09-Jan-2020 | Facts and Factors

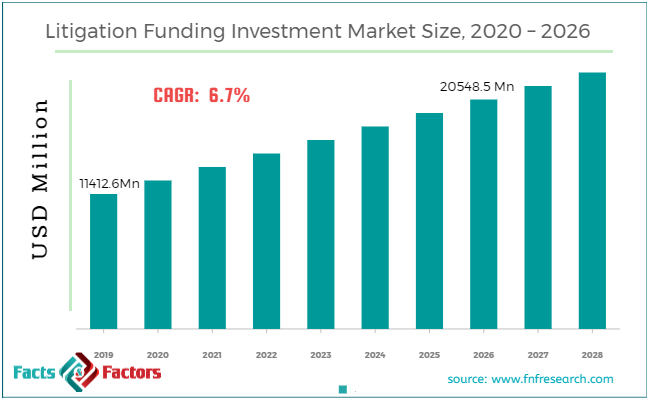

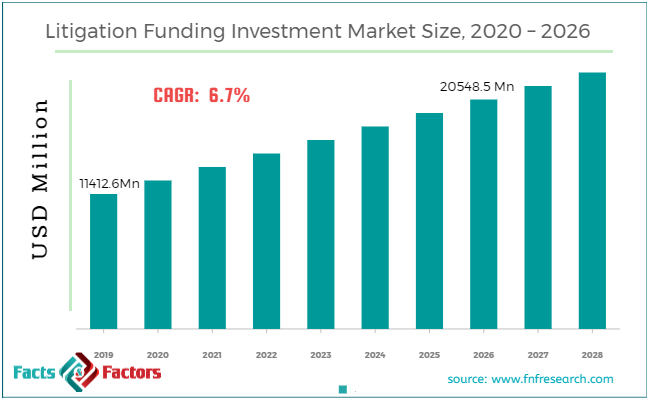

Facts and Factors Market Research has published a new report titled “Litigation Funding Investment Market By Type (Commercial Litigation, International Arbitration, and Bankruptcy Claim), By Organization Size (Small & Medium Enterprises and Large Enterprises), and By Application (Banking, Financial Services, and Insurance, Travel & Hospitality, Manufacturing, Healthcare, IT & Telecommunication, and Media & Entertainment): Global Industry Perspective, Comprehensive Analysis, and Forecast, 2018 – 2027”. According to the report, the global litigation funding investment market is predicted to be valued at approximately USD 11412.6 Million in 2019 and is expected to reach a value of around USD 20548.5 Million by 2026, at a CAGR of around 6.7% between 2020 and 2027.

The process of litigation funding is broadly referred to as the practice of providing money to a party for filing a legal suit in return for a share of any damages awarded or a share in the legal settlement. Litigation funding offers investors the avenue for expanding their range by taking part in a new asset class that does not correlate with traditional market instruments such as property, equities, bonds, or commodities. Precisely, litigation funding investment is also referred to as legal financing and third-party litigation funding.

Browse the full “Litigation Funding Investment Market By Type (Commercial Litigation, International Arbitration, and Bankruptcy Claim), By Organization Size (Small & Medium Enterprises and Large Enterprises), and By Application (Banking, Financial Services, and Insurance, Travel & Hospitality, Manufacturing, Healthcare, IT & Telecommunication, and Media & Entertainment): Global Industry Perspective, Comprehensive Analysis, and Forecast, 2018 – 2027” Report at https://www.fnfresearch.com/litigation-funding-investment-market-by-type-commercial-litigation-104

Furthermore, for the last thirty years, litigation funding has begun to gain wide acceptance across the globe with countries such as Australia, the U.S., and the UK becoming the leading countries in this domain. Recently, the governments of countries like Canada, Singapore, and Hong Kong have introduced laws supporting the funding of legal claims demonstrating the trend towards wider acceptance.

Rise in the funding of frivolous litigations to spur the market trends

An increase in the investments of petty legal suits is likely to result in massive market demand over the forecast timeline. Moreover, these legal suits have the ability to give high earnings and have low-risk potential.

Furthermore, an increase in the number of lawsuit funders across countries like the U.S. along with high-valued legal disputes involving multiple jurisdictions will sketch the profitable roadmap for the litigation funding investment industry during the period from 2020 to 2026.

In addition to this, the legalization of the lawsuit financing activities in Asian Countries like Hong Kong and Singapore will enlarge the scope of the business during the forecast period. Nevertheless, banning the lawsuit funding activities in a few of the countries and the risk of the financer losing the complete investment due to unfavorable ruling may deter the market expansion over the forecast timeslot.

Large enterprises to dominate the organization size segment in terms of revenue

The growth of the segment over the forecast timeline is due to high employee presence resulting in massive litigations against the firms. Apart from this, the giant firms have full-time legal advisors and consultants to fight the lawsuits and this can further promote segmental growth.

Banking, Financial Services, and Insurance segment to contribute a major revue share towards the overall market by 2026

The growth of the segment is owing to the acceptance of litigation funding activities in emerging economies as well as developed countries across the globe.

North America to lead the overall market growth in terms of value

The regional market dominance during the forecast period is subject to massive commercial litigation financing activities taking place in countries like the U.S. Moreover, giant firms are likely to make notable contributions towards the revenue growth of the litigation funding investment industry in the U.S.

Report Scope

Report Attribute |

Details |

Market Size in 2019 |

USD 11412.6 Million |

Projected Market Size in 2026 |

USD 20548.5 Million |

Growth Rate |

CAGR 6.7% |

Base Year |

2019 |

Forecast Years |

2020-2026 |

Key Market Players |

Burford Capital LLC, Augusta Ventures Limited, FORIS AG, Deminor, Harbour Litigation Funding Limited, Apex Litigation Finance, IMF Bentham, Legalist Inc., Nivalion, Omni Bridgeway, Longford Capital Management LP, Pravati Capital, Validity Finance LLC, Balance Legal Capital LLP, Woodsford Litigation Funding Ltd, Therium Group Holdings Limited and Others |

Key Segment |

By Type, By Organization Size, By Application and By Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Top Key Players

Some of the key players in the market include Apex Litigation Finance Limited, Deminor, Longford Capital Management, LP, Augusta Ventures Ltd., VALIDITY FINANCE, LLC, Woodsford Litigation Funding Ltd., Pravati Capital LLC, IMF Bentham Limited, Harbour Litigation Funding Limited, Burford Capital, SWIFT Financial, and Balance Legal Capital LLP.

This report segments the Litigation Funding Investment market as follows:

Litigation Funding Investment Market: By Type Segment Analysis

- Commercial Litigation

- International Arbitration

- Bankruptcy Claim

Litigation Funding Investment Market: By Organization Size Segment Analysis

- Small & Medium Enterprises

- Large Enterprises

Litigation Funding Investment Market: By Application Segment Analysis

- Banking, Financial Services, and Insurance

- Travel & Hospitality

- Manufacturing, Healthcare

- IT & Telecommunication

- Media & Entertainment

Litigation Funding Investment Market: Regional Segment Analysis

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

About Us:

Facts & Factors is a leading market research organization offering industry expertise and scrupulous consulting services to clients for their business development. The reports and services offered by Facts and Factors are used by prestigious academic institutions, start-ups, and companies globally to measure and understand the changing international and regional business backgrounds. Our client’s/customer’s conviction on our solutions and services has pushed us in delivering always the best. Our advanced research solutions have helped them in appropriate decision-making and guidance for strategies to expand their business.

Contact Us:

Facts & Factors

A 2108, Sargam,

Nanded City,

Sinhagad Road,

Pune 411041, India

USA: +1-347-989-3985

Email: [email protected]

Web: https://www.fnfresearch.com