Search Market Research Report

IT Asset Disposition Market Size, Share Global Analysis Report, 2022 – 2028

IT Asset Disposition Market Size, Share, Growth Analysis Report By Service (De-Manufacturing & Recycling, Remarketing & Value Recovery, Data Destruction/Data Sanitation, Logistics Management & Reverse Logistics, Other Services (On-site Audit solutions and Clients’ Online Portals)), By Asset Type (Computers/Laptops, Servers, Mobile Devices, Storage Devices, Peripherals), By Organization Size (Small & Medium-Sized Enterprises, Large Enterprises), By End-User (Banking, Financial Services & Insurance (BFSI), IT & Telecom, Education, Healthcare, Aerospace & Defense, Public Sector & Government Offices, Manufacturing, Media & Entertainment, Others (Energy & Utility, Construction & Real Estate, Logistics & Transportation)), and By Region - Global and Regional Industry Insights, Overview, Comprehensive Analysis, Trends, Statistical Research, Market Intelligence, Historical Data and Forecast 2022 – 2028

Industry Insights

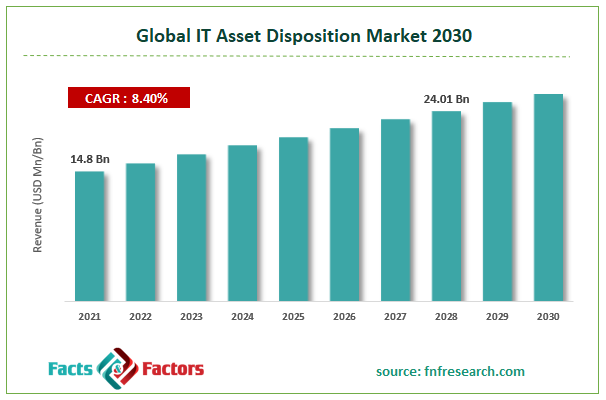

[228+ Pages Report] According to Facts and Factors, the global IT asset disposition market size was worth USD 14.8 billion in 2021 and is estimated to grow to USD 24.01 billion by 2028, with a compound annual growth rate (CAGR) of approximately 8.40 percent over the forecast period. The report analyzes the IT asset disposition market's drivers, restraints/challenges, and their effect on the demands during the projection period. In addition, the report explores emerging opportunities in the IT asset disposition market.

Market Overview

Market Overview

IT asset disposition is the secure, environmentally friendly disposal of unused or old technology. Data security for storage devices and proper environmental disposal are controlled when disposing of IT assets. ITAD vendors are experts at streamlining IT assets' disposal while minimizing costs and maximizing loss recovery. The replacement cycle for IT equipment in IT firms is extremely high. IT infrastructure is often modified by businesses. Disposing of IT assets may be challenging and risky for large enterprises due to the possible threats to data security and environmental issues posed by all deactivated electronic devices. The growing demand for data and information security in obsolete assets is one of the major factors driving the growth of the market for the disposal of IT assets. Implementing environmental safety and regulatory compliances, made possible by the prevalence of laws requiring secure and environmentally friendly disposal of e-waste, accelerates market expansion.

COVID-19 Impact:

COVID-19 Impact:

The markets of many economies have suffered due to the global epidemic. The shutdown brought the entire planet to a standstill. However, the major players in the ITAD market are doing a lot to combat the negative consequences thanks to government laws and chances for combining and changing supply chain analysis. One motivating factor is the rise in consumer ownership of various electronic devices. The ITAD is a well-supported, problem-free method of disposing of equipment. When the products have finished their lifecycle, they move toward disposal. This is preparing for a strong ITAD resurgence after the COVID-19 era, expanding their global market share.

Key Insights

Key Insights

- As per the analysis shared by our research analyst, the global IT asset disposition market value is expected to grow at a CAGR of 8.40% over the forecast period.

- In terms of revenue, the global IT asset disposition market size was valued at around USD 14.8 billion in 2021 and is projected to reach USD 24.01 billion by 2028.

- The growing demand for data and information security in obsolete assets is one of the major factors driving the growth of the market for the disposal of IT assets.

- By services, the data destruction/sanitation category dominated the market in 2021.

- By end-user, the media and entertainment category dominated the market in 2021.

- North America dominated the global IT asset disposition market in 2021.

Growth Drivers

Growth Drivers

- The rising growth of the electronic sector drives the market growth

The electronics sector is widely expanding globally. The vendors in this market are concentrating on variables such as product development and launching, which are driving factors for the global IT asset disposition market. Energy-efficient launching items are the main priority. In doing so, companies meet customer wants and give themselves a competitive advantage in the market. Additionally, they significantly impact educating consumers and organizations about properly disposing of used computer equipment.

IT asset disposition Market: Restraints

IT asset disposition Market: Restraints

- The high cost of incurring the services may hinder the market growth

Two important barriers to the expansion of the ITAD market size are the high cost of the services and the low level of awareness among enterprises. Before the IT equipment is deposited, a proper code and procedure must be followed. Due to a lack of information, many firms allocate zero dollars to the process of getting rid of these things once their performance cycle is over.

Segmentation Analysis

Segmentation Analysis

The global IT asset disposition market has been segmented into service, asset type, organization size, end-user, and region.

Based on the service, the IT asset disposition market is segregated into de-manufacturing & recycling, remarketing & value recovery, data destruction/data sanitation, logistics management & reverse logistics, and other services (on-site audit solutions and clients’ online portals). Among these, the data destruction/data sanitation segment led the market in 2021 and is expected to maintain its dominance throughout the forecast period. Data destruction/sanitization services are in high demand due to the growing requirement for the correct disposal of IT assets and the danger of compromised sensitive data in outdated assets. Data and information security are essential for any business.

Based on the asset type, the IT asset disposition market is segregated into computers/laptops, servers, mobile devices, storage devices, and peripherals. Among these, the computers/laptops segment led the market in 2021 and is expected to maintain its dominance throughout the forecast period. Due to the existence of different recoverable materials, including aluminum, copper, gold, silver, plastics, and ferrous metals, disposing of computers and laptops requires extra attention and a variety of safety precautions. Computers and laptops are typically disposed of using services like recycling, recovery, and remarketing.

The IT asset disposition market is segregated into small & medium-sized enterprises and large enterprises based on organization size. Among these, the large enterprise segment led the market in 2021 and is expected to maintain its dominance throughout the forecast period. Large organizations are typically long-standing businesses with established regional, national, or international activities. Such businesses employ over 1,000 people and operate from several sites. Private and public sector businesses make up large enterprises. Companies in this market have the resources, knowledge, and policies necessary to deal with any environmental, safety, and regulatory challenges that may arise in a competitive environment.

Based on end-user, the IT asset disposition market is segmented into banking, financial services & insurance (BFSI), IT & telecom, education, healthcare, aerospace & defense, public sector & government offices, production, media & entertainment, and other industries (energy & utility, construction & real estate, logistics & transportation). Among these, the media & entertainment segment led the market in 2021 and is expected to maintain its dominance throughout the forecast period. To meet the needs of computer-assisted graphical and audio production programs and software, the media and entertainment business needs a continual renewal and upgrade cycle of IT assets. These circumstances generate a strong need for qualified data sanitation and e-waste disposal professionals due to the growing emphasis on creating a culture of submissive environmental strategies.

Recent Developments:

Recent Developments:

- October 2020: Sims Lifecycle Services collaborated with Polish schools and educational institutions to provide used IT equipment. In these unusual times, several schools have implemented distant learning programs in which every student must learn using a computer or laptop, producing disruptions in computing device availability. The device, a brand of Sims Lifecycle Services in Poland, is bridging the gap by giving students with alternate sources for IT equipment.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2021 |

USD 14.8 Billion |

Projected Market Size in 2028 |

USD 24.01 Billion |

CAGR Growth Rate |

8.40% CAGR |

Base Year |

2021 |

Forecast Years |

2022-2028 |

Key Market Players |

DELL TECHNOLOGIES, STEPIT, IRON MOUNTAIN, TES, HEWLETT PACKARD ENTERPRISE, IBM, SIMS LIMITED, APTO SOLUTIONS, LIFESPAN INTERNATIONAL, TOTAL IT GLOBAL, and Others |

Key Segment |

By Service, Asset Type, Organization size, End-User, and Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East &, Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Regional Landscape

Regional Landscape

- North America dominated the IT asset disposition market in 2021

In 2021, North America dominated the global IT asset disposition market due to the area's thriving IT business and increasing cloud data centers. The IT asset disposition market in North America is anticipated to increase due to ongoing breakthroughs in asset disposition technology, including improvements in data security technologies and the recycling process. The region is becoming more conscious of data security, which has an unintended impact on the market for disposing of IT assets. Additionally, it is anticipated that the adoption of IT asset disposition solutions will increase dramatically over the forecast period due to the increased reliance on outsourced data hosting and processing, driven by the rising number of multi-tenant data centers (MTDC) in this region.

IT asset disposition Market: Competitive Landscape

IT asset disposition Market: Competitive Landscape

- DELL TECHNOLOGIES

- STEPIT

- IRON MOUNTAIN

- TES

- HEWLETT PACKARD ENTERPRISE

- IBM

- SIMS LIMITED

- APTO SOLUTIONS

- LIFESPAN INTERNATIONAL

- TOTAL IT GLOBAL

Global IT asset disposition Market is segmented as follows:

By Service

By Service

- De-Manufacturing and Recycling

- Remarketing and Value Recovery

- Data Destruction/Data Sanitation

- Logistics Management and Reverse Logistics

- Other Services (On-site Audit solutions and Clients’ Online Portals)

By Asset type

By Asset type

- Computers/Laptops

- Servers

- Mobile Devices

- Storage Devices

- Peripherals

By Organization size

By Organization size

- Small and Medium-sized Enterprises

- Large Enterprises

By End-User

By End-User

- Banking, Financial Services and Insurance (BFSI)

- IT and Telecom

- Education

- Healthcare

- Aerospace and Defense

- Public Sector and Government Offices

- Manufacturing

- Media and Entertainment

- Others (Energy and Utility, Construction and Real Estate, Logistics and Transportation)

By Regional Segment Analysis

By Regional Segment Analysis

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Nordic Countries

- Denmark

- Sweden

- Norway

- Benelux Union

- Belgium

- The Netherlands

- Luxembourg

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Southeast Asia

- Indonesia

- Thailand

- Malaysia

- Singapore

- Rest of Southeast Asia

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Industry Major Market Players

- DELL TECHNOLOGIES

- STEPIT

- IRON MOUNTAIN

- TES

- HEWLETT PACKARD ENTERPRISE

- IBM

- SIMS LIMITED

- APTO SOLUTIONS

- LIFESPAN INTERNATIONAL

- TOTAL IT GLOBAL

Frequently Asked Questions

Copyright © 2024 - 2025, All Rights Reserved, Facts and Factors