08-Aug-2022 | Facts and Factors

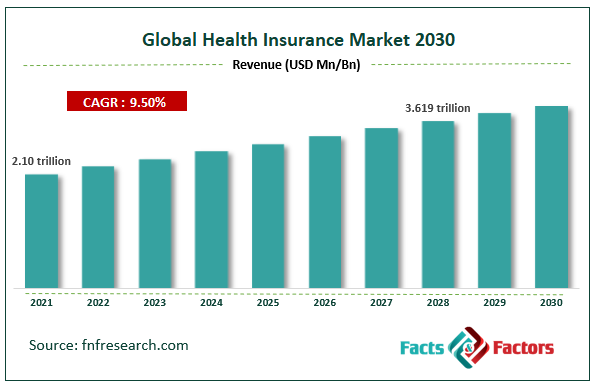

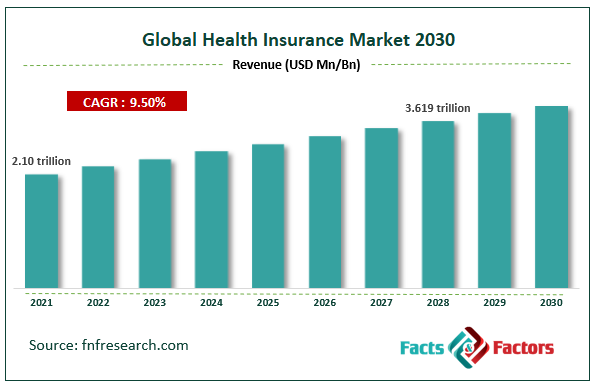

According to Facts and Factors, the global health insurance market size was worth USD 2.10 trillion in 2021 and is estimated to grow to USD 3.619 trillion by 2028, with a compound annual growth rate (CAGR) of approximately 9.50% over the forecast period. The report analyzes the health insurance market's drivers, restraints/challenges, and their effect on the demands during the projection period. In addition, the report explores emerging opportunities in the health insurance market.

Any medical costs incurred during the treatment of a sickness, accident, or other mental or physical disability are covered by health insurance. The provision of healthcare benefits is compensation in exchange for a monthly, semi-annual, or yearly premium or payroll tax. The insurer must pay the policyholder's medical costs up to the policy's coverage and duration. Depending on the insurance, the range may vary, including illnesses, age group, government laws, etc. Health insurance packages come with a wide range of features and benefits. It provides financial security for the policyholder against particular medical procedures. Health insurance benefits include reimbursement, pre- and post-hospitalization coverage, cashless hospitalization, and several add-ons. Any financial damages resulting from a medical emergency are protected for those with health insurance. It covers expenses such as ambulance fees, doctor visits, hospital stays, medicine, and childcare procedures related to getting medical treatment.

Browse the full “Health Insurance Market Size, Share, Growth Analysis Report By Insurance Type (Disease Insurance, Medical Insurance), By Coverage (Preferred Provider Organizations (PPOs), Point Of Service (POS), Health Maintenance Organizations (HMOS), Exclusive Provider Organizations (EPOS)), By End User Type (Group, Individuals), By Age Group (Senior Citizens, Adult, Minors), By Service Provider (Public and Private), By Distribution Channel (Direct Sales, Brokers/Agents, Banks, Others), and By Region - Global and Regional Industry Insights, Overview, Comprehensive Analysis, Trends, Statistical Research, Market Intelligence, Historical Data and Forecast 2022 – 2028" report at https://www.fnfresearch.com/health-insurance-market

One of the leading causes driving up the need for health insurance globally is the rising expense of healthcare services, combined with the increasing incidence of diabetes, cancer, stroke, and renal failure. Additionally, companies are now required by numerous nations' regulatory bodies to offer their worker's health insurance. Further, these organizations are enforcing the regulations that require travelers to have foreign health insurance. In addition, the growing elderly population is also encouraging people to enroll in government health insurance plans or schemes with low premium costs. Other elements supporting market expansion include rising health consciousness and bettering healthcare infrastructure.

Segmental Overview

The global health insurance market is segregated based on insurance type, coverage, end-user type, age group, distribution channel, and region. The market is divided into disease and medical insurance based on insurance type. Among these, medical insurance held significant growth in 2021.

Based on coverage, the market is classified into preferred provider organizations (PPOs), point of service (POS), health maintenance organizations (HMOs), and exclusive provider organizations (EPOS). Preferred provider organization (PPOs) led the market in 2021 and is expected to maintain their dominance during the forecast period.

Based on end-user type, the market is segmented into groups and individuals. Individuals segments will dominate the market in 2021. The age group market is segmented into senior citizens, adults, and minors. In 2021, the adult segment will dominate the market. The market is classified into private and public providers based on the service provider. The private part will dominate the market in 2021. Based on the distribution channel, the market is classified into direct sales, brokers/agents, banks, and others. Direct sales will dominate the market in 2021.

Regional Overview

The global health insurance market is divided into geographic regions: North America, Latin America, Europe, Asia Pacific, Middle East, and Africa. In 2021, North America will command the most significant global health insurance market share. The need for health insurance is rising due to rising medical costs and a rise in the number of childcare treatments. During the projected period, North America is expected to lead the worldwide market for health insurance. Regional growth will be fueled by government programs to make Medicare and Medicaid affordable and expand the population's access to health insurance. The region's good healthcare reimbursement rules and high medical product costs boost market expansion.

Due to strict federal legislation requiring residents to carry at least one health insurance coverage, Europe is anticipated to be the second-largest market throughout the projected period. The population's growing knowledge of the importance of insurance policies will also fuel market expansion in this area.

Report Scope

Report Attribute |

Details |

Market Size in 2021 |

USD 2.10 Trillion |

Projected Market Size in 2028 |

USD 3.619 Trillion |

CAGR Growth Rate |

9.50% CAGR |

Base Year |

2021 |

Forecast Years |

2022-2028 |

Key Market Players |

Aetna Inc., Aia Group Limited, Allianz, Assicurazioni Generali S.P.A., Aviva, Axa, Cigna, Ping An Insurance (Group) Company Of China Ltd., Unitedhealth Group, Zurich, and Others |

Key Segment |

By Insurance Type, Coverage, End-user Type, Age Group, Service Provider, Distribution Channel, and Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Competitive Landscape

The report contains qualitative and quantitative research on the global health insurance market, as well as detailed insights and development strategies employed by the leading competitors. The report also provides an in-depth analysis of the market's main competitors, as well as information on their competitiveness. The research also identifies and analyses important business strategies used by these main market players, such as mergers and acquisitions (M&A), affiliations, collaborations, and contracts.

Key players in the global health insurance market include Aetna Inc., Aia Group Limited, Allianz, Assicurazioni Generali S.P.A., Aviva, Axa, Cigna, Ping An Insurance (Group) Company Of China, Ltd., Unitedhealth Group, Zurich.

Recent Development:

- August 2020: To assist businesses in planning and researching secure overseas travel, Foreign Medical Group, Inc. (IMG) has increased its range of products. The new support programs offered by the business were developed to help customers make plans for 2020 and beyond.

Global Health Insurance Market is segmented as follows:

By Insurance Type

- Disease Insurance

- Medical Insurance

By Coverage

- Preferred Provider Organizations (PPOs)

- Point Of Service (POS)

- Health Maintenance Organizations (HMOS)

- Exclusive Provider Organizations (EPOS)

By End-user Type

By Age Group

- Senior Citizens

- Adult

- Minors

By Service Provider

By Distribution Channel

- Direct Sales

- Brokers/Agents

- Banks

- Others

By Region

- North America

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Nordic Countries

- Benelux Union

- Belgium

- The Netherlands

- Luxembourg

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Southeast Asia

- Indonesia

- Thailand

- Malaysia

- Singapore

- Rest of Southeast Asia

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

About Us:

Facts & Factors is a leading market research organization offering industry expertise and scrupulous consulting services to clients for their business development. The reports and services offered by Facts and Factors are used by prestigious academic institutions, start-ups, and companies globally to measure and understand the changing international and regional business backgrounds. Our client’s/customer’s conviction on our solutions and services has pushed us in delivering always the best. Our advanced research solutions have helped them in appropriate decision-making and guidance for strategies to expand their business.

Contact Us:

Facts & Factors

A 2108, Sargam,

Nanded City,

Sinhagad Road,

Pune 411041, India

USA: +1-347-989-3985

Email: [email protected]

Web: https://www.fnfresearch.com