09-Aug-2022 | Facts and Factors

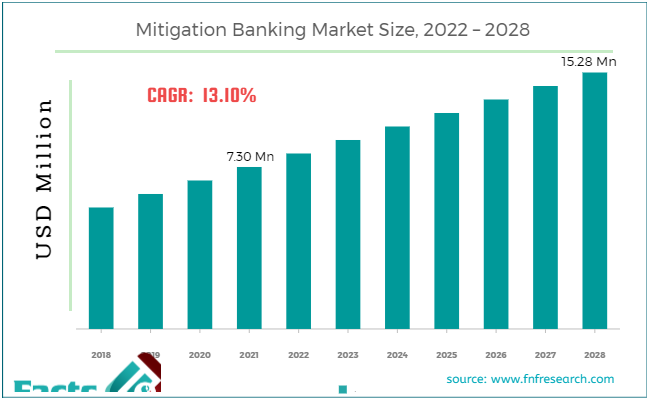

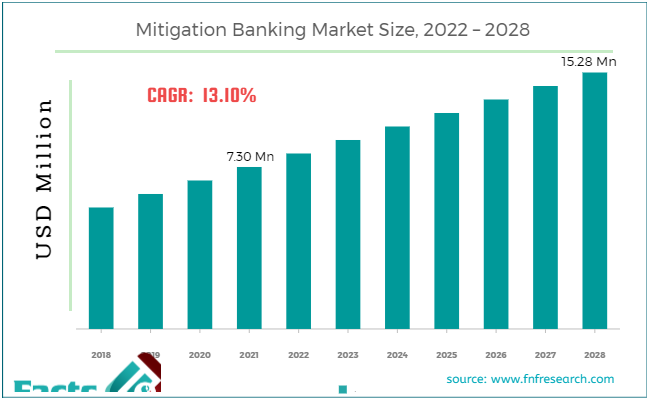

According to Facts and Factors, the global mitigation banking market size was worth around USD 7.30 million in 2021 and is estimated to grow to about USD 15.28 million by 2028, with a compound annual growth rate (CAGR) of approximately 13.10%over the forecast period. The report analyzes the mitigation banking market's drivers, restraints/challenges, and their effect on the demands during the projection period. In addition, the report explores emerging opportunities in the mitigation banking market.

To ensure that the environmental harm to streams and wetlands caused by development projects is made up for by conserving and restoring wetlands, streams, and natural habitats, a system of debits and credits known as "mitigation banking" was developed. The intensity of the environmental harm created can be lessened with mitigation banking. The practice of restoring, building, improving, or preserving the wetland and stream or any other habitat to compensate for non-preventive resource losses caused by construction operations is "mitigation banking" by the national mitigation banking association. The clean water act (CWA), which includes reimbursement for wetland interventions, is the foundation of the mitigation banking scheme, which aims to achieve the United States' goal of preventing the complete loss of this habitat. Mitigation credits are designated based on their biological existence. Owing to the rise in demand for mitigation banking, the global mitigation banking market is estimated to grow at a CAGR of 13.10% during the forecast period.

Browse the full “Mitigation Banking Market Size, Share, Growth Analysis Report By Type (Wetland or Stream Banks, Forest Conservation and Conservation Banks), By Verticals (Construction & Mining, Transportation, Energy & Utilities, Healthcare and Manufacturing), and By Region - Global and Regional Industry Insights, Overview, Comprehensive Analysis, Trends, Statistical Research, Market Intelligence, Historical Data and Forecast 2022 – 2028" report at https://www.fnfresearch.com/mitigation-banking-market

Shortly, it is anticipated that rising government resentments over biodiversity preservation will propel the rise of the mitigation banking market. The provision of political, social, economic, and ecological protection aids in boosting the nation's earning potential and negotiating position. This promotes significant foreign investment and contributes to preserving the nation's biodiversity. The leading challenge regulatory organizations face in accurately quantifying ecological losses in commercial or monetary terms is the performance of mitigation banks. Economic development is harming our waterways and wetlands, among other things. Governments worldwide are building innovative ways to restore and maintain wetlands, streams, and wildlife habitats impacted by increased consumption of commodities and industrial development.

Segmental Overview

The global mitigation banking market is segregated based on type, verticals, and region. Based on type, the market is divided into wetland or stream banks, forest conservation and conservation Banks. Among these, the wetland or stream banks segment dominated the market in 2021. Based on vertical, the market is divided into construction &mining, transportation, energy &utilities, healthcare and manufacturing. Over the forecast period, the construction &mining segment will dominate the market in 2021.

Regional Overview

The global mitigation banking market is divided into geographic regions: North America, Latin America, Europe, Asia Pacific, Middle East, and Africa. North America dominated the global mitigation banking market in 2021. During the forecasted time range, the regional market is also expected to achieve considerable revenue growth. Because of the vital need for mitigation banking technology in developed countries such as the United States, the national wetlands mitigation action plan was established, which aided in developing the mitigation banking system in the United States. Because of these pollution fees and incentives for achieving environmental balance, the global mitigation banking market is predicted to rise quickly throughout the forecast period.

Government agencies are investigating public-private cooperation approaches for carrying out mitigation banking projects. The growing number of mitigation banks has created opportunities for the construction and mining, energy and utilities, and manufacturing industries to leverage mitigation banking concepts.

Report Scope

Report Attribute |

Details |

Market Size in 2021 |

USD 7.30 Million |

Projected Market Size in 2028 |

USD 15.28 Million |

CAGR Growth Rate |

13.10% CAGR |

Base Year |

2021 |

Forecast Years |

2022-2028 |

Key Market Players |

Wetland Studies and Solutions Inc., THabitat Bank LLC, Burns & McDonnell, Mitigation Credit Services LLC, EarthBalance, Ecosystem Investment Partners (EIP), The Loudermilk Companies, Weyerhaeuser, WRA Inc. LLC, theWetlandsbank Company (TWC), Alafia River Wetland Mitigation Bank Inc., Wildwood Environmental Credit Company, The Mitigation Banking Group Inc., Great Ecology, LJA Environmental Services Inc., Ecosystem Services LLC., and Others |

Key Segment |

By Type, Verticals, and Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Key Players Insights

Key players functioning in the global mitigation banking market include wetland Studies and Solutions, Inc., THabitat Bank LLC, Burns & McDonnell, and Mitigation Credit Services, LLC. EarthBalance, Ecosystem Investment Partners (EIP), The Loudermilk Companies, Weyerhaeuser, WRA, Inc., LLC, the Wetlandsbank Company (TWC), Alafia River Wetland Mitigation Bank, Inc., Wildwood Environmental Credit Company, The Mitigation banking Group, Inc., Great Ecology, LJA Environmental Services, Inc., and Ecosystem Services, LLC.

Recent Development-

- In 2019, earth partners made an upfront investment of millions of dollars in refurbishing, forcing developers to purchase credits from them for their projects.

The global mitigation banking market is segmented as follows:

By Type

- Wetland or Stream Banks

- Forest Conservation

- Conservation Banks

By Verticals

- Construction & Mining

- Transportation

- Energy & Utilities

- Healthcare

- Manufacturing

By Region

- North America

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Nordic Countries

- Benelux Union

- Belgium

- The Netherlands

- Luxembourg

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Southeast Asia

- Indonesia

- Thailand

- Malaysia

- Singapore

- Rest of Southeast Asia

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

About Us:

Facts & Factors is a leading market research organization offering industry expertise and scrupulous consulting services to clients for their business development. The reports and services offered by Facts and Factors are used by prestigious academic institutions, start-ups, and companies globally to measure and understand the changing international and regional business backgrounds. Our client’s/customer’s conviction on our solutions and services has pushed us in delivering always the best. Our advanced research solutions have helped them in appropriate decision-making and guidance for strategies to expand their business.

Contact Us:

Facts & Factors

A 2108, Sargam,

Nanded City,

Sinhagad Road,

Pune 411041, India

USA: +1-347-989-3985

Email: [email protected]

Web: https://www.fnfresearch.com