Search Market Research Report

Green Logistics Market Size, Share Global Analysis Report, 2022 – 2028

Green Logistics Market Size, Share, Growth Analysis Report By Organisation Size (Large Enterprises, Small and Medium Enterprise), By Supply Chain Process (Transportation, Inbound Logistics, Outbound Logistics, Disposal and Reverse Logistics, Warehousing and Material Handling, Packaging), By Industry (Retail Consumer Goods, Semiconductor and Electronics, Chemical and Material, Automotive, Energy and Utilities, Farming and Agriculture, Others), and By Region - Global and Regional Industry Insights, Overview, Comprehensive Analysis, Trends, Statistical Research, Market Intelligence, Historical Data and Forecast 2022 – 2028

Industry Insights

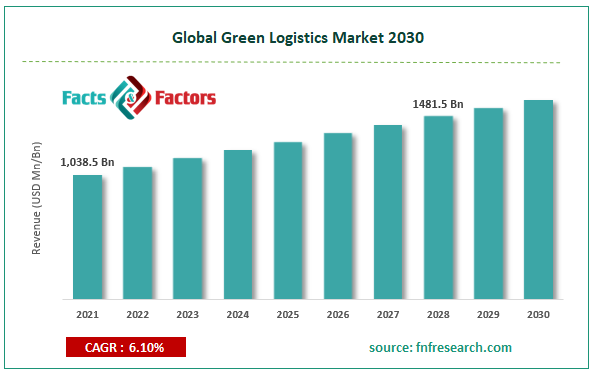

[225+ Pages Report] According to Facts and Factors, the global green logistics market size was worth USD 1,038.5 billion in 2021 and is estimated to grow to USD 1481.5 billion by 2028, with a compound annual growth rate (CAGR) of approximately 6.10% over the forecast period. The report analyzes the green logistics market's drivers, restraints/challenges, and their effect on the demands during the projection period. In addition, the report explores emerging opportunities in the Green logistics market.

Market Overview

Market Overview

Green logistics refers to a company's efforts to lessen the environmental damage that its logistical operations cause. Logistics encompasses a variety of tasks such as shipping, receiving, and material handling, as well as other activities. Logistics companies must follow guidelines to receive the energy star rating and other environmental certifications, which are essential for the company to compete in the market. As a result of global warming, ice caps, glaciers, and the weather are all suffering. Due to the rising sea level caused by melting ice caps and glaciers, businesses are concentrating on green logistics to protect the environment. For instance, the bulk of the Greenland and Antarctic sheets has decreased, according to NASA. A rise in atmospheric emissions of carbon dioxide and other pollutants due to human activity is to blame for this.

Additionally, the worldwide sea level has increased by around 8 inches over the past century. These concerns caused the transportation sector worldwide to adopt strict environmental rules. Commercial vehicles are heavily restricted from public roadways since they contribute significantly to environmental pollution. The global green logistics market is expanding due to these factors forcing multinational logistics companies to adopt environmentally friendly practices like utilizing electric vehicles in their transportation fleet.

COVID-19 Impact:

COVID-19 Impact:

The COVID-19 pandemic has caused supply chain disruptions that have reduced supply or decreased demand in the market for green logistics. Consumer and company expenditure has fallen sharply as a result of travel restrictions and social isolation policies, and this trend is expected to last for some time. The pandemic has altered end-user trends and tastes, leading to manufacturers, developers, and service providers adopting various tactics to stabilize the business.

Key Insights

Key Insights

- As per the analysis shared by our research analyst, the global green logistics market value is expected to grow at a CAGR of 6.10% over the forecast period.

- In terms of revenue, the global green logistics market size was valued at around USD 1,038.5 billion in 2021 and is projected to reach USD 1481.5 billion by 2028.

- Commercial vehicles are heavily restricted from public roadways since they contribute significantly to environmental pollution. The global green logistics market is expanding due to this factor forcing multinational logistics companies to adopt environmentally friendly practices like utilizing electric vehicles in their transportation fleet.

- By organization size, the large enterprise category dominated the market in 2021.

- By industry, the automotive category dominated the market in 2021.

- The Asia Pacific dominated the global green logistics market in 2021.

Growth Drivers

Growth Drivers

- Rapid advancements in technology to drive market growth

Creating new technologies aligned with common business requirements in the current scenario would significantly contribute to the market's surge during the predicted timeframe. The growth of digitization in global logistics is expanding the size of the global green logistics market. The increased use of artificial intelligence (AI) in the global logistics industry is expected to boost the future market for green logistics. Furthermore, corporations, particularly those with large transportation volumes, enforce climate protection measures such as limiting carbon emissions in the atmosphere. This will increase market demand during the forecast period.

Restraints

Restraints

- The high cost of green procurement may hinder the market growth

The high cost of green procurement is expected to slow the growth of the green logistics market over the forecast period. Measuring how much carbon has been emitted into the environment and creating a report on it is time-consuming and impeding the global green logistics market's demand.

Growth Opportunities

Growth Opportunities

- Increased environmental consciousness among end-use industries presents market opportunities

Increased environmental consciousness among end-use industries is expected to drive demand for the global green logistics market during the projected period. As society focuses more on ecologically friendly products, companies are emphasizing green logistics to gain a competitive advantage over their competitors, boosting the global green logistics market demand. Nonetheless, rigorous environmental regulations are projected to open up new development opportunities for the market throughout the forecast period.

Segmentation Analysis

Segmentation Analysis

The global green logistics market has been segmented into organization size, supply chain process, and fleet type.

Based on organization size, the market is segregated into large enterprises & small and medium enterprises. In 2021, the large enterprise segment dominated the global green logistics. The segment's expansion throughout the forecast period is due to the expanding demand for value creation in logistics and transportation activities. In addition, large businesses are concentrating primarily on replacing their outdated fleets with fuel-efficient ones to comply with legal requirements and save operating expenses. Moreover, due to a growing awareness of sustainability rules, major corporations are attempting to encourage green transportation by using electric vehicles.

Based on the supply chain process, the market is segregated into transportation, inbound logistics, outbound logistics, disposal and reverse logistics, warehousing and material handling and packaging. In 2021, the transportation category dominated the global green logistics. Reverse logistics are in high demand because of the flourishing eCommerce industry, which has contributed to the segment's rise over the forecast period. Additionally, the fierce competition among logistics service providers in emerging markets will open up lucrative new growth opportunities for the transportation sector throughout the projected period.

Based on the industry, the market is segmented into retail consumer goods, semiconductors and electronics, chemical and material, automotive, energy and utilities, farming and agriculture and others. In 2021, the automotive segment will dominate global green logistics. Commercial vehicles are heavily restricted from public roadways since they contribute significantly to environmental pollution. As a result of this factor encouraging global logistics organizations to embrace eco-friendly environmental policies, including the use of electric automobiles for their transportation fleet, the size of the global green logistics market is expanding.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2021 |

USD 1,038.5 Billion |

Projected Market Size in 2028 |

USD 1481.5 Billion |

CAGR Growth Rate |

6.10% CAGR |

Base Year |

2021 |

Forecast Years |

2022-2028 |

Key Market Players |

20 cube Logistics Pte Ltd, AI Futtaim Logistics, Hupac Group, KLG Europe, Mahindra Logistics Ltd., Express Freight Management, Bollore Logistics, Bowling Green Logistics DHL International GmbH, Fujitsu Limited, Go Green Logistics, Peter Green Chilled, The Green Group, Transervice Logistics Inc., United Parcel Service of America, Inc, Westerman MultiModal Logistics, and Others |

Key Segment |

By Organization Size, Supply Chain Process, Industry, and Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Regional Landscape

Regional Landscape

- The Asia Pacific dominated the green logistics market in 2021

In 2021, Asia Pacific dominated the global green logistics market. The region's market is expanding due to growing nations like India's transition to the fourth industrial revolution and embrace of new digital technologies. In addition, unified end-to-end logistics activities in countries such as India will drive regional market growth during the forecast period. The government imposes penalties for failing to meet environmental standards. The global green logistics industry is being driven by a growth in the use of electric vehicles in this region due to their zero-emission to the environment.

Competitive Landscape

Competitive Landscape

Key players within the Global Green Logistics Market include

- 20 cube Logistics Pte Ltd

- AI Futtaim Logistics

- Hupac Group

- KLG Europe

- Mahindra Logistics Ltd.

- Express Freight Management

- Bollore Logistics

- Bowling Green Logistics

- DHL International GmbH

- Fujitsu Limited

- Go Green Logistics

- Peter Green Chilled

- The Green Group

- Transervice Logistics Inc.

- United Parcel Service of America Inc

- Westerman MultiModal Logistics

Global Green Logistics Market is segmented as follows:

By Organization Size

By Organization Size

- Large Enterprises

- Small and Medium Enterprise

By Supply Chain Process

By Supply Chain Process

- Transportation

- Inbound Logistics

- Outbound Logistics

- Disposal and Reverse Logistics

- Warehousing and Material Handling

- Packaging

By Industry

By Industry

- Retail Consumer Goods

- Semiconductor and Electronics

- Chemical and Material

- Automotive

- Energy and Utilities

- Farming and Agriculture

- Others

By Region

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Nordic Countries

- Denmark

- Sweden

- Norway

- Benelux Union

- Belgium

- The Netherlands

- Luxembourg

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Southeast Asia

- Indonesia

- Thailand

- Malaysia

- Singapore

- Rest of Southeast Asia

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Industry Major Market Players

- 20 cube Logistics Pte Ltd

- AI Futtaim Logistics

- Hupac Group

- KLG Europe

- Mahindra Logistics Ltd.

- Express Freight Management

- Bollore Logistics

- Bowling Green Logistics

- DHL International GmbH

- Fujitsu Limited

- Go Green Logistics

- Peter Green Chilled

- The Green Group

- Transervice Logistics Inc.

- United Parcel Service of America Inc

- Westerman MultiModal Logistics

Frequently Asked Questions

Copyright © 2024 - 2025, All Rights Reserved, Facts and Factors