15-Jan-2020 | Facts and Factors

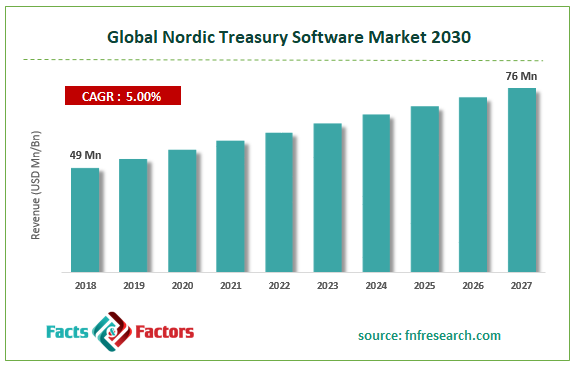

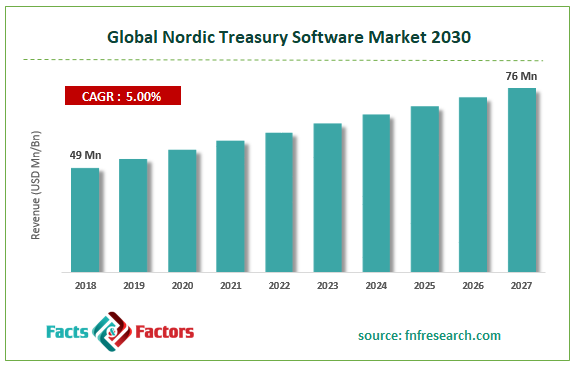

Facs and Factors Market Research has published a new report titled “Nordic Treasury Software Market By Deployment Mode (On-Premise and Cloud-Based), By Organization Size (Large Enterprises and Small & Medium-Sized Enterprises), and By Vertical (Banking, Financial Services, & Insurance (BFSI), Healthcare, Manufacturing, Consumer Goods, and Chemicals, Metals, & Energy): Industry Perspective, Comprehensive Analysis, and Forecast, 2018 – 2027”. According to the report, the demand for the Nordic Treasury Software market was valued at approximately USD 49 million in 2018 and is expected to reach a value of around USD 76 million by 2027, at a CAGR of around 5 % between 2019 and 2027.

Treasury software includes the supervision of the enterprise holdings with the key objective of controlling the liquidity of the firm along with minimizing the fiscal, functional, and reputational peril. Moreover, it comprises of disbursements, funding activities, and concentration. In top-most organizations, treasury software encompasses currencies, financial risk management, financial derivatives, and bonds. The software can be managed in-house or through third-party service providers.

Browse the full “Nordic Treasury Software Market By Deployment Mode (On-Premise and Cloud-Based), By Organization Size (Large Enterprises and Small & Medium-Sized Enterprises), and By Vertical (Banking, Financial Services, & Insurance (BFSI), Healthcare, Manufacturing, Consumer Goods, and Chemicals, Metals, & Energy): Industry Perspective, Comprehensive Analysis, and Forecast, 2018 – 2027” Report at https://www.fnfresearch.com/nordic-treasury-software-market-by-deployment-mode-on-87

Moreover, treasury management software helps in streamlining the cash management process and minimizes the exposure to cybercrime along with ensuring compliance with the organizational rules. Apart from this, treasury management software applications cover standalone items to mechanize the business process.

Large-scale acceptance of automated systems to drive the market expansion

Escalating acceptance of mechanized systems is predicted to steer the expansion of the Nordic treasury software industry over the forecast timeline. In addition to this, the treasury software has proved to be of the highest significance to the persons with limited resources.

Furthermore, the software can connect the BFSI with other industries like government, healthcare, energy, and retail. Moreover, blockchain technology can eliminate functions pertaining to the treasury such as payment deals, fiscal settlement activities, reconciliation, and auditing.

In addition to this, breakthroughs in the treasury management software including cloud-based deployment and managed solutions will enlarge the market scope over the forecast timeline. Nonetheless, the rise in the number of data breaches along with low awareness about the advantages offered by the product can restrict the growth of the industry during the forecast timeline.

BFSI segment to dominate the verticals landscape in terms of revenue by 2027

The growth of the segment is attributed to the growing need for treasury software in the banking and financial services as well as insurance activities in the region.

Cloud-based segment to register highest CAGR over the forecast period

The cloud-based segment is set to record the highest growth rate of nearly over 5% during the period from 2019 to 2027. The growth of treasury software using cloud technologies has enhanced the cost-efficacy of treasury systems along with increasing its flexibility with adapting to end-user requirements. Furthermore, growing innovation in the cloud computing domain is expected to create lucrative avenues for financial businesses operating in the treasury software market. All these factors will contribute notably to the growth of the segment over the forecast period. Moreover, the continuous research & development activities in the cloud computing domain have led to breakthroughs in treasury software systems, thereby further driving segmental growth.

Sweden to dominate the Nordic region in terms of revenue by 2027

The growth of the market in Sweden is due to the large-scale penetration of new technologies in the treasury software along with the increase in the number of favorable schemes in the country. Apart from this, the increase in the awareness levels pertaining to treasury software among the end-users will further proliferate the growth of the industry in the country.

Report Scope

Report Attribute |

Details |

Market Size in 2018 |

USD 49 million |

Projected Market Size in 2027 |

USD 76 million |

Growth Rate |

CAGR 5 % |

Base Year |

2018 |

Forecast Years |

2019-2027 |

Key Market Players |

Calypso, CRISK Software ApS, Escali Financial Systems AS, Exidio ltd. (Trezone), HCL Technologies Limited, Infor, ION (Reval), Kyriba, Mitigram, MORS Software, SAP SE, SimCorp A/S, Treasury Systems, and ZenTreasury Ltd. among others. |

Key Segment |

By Deployment Mode, By Organization Size, By Vertical |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Some of the key players in the market include Calypso, CRISK Software ApS, Escali Financial Systems AS, Exidio ltd. (Trezone), HCL Technologies Limited, Infor, ION (Reval), Kyriba, Mitigram, MORS Software, SAP SE, SimCorp A/S, Treasury Systems, and ZenTreasury Ltd. among others.

This report segments the Nordic Treasury Software market as follows:

Nordic Treasury Software Market: By Deployment Mode Segment Analysis

Nordic Treasury Software Market: By Organization Size Segment Analysis

- Large Enterprises

- Small & Medium-Sized Enterprises

Nordic Treasury Software Market: By Vertical Segment Analysis

- Banking, Financial Services, & Insurance (BFSI)

- Healthcare

- Manufacturing

- Consumer Goods

- Chemicals, Metals, & Energy

Nordic Treasury Software Market: Regional Segment Analysis

- Nordic Countries

- Denmark

- Finland

- Iceland

- Sweden

- Norway

About Us:

Facts & Factors is a leading market research organization offering industry expertise and scrupulous consulting services to clients for their business development. The reports and services offered by Facts and Factors are used by prestigious academic institutions, start-ups, and companies globally to measure and understand the changing international and regional business backgrounds. Our client’s/customer’s conviction on our solutions and services has pushed us in delivering always the best. Our advanced research solutions have helped them in appropriate decision-making and guidance for strategies to expand their business.

Contact Us:

Facts & Factors

A 2108, Sargam,

Nanded City,

Sinhagad Road,

Pune 411041, India

USA: +1-347-989-3985

Email: [email protected]

Web: https://www.fnfresearch.com