Search Market Research Report

Fusion Beverages Market Size, Share Global Analysis Report, 2022 – 2028

Fusion Beverages Market By Product Type (Fused Coffee and Tea, Carbonated Drinks, Fusion alcoholic Beverage, Fruit Juice, Energy and Sports Drinks, Others), By Distribution Channel (Off-Trade, On-Trade), and By Region - Global Industry Insights, Growth, Size, Share, Comparative Analysis, Trends, Statistical Research, Market Intelligence, and Forecast 2022 – 2028

Industry Insights

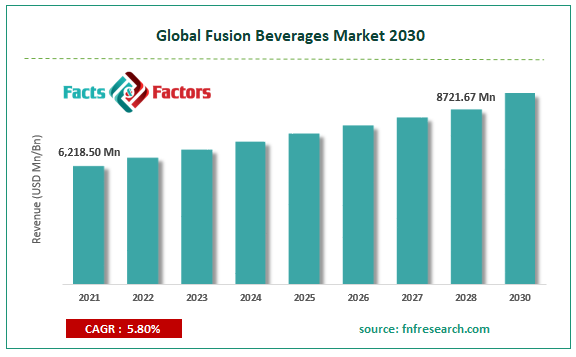

[213+ Pages Report] According to Facts and Factors, the global Fusion Beverages market size was valued at USD 6,218.50 million in 2021 and is predicted to increase at a CAGR of 5.80% to USD 8721.67 million by 2028. The study examines the market in terms of revenue in each of the major regions, which are classified into countries.

Market Overview

Market Overview

Beverages are liquids that are made for consumption and come in a variety of flavors. Some of the types could be stimulants such as milk, coffee, and tea. It could also take the form of refreshers like water, juice, or soft drinks. Fusion beverages are a brand new concept in the beverage industry. It combines new wholesomeness with great taste to satisfy. It combines new wholesomeness with great taste to satisfy consumers' taste buds. The global fusion beverages market's popularity stems from the wide range of products it provides. The market is poised for significant growth as a result of changing consumer tastes and catering to those tastes through innovative drinks such as fusion drinks. The global fusion beverages market is poised to soar on the back of increased consumer demand for flavor and wholesomeness in their food and beverage options. Furthermore, the emerging trend of dietary evaluation is expected to propel the global fusion beverages market on a high growth trajectory.

The global fusion drink market is expanding into a wide range of products. Consumer tastes are shifting, and the market is poised to expand significantly in response, thanks to innovative beverages such as Fusion Drinks. Increased beverage adoption, emerging economies, and rising health care trends in the nutritional millennium generation are some of the factors driving the fusion beverage market's growth during the forecast period. People are eating and drinking more and more nowadays. The longer people work, the less inclined they are to cook at home. As a result, it is not surprising that the shift is massive, with sub-shifts. Secondary shifts emerge as a result of the desire to eat out while remaining healthy. This is primarily due to the high level of consumer interest in wellness. As a result, demand for fusion drinks that combine healthy flavors will skyrocket during the forecast period. As healthy drinks become more popular as a lifestyle choice, beverage companies around the world are redesigning their product lines to include the most recent products in order to keep up with these ever-changing trends.

Impact of COVID – 19

Impact of COVID – 19

The global fusion beverage market has seen a negative impact on growth due to imposed restrictions as a result of the spread of COVID-19 in 2020. The raw material production of fusion beverages was impacted due to a halt in the supply chain, which resulted in the market shrinking. Import-export regulations were also impacted as a result of the border closure. Restaurants, bars, and pubs were forced to close as a result of the lockdown, further affecting the market. However, because of COVID's travel restrictions, online markets have made fusion market products more accessible.

The complete research study looks at both the qualitative and quantitative aspects of the Fusion Beverages market. Both the demand and supply sides of the market have been investigated. The demand side study examines market income in various regions before comparing it to all of the major countries. The supply side research examines the industry's top rivals, as well as their regional and global presence and strategies. Each major country in North America, Europe, Asia Pacific, the Middle East and Africa, and Latin America is thoroughly investigated.

Segmentation Analysis

Segmentation Analysis

The global Fusion Beverages market is segregated based on product type and end user.

Based on the product type, the fusion alcoholic beverages segment had a substantial share in the market growth. The new-age client wants new flavors in their foods and beverages while maintaining a healthy lifestyle. In this context, fusion alcoholic beverages have successfully carved out niches on consumer wish lists, and the growing demand for functional beverages will increase their use in the coming years. In addition, the growing popularity of house parties in recent years has aided the market's growth over the forecast period.

Based on the distribution channel, the off-trade segment dominates the market over the forecast period. This is because hypermarkets can make a large number of products available to customers at the same time and in the same location, making the shopping experience more convenient for them. Furthermore, because of the convenience, availability of products, and availability of coupons and discounts, consumers prefer to shop in stores.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2021 |

USD 6,218.50 Million |

Projected Market Size in 2028 |

USD 8,721.67 Million |

CAGR Growth Rate |

5.80% CAGR |

Base Year |

2021 |

Forecast Years |

2022-2028 |

Key Market Players |

ZICO Beverages, Pepsico, Lucozade, Coca-Cola, Pocari, Gatorade, 100 Plus, Power Ade, and Others |

Key Segment |

By Product Type, Distribution Channel, and Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Regional Landscape

Regional Landscape

The North American region dominates the fusion beverage market and will continue to do so during the forecast period due to rising living standards, the presence of the majority of market players, and the region's people's bust lifestyle. The constant development and innovation of flavors by a variety of well-established manufacturers will generate a plethora of profitable opportunities for the fusion beverage market. Other important factors influencing the growth of the fusion beverage market include the increasing penetration of e-commerce websites and the need for physical activities and health management. The major factors fostering the growth of the fusion beverage market are increasing beverage adoption, rising health management trends in emerging economies, and nutrition millennials.

List of Key Players in the Global Fusion Beverages Market:

List of Key Players in the Global Fusion Beverages Market:

- ZICO Beverages,

- Pepsico,

- Lucozade,

- Coca-Cola,

- Pocari,

- Gatorade,

- 100 Plus,

- Power Ade

- others

The Global Fusion Beverages Market is segmented as follows:

By Product Type

By Product Type

- Fused coffee and tea

- Carbonated Drinks

- Fusion alcoholic Beverage

- Fruit Juice

- Energy and Sports Drinks

- Others

By Distribution Channel

By Distribution Channel

- Off-Trade

- On-Trade

By Region

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Nordic Countries

- Denmark

- Sweden

- Norway

- Benelux Union

- Belgium

- The Netherlands

- Luxembourg

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Southeast Asia

- Indonesia

- Thailand

- Malaysia

- Singapore

- Rest of Southeast Asia

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Industry Major Market Players

- ZICO Beverages

- Pepsico

- Lucozade

- Coca-Cola

- Pocari

- Gatorade

- 100 Plus

- Power Ade

- Others

Frequently Asked Questions

Q.4. By Region, which segment will dominate the global fusion beverages market during forecast year?

Copyright © 2024 - 2025, All Rights Reserved, Facts and Factors