18-Jul-2022 | Facts and Factors

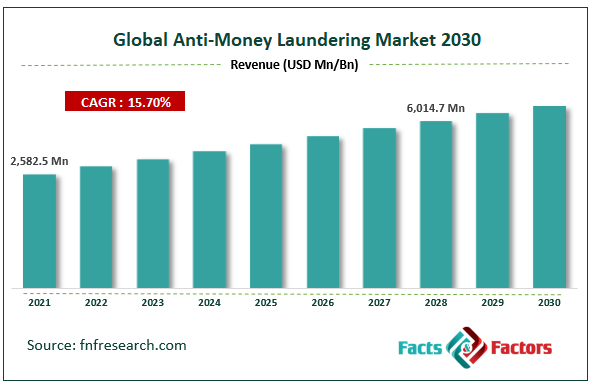

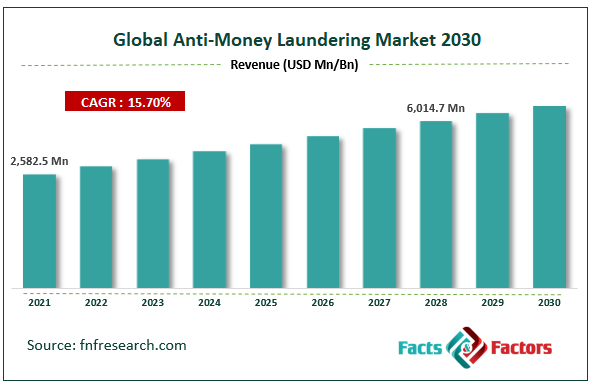

According to Facts and Factors, the Global Anti-Money Laundering Market size was valued at USD 2,582.5 million in 2021 and is predicted to increase at a CAGR of 15.7% to USD 6,014.7 million by 2028. The study examines the market in terms of revenue in each of the major regions, which are classified into countries.

The market's optimistic growth prospects might be ascribed to an increase in money laundering incidents around the world. The increased number of worldwide transactions has fuelled the implementation of anti-money laundering (AML) solutions in banks and other financial institutions. The industry is likely to increase as rules and compliance requirements for businesses become strict. Various government entities around the world have established legislation and laws to combat terrorism funding and money laundering. AML rules vary by nation, making it critical for financial institutions to ensure that their operations are in accordance with policies particular to the country of operation. These policies are driving up demand for AML solutions in the industry.

Browse the full “Anti-Money Laundering Market Size, Share, Growth Analysis Report By Type (Solution, Services), By Deployment Mode (On-premises, Cloud), By Organization Size (SMEs, Large enterprises), By End-User (Banks and Financials, Insurance Providers, Gaming & Gambling), and By Region - Global and Regional Industry Insights, Overview, Comprehensive Analysis, Trends, Statistical Research, Market Intelligence, Historical Data and Forecast 2022 – 2028" report at https://www.fnfresearch.com/anti-money-laundering-market

During the projected period, growing artificial intelligence technology in AML solutions and increased acceptance of cloud-based solutions are expected to give attractive prospects for AML software market advancement. Adopting compliance management systems like AML in the coming years is expected to provide a large potential due to the increased demand to analyze risk indicators across numerous industrial verticals. However, a shortage of AML expertise is expected to stymie the expansion of the anti-money laundering software market. Various legislation in different nations requires financial institutions to detect and report customers who engage in fraudulent behavior. Even after implementing AML solutions, it is difficult to identify frauds owing to the increasing frequency of sophisticated assaults such as phishing, card fraud, skimming, identity fraud, money laundering, investment fraud, terrorism funding, and sanction breaches.

Segmental Overview

In terms of Deployment Mode, the on-premise segment led the market, accounting for more than 50.0 percent of worldwide revenue. Anti-money laundering solutions deployed on-premise give enterprises complete control over applications, platforms, data, and systems, which can be easily managed by the organization's in-house IT personnel. At the same time, the segment is in high demand in enterprises where user credentials are crucial for business operations. To protect themselves from unwanted attacks, the firms deploy on-premise anti-money laundering.

On the basis of end-user, banks and other financial institutions had the greatest market share in the forecast period. This can be attributed to the growing global acceptance of banking and financial services such as commercial banking, pension funds, and retail banking, as well as developments in digital banking technology. The increased usage of banking and financial services has increased the frequency of fraud and money laundering, which is propelling the global anti-money laundering industry forward.

Regional Overview

North America is predicted to contribute the greatest market share in terms of revenues throughout the projection period because it is a technologically advanced region with a high number of early adopters and the presence of key market players. Factors such as the proliferation of inorganic growth methods among key AML vendors, advances in the deployment of AI, ML in AML solutions, and rising demand for cloud-based AML solutions are projected to fuel the demand for anti-money laundering solutions.

Europe is predicted to contribute to the fastest-growing region with the greatest CAGR throughout the projection period due to its technological advancements and early acceptance of new technologies. Continuous regulatory landscape developments, such as new stringent data privacy laws such as AMLD5, GDPR, and PCI DSS, as well as emerging trends related to trade-based money laundering and virtual currencies, such as a shift towards the non-bank financial sector and non-financial profession, are expected to fuel the demand for AML solutions in the European region.

Report Scope

Report Attribute |

Details |

Market Size in 2021 |

USD 2,582.5 Million |

Projected Market Size in 2028 |

USD 6,014.7 Million |

CAGR Growth Rate |

15.7% CAGR |

Base Year |

2021 |

Forecast Years |

2022-2028 |

Key Market Players |

ACI Worldwide (US), BAE Systems (UK), Nice Actimize (US), FICO (US), SAS Institute (US), Oracle Corporation (US), Experian (Ireland), LexisNexis Risk Solution (US), Fiserv (US),FIS (US), Dixtior (Portugal), TransUnion (US), Wolter’s Kluwer (The Netherlands), Temenos (Switzerland), Nelito Systems (India), TCS (India), Workfusion (US), Napier (UK), Quantaverse (US), Complyadvantage (UK), Acuant (US), FeatureSpace (UK), Feedzai (US), Finacus Solutions (India), CaseWare RCM (Canada), Comarch SA (Poland), and Others |

Key Segment |

By Type, Deployment Mode, Organization Size, End User, and By Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Competitive Landscape

Some of the major companies operating in the global anti-money laundering market are ACI Worldwide (US), BAE Systems (UK), Nice Actimize (US), FICO (US), SAS Institute (US), Oracle Corporation (US), Experian (Ireland), LexisNexis Risk Solution (US), Fiserv (US),FIS (US), Dixtior (Portugal), TransUnion (US), Wolter’s Kluwer (The Netherlands), Temenos (Switzerland), Nelito Systems (India), TCS (India), Workfusion (US), Napier (UK), Quantaverse (US), Complyadvantage (UK), Acuant (US), FeatureSpace (UK), Feedzai (US), Finacus Solutions (India), CaseWare RCM (Canada), Comarch SA (Poland) and among others.

The global anti-money laundering market is segmented as follows:

By Type

By Deployment Mode

By Organization Size

By End-User

- Banks and Financials

- Insurance Providers

- Gaming & Gambling

By Region

- North America

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Nordic Countries

- Benelux Union

- Belgium

- The Netherlands

- Luxembourg

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Southeast Asia

- Indonesia

- Thailand

- Malaysia

- Singapore

- Rest of Southeast Asia

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

About Us:

Facts & Factors is a leading market research organization offering industry expertise and scrupulous consulting services to clients for their business development. The reports and services offered by Facts and Factors are used by prestigious academic institutions, start-ups, and companies globally to measure and understand the changing international and regional business backgrounds. Our client’s/customer’s conviction on our solutions and services has pushed us in delivering always the best. Our advanced research solutions have helped them in appropriate decision-making and guidance for strategies to expand their business.

Contact Us:

Facts & Factors

A 2108, Sargam,

Nanded City,

Sinhagad Road,

Pune 411041, India

USA: +1-347-989-3985

Email: [email protected]

Web: https://www.fnfresearch.com