Search Market Research Report

Protein Expression Market Size, Share Global Analysis Report, 2022 – 2028

Protein Expression Market Size, Share, Growth Analysis Report By Expression System (Prokaryotic Expression Systems, Mammalian Cell Systems, Insect Cell Systems, Yeast Systems, Other Systems), By Product (Reagents, Expression Vectors, Competent Cells, Instruments, Services), By Application (Therapeutic, Industrial, Research), By End-Use (Pharmaceutical and biotechnological companies, Academic research, Contract research organizations and Others), and By Region - Global and Regional Industry Insights, Overview, Comprehensive Analysis, Trends, Statistical Research, Market Intelligence, Historical Data and Forecast 2022 – 2028

Industry Insights

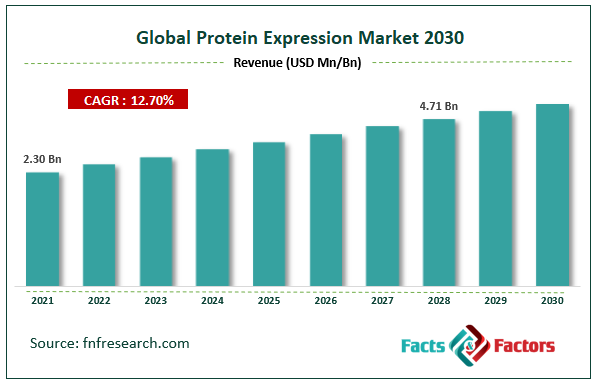

[220+ Pages Report] According to Facts and Factors, the protein expression market size was worth USD 2.30 billion in 2021 and is estimated to grow to USD 4.71 billion by 2028, with a compound annual growth rate (CAGR) of approximately 12.70% over the forecast period. The report analyzes the protein expression market's drivers, restraints/challenges, and their effect on the demands during the projection period. In addition, the report explores emerging opportunities in the protein expression market.

Market Overview

Market Overview

Protein expression is a biotechnological process that produces a particular protein. It is typically accomplished by manipulating an organism's gene expression to express a recombinant gene in large quantities. Numerous opportunities for generating and separating heterologous proteins for scientific, medical, and industrial uses have been made possible by the advancement of genetic engineering and recombinant technology. Large-scale recombinant protein expression and isolation are now possible thanks to significant advancements in biotechnology. Creating recombinant proteins that can enter a cell is one of the main accomplishments. By focusing on intracellular mechanisms or using therapeutic proteins to replace intracellularly active enzymes, such advancements open up new possibilities in therapeutic medicine. A few factors fueling the protein expression market's growth are age-related disorders, a growing geriatric population, and an increase in chronic diseases like cancer. As a result of increased funding for protein research, the market for protein expression is also expanding.

COVID-19 Impact:

COVID-19 Impact:

The COVID-19 epidemic and ensuing lockdowns had a devastating effect on the majority of industries around the world. During this time, there was a major revamp of the healthcare sector. The pandemic had beneficial and bad effects on numerous pharmaceutical, biotechnology, and medical device industries. Researchers are using synthetic biology, particularly in cell-free protein expression systems, to create novel instruments, vaccines, and treatments for COVID-19 patients as the globe continues to struggle with its effects. As a result, the market was positively affected.

Key Insights

Key Insights

- As per the analysis shared by our research analyst, the protein expression market value is expected to grow by 12.70% over the forecast period.

- In terms of revenue, the protein expression market was worth USD 2.30 billion in 2021 and is estimated to grow to USD 4.71 billion by 2028.

- By product, the reagents segment dominated the market in 2021.

- By application, the therapeutic segment dominated the market in 2021.

- North America dominated the protein expression market in 2021.

Growth Drivers

Growth Drivers

- Increased incidence of diseases drives the market growth

The market for protein expression systems is driven by the increased incidence of diseases, including cancer, cardiovascular disease, and genetic abnormalities. Insulin is one protein-based drug that has incredible success in treating various diseases. Businesses are also spending money on developing protein expression technologies, including baculovirus expression systems (used in insect cells), transient expression (used in mammalian cells), and stable expression.

Protein treatments have a reduced risk of side effects due to their high level of effectiveness, considerably fueling the market's expansion. With the development of genetic engineering, which has created a plethora of novel pathways and chances for extensive protein expression and isolation, the transient protein expression industry is also pushing the global market.

Restraints

Restraints

- Strict government guidelines may hinder the market growth

Government restrictions on creating and manufacturing biologics may limit the market's expansion. Before receiving regulatory approval, the new biologics undergo rigorous preclinical and clinical testing. The successful conclusion of clinical trials, which is a protracted, expensive, and uncertain process, is a prerequisite for commercializing biologics, including insulin, hormones, therapeutic antibodies, rising, and vaccines.

Segmentation Analysis

Segmentation Analysis

The protein expression market has been segmented into expression systems, products, applications and end-use.

Based on expression systems, the market has been segmented into prokaryotic expression systems, mammalian cell systems, insect cell systems, yeast systems, and others. The prokaryotic expression systems segment dominated in 2021 because of its wide use, great production efficiency, and low manufacturing cost. Manufacturers are concentrating on mergers, acquisitions, and collaboration to increase their product portfolio and solidify their position in the market.

Based on product, the market is segmented as reagents, expression vectors, competent cells, instruments, and services. The reagents segment is expected to grow during the forecast period in 2021. Producing proteins involves using acids, bases, acrylamides, buffers, detergents, general reagents, protease inhibitors, and solvents. These chemicals have been employed in academia, business, and pharmaceutical production. Therefore, recurring procurement of reagents for various applications is anticipated to support market expansion.

Based on application, the market is segmented as therapeutic, industrial, and research. The major portion of this market in 2021 was devoted to therapeutic uses. The increasing prevalence of the condition and increasing R&D effort are credited with driving the growth of this market segment. A surge in proteomics-based research and the global spread of chronic diseases might be blamed for the segment's sizable market share.

Based on end-use, the market is segmented into pharmaceutical and biotechnological companies, academic research, contract research organizations and others. The pharmaceutical and biotechnological segment dominated the market in 2021 because the market for therapeutic proteins like insulin, growth hormone, and vaccinations is expanding. The market is partly expanding due to greater expenditure on the design and development of new drugs. Due to the increasing outsourcing by biotechnology and pharmaceutical companies for discovering new pharmaceuticals and biologics, the contract research organization segment is anticipated to increase at the highest rate during the study period.

Recent Developments

Recent Developments

- In 2020, Merck planned to open a new biotech development center in Switzerland. The company will invest USD 282.5 million toward achieving this objective. This facility will improve the company's position in the protein expression sector.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2021 |

USD 2.30 Billion |

Projected Market Size in 2028 |

USD 4.71 Billion |

CAGR Growth Rate |

12.70% CAGR |

Base Year |

2021 |

Forecast Years |

2022-2028 |

Key Market Players |

Agilent Technologies Inc., Thermo Fisher Scientific Inc, Bio-Rad Laboratories Inc., Merck KGaA, Promega Corporation, New England Biolabs, Qiagen, Takara Bio Inc., Oxford Expression Technologies, Lucigen Corporation, and Others |

Key Segment |

By Expression Systems, Product, Application, End-use, and Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East &, Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Regional Landscape

Regional Landscape

- North America expected to dominate the Protein Expression Market

North America led the market in 2021. This is because many sizable biopharmaceuticals, pharmaceutical, and biotechnology companies, such as Merck KGaA, Amgen Inc., and F. Hoffmann-La Roche Ltd., are based in this region. The U.S. dominated the market for protein expression throughout all North America. The country is witnessing a surge in research focus on stem cells and cancer and an increase in chronic ailments like cardiovascular and blood diseases. Many biopharmaceutical companies are promoting stem cell research as one of the most potent treatments for various disorders with cutting-edge protein expression tools. As a result, it is anticipated that demand for items involving protein expression will rise throughout the projected period.

Competitive Landscape

Competitive Landscape

- Agilent Technologies Inc.

- Thermo Fisher Scientific Inc

- Bio-Rad Laboratories Inc.

- Merck KGaA

- Promega Corporation

- New England Biolabs

- Qiagen

- Takara Bio Inc.

- Oxford Expression Technologies

- Lucigen Corporation.

Global Protein Expression Market is segmented as follows:

By Expression Systems

By Expression Systems

- Prokaryotic expression systems

- Mammalian cell systems

- Insect cell systems

- Yeast systems

- Other systems

By Product

By Product

- Reagents

- Competent cells

- Expression vectors

- Services

- Instruments

By Application

By Application

- Therapeutic

- Industrial

- Research

By End-use

By End-use

- Pharmaceutical and biotechnological companies

- Academic research

- Contract research organizations

- Others

By Regional Segment Analysis

By Regional Segment Analysis

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Nordic Countries

- Denmark

- Sweden

- Norway

- Benelux Union

- Belgium

- The Netherlands

- Luxembourg

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Southeast Asia

- Indonesia

- Thailand

- Malaysia

- Singapore

- Rest of Southeast Asia

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Industry Major Market Players

- Agilent Technologies Inc.

- Thermo Fisher Scientific Inc

- Bio-Rad Laboratories Inc.

- Merck KGaA

- Promega Corporation

- New England Biolabs

- Qiagen

- Takara Bio Inc.

- Oxford Expression Technologies

- Lucigen Corporation

Frequently Asked Questions

Copyright © 2024 - 2025, All Rights Reserved, Facts and Factors