09-Jan-2020 | Facts and Factors

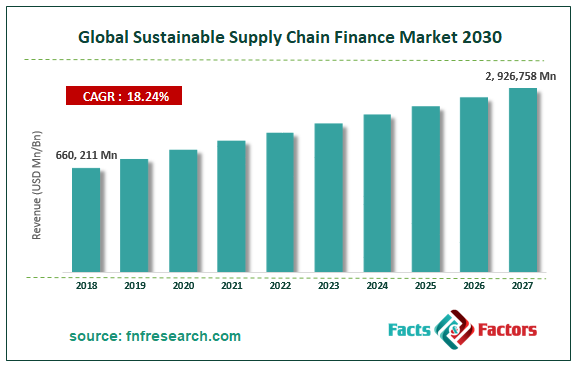

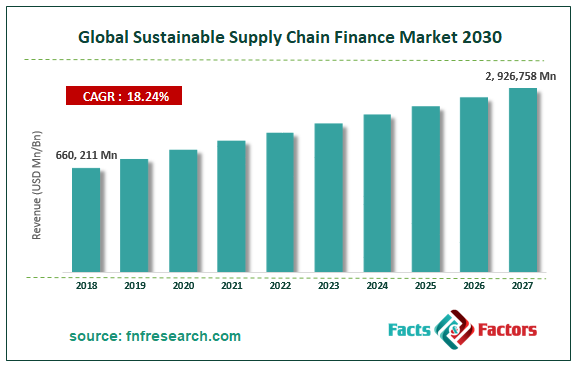

Facts and Factors Market Research has published a new report titled “Sustainable Supply Chain Finance Market By Type (Financial Institution, Buyer Financed, Multiple Source, and Supplier Financed), By Organization Size (Large Enterprises and Small & Medium-Sized enterprises), and By End-User (Footwear & Apparel, Food & Beverage, Automobile, Power & Energy, Chemicals & Materials, and Manufacturing): Global Industry Perspective, Comprehensive Analysis, and Forecast, 2018 – 2027”. According to the report, the global sustainable supply chain finance market is predicted to be valued at approximately USD 660, 211 million in 2018 and is expected to reach a value of around USD 2, 926,758 million by 2027, at a CAGR of around 18.24 % between 2019 and 2027.

In case of consumers, sustainable supply chain finance provides an exceptional solution for achieving sustainable sourcing goals, raises the security supply, and enhances the business relations with suppliers through rewarding sustainable behaviors in the supply chain at reasonable costs to the firm. In case of merchants, sustainable supply chain finance offers easy accessibility to working capital, robust customer relations, and the ability to enhance sustainability value.

Browse the full “Sustainable Supply Chain Finance Market By Type (Financial Institution, Buyer Financed, Multiple Source, and Supplier Financed), By Organization Size (Large Enterprises and Small & Medium-Sized enterprises), and By End-User (Footwear & Apparel, Food & Beverage, Automobile, Power & Energy, Chemicals & Materials, and Manufacturing): Global Industry Perspective, Comprehensive Analysis, and Forecast, 2018 – 2027” Report at https://www.fnfresearch.com/sustainable-supply-chain-finance-market-by-type-financial-181

Moreover, regional banks can form a partnership with global buyers for offering access to finance at a competitive rate of interest. It also helps in the funding of micro as well as small and medium-sized firms lacking the necessary finance as well as technical skills for enhancing environmental, social management, and operating performance. Apparently, sustainable supply chain management has become a key focus area for giant firms as it assists them in addressing competitive pressures caused due to novel environmental laws, escalating power costs, factory standards, and customer & government demands.

Growing eCommerce activities to drive the market trends

The success of new online retail firms like Alibaba and Amazon, who were funding small firms for the last few years, will take the sustainable supply chain finance industry to the peak during the forecast period.

Furthermore, the rapid expansion of the supply chain finance ecosystem for sustaining the operational efficiency of banks and FinTech players will further steer the market expansion during the forecast timeline. Nonetheless, complications involved in the supply chain activities and automation can pose a threat to the expansion of the sustainable supply chain finance industry during the period from 2019 to 2027.

Large enterprises segment to record the highest CAGR by 2027

The large enterprise's segment is poised to register the highest growth rate of 18% during the period from 2019 to 2027. The growth of the segment is attributed to the ability of the giant firms to address the escalating competition in business occurring as a result of environmental laws, high power prices, workplace rules, and customer demands. Today, big firms are incorporating eligibility prerequisites, depending on sustainability, into contractual relations with dealers.

Foot & apparel segment to dominate the end-user landscape over the forecast period

The growth of the segment during the forecast timeline is owing to the ability of sustainability programs to optimize the product as well as processes across the footwear sector.

North America to dominate the overall market surge during the forecast period

The growth of the sustainable supply chain finance industry during the forecast period is due to technological breakthroughs, robust industrial base, and strict enforcement of laws promoting business growth. Apart from this high demand for sustainable supply chain finance activities will propel the regional market growth during the forecast period.

Some of the key players in the market include BNP Paribas, DBS Bank Ltd., Citigroup, Inc., First Abu Dhabi Bank, ING Bank N.V., FMO, Standard Chartered, HSBC Group, and TIER Sustainable Supply Chain Finance.

Report Scope

Report Attributes |

Details |

Market Size in 2018 |

USD 660, 211 Million |

Projected Market Size in 2027 |

USD 2, 926,758 Million |

Growth Rate |

CAGR 18.24 % |

Base Year |

2018 |

Forecast Years |

2019 – 2027 |

Key Market Players |

BNP Paribas, DBS Bank Ltd., Citigroup, Inc., First Abu Dhabi Bank, ING Bank N.V., FMO, Standard Chartered, HSBC Group, and TIER Sustainable Supply Chain Finance. |

Key Segment |

By Type, By Organization Size, By End-User, By Regional |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

This report segments the Sustainable Supply Chain Finance market as follows:

Sustainable Supply Chain Finance Market: By Type Segment Analysis

- Financial Institution

- Buyer Financed

- Multiple Source

- Supplier Financed

Sustainable Supply Chain Finance Market: By Organization Size Segment Analysis

- Large Enterprises

- Small & Medium-Sized enterprises

Sustainable Supply Chain Finance Market: By End-User Segment Analysis

- Footwear & Apparel

- Food & Beverage

- Automobile

- Power & Energy

- Chemicals & Materials

- Manufacturing

Sustainable Supply Chain Finance Market: Regional Segment Analysis

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

About Us:

Facts & Factors is a leading market research organization offering industry expertise and scrupulous consulting services to clients for their business development. The reports and services offered by Facts and Factors are used by prestigious academic institutions, start-ups, and companies globally to measure and understand the changing international and regional business backgrounds. Our client’s/customer’s conviction on our solutions and services has pushed us in delivering always the best. Our advanced research solutions have helped them in appropriate decision-making and guidance for strategies to expand their business.

Contact Us:

Facts & Factors

A 2108, Sargam,

Nanded City,

Sinhagad Road,

Pune 411041, India

USA: +1-347-989-3985

Email: [email protected]

Web: https://www.fnfresearch.com