16-Aug-2022 | Facts and Factors

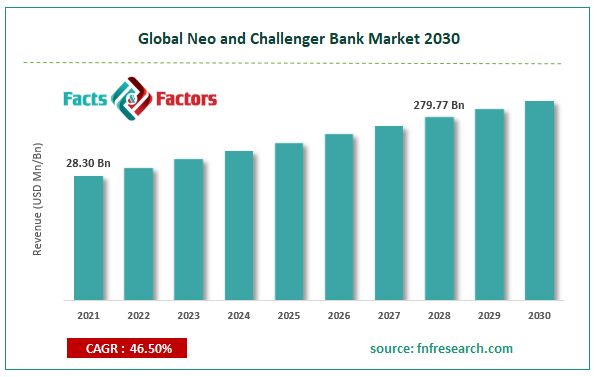

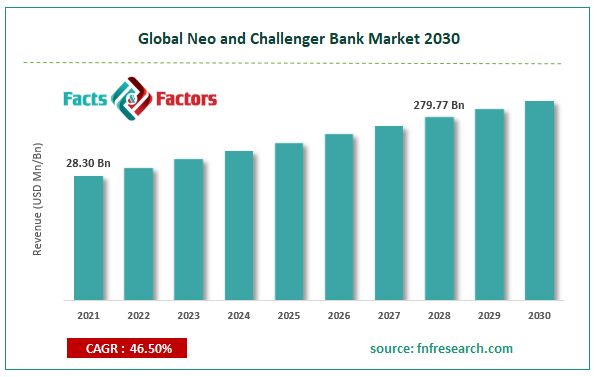

According to Facts and Factors, the global neo and challenger bank market size was worth USD 28.30 billion in 2021 and is estimated to grow to USD 279.77 billion by 2028, with a compound annual growth rate (CAGR) of approximately 46.50% over the forecast period. The report analyzes the global neo and challenger bank market's drivers, restraints/challenges, and their effect on the demands during the projection period. In addition, the report explores emerging opportunities in the global neo and challenger bank market.

Neobank is a digital-only bank with no physical locations and uses a partnered bank license to function in the market. These banks operate entirely through mobile applications, including digital and mobile-first financial payment solutions, remittance and money transfer services, lending, checking and savings account, insurance, and mortgages. Neobanks offer value-added services, including automated accounting, cost management, and payroll, particularly for small and medium-sized businesses. Besides, challenger banks are well-established businesses that operate in the market with full banking licenses. These banks offer various services, including lending, credit cards, checking and merchant accounts, investing and savings accounts, and mobile banking (retirement savings, insurance products, and buying & selling of cryptocurrency). Using various technologies in their product offerings, these banks consistently threaten the established traditional banks.

Browse the full “Neo and Challenger Bank Market Size, Share, Growth Analysis Report By Service Type (Loans, Mobile Banking, Checking & Savings Account, Payment & Money Transfer, and Others) and End User (Business and Personal), and By Region - Global and Regional Industry Insights, Overview, Comprehensive Analysis, Trends, Statistical Research, Market Intelligence, Historical Data and Forecast 2022 – 2028" report at https://www.fnfresearch.com/neo-and-challenger-bank-market

Neo and challenger banks have joined forces to enter the banking business with cutting-edge features, real-time services, and customer-centric products & services, challenging the market's incumbent traditional banks. Higher interest rates primarily drive the market offered to customers compared to traditional banks, government & regulatory backing for banking activities, and improved convenience offered by mobile applications. The market expansion is nonetheless constrained by online client acquisition costs and the profitability of these startup banks.

Segmental Overview

Service type and end-user are the two market segments for the global neo and challenger bank market. The market is divided into five categories based on service type: loans, mobile banking, checking and savings accounts, payments and money transfers, and others. In 2021, the loan segment dominated the neo and challenger bank market in terms of service type. The market is divided into business and personal segments based on the end user. In 2021, the business segment dominated the neo and challenger bank industry based on offending users, and it is anticipated that it will continue its dominance during the forecast period.

Regional Overview

The global neo and challenger bank market are divided into four regions based on regional analysis: North America, Europe, Asia Pacific, and the Rest of the World. In 2021, North America accounted for the largest market share during the projected period. Due to major players like Atom Bank plc and Fidor Solutions AG, the market will increase due to the incorporation of new technologies into the product line. Increased expenditures would expand the market expansion across the region by businesses on R&D.

However, because of the region's developing economies, Asia-Pacific is predicted to experience the fastest growth rate in the near future. Easy and convenient banking services and the expansion of digital-only banks in nations like Australia, Japan, China, and India are factors boosting the industry in this area. Consequently, these developments became some of the key neo and challenger bank market trends in the area.

Report Scope

Report Attribute |

Details |

Market Size in 2021 |

USD 28.30 Billion |

Projected Market Size in 2028 |

USD 279.77 Billion |

CAGR Growth Rate |

46.50% CAGR |

Base Year |

2021 |

Forecast Years |

2022-2028 |

Key Market Players |

Atom Bank plc, Fidor Solutions AG, Monzo Bank Limited, Movencorp Inc., MYbank, Number26 GmbH, Simple Finance Technology Corporation, Tandem Bank, UBank Limited, WeBank, and Others |

Key Segment |

By Service Type, End User, and Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Key Players Insights

The report contains qualitative and quantitative research on the global neo and challenger bank market, as well as detailed insights and development strategies employed by the leading competitors. The report also provides an in-depth analysis of the market's main competitors, as well as information on their competitiveness. The research also identifies and analyses important business strategies used by these main market players, such as mergers and acquisitions (M&A), affiliations, collaborations, and contracts.

Key players in the global neo and challenger bank market include Atom Bank plc, Fidor Solutions AG, Monzo Bank Limited, Movencorp Inc., MYbank, Number26 GmbH, Simple Finance Technology Corporation, Tandem Bank, UBank Limited, WeBank, and others.

Recent Development:

- Beginning in March 2021, Atom Bank will work with Open Banking credit reference company Credit Kudos to automate the evaluation of small business loan applications and provide in-the-moment financial information on enterprises.

- In May 2019, Jumio and Monzo signed a new multi-year deal, further solidifying their long-standing cooperation. Jumio is the top AI-powered trusted identity as a service provider, and Monzo is one of the top digital banks in the UK. Change Market Name and CAGR Value.

The Global Neo and Challenger Bank Market is segmented as follows:

By Service Type

- Loans

- Mobile Banking

- Checking & Savings Account

- Payment & Money Transfer

- Others

By End User

By Region

-

North America

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Nordic Countries

- Benelux Union

- Belgium

- The Netherlands

- Luxembourg

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Southeast Asia

- Indonesia

- Thailand

- Malaysia

- Singapore

- Rest of Southeast Asia

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

About Us:

Facts & Factors is a leading market research organization offering industry expertise and scrupulous consulting services to clients for their business development. The reports and services offered by Facts and Factors are used by prestigious academic institutions, start-ups, and companies globally to measure and understand the changing international and regional business backgrounds. Our client’s/customer’s conviction on our solutions and services has pushed us in delivering always the best. Our advanced research solutions have helped them in appropriate decision-making and guidance for strategies to expand their business.

Contact Us:

Facts & Factors

A 2108, Sargam,

Nanded City,

Sinhagad Road,

Pune 411041, India

USA: +1-347-989-3985

Email: [email protected]

Web: https://www.fnfresearch.com