14-Jan-2020 | Facts and Factors

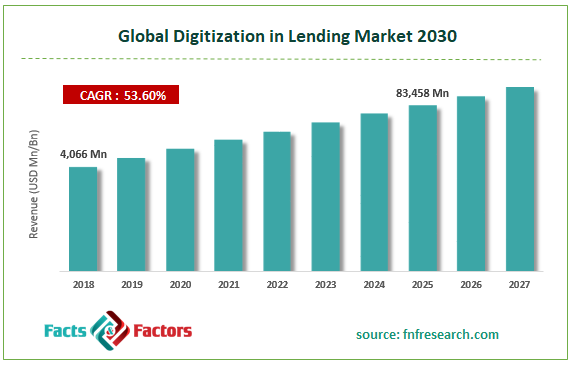

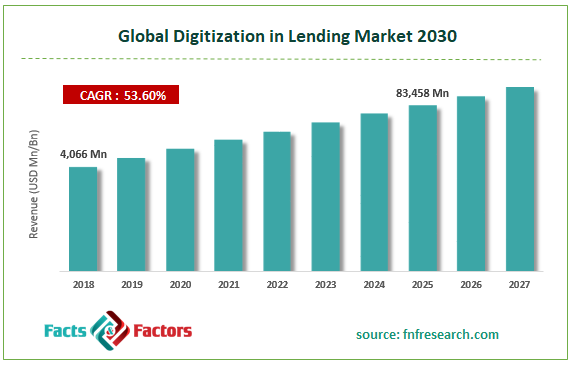

Facts and Factors Market Research has published a new report titled “Digitization in Lending Market By Loan Type (Personal Loans, Business Loans, and Auto Loans) and By Deployment (On Computer and On Smart Phone): Global Industry Perspective, Comprehensive Analysis, and Forecast, 2018 – 2025”. According to the report, the global Digitization in Lending market is predicted to be valued at approximately USD 4,066 million in 2018 and is expected to reach a value of around USD 83,458 million by 2025, at a CAGR of around 53.6% between 2019 and 2025.

Digitization in lending is the breakthrough in the lending & borrowing method that is performed digitally without the utilization of paperwork. Moreover, digitization helps lenders target end-users through real-time offerings. Apart from this, digitization in lending automates complicated procedures and minimizes manual interventions.

Browse the full “Digitization in Lending Market By Loan Type (Personal Loans, Business Loans, and Auto Loans) and By Deployment (On Computer and On Smart Phone): Global Industry Perspective, Comprehensive Analysis, and Forecast, 2018 – 2025” Report at https://www.fnfresearch.com/digitization-in-lending-market-by-loan-type-personal-302

Furthermore, digitization in lending across the banking sector has become a standard for retail credit processing. With the onset of digital revolution along with the growing digitization in lending activities, personal-loan applications nowadays are submitted through swiping on the smartphones. Today, banks are treating small & medium-sized enterprises as their digital priority. Moreover, traditional banks, as well as FinTech firms, have started offering online plans in lending for small & medium-scale firms. This has resulted in less time in approving of the loans or disbursements and this has made the digitized lending popular both among the consumers and the firms. Digitization in lending also helps the banks to improve their operational efficacy.

Massive acceptance of digital lending will steer the market trends

The large-scale digitization along with the massive acceptance of digitization in lending processes like customer loans, vehicle loans, personnel loans, and business loans will steer the growth of the market over the forecast period.

Furthermore, digitization of the lending processes witnessed across the financial institutions like banks will further proliferate the market growth over the forecast timeline. Apart from this, digitization assists the banks to proficiently target the consumers. However, the lack of interoperability & issues like data theft can negatively impact business growth over the forecast timeline. Nevertheless, digital channels enhance the lending experience for the consumers and this will offer new growth avenues for the market over the forecast period.

Business loans to dominate the loan type segment over the forecast period

The growth of the business loans segment during the period from 2019 to 2025 is owing to an increase in the number of small & mid-sized businesses. Apart from this, digitization in lending process brings reduction in operating costs and helps in retaining the customers as well as small businesses.

On Smart Phone segment to record highest CAGR over the forecast period

The On smartphone segment is set to register the highest growth rate of over 53% during the period from 2019 to 2025. The segmental growth is credited to large-scale technological breakthroughs witnessed in smartphones, easy access, and robust app development in smartphones.

Europe to dominate the digitization in lending industry by 2025 in terms of revenue

The growth of the regional market during the forecast timeline is owing to massive digitization in lending procedures witnessed in the financial institutions across countries like France, Germany, and the UK.

Report Scope

Report Attribute |

Details |

Market Size in 2018 |

USD 4,066 Million |

Projected Market Size in 2025 |

USD 83,458 Million |

CAGR Growth Rate |

53.6% CAGR |

Base Year |

2018 |

Forecast Years |

2019-2025 |

Key Market Players |

Lending Stream, 118118Money, Prosper Marketplace Inc., Avant Inc., Elevate, Rise Credit, FirstCash Inc., Speedy Cash, Check ‘n Go, LendUp, NetCredit, Opportunity Financial LLC, Simplic, Headway Capital Partners LLP, Blue Vine, RapidAdvance, Amigo Loans Ltd., Lendico, Trigg, Wonga Group, and Others |

Key Segment |

By Loan Type, Deployment, and Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Some of the key players involved in the business include Lending Stream, 118118Money, Prosper Marketplace, Inc., Avant, Inc., Elevate, Rise Credit, FirstCash, Inc., Speedy Cash, Check ‘n Go, LendUp, NetCredit, Opportunity Financial, LLC, Simplic, Headway Capital Partners LLP, Blue Vine, RapidAdvance, Amigo Loans Ltd., Lendico, Trigg, and Wonga Group among others.

This report segments the Digitization in Lending market as follows:

Digitization in Lending Market: By Loan Type Analysis

- Personal Loans

- Business Loans

- Auto Loans

Digitization in Lending Market: By Deployment Analysis

- On Computer

- On Smart Phone

Digitization in Lending : By Regional Segment Analysis

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

About Us:

Facts & Factors is a leading market research organization offering industry expertise and scrupulous consulting services to clients for their business development. The reports and services offered by Facts and Factors are used by prestigious academic institutions, start-ups, and companies globally to measure and understand the changing international and regional business backgrounds. Our client’s/customer’s conviction on our solutions and services has pushed us in delivering always the best. Our advanced research solutions have helped them in appropriate decision-making and guidance for strategies to expand their business.

Contact Us:

Facts & Factors

A 2108, Sargam,

Nanded City,

Sinhagad Road,

Pune 411041, India

USA: +1-347-989-3985

Email: [email protected]

Web: https://www.fnfresearch.com