07-Jan-2020 | Facts and Factors

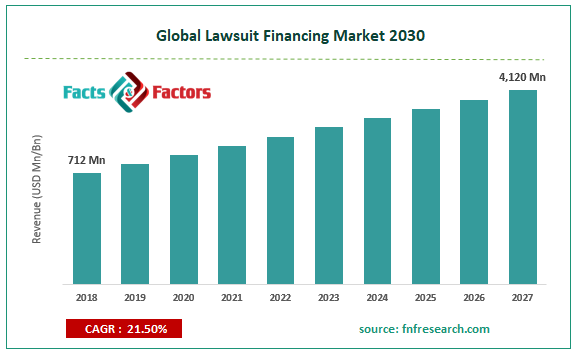

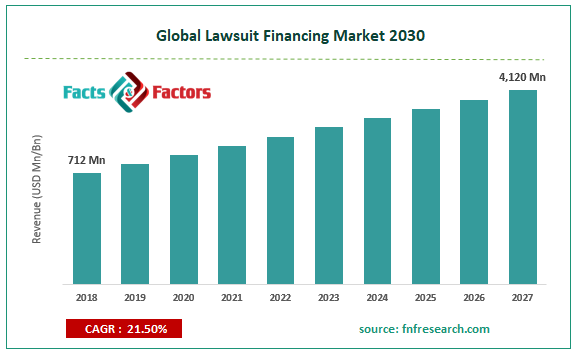

Facts and Factors Market Research has published a new report titled “Lawsuit Financing Market By Type (Consumer Litigation Funding and Commercial Litigation Funding), By Case Type (Class Action Lawsuit Funding, Settlement Funding, Labor Lawsuit Funding, Workers’ Compensation, Medical Malpractice Lawsuit Funding, and Personal Injury Lawsuit Funding), and By End-User (Individuals, Attorneys, and Businesses): Global Industry Perspective, Comprehensive Analysis, and Forecast, 2018 – 2027”. According to the report, the global lawsuit financing market was valued at approximately USD 712 million in 2018 and is expected to reach a value of around USD 4,120 million by 2027, at a CAGR of around 21.5% between 2019 and 2027.

Lawsuit financing also referred to as litigation funding is a procedure in which a litigant makes use of the asset value of commercial arbitration or legal suit in order to secure capital from the third party for financing the lawsuit. Moreover, the third-party funder can pay a part or all the costs related to the dispute in the return for the share in the profits of the legal dispute or settlement if successful. Even if the legal suit fails, the funder has to bear the expenses as per the deal or agreement.

Browse the full “Lawsuit Financing Market By Type (Consumer Litigation Funding and Commercial Litigation Funding), By Case Type (Class Action Lawsuit Funding, Settlement Funding, Labor Lawsuit Funding, Workers’ Compensation, Medical Malpractice Lawsuit Funding, and Personal Injury Lawsuit Funding), and By End-User (Individuals, Attorneys, and Businesses): Global Industry Perspective, Comprehensive Analysis, and Forecast, 2018 – 2027” Report at https://www.fnfresearch.com/lawsuit-financing-market-by-type-consumer-litigation-funding

Escalating awareness about litigation funding to drive the market trends

Large-scale awareness about lawsuit financing among the customers is expected to contribute massively towards the expansion of the market over the forecast timeline. In addition to this, litigation finance is growing into a vital domain of the business law with the number of customers & firms making use of it to resolve the business challenges. Apparently, large-scale penetration of key players across the emerging regions like the Asia Pacific will impel the expansion of the lawsuit financing industry over the forecast timeline.

Moreover, litigation financing solves the risk of business spending by offering corporates with the opportunity of transferring the complete lawsuit risk to the third party. This will further boost the market trends over the forecast timeline. In addition to this, massive concerns of officials regarding the advantages related to legal dispute financing are projected to steer the lawsuit financing market over the forecast timeline. Nevertheless, costly risk environment for firms like enterprise risk management, data privacy, compliance, and Cybersecurity will inhibit the growth of the market over the forecast period.

Commercial litigation funding segment to hold leading market revenue share over the forecast timeline

The segment is also likely to register the CAGR of nearly 22.5% over the forecast timeline. The growth of the segment is due to the massive financing of payment of lawyer fees and legal costs through commercial litigation funding activities.

Attorneys segment to dominate the end-user landscape over the forecast period

The growth of the segment is due to massive litigation funding activities of the attorneys for arguing in favor or against the legal suit in the court of law.

North American region to contribute majorly towards the overall regional market revenue share by 2027

The growth of the market in the region is due to the massive popularity of the lawsuit financing activities in countries like the U.S. and Canada. Reportedly, North America contributed nearly about 40% towards the overall market share in 2018.

Report Scope

Report Attribute |

Details |

Market Size in 2018 |

USD 712 Million |

Projected Market Size in 2027 |

USD 4,120 Million |

Growth Rate |

CAGR 21.5% |

Base Year |

2018 |

Forecast Years |

2019-2027 |

Key Market Players |

Burford Capital Ltd., Pravati Capital LLC, Harbour Litigation Funding Limited, Global Funding Solutions LLC, Legalist, Inc., Lawsuit Financial LLC, LawCash, Law Finance Group LLC, Vannin Capital PCC, Fast Funds, Oasis Legal Finance Group, LLC, High Rise Financial, Fair Rate Funding, Argenta Legal Funding, Bentham Capital LLC and Others |

Key Segment |

By Type, By Case Type, By End-User and By Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Top Market Players:

Some of the major participants in the lawsuit financing market include Burford Capital Ltd., Pravati Capital LLC, Harbour Litigation Funding Limited, Global Funding Solutions LLC, Legalist, Inc., Lawsuit Financial LLC, LawCash, Law Finance Group LLC, Vannin Capital PCC, Fast Funds, Oasis Legal Finance Group, LLC, High Rise Financial, Fair Rate Funding, Argenta Legal Funding, and Bentham Capital LLC.

This report segments the lawsuit financing market as follows:

Global Lawsuit Financing Market: By Type Segment Analysis

- Consumer Litigation Funding

- Commercial Litigation Funding

Global Lawsuit Financing Market: By Case Type Segment Analysis

- Class Action Lawsuit Funding

- Settlement Funding

- Labor Lawsuit Funding

- Workers’ Compensation

- Medical Malpractice Lawsuit Funding

- Personal Injury Lawsuit Funding

Global Lawsuit Financing Market: By End-User Segment Analysis

- Individuals

- Attorneys

- Businesses

- Small and Medium Law Firms

- Large Law Firms

Global Lawsuit Financing Market: Regional Segment Analysis

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

About Us:

Facts & Factors is a leading market research organization offering industry expertise and scrupulous consulting services to clients for their business development. The reports and services offered by Facts and Factors are used by prestigious academic institutions, start-ups, and companies globally to measure and understand the changing international and regional business backgrounds. Our client’s/customer’s conviction on our solutions and services has pushed us in delivering always the best. Our advanced research solutions have helped them in appropriate decision-making and guidance for strategies to expand their business.

Contact Us:

Facts & Factors

Global Headquarters

Level 8, International Finance Center, Tower 2,

8 Century Avenue, Shanghai,

Postal - 200120, China

Tel: +86 21 80360450

Email: [email protected]

Web: https://www.fnfresearch.com