in 2023. It will continue to dominate over the estimated period owing to the increasing need for specialized treatments like OIT, biologics, and emergency treatments widely offered in hospitals and clinical settings. Hospital pharmacies are also important in managing patients with complex or severe food allergies that need constant supervision and follow-ups. Hospital pharmacies usually manage high-risk and complex food allergy treatments, comprising the ones that need medical supervision, like injectable biologics for severe incidences and OIT for peanut allergies. Hospital pharmacies are essential in emergencies since they offer immediate access to several life-saving therapies, including epinephrine treatment.

Regional Analysis

Regional Analysis

- North America to witness significant growth over the forecast period

North America held a notable share of the global food allergy treatment market in 2023 and is projected to continue its dominance with a 39.14% revenue share over the forecast period. The key reasons for the growth comprise growing incidences of food allergies, developed healthcare infrastructure, and the presence of key pharmaceutical companies. The U.S. reports that nearly 33 million people, comprising 8% of young people, suffer from allergies. This prevalence fuels the demand for interventions and effective treatments. The region also brags about its cutting-edge medical facilities and strong healthcare system, thus promising access to superior treatments and timely diagnosis. North America is also home to the major pharmaceutical companies, with expertise in allergy cures, supporting speedy development and distribution of products.

Europe held a revenue of $ 2.98 billion in 2024 and is projected to be the second-leading region among others. The factors driving the regional market include increased cases of food allergies, improved healthcare infrastructure, and rising investment in R&D.

According to studies, approximately 2.7% of children in the region have confirmed food allergies clinically. Economies like France, Germany, and the United Kingdom have reported significant numbers of people affected, thus fueling the need for improved treatments.

Also, the region's sophisticated healthcare systems, especially in the leading nations, support exhaustive allergy treatment services and diagnosis. Furthermore, rising investments in allergy R&D have considerably developed novel therapies. For example, in October 2024, the UK introduced the SEAL clinical trial to prevent infant food allergies.

Competitive Analysis

Competitive Analysis

The global food allergy treatment market is led by players like:

- Aimmune Therapeutics

- DBV Technologies

- Teva Pharmaceuticals

- Sanofi

- Novartis

- Regeneron Pharmaceuticals

- MedImmune (AstraZeneca)

- Stallergenes Greer

- Kendle International

- Bausch Health

- Amgen

- Eli Lilly and Company

- Merck & Co.

- Purdue Pharma

- Bayer Healthcare

Key Market Trends

Key Market Trends

- Precision and personalized medicine:

As research improves, the shift towards personalized treatments modified to meet patients' needs also increases. This trend comprises the development of diagnostic solutions that can efficiently decide the suitable treatment for patients, thus enhancing the efficiency of treatments.

- Monoclonal antibodies and biologic drugs:

Novel biologic treatments like monoclonal antibodies, such as Xolair, are gaining traction for treating food-associated allergies. These drugs majorly reduce reactions by aiming at certain molecules in the immune response. The said trend is also driving the availability of therapies for patients who do not respond appropriately to conventional treatments and for patients with severe allergies.

The global food allergy treatment market is segmented as follows:

By Allergen Type Segment Analysis

By Allergen Type Segment Analysis

- Dairy Products

- Poultry Product

- Tree Nuts

- Peanuts

- Shellfish

- Wheat

- Soy

- Others

By Drug Type Segment Analysis

By Drug Type Segment Analysis

- Antihistamines

- Epinephrine

- Immunotherapy

By Route of AdministrationSegment Analysis

By Route of AdministrationSegment Analysis

- Oral

- Parenteral

- Other

By End Use Segment Analysis

By End Use Segment Analysis

- Hospital Pharmacies

- Retail Pharmacies

- Others

By Regional Segment Analysis

By Regional Segment Analysis

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- Southeast Asia

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Industry Major Market Players

- Aimmune Therapeutics

- DBV Technologies

- Teva Pharmaceuticals

- Sanofi

- Novartis

- Regeneron Pharmaceuticals

- MedImmune (AstraZeneca)

- Stallergenes Greer

- Kendle International

- Bausch Health

- Amgen

- Eli Lilly and Company

- Merck & Co.

- Purdue Pharma

- Bayer Healthcare

Frequently Asked Questions

Copyright © 2024 - 2025, All Rights Reserved, Facts and Factors