13-Sep-2022 | Facts and Factors

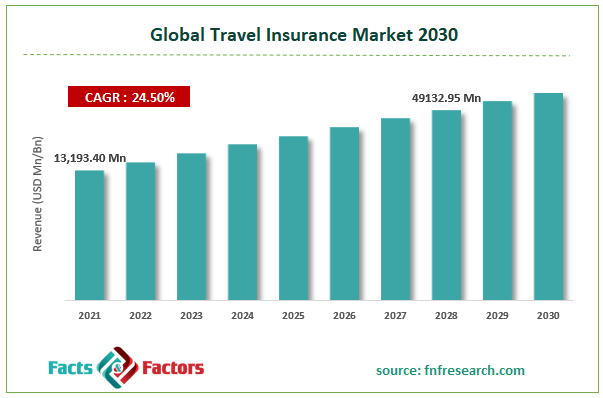

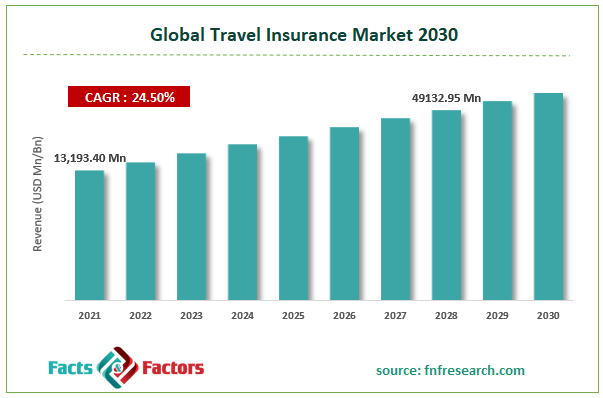

According to Facts and Factors, the global travel insurance market size was worth USD 13,193.40 million in 2021 and is estimated to grow to USD 49132.95 million by 2028, with a compound annual growth rate (CAGR) of approximately 24.50% over the forecast period. The report analyzes the travel insurance market's drivers, restraints/challenges, and their effect on the demands during the projection period. In addition, the report explores emerging opportunities in the travel insurance market.

A sort of insurance known as travel insurance covers any unexpected or undesirable losses that may happen while traveling (either internationally or domestically). While more comprehensive travel insurance policies may also cover trip cancellation, lost luggage, public liability, delayed flights, and other unexpected costs during the travel period, typical travel insurance policies are typically designed to cover any medical emergencies during travel. It is in force from the day of departure until the insured person returns home. Many businesses now offer travel insurance with round-the-clock emergency services, including replacing cash wires & lost passports and helping & rebooking delayed flights. Following the needs of the insured people and their geographic region, they also provide customization possibilities.

Browse the full “Travel Insurance Market Size, Share, Growth Analysis Report By Coverage Type (Single-Trip Travel Insurance and Annual Multi-Trip Travel Insurance), By Distribution Channel (Insurance Intermediaries, Insurance Companies, Banks, Insurance Brokers, and Insurance Aggregators), By End User (Senior Citizens, Education Travelers, Business Travelers, Family Travelers, and Others), and By Region - Global and Regional Industry Insights, Overview, Comprehensive Analysis, Trends, Statistical Research, Market Intelligence, Historical Data and Forecast 2022 – 2028" report at https://www.fnfresearch.com/travel-insurance-market

The ease with which travelers can book flights online using smartphones and websites that offer a large selection of holiday packages is causing tourism growth, driving the global travel insurance market's expansion. Flight delays, missing luggage, and medical problems are just a few of the occurrences that the increase in tourism could bring about. One of the main factors driving the market's growth is how customers purchase travel insurance to lower these risks. Additionally, solution providers should considerably profit from integrating cutting-edge technologies like Artificial Intelligence (A.I.), data analytics, and machine learning with G.P.S. during the forecasted period to enhance the current travel insurance platform. Many travel insurance providers are working to grow their relationships with insurers to improve their services and meet client expectations. These improvements are intended to improve the consumer experience. This fuels market expansion. Relaxations of government regulations and mandates have encouraged people to purchase travel insurance, which is predicted to continue the market's expansion. Venture capital firms have recently been concentrating on start-ups and assisting them in obtaining money to expand their product portfolios and solidify their market positions, thereby spurring market growth.

The global travel insurance market has been segmented into coverage type, distribution channel, end-user, and region. Based on the coverage type, the travel insurance market is segregated into single-trip travel insurance and annual multi-trip travel insurance. Among these, the single-trip travel insurance segment led the market in 2021 and is expected to maintain its dominance throughout the forecast period. Based on the distribution channel, the travel insurance market is segregated into insurance intermediaries, insurance companies, banks, insurance brokers, and insurance aggregators. Among these, the insurance companies segment led the market in 2021 and is expected to maintain its dominance throughout the forecast period. Based on end users, the travel insurance market is segmented into senior citizens, education travelers, business travelers, family travelers, and others. Among these, the business travelers segment led the market in 2021 and is expected to maintain its dominance throughout the forecast period.

The global travel insurance market is divided into geographic regions: North America, Latin America, Europe, Asia Pacific, the Middle East, and Africa. Due to the rising tendency of passengers to purchase yearly travel insurance packages to avoid the trouble of doing so for each trip, North America topped the worldwide travel insurance market in 2021. The easing of travel restrictions and lifting the state of emergency will greatly expand the market. The domestic travel insurance plan offers extensive coverage for people traveling abroad. Domestic travel insurance plans make travel simple for different U.S. cities and locations. Spending on travel insurance is increasing, which helps the domestic market's growth due to the insurance offering complete compensation in unforeseen scenarios. The number of business visits is increasing as market participants in this country expand. Multiple trip insurance serves as a one-time complete solution, removing the inconvenience of purchasing a new plan for each trip. These insurance policies provide simple renewal, financial help, and document clearing.

Report Scope

Report Attribute |

Details |

Market Size in 2021 |

USD 13,193.40 Million |

Projected Market Size in 2028 |

USD 49,132.95 Million |

CAGR Growth Rate |

24.50% CAGR |

Base Year |

2021 |

Forecast Years |

2022-2028 |

Key Market Players |

ALLIANZ, AXA, Insure and Go Insurance Services Limited, Seven Corners Inc., AMERICAN INTERNATIONAL GROUP INC., Assicurazioni Generali S.P.A., Trip Mate Inc., Travel Insured International, Travel Safe Insurance, USI INSURANCE SERVICES LLC. , and Others |

Key Segment |

By Coverage Type, Distribution Channel, End-User, and Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East &, Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Key global travel insurance market players include ALLIANZ, A.X.A., Insure and Go Insurance Services Limited, Seven Corners Inc., AMERICAN INTERNATIONAL GROUP INC., AssicurazioniGenerali S.P.A., Trip Mate Inc., Travel Insured International, Travel Safe Insurance and USI INSURANCE SERVICES LLC.

Global Travel Insurance Market is segmented as follows:

By Coverage Type

- Single-Trip Travel Insurance

- Annual Multi-Trip Travel Insurance

By Distribution Channel

- Insurance Intermediaries

- Insurance Companies

- Banks

- Insurance Brokers

- Insurance Aggregators

By End-User

- Senior Citizens

- Education Travelers

- Business Travelers

- Family Travelers

- Others

By Region

- North America

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Nordic Countries

- Benelux Union

- Belgium

- The Netherlands

- Luxembourg

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Southeast Asia

- Indonesia

- Thailand

- Malaysia

- Singapore

- Rest of Southeast Asia

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

About Us:

Facts & Factors is a leading market research organization offering industry expertise and scrupulous consulting services to clients for their business development. The reports and services offered by Facts and Factors are used by prestigious academic institutions, start-ups, and companies globally to measure and understand the changing international and regional business backgrounds. Our client’s/customer’s conviction on our solutions and services has pushed us in delivering always the best. Our advanced research solutions have helped them in appropriate decision-making and guidance for strategies to expand their business.

Contact Us:

Facts & Factors

A 2108, Sargam,

Nanded City,

Sinhagad Road,

Pune 411041, India

USA: +1 (347) 690-0211

Email: [email protected]

Web: https://www.fnfresearch.com