Search Market Research Report

Packaging Coating Additives Market Size, Share Global Analysis Report, 2022 – 2028

Packaging Coating Additives Market Size, Share, Growth Analysis Report By Function (Slip, Antistatic, Anti-Fog, Anti-Block, Antimicrobial), By Formulation (Water-based, Solvent-based, Powder-based), By Application (Food Packaging, Industrial Packaging, Healthcare Packaging, Consumer Packaging, Others), and By Region - Global and Regional Industry Insights, Overview, Comprehensive Analysis, Trends, Statistical Research, Market Intelligence, Historical Data and Forecast 2022 – 2028

Industry Insights

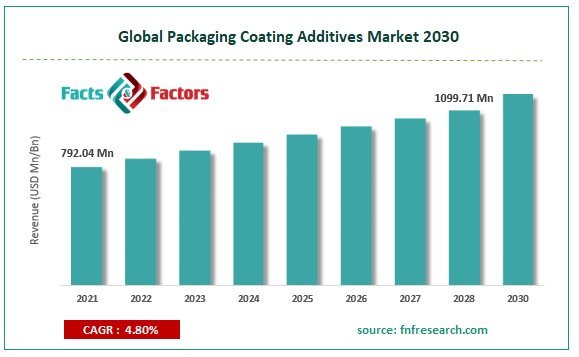

[240+ Pages Report] According to the report published by Facts Factors, the global Packaging Coating Additives market size was worth around USD 792.04 million in 2021 and is predicted to grow to around USD 1099.71 million by 2028 with a compound annual growth rate (CAGR) of roughly 4.80% between 2022 and 2028. The report analyzes the global Packaging Coating Additives market’s drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the Global Packaging Coating Additives market.

Market Overview

Market Overview

Customized packing materials coupled with solvents and applied to different packaging solutions to enhance their physical, chemical, mechanical, and thermal properties are referred to as packaging coating additives. Some of the typical techniques used for varnishing layers of papers, cans, containers, and boxes include coating, dipping, and spraying. Packaging coating additives aid in lowering surface friction, assuring product safety, removing the possibility of external contamination, and improving the efficiency of package manufacture and processing. They also have corrosion-resistant, antibacterial, and water-repellent qualities, which makes them a popular choice for packaging consumer items, medical devices, and industrial goods. Currently, package coating additives can be found in the market in powder-based, solvent-based, and water-based formulation forms. Additives for packaging coatings are used to improve the packaging methods now in use. These additives improve the qualities of packaging materials while improving the handling and assembly of bundles. These coating additives serve as a barrier between the product and the packaging material, preventing the latter from clinging to the former and destroying it.

Key Insights

Key Insights

- As per the analysis shared by our research analyst, the global Packaging Coating Additives market is estimated to grow annually at a CAGR of around 4.80% over the forecast period (2022-2028).

- In terms of revenue, the global Packaging Coating Additives market size was valued at around USD 792.04 million in 2021 and is predicted to grow to around USD 1099.71 million by 2028. Due to a variety of driving factors, the market is predicted to rise at a significant rate.

- Based on function segmentation, anti-block was predicted to show maximum market share in the year 2021

- Based on formulation segmentation, water based was predicted to show maximum market share in the year 2021

- Based on application segmentation, food packaging was predicted to show maximum market share in the year 2021

- On the basis of region, Asia-Pacific was the leading revenue generator in 2021.

Covid-19 Impact

Covid-19 Impact

The packaging coating additives market has suffered because of the Covid-19 epidemic in terms of volume sales, production, and distribution. The numerous restrictions imposed by governments all around the world had a significant impact on logistics as well. Due to restrictions on imports, exports, and trading activities brought on by the pandemic, the packaging coating additives market's operations were abruptly stopped. However, the market is anticipated to expand significantly in the years to come, with the increase in demand from the healthcare industry thought to be the main driver of this growth.

Growth Drivers

Growth Drivers

- Increasing health awareness to drive market expansion

Due to rising nosocomial infection rates and recent pandemic outbreaks of fatal viruses like H5N1 avian influenza and H1N1 flu, public awareness of health-related issues is expanding. Antimicrobial packaging additives are in greater demand across a range of industries, including healthcare and pharmaceuticals. High antibacterial activity, hardness, durability, and clarity are just a few of the qualities antimicrobial packaging additives have. Equipment made of non-toxic plastic uses them. Antimicrobial additives are being used in air vents to stop the transmission of communicable diseases due to the increase in hospital-acquired infections. A rise in consumer health and hygiene consciousness is anticipated to boost demand for antimicrobial compounds, which will therefore boost demand for the global packaging coating additives market.

Restraints

Restraints

- Volatility of raw material prices to hamper market growth

One of the biggest problems facing the producers of package coating additives is the fluctuation in the price of the raw materials used in their production. For instance, changes in the price of oil and gas have increased the cost of raw materials used to make antistatic compounds. Similar to this, one of the major obstacles to the expansion of the market for antimicrobial additives is the variable cost of the raw materials used in their synthesis. Silver, copper, and zinc are the main basic minerals used in the production of products with antibacterial compounds. These raw ingredients are highly expensive. The use of silver antimicrobials is restricted by their high cost, particularly in areas like South America and Asia Pacific. The market for package coating additives is being held back by the erratic price of these components.

Opportunity

Opportunity

- Emerging markets to create strong growth opportunities

For participants in the global package coating additives market, emerging regions like China, India, Indonesia, and Brazil, among others, provide tremendous potential for expansion. Due to the expansion of end-use industrial, it is anticipated that the market in China, India, Indonesia, and Brazil would expand quickly. In the upcoming years, the packaging coating additives market is anticipated to increase thanks to the potential opportunities in these nations. Major companies like Clariant AG (Switzerland) and BASF SE (Germany) have designed their business strategies to emphasize entering and establishing bases in these developing areas.

Challenges

Challenges

- Managing plastic waste from different industries to pose challenge for market

Large amounts of waste generated by the packaging sector are not only difficult to dispose of, but also harmful to the environmental. Plastic waste buildup on the earth's surface has a negative effect on both human life and the habitats of wildlife. Plastic garbage is a health risk for living things in the air, water, and on land since plastic decomposition is exceedingly slow. Low-cost plastics are frequently utilized to create a variety of packaging materials, including agricultural films and food & beverage packaging films, due to their resilience. End users find it challenging to handle the plastic trash produced by these businesses. Therefore, a number of nations are putting restrictions on the use of plastic products and enacting regulatory standards, which has an impact on the expansion of the packaging industry. The fall in demand for plastic packaging products presents a significant problem for the producers of packaging coating additives because the packaging sector is one of the primary end-use industries for the market for packaging coating additives.

Segmentation Analysis

Segmentation Analysis

- The global Packaging Coating Additives market is segmented based on function, formulation, application, and region

Based on function, the market is segmented into slip, antistatic, anti-fog, anti-block, and antimicrobial. During the anticipated period, the anti-block category is anticipated to hold the greatest market share for packaging coating additives. Due to their low cost, inorganic anti-block additives are utilized in numerous packaging applications. The need for anti-block additives is rising as the population, disposable income, and style of living all increase.

Based on formulation, the market is segmented into water-based, solvent-based, and powder-based. According to estimates, the packaging coating additives market's water-based formulations will experience the fastest growth throughout the anticipated time frame. The water-based category will retain the largest market share because of its superior advantages, including lower VOCs, more press stability, improved wash-up time, and improved heat resistance.

Based on application, the market is segmented into food packaging, industrial packaging, healthcare packaging, consumer packaging, and others. During the forecast period, food packaging is anticipated to be the packaging coating additives market's fastest-growing application category. Plastic is used in food packaging, and it is prone to friction, microbiological activity, and fog. The market for food packaging applications is being driven by rising packaged food demand as well as rising finance and investment from producers of packaging additives.

Recent Developments:

Recent Developments:

- In January 2020, ProAmpac acquired Rosenbloom Groupe Inc., Hymopack Ltd. And Dyne-A-Pak, business based in Canada that manufactures packaging products. This acquisition facilitates the expansion of ProAmpac in the region.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2021 |

USD 792.04 Million |

Projected Market Size in 2028 |

USD 1099.71 Million |

CAGR Growth Rate |

4.80% CAGR |

Base Year |

2021 |

Forecast Years |

2022-2028 |

Key Market Players |

Croda International Plc, BASF SE, Clariant AG, Lonza Group, 3M Company, Arkema Group (France), Evonik Industries AG, Solvay S.A., Ampacet Corporation, Addcomp Holland Bv, Kao Corporation, Abril Industrial Waxes Ltd, PCC Chemax Inc., Munzing Chemie Gmbh, and others. |

Key Segment |

By Function, Formulation, Application, and Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East &, Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Regional Analysis

Regional Analysis

- Asia Pacific to lead the market growth during the projection period

The global packaging coating additives market was dominated by the Asia-Pacific region in 2021, and it is anticipated to grow at the highest CAGR during the projected period. This can be linked to rising packaging application demand. The region's market is growing favorably as a result of factors like the simple availability of raw materials, shifting lifestyles, and fast industrialization. Japan, India, Indonesia, and China are the other top nations in the region.

Due to significant technical improvements and rising health consciousness for food packaging applications, the North American market held the second-largest market share in 2021. Because of the growing interest in bio-based slip additives, the US is the biggest contributor to the region.

Due to strict government laws banning the use of plastic goods for packaging, the European market held a sizeable market share in 2021 and is anticipated to increase at a moderate CAGR over the review period. Due to its innovative product development and the presence of significant manufacturing firms like BASF SE and Evonik Industries AG in the area, Germany is the leading nation in the region.

Competitive Analysis

Competitive Analysis

- Croda International Plc

- BASF SE

- Clariant AG

- Lonza Group

- 3M Company

- Arkema Group (France)

- Evonik Industries AG

- Solvay S.A.

- Ampacet Corporation

- Addcomp Holland Bv

- Kao Corporation

- Abril Industrial Waxes Ltd

- PCC Chemax Inc.

- Munzing Chemie Gmbh

The global Packaging Coating Additives market is segmented as follows:

By Function

By Function

- Slip

- Antistatic

- Anti-Fog

- Anti-Block

- Antimicrobial

By Formulation

By Formulation

- Water-based

- Solvent-based

- Powder-based

By Application

By Application

- Food Packaging

- Industrial Packaging

- Healthcare Packaging

- Consumer Packaging

- Others

By Regional Segment Analysis

By Regional Segment Analysis

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Nordic Countries

- Denmark

- Sweden

- Norway

- Benelux Union

- Belgium

- The Netherlands

- Luxembourg

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Southeast Asia

- Indonesia

- Thailand

- Malaysia

- Singapore

- Rest of Southeast Asia

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Industry Major Market Players

- Croda International Plc

- BASF SE

- Clariant AG

- Lonza Group

- 3M Company

- Arkema Group (France)

- Evonik Industries AG

- Solvay S.A.

- Ampacet Corporation

- Addcomp Holland Bv

- Kao Corporation

- Abril Industrial Waxes Ltd

- PCC Chemax Inc.

- Munzing Chemie Gmbh

Frequently Asked Questions

1. Which key factors will influence Global Packaging Coating Additives market growth over 2022-2028?

3. Which region will contribute notably towards the Global Packaging Coating Additives market value?

Copyright © 2024 - 2025, All Rights Reserved, Facts and Factors