Search Market Research Report

Catheter Stabilization Device Market Size, Share Global Analysis Report, 2022 – 2028

Catheter Stabilization Device Market Size, Share, Growth Analysis Report By Products (Arterial Securement Devices, Central Venous Catheter Securement Devices, Peripheral Securement Devices, Urinary Catheter Securement Devices, Chest Drainage Tube Securement Devices and Others), By End-Use (Hospitals, Home Care Settings and Others), and By Region- Global and Regional Industry Insights, Overview, Comprehensive Analysis, Trends, Statistical Research, Market Intelligence, Historical Data and Forecast 2022 – 2028

Industry Insights

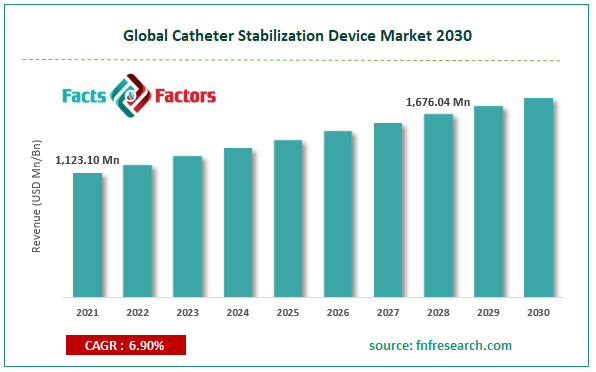

[220+ Pages Report] According to Facts and Factors, the Global Catheter Stabilization Device market size was worth USD 1,123.10 million in 2021 and is estimated to grow to about USD 1,676.04 million by 2028, with a compound annual growth rate (CAGR) of approximately 6.90% over the forecast period. The report analyzes the Catheter Stabilization Device market’s drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the Catheter Stabilization Device market.

Market Overview

Market Overview

A catheter is a small, flexible tube-like device that doctors use to insert into patients' bodies or remove fluids from them. Medical add-ons called catheter stabilization devices are used to retain the catheter in place firmly. By wrapping around the thigh's circumference, catheter stabilization devices like catheter leg straps allow patients to move around while the catheter is attached to the thigh. They are made simple to attach and remove in a matter of minutes. It is simpler to see the insertion site for cleaning and inspection purposes. It makes use of a clipping attachment to alter the shape of various body parts so that the catheter can be secured firmly using an adhesive pad.

The ophthalmic, urological, neuromuscular, gastrointestinal, and cardiovascular applications in medical applications are among the sectors driving the worldwide catheter stabilization device market. It can be used as a urinary catheter to drain urine from the bladder, for medication, for angioplasty or angiography, to drain fluid buildup in an abdominal abscess, or to test blood pressure in an artery or vein. It is an essential component of medical and surgical operations. The rise in non-invasive procedure demand fuels the need for catheters. Catheter stabilization devices are captive items for catheters, and as the need for catheters rises, the demand for these products increases.

COVID-19 Impact:

COVID-19 Impact:

The COVID-19 pandemic increased the number of respiratory and cardiovascular surgeries, leading industry participants to increase the manufacturing of fixation devices. As a result, catheter stabilization devices are expected to be in high demand in hospitals and diagnostic facilities. North America and Europe will continue to be the most active markets for chest drainage tubes and central venous catheter securement devices. Market forecasts will be positive due to favorable government policies and an increase in healthcare budgets.

Key Insights

Key Insights

- Catheter Stabilization Device market share value at CAGRof 6.90% over the forecast period.

- The ophthalmic, urological, neuromuscular, gastrointestinal, and cardiovascular applications in medical applications are among the sectors driving the worldwide catheter stabilization device market.

- The arterial securement devices segment will dominate the market by products in 2021.

- By end-use, the hospital's segment will dominate the market in 2021.

- North America will dominate the Global Catheter Stabilization Device market in 2021.

Growth Drivers

Growth Drivers

- The rapid rise in the prevalence of cardiovascular disorders is likely to pave the way for global market growth

As catheter stabilization devices are used during many cardiovascular surgical operations, the prevalence of cardiovascular disorders is expected to increase during the projection period. Such operations often involve the use of cardiac and urine catheters. This ailment alone is to blame for 32% of all fatalities worldwide.

Restraints

Restraints

- Complications associated with catheter use may hamper the global market growth

During the projection period, it is predicted that complications related to the use of catheters on patients during surgical and non-surgical procedures will pose a challenge to product demand. For instance, urinary catheters are the primary reason for urinary tract infections in healthcare settings (UTIs). Fever, chills, pus-clouded urine, burning in the urethra or vaginal region, and bloody urine are just a few of the symptoms that can result from UTIs.

Opportunities

Opportunities

- The growing global geriatric population brings up several growth opportunities

As geriatrics are more prone to illnesses including Parkinson's, urinary retention, cardiovascular disorders, and urinary incontinence, the market for catheter stabilization devices and catheter securement devices is being driven by the rapid increase in the world's geriatric population. The World Health Organization (WHO) predicts that by 2030, there will be nearly 1.4 billion persons over the age of 60, up from 1 billion in 2020. The number of persons in the globe who are 60 years or older will double by 2050.

Segmentation Analysis

Segmentation Analysis

The global Catheter Stabilization Device market is segregated on the basis of products,end-use, and region.

By-products, end-use, and region. Based on products, the market is divided into Arterial Securement Devices, Central Venous Catheter Securement Devices, Peripheral Securement Devices, Urinary Catheter Securement Devices, Chest Drainage Tube Securement Devices and Others. Among these, the Arterial Securement Devices segment dominates the market in 2021. Arterial catheters are widely utilized in everyday modern healthcare practices around the world. Due to the widespread use of arterial catheters in a high number of procedures connected with cardiovascular disorders and cancer therapies, this category held the majority of the market share. Because of the widespread use of these devices, security is essential in order to mitigate the risks associated with their use. Arterial catheters are commonly utilized for interventions in intensive care units around the world.

By end-use, the market is divided into Hospitals, Home Care Settings and Others. Over the forecast period, the Hospitals segment is expected to develop at the fastest rate in 2021. Hospitals do a large number of procedures. Catheters have been routinely employed in hospitals for a variety of therapies. In hospitalized patients, the prevalence of illnesses related to their use is significant. Catheter-Associated Urinary Tract Infections (CAUTI) are the most frequently reported hospital-acquired infections, and their frequency is increasing. The increasing occurrence of infections in hospitals leads to this segment's considerable share. Improving healthcare services in emerging nations and the growing number of hospitals worldwide are predicted to contribute to the increased use of stabilizing devices.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2021 |

USD 1,123.10 Million |

Projected Market Size in 2028 |

USD 1,676.04 Million |

CAGR Growth Rate |

6.90% CAGR |

Base Year |

2021 |

Forecast Years |

2022-2028 |

Key Market Players |

C.R. Bard Inc., Baxter, 3M, B Braun Melsungen AG, Merit Medical Systems Inc., ConvaTec Inc., Centurion Medical Products, TIDI Products LLC, Smiths Medical, and Others |

Key Segment |

By Products, End-use, and Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Recent Developments

Recent Developments

- In October 2019, The first Foley catheter stabilizer ever created by CATHETRIX was introduced, actively preventing potential harm to the bladder and urethra from unintentional urine catheter removal. At MEDICA 2019 in Germany, the catheter securement device FoleySafe was displayed.

- In 2019, Hold-n-Place Catheter Securement Products, which are engineered stabilization devices (ESD) with a soft, pleasant, and flexible design, were introduced by Dale Medical Products, Inc. (the US).

Regional Landscape

Regional Landscape

- High surgical rate likely to help North America dominate the global market

North America is expected to dominate the catheter Stabilization DeviceMarket in 2021. The high surgical rate raises the demand for stabilizing devices and accounts for a considerable share of this region, One of the causes causing the market to rise is the widespread use of catheterization procedures in the examination, diagnosis, and treatment. Furthermore, it is projected that rising intravascular catheter utilization in this region will fuel the market. Because of the rise in catheter implantation, the United States has the greatest market here and globally.

Over the forecast period, Asia Pacific regional market is expected to grow at a significant rate in the Catheter Stabilization Device market in 2021because there is a large patient pool, a growing target population, a large unmet need, and enhanced regional infrastructure. In addition, rising demand for various surgeries, improved healthcare facilities, and increased public and professional awareness are predicted to fuel growth in this area.

Competitive Landscape

Competitive Landscape

Key players within the global catheter stabilization device market include

- C.R. Bard Inc.

- Baxter

- 3M

- B Braun Melsungen AG

- Merit Medical Systems Inc.

- ConvaTec Inc.

- Centurion Medical Products

- TIDI Products LLC

- Smiths Medical

Global Catheter Stabilization Device market is segmented as follows:

By Products

By Products

- Arterial Securement Devices

- Central Venous Catheter Securement Devices

- Peripheral Securement Devices

- Urinary Catheter Securement Devices

- Chest Drainage Tube Securement Devices

- Others

By End-use

By End-use

- Hospitals

- Home Care Settings

- Others

By Region

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Nordic Countries

- Denmark

- Sweden

- Norway

- Benelux Union

- Belgium

- The Netherlands

- Luxembourg

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Southeast Asia

- Indonesia

- Thailand

- Malaysia

- Singapore

- Rest of Southeast Asia

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Industry Major Market Players

- C.R. Bard Inc.

- Baxter

- 3M

- B Braun Melsungen AG

- Merit Medical Systems Inc.

- ConvaTec Inc.

- Centurion Medical Products

- TIDI Products LLC

- Smiths Medical.

Copyright © 2023 - 2024, All Rights Reserved, Facts and Factors