Search Market Research Report

Nucleic Acid Isolation And Purification Market Size, Share Global Analysis Report, 2022 – 2028

Nucleic Acid Isolation And Purification Market Size, Share, Growth Analysis Report By Product (Kits, Reagents, Instrument), By Type (Plasmid DNA Isolation and Purification, Total RNA Isolation and Purification, Circulating Nucleic Acid Isolation and Purification, Genomic DNA Isolation and Purification, Messenger RNA Isolation and Purification, microRNA Isolation and Purification, PCR Cleanup, Other Nucleic Acid Isolation and Purification Types), By Method (Column-based Isolation and Purification, Magnetic Bead-based Isolation and Purification, Reagent-based Isolation and Purification, Other Isolation and Purification Methods), By Application (Diagnostics, Drug Discovery & Development, Personalized Medicine, Agriculture & Animal Research, Other Applications), By End User (Hospitals & Diagnostic Centers, Academic & Government Research Institutes, Pharmaceutical & Biotechnology Companies, Contract Research Organizations, Other End Users), and By Region - Global and Regional Industry Insights, Overview, Comprehensive Analysis, Trends, Statistical Research, Market Intelligence, Historical Data and Forecast 2022 – 2028

Industry Insights

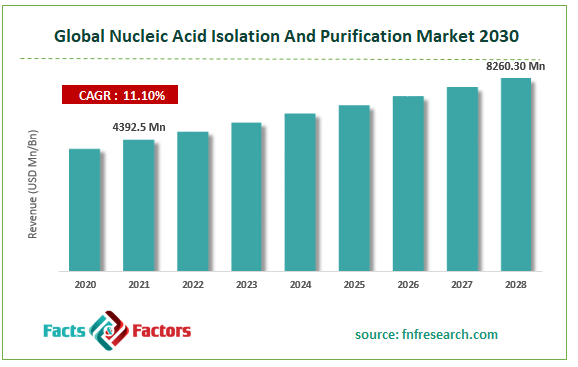

[225+ Pages Report] According to Facts and Factors, the nucleic acid isolation & purification market size was worth USD 4392.5 million in 2021 and is estimated to grow to USD 8260.30 million by 2028, with a compound annual growth rate (CAGR) of approximately 11.10% over the forecast period. The report analyzes the nucleic acid isolation & purification market's drivers, restraints/challenges, and their effect on the demands during the projection period. In addition, the report explores emerging opportunities in the nucleic acid isolation & purification market.

Nucleic Acid Isolation & Purification Market: Overview

Nucleic Acid Isolation & Purification Market: Overview

Nucleic acids must be isolated and purified for many medical uses, including medication development, research, and others. Nucleic acids like DNA and RNA are of the highest quality and purity and are needed for various scientific and therapeutic applications. For forensic, medicinal, and scientific purposes, as well as for genetic study, DNA or RNA must be isolated and purified. Different methods are used to carry out the procedure, including reagent-based methods, column-based methods, and others. Hair, blood, bones, sperm, saliva, nails, and urine are some examples of possible sources for nucleic acid isolation and purification.

COVID-19 Impact:

COVID-19 Impact:

The COVID-19 outbreak has resulted in an enormous surge in diagnostics and therapy development for the condition. The field of nucleic acid isolation and purification is projected to advance due to the research being done to understand the infection's dynamics better. On the other hand, it is predicted that personalized medicine, the majority of diagnostic assays, and COVID-19 molecular testing will expand steadily in the next five years. A significant producer rise has been observed to improve patient access to coronavirus diagnostic testing, vaccine development, and medication testing in laboratories, hospitals, and other nationwide testing locations. The need for diagnostic tools and other critical care medical equipment has grown dramatically over the past two years due to the coronavirus' quick spread. Facilities that provide healthcare services were inundated with patient submissions for COVID-19 screening and treatment in 2020–2021. It caused significant disruptions in clinical operations within inpatient care facilities, which prompted provider facilities to prioritize essential patient care procedures.

Key Insights

Key Insights

- As per the analysis shared by our research analyst, the nucleic acid isolation & purification market value is expected to grow at a CAGR of 11.10% over the forecast period.

- In terms of revenue, the nucleic acid isolation & purification market size was worth USD 4392.5 million in 2021 and is estimated to grow to USD 8260.30 million by 2028

- The increase in spending on R&D activities is what is fuelling the growth of this market.

- By type, the RNA isolation and purification category dominated the market in 2021.

- By this method, the magnetic beads segment dominated the market in 2021.

- North America dominated the nucleic acid isolation & purification market in 2021.

Nucleic Acid Isolation & Purification Market: Drivers

Nucleic Acid Isolation & Purification Market: Drivers

- Ongoing development and research drive the market growth

Furthermore, the market for nucleic acid separation and purification will grow due to developments in medical technology, expanding awareness-raising campaigns by both public and private groups, and rising government support. The nucleic acid isolation and purification market will expand faster for other reasons, including the increased need for efficient treatments and the rising adoption rate for early genetic counseling. Additionally, the nucleic acid separation and purification market will grow due to increased disposable income, seizure instances, and changing lifestyles.

Nucleic Acid Isolation & Purification Market: Restraints/Challenges

Nucleic Acid Isolation & Purification Market: Restraints/Challenges

- The high price of automated tools may hinder the market growth

Utilizing kits and automated nucleic acid isolation and purification tools is generally more expensive than traditional techniques. Automated instruments provide many advantages, including faster throughput, shorter working periods, easier isolation processes, and enhanced safety. The high price of these gadgets, however, prevents widespread use. Automated equipment for NAIP costs between USD 8,000 to USD 160,000. Additionally, this equipment comes with additional reagents, disposables, maintenance, and training costs. This pricey equipment is outside the price range of institutions and businesses with lower R&D resources.

Nucleic Acid Isolation & Purification Market: Segmentation

Nucleic Acid Isolation & Purification Market: Segmentation

The nucleic acid isolation & purification market has been segmented into product, type, method, application, and end-user.

Based on product, the market has been segmented into kits, reagents, and instruments. The kits segment dominated in 2021. The widespread use of kits and reagents for DNA and RNA isolation in the creation of samples and libraries, as well as the affordability and simplicity of using kits, can be credited for the market's expansion.

Based on type, the market is segmented as plasmid DNA isolation and purification, total RNA isolation and purification, circulating nucleic acid isolation and purification, genomic DNA isolation and purification, messenger RNA isolation and purification, microRNA isolation and purification, PCR cleanup, other nucleic acid isolation and purification types. The circulating nucleic acid isolation and purification segment are expected to grow during the forecast period in 2021. Due to the rising usage of pure mRNA for COVID-19 diagnostics and the dominance of the RNA isolation and purification segment in the nucleic acid isolation and purification market, which accounted for the greatest revenue share

Based on methods, the market is segmented as column-based isolation and purification, magnetic bead-based isolation and purification, reagent-based isolation and purification, and other isolation and purification methods. The major portion of this market in 2021 was devoted to column-based isolation and purification. Silica columns are frequently used to extract higher-quality nucleic acids quickly. Additionally, these methods can be used in spin columns and microchips, which have several benefits like cost-effectiveness, quick organic extraction, and compatibility with automated instruments. As a result, these techniques are frequently used in nucleic acid isolation techniques.

Based on application, the market is segmented into diagnostics, drug discovery & development, personalized medicine, agriculture & animal research and other applications. The diagnostics segments dominated the market in 2021. Due to the increasing patient awareness of genomic diagnostics and the increased effectiveness of genomic sequencing in diagnosing diseases, this market's huge share and rapid growth rate can be explained.

Based on end-user, the market is segmented into hospitals & diagnostic centers, academic & government research institutes, pharmaceutical & biotechnology companies, contract research organizations and other end users. The hospitals & diagnostic centers segment dominated the market in 2021. The growing research efforts and the use of nucleic acid tests in molecular diagnostics can be blamed for the segment's sizable market share. Techniques for isolating and purifying DNA/RNA are considered effective diagnostic tools for hereditary illnesses such as sickle cell anemia, hemophilia A, and Tay-Sachs disease.

Recent Developments

Recent Developments

- In 2021, Thermo expanded its clinical research offerings when it purchased PPD, a major global provider of clinical research services for biopharmaceutical and biotech industries.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2021 |

USD 4,392.5 Million |

Projected Market Size in 2028 |

USD 8,260.30 Million |

CAGR Growth Rate |

11.10% CAGR |

Base Year |

2021 |

Forecast Years |

2022-2028 |

Key Market Players |

QIAGEN N.V., Thermo Fisher Scientific, F. Hoffmann-La Roche Ltd., Promega Corporation, Agilent Technologies, Bio-Rad Laboratories, Danaher Corporation, G.E. Healthcare, Illumina Inc., Merck KGaA, Takara Bio, Zymo Research, New England Biolabs, Norgen Biotek Corp, Omega Bio-tek, Genaxxon Bioscience GmbH, 3B BlackBio Biotech India Limited, Invitek Molecular, BioVision, Analytik Jena AG., and Others |

Key Segment |

By Product, Type, Method, Application, End User, and Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East &, Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Nucleic Acid Isolation & Purification Market: Regional Landscape

Nucleic Acid Isolation & Purification Market: Regional Landscape

- North America expected to dominate the Nucleic Acid Isolation & Purification Market

In 2021, the highest market share belonged to North America. The area's main driver of market expansion is the presence of well-established players and their attempts to create technologically advanced fast purification and isolation systems. Additionally, the increasing financing initiatives for biotechnology research are accelerating the market's growth in the area. On the other hand, during the projected period, the Asia Pacific region is anticipated to develop at the greatest CAGR. Rising economic growth, substantial life sciences research, an increasing patient population, supportive government measures, and numerous creative biotech companies in the area are all factors causing the market in the region to flourish.

Nucleic Acid Isolation & Purification Market: Competitive Landscape

Nucleic Acid Isolation & Purification Market: Competitive Landscape

- QIAGEN N.V.

- Thermo Fisher Scientific

- F. Hoffmann-La Roche Ltd.

- Promega Corporation

- Agilent Technologies

- Bio-Rad Laboratories

- Danaher Corporation

- G.E. Healthcare

- Illumina Inc.

- Merck KGaA

- Takara Bio

- Zymo Research

- New England Biolabs

- Norgen Biotek Corp

- Omega Bio-tek

- Genaxxon Bioscience GmbH

- 3B BlackBio Biotech India Limited

- Invitek Molecular

- BioVision

- Analytik Jena AG.

Global Nucleic Acid Isolation & Purification Market is segmented as follows:

By Product

By Product

- Kits

- Reagents

- Instruments

By Type

By Type

- Plasmid DNA Isolation and Purification

- Total RNA Isolation and Purification

- Circulating Nucleic Acid Isolation and Purification

- Genomic DNA Isolation and Purification

- Messenger RNA Isolation and Purification

- microRNA Isolation and Purification

- PCR Cleanup

- Other Nucleic Acid Isolation and Purification Types

By Method

By Method

- Column-based Isolation and Purification

- Magnetic Bead-based Isolation and Purification

- Reagent-based Isolation and Purification

- Other Isolation and Purification Methods

By Application

By Application

- Diagnostics

- Drug Discovery & Development

- Personalized Medicine

- Agriculture & Animal Research

- Other Applications

By End User

By End User

- Hospitals & Diagnostic Centers

- Academic & Government Research Institutes

- Pharmaceutical & Biotechnology Companies

- Contract Research Organizations

- Other End Users

By Regional Segment Analysis

By Regional Segment Analysis

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Nordic Countries

- Denmark

- Sweden

- Norway

- Benelux Union

- Belgium

- The Netherlands

- Luxembourg

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Southeast Asia

- Indonesia

- Thailand

- Malaysia

- Singapore

- Rest of Southeast Asia

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Industry Major Market Players

- QIAGEN N.V.

- Thermo Fisher Scientific

- F. Hoffmann-La Roche Ltd.

- Promega Corporation

- Agilent Technologies

- Bio-Rad Laboratories

- Danaher Corporation

- G.E. Healthcare

- Illumina Inc.

- Merck KGaA

- Takara Bio

- Zymo Research

- New England Biolabs

- Norgen Biotek Corp

- Omega Bio-tek

- Genaxxon Bioscience GmbH

- 3B BlackBio Biotech India Limited

- Invitek Molecular

- BioVision

- Analytik Jena AG.

Frequently Asked Questions

Copyright © 2024 - 2025, All Rights Reserved, Facts and Factors