06-Sep-2022 | Facts and Factors

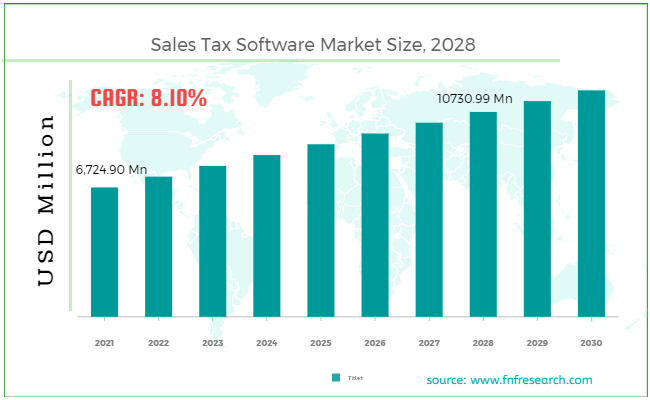

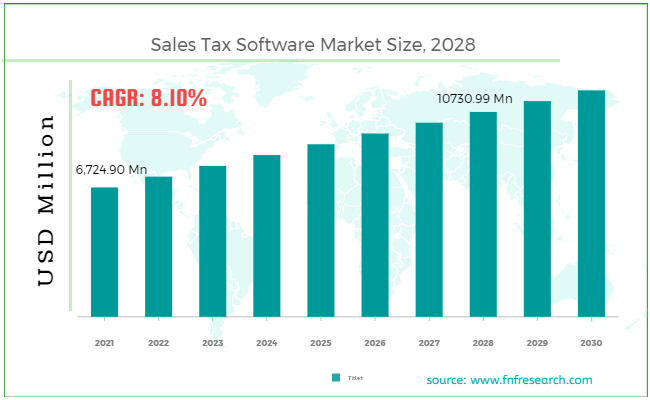

According to Facts and Factors, the global sales tax software market size was worth USD 6,724.90 million in 2021 and is estimated to grow to about USD 10730.99 million by 2028, with a compound annual growth rate (CAGR) of approximately 8.10% over the forecast period. The report analyzes the sales tax software market drivers, restraints/challenges, and their effect on the demands during the projection period. In addition, the report explores emerging opportunities in the sales tax software market.

Sales tax software, offered by professional financial and IT companies, automates the process of filing sales tax. Giving consuming organizations access to specialized software helps them organize their financial activities and lowers the likelihood of human error while reporting sales tax. Compared to accounting experts, this software offers a better operational solution as it continuously updates the regulations provided by the relevant authorities. The widespread use of the internet and cloud computing is one of the key advantages for the sales tax software business and its suppliers. The use of specialist software solutions and cutting-edge technologies made available via the internet and cloud-based deployment model has resulted from this technological accessibility. It has helped businesses structure their operations more effectively. The market for sales tax software is expanding due to complicated legislation and compliances, rising transaction volumes, and other factors.

Browse the full “Sales Tax Software Market Size, Share, Growth Analysis Report By Solution (Consumer Use Tax Management, Tax Filings, Others), By Deployment Mode (Cloud, On-Premise), By Industry Vertical (BFSI, Transportation, Retail, Telecom & IT, Healthcare, Others), and By Region - Global and Regional Industry Insights, Overview, Comprehensive Analysis, Trends, Statistical Research, Market Intelligence, Historical Data and Forecast 2022 – 2028" report at https://www.fnfresearch.com/sales-tax-software-market

An essential factor accelerating the global sales tax software market's growth is the widespread use of the internet and cloud computing, leading to higher adoption of these services. Additionally, the growth in cross-border trade and online retailers worldwide, coupled with current trends like e-commerce and the amounts related to these transactions, have complicated the tax filing process and called for a simplified tax filing service. During the projection above period, the market for sales tax software will see a growth in research & development efforts and a rise in demand from emerging economies. Businesses have greatly profited from the paradigm shift away from manual, antiquated procedures to automated, modern ones. Increased productivity, cost savings, and income opportunities are some advantages that are anticipated to accelerate the market for sales tax software adoption.

The main factors limiting market growth, among others, are the rise in the absence of quality infrastructure needed for efficient operations of these services, the increase in the demand for knowledgeable professionals to provide efficient workflow of services & maintain the operational cycle, and the increase in concerns regarding the security of confidential data of an enterprise with the deployment of these services over the cloud.

The global sales tax software market is segmented on a solution, deployment mode, industry vertical, and region. Based on the solution, the market is segmented into consumer use tax management, tax filings, and others. The tax filings segment dominated the market in 2021. Based on deployment mode, the market is segmented into cloud and on-premise. The cloud segment dominated the market in 2021. Based on industry vertical, the market is segmented into BFSI, transportation, retail, telecom & IT, and healthcare. The retail segment dominated the market in 2021.

North America dominated the global sales tax software market in 2021. The increase in transaction levels and accompanying amounts has made reporting taxes in this region more challenging. Another reason driving growth in North America is the increasing need for sales tax software from various sectors, including transportation, IT & communications, retail, and healthcare. As a result of the expanding global digital revolution, adopting a cloud-based solution is boosting regional market growth. To promote digital services by businesses and consumers, the governments of emerging countries like the US and Canada are implementing several actions.

Report Scope

Report Attribute |

Details |

Market Size in 2021 |

USD 6,724.90 Million |

Projected Market Size in 2028 |

USD 10,730.99 Million |

CAGR Growth Rate |

8.10% CAGR |

Base Year |

2021 |

Forecast Years |

2022-2028 |

Key Market Players |

AVALARA, APEX ANALYTIX, CCH INCORPORATED, EDOC SOLUTIONS, VERTEX INC, RYAN LLC, SALES TAX DATALINK, LEXISNEXIS, SAGA INTACT INC, ZOHO CORPORATION, and Others |

Key Segment |

By Solution, Deployment Type, Industry Vertical, and Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East &, Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Key players in the global sales tax software market include AVALARA, APEX ANALYTIX, CCH INCORPORATED, EDOC SOLUTIONS, VERTEX INC, RYAN LLC, SALES TAX DATALINK, LEXISNEXIS, SAGA INTACT INC and ZOHO CORPORATION.

Recent Development:

- February 2022: With its tax compliance software, Avalara has certified more than 20 applications, including accounting, enterprise resource planning, e-commerce, mobile commerce, point-of-sale, and CRM systems.

- June 2019: The "Technology Partner Program" was made public by TaxJar, and it will assist in providing partners with higher-quality services as well as the finest technology certifications, the most comprehensive supporting solutions, and marketing resources that will be available as needed. As more and more technology service providers incorporate their services into the program, improving the quality of service offerings, this program will attract a wider consumer base.

The global sales tax software market is segmented as follows:

By Solution

- Consumer Use Tax Management

- Tax Filings

- Others

By Deployment Type

By Industry Vertical

- BFSI

- Transportation

- Retail

- Telecom & IT

- Healthcare

- Others

By Region

- North America

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

About Us:

Facts & Factors is a leading market research organization offering industry expertise and ethical consulting services to clients for their business development. The reports and services offered by Facts and Factors are used by prestigious academic institutions, start-ups, and companies globally to measure and understand the changing international and regional business backgrounds. Our client’s/customer’s conviction in our solutions and services has pushed us in delivering always the best. Our advanced research solutions have helped them in appropriate decision-making and guidance for strategies to expand their business.

Contact Us:

Facts & Factors

A 2108, Sargam,

Nanded City,

Sinhagad Road,

Pune 411041, India

USA: +1-347-989-3985

Email: [email protected]

Web: https://www.fnfresearch.com