19-Mar-2021 | Facts and Factors

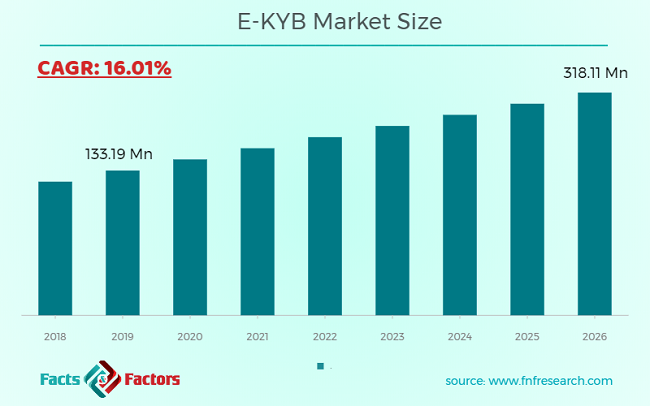

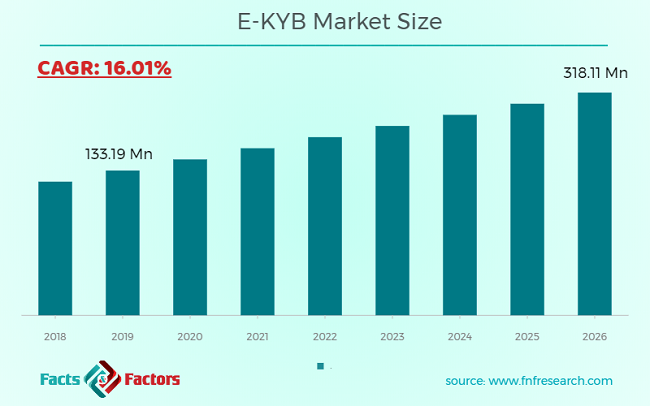

As per the report published by Facts and Factors, the global e-KYB market was valued at approximately USD 133.19 Million in 2019 and is expected to generate revenue of around USD 318.11 Million by end of 2026, growing at a CAGR of around 16.01% between 2020 and 2026.

Know Your Business (KYB) is a process similar to the widely known process of KnowYour Customer (KYC). The primary difference lies in the purpose of the processes. Know Your Business (KYB) is mainly emphasizing identifying companies and suppliers. Know Your Business (KYB) also emphasizes verifying information related to consumers as well as customers. KYB process is conducted by many companies to carry out due diligence to identify the businesses they work with and fight money laundering and other related crimes. KYB processes have become a mandatory requirement for legal compliance. KYB process is a necessity for companies that work with a large number of small and medium-sized enterprises or freelancers to avoid crimes and thefts.

Moreover, owing to the introduction of new strict AML regulations, organizations are more inclined towards online document verification services which can comply with various standards and regulations. This trend has driven the demand for e-KYB processes.

Report Scope

Report Attribute |

Details |

Market Size in 2019 |

USD 133.19 Million |

Projected Market Size in 2026 |

USD 318.11 Million |

CAGR Growth Rate |

16.01% CAGR |

Base Year |

2019 |

Forecast Years |

2020-2026 |

Key Market Players |

Dnow, Jumio, Onfido, Shufti Pro, Trulioo, TruNarrative, and Others |

Key Segment |

By End-Users, and Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Major players in the market areTruNarrative, Trulioo, Jumio, IDnow, Onfido, Shufti Proamong, and among others.

The Rising Digitization of Banking Sector

Documentation and recognition processes have been digitized as a result of the digitization of banks and financial institutions. Physical supporting documents for KYC and KYB from customers, such as proof of a certificate of incorporation, identity, memorandum of association, proof of birth, proof of address, and so on, have been considered a lengthy procedure. Furthermore, banks and other financial institutions invested resources, and time collecting and maintaining physical copies of verification documents, causing additional strain and work for the businesses. Banks have been exposed to a greater degree of transformation as a result of digitization. The influence of technology on society, as well as the entry of Fintech start-ups that contribute to banking services, has exposed banks to fierce competition, adding more virtual touchpoints and reinvigorating banks' emphasis on building and maintaining relationships with customers. Because of digitization, KYC and KYB have been centralized, which can result in less bottlenecks during internal and external audits, client onboarding, transaction processing, and so on. The digitization process will assist organizations in offering a quick and painless process for online verification maintenance while still meeting regulatory requirements. Furthermore, it enables organizations to provide fast and friendly service to their customers. e-KYB also assists in the prevention of forgery by providing actual digital verification and authentication of address data and identity, allowing for faster documentation.

North America Region Dominates the Global E-KYB Market

North America led the e-KYB market in 2019. It accounted for more than 40% shares of the total market in 2019. The U.S. is a major contributor to the market in the region. It held for more than 80% share of the total market in the region during 2019. North America was followed by Europe and Asia-Pacific in 2019. Furthermore, Asia Pacific is predicted to witness the highest growth of the market of e-KYB during the forecast period.

In the Asia Pacific, China and India are the major countries that are expected to contribute to the lucrative growth of the e-KYB market over the coming years. Moreover, the rising income level, growing spending capability, and growing e-commerce industry would be the key contributors to growth in the region over the forthcoming years. Growing government initiatives for digitization may impact positively the e-KYB market in Asian countries. Furthermore, rising standards of living, coupled with increasing disposable income are expected to boost demand for e-KYB globally. Thus, in turn, is likely to cater the robust demand for the e-KYB market in the upcoming years.

Browse the full“E-KYB Market By End-Users (Banks, E-payment Service Providers, Financial Institutions, Government Entities, Insurance Companies, Telecom Companies, and Others): Global Industry Perspective, Comprehensive Analysis, and Forecast, 2020 – 2026.” report at https://www.fnfresearch.com/e-kyb-market

The global e-KYB market is segmented as follows:

By End-Users:

- Banks

- Financial Institutions

- E-payment Service Providers

- Telecom Companies

- Government Entities

- Insurance Companies

- Others

By Region:

- North America

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

About Us:

Facts & Factors is a leading market research organization offering industry expertise and scrupulous consulting services to clients for their business development. The reports and services offered by Facts and Factors are used by prestigious academic institutions, start-ups, and companies globally to measure and understand the changing international and regional business backgrounds. Our client’s/customer’s conviction on our solutions and services has pushed us in delivering always the best. Our advanced research solutions have helped them in appropriate decision-making and guidance for strategies to expand their business.

Contact Us:

Facts & Factors

A 2108, Sargam,

Nanded City,

Sinhagad Road,

Pune 411041, India

USA: +1 (347) 690-0211

Email: [email protected]

Web: https://www.fnfresearch.com