Search Market Research Report

Automotive Secondary Wiring Harness Market Size, Share Global Analysis Report, 2018 – 2025

Automotive Secondary Wiring Harness Market By Vehicle Type (Passenger Car, Heavy Commercial Vehicle, and Light Commercial Vehicle), By Electric Vehicle Type (Battery Electric Vehicles, Hybrid Electric Vehicles, and Plug-in Hybrid Electric Vehicles), and By Application (Engine, Electronic Parking Brakes, Cabin , Electronic Gear Shift System, Body, and Chassis): Global Industry Perspective, Comprehensive Analysis, and Forecast 2018 – 2025

Industry Insights

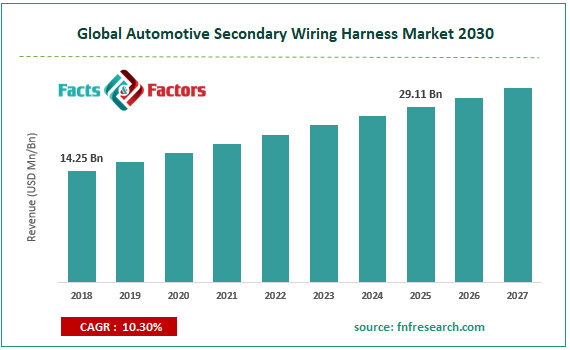

The report covers the forecast and analysis of the Automotive Secondary Wiring Harness market on a global and regional level. The study provides historical data from 2015 to 2018 along with a forecast from 2019 to 2025 based on revenue (USD Billion). The study includes drivers and restraints of the Automotive Secondary Wiring Harness market along with the impact they have on the demand over the forecast period. Additionally, the report includes the study of opportunities available in the Automotive Secondary Wiring Harness market on a global level.

In order to give the users of this report a comprehensive view of the Automotive Secondary Wiring Harness market, we have included a competitive landscape and an analysis of Porter’s Five Forces model for the market. The study encompasses a market attractiveness analysis, wherein all the segments are benchmarked based on their market size, growth rate, and general attractiveness.

The report provides company market share analysis to give a broader overview of the key players in the market. In addition, the report also covers key strategic developments of the market including acquisitions & mergers, new product & service launches, agreements, partnerships, collaborations & joint ventures, research & development, and regional expansion of major participants involved in the market on a global and regional basis.

The study provides a decisive view of the Automotive Secondary Wiring Harness market by segmenting the market based on vehicle type, electric vehicle type, application, and regions. All the segments have been analyzed based on present and future trends and the market is estimated from 2019 to 2025. The regional segmentation includes the current and forecast demand for North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa.

A rise in the need for comfort in vehicles and demand for safety accessories will prompt the expansion of the automotive secondary wiring harness market over the forecast period. Nonetheless, acceptance of new wireless systems in the vehicle sector will decimate the market growth during the forecast timespan. However, the massive trend among vehicle manufacturers to introduce secured features like anti-lock braking systems, electronic braking systems, and electronic stability programs will create new growth avenues for the market during the period from 2019 to 2025.

The overall automotive secondary wiring harness industry is sectored based on vehicle type, electric vehicle type, and application. Based on the vehicle type, the industry is divided into Passenger Car, Heavy Commercial Vehicles, and Light Commercial Vehicles. In terms of electric vehicle type, the market is classified into Hybrid Electric Vehicles, Battery Electric Vehicles, and Plug-in Hybrid Electric Vehicles. Application-wise, the industry is segregated into Engine, Electronic Parking Brakes, Cabin, Electronic Gear Shift System, Body, and Chassis.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2018 |

USD 14.25 Billion |

Projected Market Size in 2025 |

USD 29.11 Billion |

CAGR Growth Rate |

10.3% CAGR |

Base Year |

2020 |

Forecast Years |

2018-2025 |

Key Market Players |

Nexans, Cypress Holdings, Inc., Lear Corporation, Viney Corporation Limited, Fujikura Ltd., Spark Minda, Ashok Minda Group, YURA CORPORATION, YAZAKI Corporation, Federal-Mogul LLC, Samvardhana Motherson Group, Sumitomo Electric Industries, Ltd., Rajashree International, Delphi Technologies, Leoni AG, THB Group, and Furukawa Electric Co., Ltd. |

Key Segment |

By Vehicle Type, By Electric Vehicle Type, By Application, By Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

This report segments the Automotive Secondary Wiring Harness market as follows:

This report segments the Automotive Secondary Wiring Harness market as follows:

Some of the key players in the market include

Some of the key players in the market include

- Nexans

- Cypress Holdings Inc.

- Lear Corporation

- Viney Corporation Limited

- Fujikura Ltd.

- Spark Minda

- Ashok Minda Group

- YURA CORPORATION

- YAZAKI Corporation

- Federal-Mogul LLC

- Samvardhana Motherson Group

- Sumitomo Electric Industries Ltd.

- Rajashree International

- Delphi Technologies

- Leoni AG

- THB Group

- Furukawa Electric Co.Ltd.

By Vehicle Type Segment Analysis

By Vehicle Type Segment Analysis

- Passenger Car

- Heavy Commercial Vehicle

- Light Commercial Vehicle

By Electric Vehicle Type Segment Analysis

By Electric Vehicle Type Segment Analysis

- Battery Electric Vehicles

- Hybrid Electric Vehicles

- Plug-in Hybrid Electric Vehicles

By Application Segment Analysis

By Application Segment Analysis

- Engine

- Electronic Parking Brakes

- Cabin

- Electronic Gear Shift System

- Body

- Chassis

Global Automotive Secondary Wiring Harness Market: Regional Segment Analysis

Global Automotive Secondary Wiring Harness Market: Regional Segment Analysis

- North America

- U.S.

- Europe

- UK

- France

- Germany

- Asia Pacific

- China

- Japan

- India

- Latin America

- Brazil

- Middle East and Africa

Industry Major Market Players

- Nexans,

- Cypress Holdings Inc.,

- Lear Corporation,

- Viney Corporation Limited,

- Fujikura Ltd.,

- Spark Minda,

- Ashok Minda Group,

- YURA CORPORATION,

- YAZAKI Corporation,

- Federal-Mogul LLC,

- Samvardhana Motherson Group,

- Sumitomo Electric Industries Ltd.,

- Rajashree International,

- Delphi Technologies,

- Leoni AG,

- THB Group,

- Furukawa Electric Co. Ltd.

Frequently Asked Questions

Copyright © 2024 - 2025, All Rights Reserved, Facts and Factors