Search Market Research Report

White Spirit Market Size, Share Global Analysis Report, 2022 – 2028

White Spirit Market Size, Share, Growth Analysis Report By Type (Type 0, Type 1, Type 2, Type 3), By Flash Point (Low, Medium, High), By Application (Thinner & Solvent, Fuels, Cleaning Agent, Degreasing Agent, Others), and By Region - Global Industry Insights, Comparative Analysis, Trends, Statistical Research, Market Intelligence, and Forecast 2022 – 2028

Industry Insights

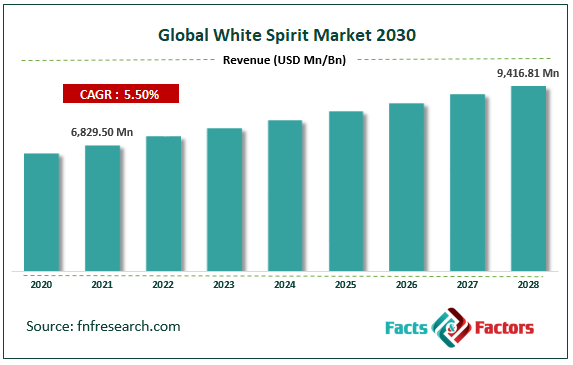

[217+ Pages Report] According to Facts and Factors, the global white spirit market size was valued at USD 6,829.50 million in 2021 and is predicted to increase at a CAGR of 5.50% to USD 9,416.81 million by 2028. The study examines the market in terms of revenue in each of the major regions, which are classified into countries.

Market Overview

Market Overview

White spirit is a clear, translucent liquid generated from petroleum that is commonly used as an organic solvent in painting and other purposes. The increased use of white spirits in the end-use sectors of paints and coatings, adhesives, and inks and dyes is driving global market demand. White spirit is frequently used as a cleaning solvent, degreasing solvent, and aerosol solvent due to its combination of aliphatic and alicyclic hydrocarbons. White spirit is also used in wood preservation solvents, varnishes, and lacquer solvents, among other things. All of these reasons contribute to the global white spirits market's demand. Due to its widespread use as a paint thinner and a cleaning agent for paint brushes, the paint industry is the greatest consumer of the white spirit. The addition of white spirit reduces the viscosity of the paint and speeds up the drying process. Furthermore, the white spirit aiding the smoothness of paint products is another significant aspect that raises the global market's demand and, as a result, is expected to give new potential chances during the projected period.

The cleansing agent white spirit is quite effective. It's a powerful solution that's well-known for its adaptability and efficacy. While painting, it can be used as a solvent to erase mistakes. It can also be used to dissolve gum and resins that have become embedded in garments or carpets. It's often used as a cleaning agent for car parts and heavy machinery in the automotive industry. It can remove even the most stubborn oil and chemical stains. With white spirit, even dried paint that has thickened can be dissolved and readily removed. White spirit can also be used to clean and polish wooden furniture and flooring. Governments' strict controls on building and construction for various initiatives, such as creating homes for homeless poor people, will drive the demand for white spirits, as building a home also necessitates the application of paint. As painting a house without white thinner or spirit is impossible. As a result, the white spirit has become an essential component of the building and construction sector.

Impact of COVID - 19

Impact of COVID - 19

COVID-19 had a negative impact on the market in 2020. As a result of the pandemic situation, various countries throughout the world went into lockdown to prevent the virus from spreading. This harmed demand for white spirit in a variety of applications such as paint thinner, fuel, degreasing agent, and others, as production units in industries such as paints and coatings, construction, automotive, and others were forced to shut down due to labour shortages and supply chain disruptions. However, in 2021, the situation is likely to improve, benefiting the industry over the forecast period. In the medium term, the market's growth is being driven by rising demand from the paints and coatings industry, as well as increased infrastructure development.

The complete research study looks at both the qualitative and quantitative aspects of the White Spirit market. Both the demand and supply sides of the market have been investigated. The demand side study examines market income in various regions before comparing it to all of the major countries. The supply side research examines the industry's top rivals, as well as their regional and global presence and strategies. Each major country in North America, Europe, Asia Pacific, the Middle East and Africa, and Latin America is thoroughly investigated.

Segmentation Analysis

Segmentation Analysis

The global White Spirit market is segregated based on Type, Flash Point, and Application.

By Type, Solvent extracted white spirit, commonly known as Type 2 white spirit, is a mixture of hydrocarbons derived as a raffinate from the solvent extraction process. The expanding demand for type 2 white spirit is primarily driven by the paint and coatings, adhesives, and cleaning chemical industries. Another key element driving the growing demand for type 2 white spirit is the increasing use of these compounds in various end-use industries such as automotive, construction, composites, and chemicals.

By Application, the largest application segment of the white spirits market is thinner and solvent. White spirit is used as a thinner and is an essential ingredient in the production of solvent-based paints and coatings. White spirit is used as a thinner to lessen the viscosity of the paint and allow for a slower rate of evaporation. As a result, white spirit-thinned paints dry to a smoother surface and produce a leveled coat on the surface they're applied. The rising demand for new homes as a result of the growing number of nuclear families has resulted in the development of new residential and commercial structures, which is projected to continue. The building industry's expansion is boosting demand for paints and coatings in these areas, which will have a direct impact on white spirit demand.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2021 |

USD 6,829.50 Million |

Projected Market Size in 2028 |

USD 9,416.81 Million |

CAGR Growth Rate |

5.50% CAGR |

Base Year |

2021 |

Forecast Years |

2022-2028 |

Key Market Players |

Royal Dutch Shell (The Netherlands), Total SA (France), ExxonMobil (US), Idemitsu Kosan Co. Ltd (Japan), Bharat Petroleum Corporation Limited (India), Indian Oil Corporation Limited (India), ThaiOil Company (Japan), and Others |

Key Segment |

By Type, Flash Point, Application, and Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Regional Landscape

Regional Landscape

The expansion of the construction industry in APAC is boosting demand for paints and coatings, which will have a direct impact on white spirit consumption. Construction activity is exploding in APAC's rising economies. The expanding standard of living increased housing building expenditures, and investments in a variety of industries, including appliances, automotive, general industrial, architectural, and furniture, all contribute to this. China is a major user of white spirit in the Asia-Pacific region. During the projection period, China's white spirit market is expected to grow at a high rate. During the forecast period, China's paints and coatings industry is expected to see strong demand, owing to an increase in the demand for decorative coatings.

Competitive Landscape

Competitive Landscape

The report contains qualitative and quantitative research on the global white spirit market, as well as detailed insights and development strategies employed by the leading competitors. The report also provides an in-depth analysis of the market's main competitors, as well as information on their competitiveness. The research also identifies and analyses important business strategies used by these main market players, such as mergers and acquisitions (M&A), affiliations, collaborations, and contracts.

List of Key Players in the Global White Spirit Market:

- Royal Dutch Shell (The Netherlands)

- Total SA (France)

- ExxonMobil (US)

- Idemitsu Kosan Co. Ltd (Japan)

- Bharat Petroleum Corporation Limited (India)

- Indian Oil Corporation Limited (India)

- ThaiOil Company (Japan)

The Global White Spirit Market is segmented as follows:

By Type

By Type

- Type 0

- Type 1

- Type 2

- Type 3

By Flash Point

By Flash Point

- Low

- Medium

- High

By Application

By Application

- Thinner & Solvent

- Fuels

- Cleaning Agent

- Degreasing Agent

- Others

By Region

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Nordic Countries

- Denmark

- Sweden

- Norway

- Benelux Union

- Belgium

- The Netherlands

- Luxembourg

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Southeast Asia

- Indonesia

- Thailand

- Malaysia

- Singapore

- Rest of Southeast Asia

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Industry Major Market Players

- Royal Dutch Shell (The Netherlands)

- Total SA (France)

- ExxonMobil (US)

- Idemitsu Kosan Co. Ltd (Japan)

- Bharat Petroleum Corporation Limited (India)

- Indian Oil Corporation Limited (India)

- ThaiOil Company (Japan)

Frequently Asked Questions

Copyright © 2024 - 2025, All Rights Reserved, Facts and Factors