Search Market Research Report

Wheel Loaders Market Size, Share Global Analysis Report, 2022 – 2028

Wheel Loaders Market Size, Share, Growth Analysis Report By Types (Armored Wheel Loaders, Tractor Front Loaders, Compact Front End Loaders, and Skid Loaders & Track Loaders), By Net Operating Power (20 – 40 Hp, 40 – 80 Hp, 80 – 120 Hp, 120 – 160 Hp, 160 Hp, And Above), By Types of Bucket (Bottom Bucket, Flat Bottom Bucket, Backhoe Bucket, Demolition Bucket, Excavating Buckets, And Others),By End-Use Application (Stone Quarries, Mining Zones, Construction Sites, Military & Defense, and Public Sectors), and By Region - Global and Regional Industry Insights, Overview, Comprehensive Analysis, Trends, Statistical Research, Market Intelligence, Historical Data and Forecast 2022 – 2028

Industry Insights

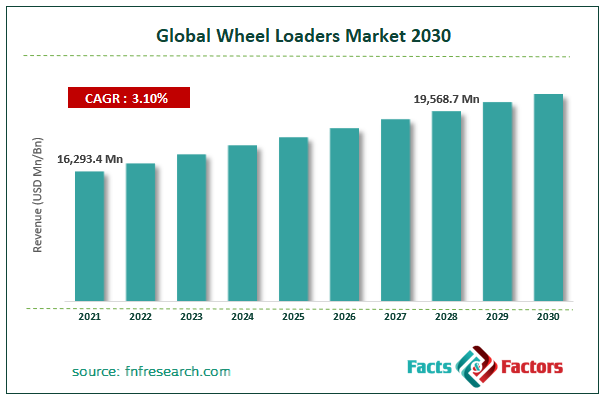

[225+ Pages Report] According to Facts and Factors, the global wheel loaders market size was worth USD 16,293.4 million in 2021 and is estimated to grow to USD 19,568.7 million by 2028, with a compound annual growth rate (CAGR) of approximately 3.1% over the forecast period. The report analyzes the wheel loaders market's drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the wheel loaders market.

Market Overview

Market Overview

Wheel loaders are mobile shovels with multiple uses. They may move goods from stockpiles to trucks, haul big loads, and move items about job sites. Construction, agriculture, forestry, and mining are just a few industries that use wheel loaders. The public sector also uses wheel loaders, businesses that rent equipment, sand and gravel pits, and businesses that deal with industrial waste for site preparation work, digging, and moving and putting items. They are also used to dig, remove debris, install pipes, and load commodities into trucks, among other things. Since the backhoe loader bucket is primarily utilized as a piece of digging equipment, the front loader bucket capacity is significantly higher than the backhoe loader buckets.

The wheel level of the machine cannot be reached with the backhoe's digging apparatus. The development of the transportation infrastructure and large-scale construction projects, among other activities, has been driving the market's overall growth. Another element influencing the market's expansion is the introduction of new products by the major players. The market's expansion has been hampered by the high price of wheel loaders and the substantial upfront investment required to manufacture them.

COVID-19 Impact:

COVID-19 Impact:

With the rigorous lockdowns and social segregation implemented to stop the COVID-19's spread, the market for wheel loaders suffered. The market for compact wheel loaders was hurt by the lack of customer confidence, the partial company shutdown, and the uncertain economic climate. Operations in logistics and the supply chain were hampered during the outbreak. The speed at which the COVID 19 issue has intensified has shocked the global economy. The epidemic has had an effect on people's social well-being, economics, and public health all around the world.

The economic stagnation brought on by the lockdown orders issued by government authorities in several nations also affected the construction equipment industry. However, because of the relaxing of the restrictions, it is anticipated that the market for compact wheel loaders would pick up steam in the post-pandemic scenario.

Key Insights

Key Insights

- As per the analysis shared by our research analyst, the global wheel loaders market value is expected to grow at a CAGR of 3.1% over the forecast period.

- In terms of revenue, the global wheel loaders market size was valued at around USD 16,293.4 million in 2021 and is projected to reach USD 19,568.7 million by 2028.

- The market is expanding as a result of expanding infrastructure investments and a significant number of construction projects in emerging and developing nations.

- By type, the compact front-end loaders category dominated the market in 2021.

- By end-use application, the construction category dominated the market in 2021.

- The Asia Pacific dominated the global wheel loaders market in 2021.

Growth Drivers

Growth Drivers

- Rapid infrastructure development will enhance the growth of the market

The market for wheel loaders will expand due to rising infrastructure investments. Increasing public infrastructure spending is essential for a country's economy to remain stable and flourish. The public sector and government organizations handle most infrastructure development projects in Asia. Investments are expected to expand rapidly throughout Asia, especially in the transportation industry. During the forecast period and beyond, it's anticipated that nations like Indonesia and the Philippines will spend significantly on road and highway construction. Thus, these advancements are anticipated to stimulate significant investment in the construction sector, thereby increasing demand for wheel loaders.

Restraints

Restraints

- Increased growth of the rental market will restrict the growth of the market

In developed nations in Europe and North America, the market for renting construction equipment has a high penetration rate. Renting construction equipment is a trend that is quickly spreading to emerging countries as well. At reasonable rates, wheel loaders and other construction equipment are frequently offered for rent. The expansion of equipment available for rental may persuade small end users to choose such products. As a result, fewer new pieces of equipment will be bought, hurting wheel loader sales. Thus, increased rental company rivalry could negatively impact market vendors' capacity to draw in and hold on to customers and their ability to generate income. This would impact the expansion of the worldwide wheel loaders market.

Segmentation Analysis

Segmentation Analysis

The global wheel loaders market has been segmented into types, net operating power, types of buckets, and end-use applications.

Based on types, the worldwide wheel loaders market is segmented into armored wheel loaders, tractor front loaders, compact front end loaders, and skid loaders & track loaders. In terms of type, the market was led by compact front-end loaders in 2021. One of the key factors propelling the growth of compact front-end loaders is the rise in residential construction and infrastructure development activities worldwide. The need for small, high-performance machines, like compact wheel loaders, is increasing as building activity picks up.

Based on net operating power, the worldwide wheel loaders market is segmented into 20 – 40 hp, 40 – 80 hp, 80 – 120 hp, 120 – 160 hp, 160 hp, and above. With a market share of more than 68.0% in 2021, the loader with an operating power greater than 160 HP prevailed. The loaders above 160 HP networking power are effective and small. Small-scale applications involving agriculture, landscaping, and grounds maintenance call for the employment of these kinds of loaders.

Based on the types of buckets, the worldwide wheel loaders market is segmented into the bottom bucket, flat bottom bucket, backhoe bucket, demolition bucket, excavating buckets, and others. In 2021, the backhoe bucket category dominated the market. The backhoe loader can do various jobs, including digging, conveying building supplies, excavating materials for small demolition projects, powering construction machinery, landscaping, and paving roads.

Based on application, the worldwide wheel loaders market is segmented into stone quarries, mining zones, construction sites, military & defense, and public sectors. The construction sector is expected to develop at the quickest rate in the global market, accounting for more than 41% in 2021. Growing government emphasis on urbanization and an increase in large-scale infrastructure development projects, such as the Smart City Mission in India, Sound Transit 3 (ST3) Construction Project in the U.S., and others globally, are the main factors promoting the segment's growth.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2021 |

USD 16,293.4 Million |

Projected Market Size in 2028 |

USD 19,568.7 Million |

CAGR Growth Rate |

3.1% CAGR |

Base Year |

2021 |

Forecast Years |

2022-2028 |

Key Market Players |

Caterpillar Inc., Hitachi Ltd., Deere & Company, Kawasaki Heavy Industries Limited, Komatsu Ltd., Larsen & Toubro Limited, New Holland Construction, and Others |

Key Segment |

By Types, Net Operating Power, Types Of Bucket, End-Use Application, and Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Recent Developments

Recent Developments

- In May 2022, Caterpillar introduced its next-generation compact wheel loaders. The new Next Generation Cat 906, 907, and 908 wheel loaders boast a re-engineered operator's station, leveraging exclusive Cat technologies to improve the operator experience and provide larger wheel loader model comfort on a smaller platform. They build on the success of the Cat M-Series Compact Wheel Loaders.

Regional Landscape

Regional Landscape

- The Asia Pacific dominated the wheel loaders market in 2021

With a market share of over 47.0 percent in 2021, Asia Pacific led the industry and is expected to develop at the highest rate throughout the projected period. Rising infrastructure projects and building activity in developing nations like China and India are to blame for the surge. Infrastructure investments undertaken by these nations are driving the demand for construction equipment like wheel loaders.

The Indian government is actively pursuing many efforts to mechanize the agricultural industry to boost agricultural production and satisfy the nation's rising food demand. Wheel loaders are being utilized more frequently in the agricultural sector, which is predicted to increase demand in the Indian market. The Asia Pacific region is distinguished by well-known businesses like Kubota Corporation, Komatsu Ltd., and Hyundai Heavy Industries Co.

Competitive Landscape

Competitive Landscape

Key players within the global wheel loaders market include

- Caterpillar Inc.

- Hitachi Ltd.

- Deere & Company

- Kawasaki Heavy Industries Limited

- Komatsu Ltd.

- Larsen & Toubro Limited

- New Holland Construction.

Global Wheel Loaders Market is segmented as follows:

By Types

By Types

- Armored Wheel Loaders

- Tractor Front Loaders

- Compact Front End Loaders

- Skid Loaders & Track Loaders

By Net Operating Power

By Net Operating Power

- 20 – 40 HP

- 40 – 80 HP

- 80 – 120 HP

- 120 – 160 HP

- 160 HP and Above

By Types Of Bucket

By Types Of Bucket

- Bottom Bucket

- Flat Bottom Bucket

- Backhoe Bucket

- Demolition Bucket

- Excavating Buckets

- Others

By End-Use Application

By End-Use Application

- Stone Quarries

- Mining Zones

- Construction Sites

- Military & Defense

- Public Sectors

By Region

By Region

-

North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Nordic Countries

- Denmark

- Sweden

- Norway

- Benelux Union

- Belgium

- The Netherlands

- Luxembourg

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Southeast Asia

- Indonesia

- Thailand

- Malaysia

- Singapore

- Rest of Southeast Asia

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Industry Major Market Players

- Caterpillar Inc.

- Hitachi Ltd.

- Deere & Company

- Kawasaki Heavy Industries Limited

- Komatsu Ltd.

- Larsen & Toubro Limited

- New Holland Construction.

Frequently Asked Questions

Copyright © 2024 - 2025, All Rights Reserved, Facts and Factors