Search Market Research Report

Geospatial Imagery Analytics Market Size, Share Global Analysis Report, 2022 – 2028

Geospatial Imagery Analytics Market Size, Share, Growth Analysis Report By Type (Imagery Analytics and Video Analytics), By Collection Mediums (Satellites, Geographic Information System, Unmanned Aerial Vehicles, and Others), By Deployment Mode (Cloud, and On-premises), By Organization Size (Large Enterprises, Small & Medium-sized Enterprises (SMEs)), By Vertical (Insurance, Defense & Security, Government, Environmental Monitoring, Energy, Utility, & Natural Resources, Engineering & Construction, Mining & Manufacturing, Agriculture, Healthcare & Life Sciences, and Other Verticals), and By Region - Global and Regional Industry Insights, Overview, Comprehensive Analysis, Trends, Statistical Research, Market Intelligence, Historical Data and Forecast 2022 – 2028

Industry Insights

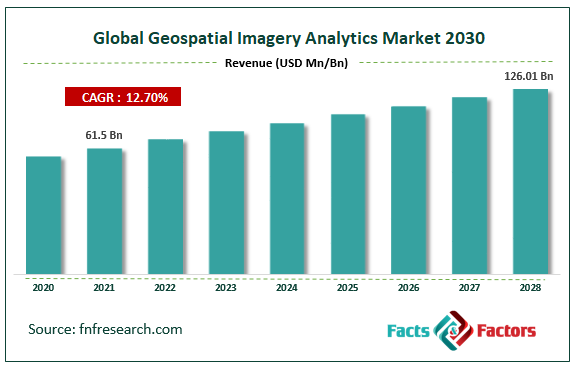

[230+ Pages Report] According to Facts and Factors, the global geospatial imagery analytics market size was worth USD 61.5 billion in 2021 and is estimated to grow to USD 126.01 billion by 2028, with a compound annual growth rate (CAGR) of approximately 12.70% over the forecast period. The report analyzes the geospatial imagery analytics market's drivers, restraints/challenges, and their effect on the demands during the projection period. In addition, the report explores emerging opportunities in the geospatial imagery analytics market.

Market Overview

Market Overview

Geospatial imaging analytics is a set of tools for assisting and analyzing geographic data gathered from sources such as GPS, satellite images, or mapping to create valuable information for making crucial business decisions. The geospatial imaging analysis system is based on big data analytics and contains predictive analytics. Its support in the corporate and public sectors facilitates important business decisions, risk assessment & catastrophe management, urban development, and climatic conditions. Compared to 3D and 2D analysis, geospatial imaging analysis generates more accurate images. The usage of big data and artificial intelligence (Al) to improve geospatial imagery analytics solutions and intense competition among market rivals are driving the market. The market for geospatial imaging analytics will expand more quickly due to rising income levels and the progress of analytics technology.

COVID-19 Impact:

COVID-19 Impact:

Supply chains were largely disrupted, and some economies collapsed due to COVID-19. However, during the lockdown, demand for geospatial analytics solutions increased significantly. It became crucial to keep tabs on everyone's movements to stop the sickness from spreading. Additionally, the production facilities were shut down, which made it more difficult to control and supply electrical components. Overall, the geospatial imagery analytics market eventually overcame the initial effects of the worldwide epidemic and will have tremendous growth in the forecast period.

Key Insights

Key Insights

- As per the analysis shared by our research analyst, the global geospatial imagery analytics market value is expected to grow at a CAGR of 12.70% over the forecast period.

- In terms of revenue, the global geospatial imagery analytics market size was valued at around USD 61.5 billion in 2021 and is projected to reach USD 126.01 billion by 2028.

- The usage of big data and artificial intelligence (Al) to improve geospatial imagery analytics solutions and intense competition among market rivals are driving the market.

- By type, the imagery analytics category dominated the market in 2021.

- By deployment model, the cloud category dominated the market in 2021.

- North America dominated the global geospatial imagery analytics market in 2021.

Growth Drivers

Growth Drivers

- The rise of geospatial imagery analytics technologies drives the market growth

The frequency and volume of data collection are rising exponentially with the development of geospatial technologies. The management of this enormous volume of data is the main difficulty facing many enterprises throughout the world. Machines can process gigabytes of geographical data and produce insightful results using AI and deep learning. Additionally, the fusion of cutting-edge technologies with geospatial imaging technology can offer governments and researchers information for managing pandemics, such as satellite photos. Systems that use AI can detect disease outbreaks in a variety of locations. All these factors will spur the growth of the global geospatial imagery analytics market in the coming period.

Restraints

Restraints

- Regulations and legal issues may hinder the market growth

Limitations constrain the use of geospatial imaging analytics solutions in the data gathering methods caused by geographic variances, intellectual property rights, data licensing, location privacy, and geospatial data storage. Such legal issues are crucial for geospatial technology vendors since they guarantee major governmental and private geospatial projects.

Opportunities

Opportunities

- Increasing implementation of 5G networks presents market opportunities

Many nations are developing 5G technology and infrastructure to attract foreign direct investments into their nations. Projects aimed at creating smart cities are largely supported by geospatial technology. Using precise data from geospatial imagery and video analytics technology aids the public and government sectors design appropriate city infrastructure.

Segmentation Analysis

Segmentation Analysis

The global geospatial imagery analytics market has been segmented into type, collection medium, deployment mode, organization size, verticals, and region.

Based on the type, the geospatial imagery analytics market is segregated into imagery and video analytics. Among these, the imagery analytics segment led the market in 2021 and is expected to maintain its dominance throughout the forecast period. Imaging analytics are used due to the ease with which high-resolution photographs can now be obtained due to the several technological advancements in satellite technology.

Based on the collection medium, the geospatial imagery analytics market is segregated into satellites, geographic information systems, unmanned aerial vehicles, and others. Among these, the geographic information system segment led the market in 2021 and is expected to maintain its dominance throughout the forecast period owing to more remote sensing applications using geographic information systems (GIS). As location-based analytics services increase, businesses are switching to the GIS data collection strategy, which allows them to improve their overall efficiency and decision-making.

Based on the deployment mode, the geospatial imagery analytics market is segregated into cloud and on-premises. Among these, the cloud segment led the market in 2021 and is expected to maintain its dominance throughout the forecast period. The cloud-based deployment enables organizations to analyze and communicate data discoveries more effectively, foster collaboration, and give decision-makers quicker access to business intelligence, which has led to a larger acceptance of the technology in the geospatial imaging analytics market.

The geospatial imagery analytics market is segregated into large and small & medium-sized enterprises (SMEs) based on organization size. Among these, the small & medium-sized enterprises (SMEs) segment led the market in 2021 and is expected to maintain its dominance throughout the forecast period as cloud-based products and services assist customers in boosting productivity and enhancing corporate success. Due to the growing popularity of the cloud, many large businesses are utilizing geospatial imagery analytics software and services, and this trend is anticipated to continue during the projection period.

Based on verticals, the geospatial imagery analytics market is segmented into insurance, defense & security, government, environmental monitoring, energy, utility, natural resources, engineering & construction, mining & manufacturing, agriculture, healthcare & life sciences, and other verticals. Among these, the healthcare & life sciences segment led the market in 2021 and is expected to maintain its dominance throughout the forecast period by delivering real-time data that can support decisions and give actionable insights for the vertical, geospatial imaging analytics aids in decision-making. It provides information that can help improve the efforts to provide patient care, services, and current practices.

Recent Developments:

Recent Developments:

- November 2021: To offer customers sophisticated agriculture data products, Planet Labs bought VanderSat.

- October 2021: Ola bought geospatial firm GeoSpoc in October 2021 to advance and improve its cutting-edge location intelligence technologies.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2021 |

USD 61.5 Billion |

Projected Market Size in 2028 |

USD 126.01 Billion |

CAGR Growth Rate |

12.70% CAGR |

Base Year |

2021 |

Forecast Years |

2022-2028 |

Key Market Players |

Google, Microsoft, Oracle, L3Harris Corporation, Hexagon AB, ESRI, TomTom, Trimble, UrtheCast, Geocento, Sparkgeo, Mapidea, ZillionInfo, Geospin, Alteryx, RMSI, Maxar Technologies, Ola, Planet Labs, Orbital Insight, OneView, Boston Geospatial, SafeGraph, Hydrosat, GeoVerra, Slingshot Aerospace, and Others |

Key Segment |

By Type, Collection Mediums, Deployment Mode, Organization Size, Vertical, and Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East &, Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Regional Landscape

Regional Landscape

- North America dominated the geospatial imagery analytics market in 2021

In 2021, North America dominated the global geospatial imagery analytics market due to the geospatial technologies that have been added to big data, the internet of things, artificial intelligence (AI), and machine learning (ML) to improve communication regions. The expansion is also a result of several developed economies, like Canada and the US, and the emphasis on innovations brought about by R&D and different technology. The greatest market for geospatial imagery analytics products is North America, a region that generates a lot of data.

Competitive Landscape

Competitive Landscape

- Microsoft

- Oracle

- L3Harris Corporation

- Hexagon AB

- ESRI

- TomTom

- Trimble

- UrtheCast

- Geocento

- Sparkgeo

- Mapidea

- ZillionInfo

- Geospin

- Alteryx

- RMSI

- Maxar Technologies

- Ola

- Planet Labs

- Orbital Insight

- OneView

- Boston Geospatial

- SafeGraph

- Hydrosat

- GeoVerra

- Slingshot Aerospace.

Global Geospatial Imagery Analytics Market is segmented as follows:

By Type

By Type

- Imagery Analytics

- Video Analytics

By Collection Mediums

By Collection Mediums

- Satellites

- Geographic Information System

- Unmanned Aerial Vehicles

- Others

By Deployment Mode

By Deployment Mode

- Cloud

- On-premises

By Organization Size

By Organization Size

- Large enterprises

- Small and medium-sized enterprises (SMEs)

By Vertical

By Vertical

- Insurance

- Defense and Security

- Government

- Environmental Monitoring

- Energy, Utility, and Natural Resources

- Engineering and Construction

- Mining and Manufacturing

- Agriculture

- Healthcare and Life Sciences

- Other Verticals

By Regional Segment Analysis

By Regional Segment Analysis

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Nordic Countries

- Denmark

- Sweden

- Norway

- Benelux Union

- Belgium

- The Netherlands

- Luxembourg

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Southeast Asia

- Indonesia

- Thailand

- Malaysia

- Singapore

- Rest of Southeast Asia

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Industry Major Market Players

- Microsoft

- Oracle

- L3Harris Corporation

- Hexagon AB

- ESRI

- TomTom

- Trimble

- UrtheCast

- Geocento

- Sparkgeo

- Mapidea

- ZillionInfo

- Geospin

- Alteryx

- RMSI

- Maxar Technologies

- Ola

- Planet Labs

- Orbital Insight

- OneView

- Boston Geospatial

- SafeGraph

- Hydrosat

- GeoVerra

- Slingshot Aerospace.

Frequently Asked Questions

Copyright © 2024 - 2025, All Rights Reserved, Facts and Factors