Search Market Research Report

Water Treatment Chemicals Market Size, Share Global Analysis Report, 2022 – 2028

Water Treatment Chemicals Market Size, Share, Growth Analysis Report By Type (Scale Inhibitors, Corrosion Inhibitors, Coagulants & Flocculants, Chelating Agents, and Biocides & Disinfectants), By End-User (Commercial, Residential, and Industrial), and By Region - Global and Regional Industry Insights, Overview, Comprehensive Analysis, Trends, Statistical Research, Market Intelligence, Historical Data and Forecast 2022 – 2028

Industry Insights

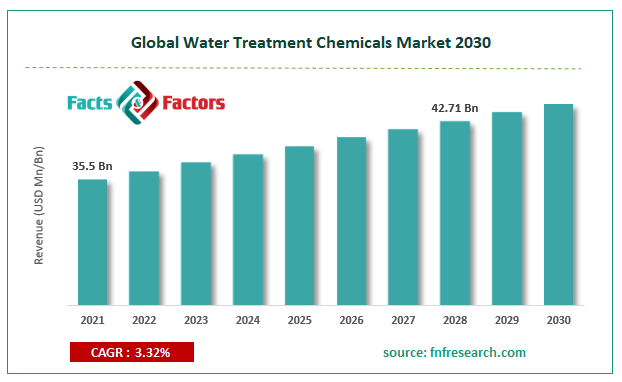

[218+ Pages Report] According to Facts and Factors, the global water treatment chemicals market size was worth around USD 35.5 billion in 2021 and is predicted to grow to around USD 42.71 billion by 2028 with a compound annual growth rate (CAGR) of roughly 3.32% between 2022 and 2028. The report analyzes the global water treatment chemicals market drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the water treatment chemicals market.

Market Overview

Market Overview

Water treatment is the process that is followed to improve the quality of the water for all intent and purposes. The end goal of using chemicals for water treatment is to convert the water quality into desired results for a specific purpose. This could vary from drinking, irrigation, industrial water supply, water recreation, and other activities where water is required in high or small amounts. Water treatment chemicals remove contaminants from the water body and if complete removal is not required or possible, they at least reduce it to smaller quantities so that water can be reused. These chemicals are necessary for the survival of animal and plants as they help to circulate the water in the ecosystem. The use of chemicals is one of the various methods through which water is purified. Pre-chlorination is the method used to control algae formation and restrict biological growth in the water area. The most widely used disinfectants in public water bodies are chloramine and chlorine. Some other chemicals included in the list are non-ferric aluminum sulfate, sodium hypochlorite, ferric aluminum sulfate, trichloroisocyanuric acid, and hydrated lime.

Key Insights

Key Insights

- As per the analysis shared by our research analyst, the global water treatment chemicals market is estimated to grow annually at a CAGR of around 3.32% over the forecast period (2022-2028)

- In terms of revenue, the global water treatment chemicals market size was valued at around USD 35.5 billion in 2021 and is projected to reach USD 42.71 billion, by 2028. Due to a variety of driving factors, the market is predicted to rise at a significant rate

- Based on type segmentation, corrosion inhibitors were predicted to show maximum market share in the year 2021

- Based on end-user segmentation, industrial was the leading end-user in 2021

- On the basis of region, North America was the leading revenue generator in 2021

Growth Drivers

Growth Drivers

- Increasing water pollution to propel market demand

The global water treatment chemicals market is projected to grow owing to the increasing water pollution across the globe as a direct impact of globalization, industrialization, and modernization. As the world moves towards technological and economic growth, the natural resources as commercial and industrial units focus only on profits and not on the impact their business operations leave on the ecological system. For instance, the agriculture sector, the most important industry, while it consumes the largest amount of freshwater, it is also regarded as the top-ranking industry that leads to water pollution. This is due to the harmful chemicals used in synthetic fertilizers and pesticides that percolate in the soil and make their way to water bodies. As per a recent report, more than 40% of America’s lakes are too polluted to conduct activities like fishing or swimming. The aquatic life in these lakes is damaged beyond repair. More than 1.29 trillion of untreated and sewage water is dumped in the regional water bodies.

Restraints

Restraints

- Alternate measures to restrict market expansion

Using chemicals is not the only method for water treatment. There are several other methods including physical, Physico-chemical, and biological. In the physical process, the stress is laid on physical processes that can filter water. The most commonly used methods are filtration, which involves water purification based on the particle size of the pollutants. Sedimentation required the application of a gravity setting to filter water content in one of the most widely used methods for water treatment. In places where there is a lack of constant electricity supply, the physical treatment of wastewater is considered the most effective method.

Opportunities

Opportunities

- Increasing awareness to provide more growth opportunities

For the longest time, the general population lacked access to information related to the impact that globalization has on the environment. In recent times, there have been sudden changes in the ecological system that cannot be ignored including global warming, famine, drought, and other naturally occurring calamities. This has diverted the attention of the population toward the environmental resulting in more people being aware of the repercussions that the modern world brings along with it. This in turn has increased the pressure on large and small corporations to reduce the impact of industrial operations on the nearby surrounding which may drive the demand for chemical water treatment processes.

Challenges

Challenges

- Training skilled employees to pose a major challenge

One of the key challenges the global water treatment chemicals market players may face is training or skilled labor. Chemical water treatment is an advanced form of treating water and is a highly technological process, especially in units that treat water in large amounts. Hence training the right set of individuals is an important factor for the unit to perform well and any misinformation can lead to the personnel falling at risk of misunderstanding the process and causing severe damage. This could pose a high-cost investment for normal-size companies that work on limited budgets.

Segmentation Analysis

Segmentation Analysis

- The global water treatment chemicals market is segmented based on type, end-user, and region

Based on type, the global market divisions are scale inhibitors, corrosion inhibitors, coagulants & flocculants, chelating agents, and biocides & disinfectants. The global market was dominated by the corrosion inhibitors segment in 2021 as they help to minimize the corrosion of metal surfaces that are used in boilers or cooling towers. As per certain estimates, the oil & gas industry loses more than USD 1.2 billion every year due to pipeline corrosion. Severe cases of offshore pipeline corrosion are recorded every year.

Based on end-user, the global market divisions are commercial, residential, and industrial. In 2021, the highest registered revenue was from the industrial segment as the index for industrial water pollution has increased multifold over the last decade. Strict government regulations are now in place holding corporations and business responsible for the impact of the business procedure on the ecological system. In October 2022, the Environment Secretary in the EU announced the intention to increase fines on industries for environmental pollution to £250 million.

Recent Developments:

Recent Developments:

- In August 2022, Huliot India, an Israeli technology company, announced the launch of the ClearBlack Sewage Treatment Plant for the Indian market. The new technology is one of the most effective water treatment plants and can save up to 40% of the water

- In May 2022, ChemREADY announced the launch of the Legionella program which is projected to prevent building water systems from the growth of water-borne pathogens. The services will most likely leave the highest impact on the healthcare sector

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2021 |

USD 35.5 Billion |

Projected Market Size in 2028 |

USD 42.71 Billion |

CAGR Growth Rate |

3.32% CAGR |

Base Year |

2021 |

Forecast Years |

2022-2028 |

Key Market Players |

Solenis, SUEZ, The Dow Chemical Company, Kurita Europe GmbH, Ecolab, Kemira Oyj, SNF Group, Buckman, Somicon ME FZC, Cortec Corporation, and Others |

Key Segment |

By Type, End-User, and Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East &, Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Regional Analysis

Regional Analysis

- North America to witness the highest growth during the projection period

The global water treatment chemicals market is projected to witness the highest growth in North America owing to the increasing regulations on industrial units related to the impact of business operations on the surrounding environment. The United States Environmental Protection Agency has laid down the Clean Water Act (CWA) which works on establishing basic guidelines and protocols for regulating the quality of the water in the US. The program has various sub-segmented related to compliance and enforcement. In 2019, the country’s spending on water supply and treatment of wastewater reached USD 112.9 billion. As per official data, Canada’s expense on wastewater management has increased by 41.9% from 2008 to 2016. In 2019, businesses in Canada were known to have spent around USD 21 billion on limiting the operational impact on the environment. The region has witnessed a rise in the number of domestic regulatory bodies protesting against water pollution and generating mass awareness which could further drive the demand in the regional market.

Competitive Analysis

Competitive Analysis

- Solenis

- SUEZ

- The Dow Chemical Company

- Kurita Europe GmbH

- Ecolab

- Kemira Oyj

- SNF Group

- Buckman

- Somicon ME FZC

- Cortec Corporation

The global water treatment chemicals market is segmented as follows:

By Type

By Type

- Scale Inhibitors

- Corrosion Inhibitors

- Coagulants & Flocculants

- Chelating Agents

- Biocides & Disinfectants

By End-User

By End-User

- Commercial

- Residential

- Industrial

By Regional Segment Analysis

By Regional Segment Analysis

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Nordic Countries

- Denmark

- Sweden

- Norway

- Benelux Union

- Belgium

- The Netherlands

- Luxembourg

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Southeast Asia

- Indonesia

- Thailand

- Malaysia

- Singapore

- Rest of Southeast Asia

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Industry Major Market Players

- Solenis

- SUEZ

- The Dow Chemical Company

- Kurita Europe GmbH

- Ecolab

- Kemira Oyj

- SNF Group

- Buckman

- Somicon ME FZC

- Cortec Corporation

Frequently Asked Questions

Copyright © 2024 - 2025, All Rights Reserved, Facts and Factors