06-Sep-2022 | Facts and Factors

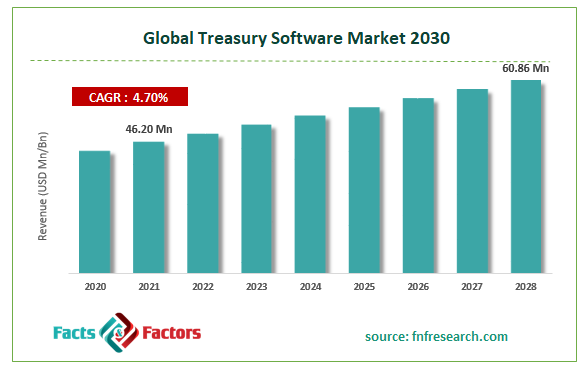

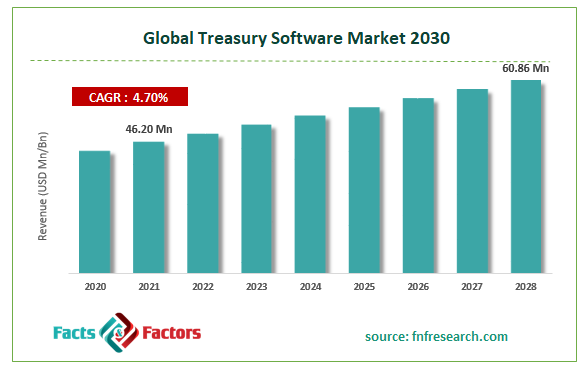

According to Facts and Factors, the global treasury software market size was worth USD 46.20 million in 2021 and is estimated to grow to about USD 60.86 million by 2028, with a compound annual growth rate (CAGR) of approximately 4.70% over the forecast period. The report analyzes the treasury software market drivers, restraints/challenges, and their effect on the demands during the projection period. In addition, the report explores emerging opportunities in the treasury software market.

Cash or treasury management software ensures that financial risk management rules and processes are properly managed. It encompasses the oversight of the company's assets with the primary goal of regulating its liquidity and reducing the risk to its finances, operations, and reputation. Additionally, it consists of concentration, financial operations, and payouts. Treasury software in the best companies covers bonds, financial derivatives, financial risk management, and currencies. The software can be administered either internally or by outside service providers. The program decreases exposure by preventing cybercrime, guaranteeing regulatory compliance, and streamlining cash management procedures. In other words, it relates to developing regulations that guarantee a business maintains its financial stability. Regardless of the size, managing cash flow is essential to a business's existence. Companies use treasury software to automate three key areas: cash flows, assets, and investments.

Browse the full “Treasury Software Market Size, Share, Growth Analysis Report By Deployment Mode (On-Premise, Cloud-Based), By Organization Size (Large Enterprises, Small & Medium-Sized Enterprises), By Vertical (Banking, Financial Services, & Insurance (BFSI), Healthcare, Manufacturing, Consumer Goods, Chemicals, Metals, & Energy), and By Region - Global and Regional Industry Insights, Overview, Comprehensive Analysis, Trends, Statistical Research, Market Intelligence, Historical Data and Forecast 2022 – 2028" report at https://www.fnfresearch.com/treasury-software-market

The widespread use of automation systems is projected to impact the growth of the global treasury software market over the forecast period. The growing acceptance of treasury software among end users such as governments, banks, and corporations is also expected to fuel the market's growth. Furthermore, thorough and precise audit control, as well as lower expenses, are projected to have a beneficial impact on the growth of the treasury software industry. Furthermore, the widespread use of treasury management systems (TMS) to automate financial operations and quick changes in corporate and government laws are projected to fuel demand for treasury software, propelling the treasury software market forward. However, data breaches caused by computer viruses, worms, and phishing are expected to be major constraints for the growth of treasury software during the forecast period, while a lack of awareness about the benefits of treasury software in developing countries may pose a challenge to the market's growth. Similarly, rapid advancements in treasury management software such as cloud-based deployment and managed services, as well as advancements in technologies such as artificial intelligence (AI), blockchain, analytics, and cloud computing, are expected to create numerous opportunities that will drive the treasury software market during the forecast period.

The global treasury software market is segmented on deployment mode, organization size, vertical, and region. Based on deployment mode, the market is segmented into on-premise and cloud-based. The cloud-based segment dominated the market in 2021. Based on organization size, the market is segmented into large enterprises and small & medium-sized enterprises. The large enterprise segment dominated the market in 2021. Based on vertical, the market is segmented into banking, financial services, & insurance (BFSI), healthcare, manufacturing, consumer goods & chemicals, metals, and energy. The banking, financial services, & insurance (BFSI) segment dominated the market in 2021.

North America dominated the global treasury software market in 2021 due to its advanced technological infrastructure. The United States dominates North America due to the extensive adoption of cutting-edge technology and the presence of important players in the region. The industry is also flourishing. The region's growing embrace of cutting-edge technology and the launch of new products have led to its domination. Furthermore, it is projected that the rising number of competitors operating at the local level will hasten market expansion in this region. The developing technology industry contributed to the growth of North America's market.

Report Scope

Report Attribute |

Details |

Market Size in 2021 |

USD 46.20 Million |

Projected Market Size in 2028 |

USD 60.86 Million |

CAGR Growth Rate |

4.70% CAGR |

Base Year |

2021 |

Forecast Years |

2022-2028 |

Key Market Players |

Calypso, CRISK Software ApS, Escali Financial Systems AS, Exidio ltd. (Trezone), HCL Technologies Limited, Infor, ION (Reval), Kyriba, Mitigram, MORS Software, SAP SE, SimCorp A/S, Treasury Systems, ZenTreasury Ltd, and Others |

Key Segment |

By Deployment Mode, Organization Size, Vertical, and Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East &, Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Key players in the global treasury software market include Calypso, CRISK Software ApS, Escali Financial Systems AS, Exidio ltd. (Trezone), HCL Technologies Limited, Infor, ION (Reval), Kyriba, Mitigram, MORS Software, SAP SE, SimCorp A/S, Treasury Systems, and ZenTreasury Ltd., among others.

Recent Development:

- December 2021: Finastra announced the completion of its acquisition of Malauzai in December 2021 to facilitate digital transformation for community banks and credit unions nationwide. To provide a smooth banking experience with a wide range of services, the company was able to connect Malauzi's digital solution to Finastra's Fusion Phoenix core banking system, thanks to this.

- August 2021: The expansion of SS&C Geneva in China was announced by SS&C Technologies, Inc. to diversify its clientele and boost operational effectiveness. This action was taken to diversify the product line and encourage business growth. This also aided the business in developing a solid product, strategy, and sales network throughout the area.

The Global Treasury Software Market is segmented as follows:

By Deployment Mode

By Organization Size

- Large Enterprises

- Small & Medium-Sized Enterprises

By Vertical

- Banking, Financial Services, & Insurance (BFSI)

- Healthcare

- Manufacturing

- Consumer Goods

- Chemicals, Metals, & Energy

By Region

- North America

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Nordic Countries

- Benelux Union

- Belgium

- The Netherlands

- Luxembourg

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Southeast Asia

- Indonesia

- Thailand

- Malaysia

- Singapore

- Rest of Southeast Asia

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

About Us:

Facts & Factors is a leading market research organization offering industry expertise and scrupulous consulting services to clients for their business development. The reports and services offered by Facts and Factors are used by prestigious academic institutions, start-ups, and companies globally to measure and understand the changing international and regional business backgrounds. Our client’s/customer’s conviction on our solutions and services has pushed us in delivering always the best. Our advanced research solutions have helped them in appropriate decision-making and guidance for strategies to expand their business.

Contact Us:

Facts & Factors

A 2108, Sargam,

Nanded City,

Sinhagad Road,

Pune 411041, India

USA: +1-347-989-3985

Email: [email protected]

Web: https://www.fnfresearch.com