06-Sep-2022 | Facts and Factors

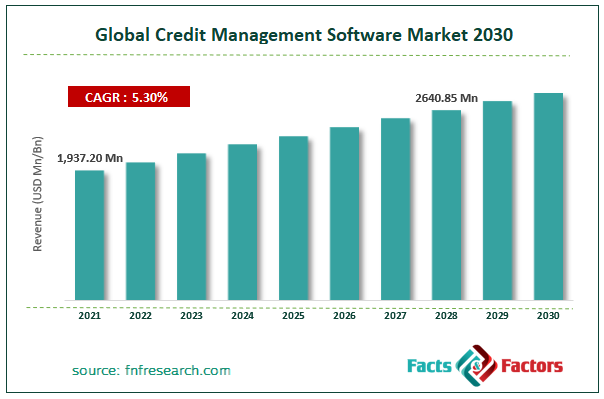

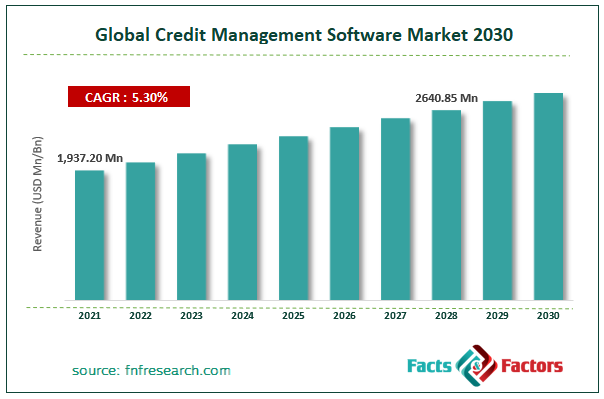

According to Facts and Factors, the global credit management software market size was worth USD 1,937.20 million in 2021 and is estimated to grow to USD 2640.85 million by 2028, with a compound annual growth rate (CAGR) of approximately 5.30% over the forecast period. The report analyzes the credit management software market's drivers, restraints/challenges, and their effect on the demands during the projection period. In addition, the report explores emerging opportunities in the credit management software market.

The process of credit management is prioritized and automated by credit management software. It also helps with storing important data while assisting with several daily chores carried out by team members of the credit management department. Moreover, it helps with the precise recording of invoices and controlling the cash flow in firms. Additionally, credit management software can be utilized as a component of other software or linked to many areas of a business. As a result, there is an increase in demand for credit management software from businesses across various industries, which is projected to fuel the market's expansion over the next few years.

Browse the full “Credit Management Software Market Size, Share, Growth Analysis Report By Deployment Model (On-Premise, Cloud), By Enterprise Size (Large Enterprise, Small & Medium Enterprises), By Industry Vertical (BFSI, Health Care, Retail, IT & Telecommunication, Government, Others), and By Region - Global and Regional Industry Insights, Overview, Comprehensive Analysis, Trends, Statistical Research, Market Intelligence, Historical Data and Forecast 2022 – 2028" report at https://www.fnfresearch.com/credit-management-software-market

The global credit management software market is expanding as people become more and more aware of the advantages of adopting automation and specialized software. Software for credit management offers benefits like increased productivity, improved cash flow management, deepest understanding of client behavior, and many more. Due to the advantages credit management software provides, end-user industries like telecom, healthcare, manufacturing, information technology, and electronics are utilizing it. Credit management software offers crucial insights into the flow of business invoices for several transactions occurring inside or outside the company. Over the anticipated time, the market will grow due to the advantages provided by credit management software.

Additionally, credit management software can be used in conjunction with other commonly used programs in sectors like enterprise resource management (ERP). Credit management software works in conjunction with ERP to improve the management of resources and business transactions. Large capital investment is the main issue that would restrain the growth of the credit management software market.

The global credit management software market has been segmented into deployment model, enterprise size, industry vertical, and region. Based on the deployment model, the credit management software market is segregated into on-premises and cloud. Among these, the cloud segment led the market in 2021 and is expected to maintain its dominance throughout the forecast period. Based on enterprise size, the credit management software market is segregated into large enterprises and small & medium enterprises. Among these, the large enterprise segment led the market in 2021 and is expected to maintain its dominance throughout the forecast period. Based on industry vertical, the credit management software market is segmented into BFSI, healthcare, retail, IT &telecommunication, government, and others. Among these, the BFSI segment led the market in 2021 and is expected to maintain its dominance throughout the forecast period.

The global credit management software market is divided into geographic regions: North America, Latin America, Europe, Asia Pacific, the Middle East, and Africa. Europe dominated the global market for credit management software in 2021. In countries like Germany, France, the UK, and Italy, where small and medium-sized firms are highly prevalent, the expansion of the regional market is blamed for this. Furthermore, due to the strict enforcement of the laws governing credit management activities, the product is now more commonly acknowledged by respectable regional firms. The adoption of credit management software has increased across various organizations over the past ten years due to considerable industrialization brought on by massive foreign investment with the accessibility of cheap labor.

Report Scope

Report Attribute |

Details |

Market Size in 2021 |

USD 1,937.20 Million |

Projected Market Size in 2028 |

USD 2,640.85 Million |

CAGR Growth Rate |

5.30% CAGR |

Base Year |

2021 |

Forecast Years |

2022-2028 |

Key Market Players |

CreditDevice, Esker SA, Onguard BV, Credica Ltd, Rimilia Holdings Ltd, Finastra, Equinity Group Plc, HighRadius Corporation, Cforia Software Inc, Serrala Group GmbH, and Others |

Key Segment |

By Deployment Model, Enterprise Size, Industry Vertical, and Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East &, Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Key global credit management software market players include CreditDevice, Esker SA, Onguard BV, Credica Ltd, Rimilia Holdings Ltd, Finastra, Equinity Group Plc, HighRadius Corporation, Cforia Software Inc, and Serrala Group GmbH.

Recent Developments:

- October 2020: Emagia, a top supplier of digital order-to-cash automation solutions, and WNS (Holdings) Limited, a top global supplier of business process management (BPM) services, have established a strategic alliance. Through a comprehensive "Quote-to-Sustain offering," the alliance aims to hasten the digital transition of order-to-cash in large, international organizations.

Global Credit Management Software Market is segmented as follows:

By Deployment Model

By Enterprise Size

- Large Enterprise

- Small & Medium Enterprises

By Industry Vertical

- BFSI

- Healthcare

- Retail

- IT & Telecommunication

- Government

- Others

By Region

- North America

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Nordic Countries

- Benelux Union

- Belgium

- The Netherlands

- Luxembourg

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Southeast Asia

- Indonesia

- Thailand

- Malaysia

- Singapore

- Rest of Southeast Asia

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

About Us:

Facts & Factors is a leading market research organization offering industry expertise and scrupulous consulting services to clients for their business development. The reports and services offered by Facts and Factors are used by prestigious academic institutions, start-ups, and companies globally to measure and understand the changing international and regional business backgrounds. Our client’s/customer’s conviction on our solutions and services has pushed us in delivering always the best. Our advanced research solutions have helped them in appropriate decision-making and guidance for strategies to expand their business.

Contact Us:

Facts & Factors

A 2108, Sargam,

Nanded City,

Sinhagad Road,

Pune 411041, India

USA: +1-347-989-3985

Email: [email protected]

Web: https://www.fnfresearch.com