Search Market Research Report

Biologics Outsourcing Market Size, Share Global Analysis Report, 2024 – 2032

Biologics Outsourcing Market Size, Share, Growth Analysis Report By Product (Vaccines, Recombinant Protein, Antibody, Others), By Source (Microbial, Human, Others), By Applications (Stem Cell Research, Vaccine Development, Oncology, Blood Related Products Development, Tissue Related Products Testing, Cellular & Gene Therapy), By End User (Biotechnology Industries, Pharmaceutical Industries, Contract Development & Manufacturing Organization (CDMO)), and By Region - Global and Regional Industry Insights, Overview, Comprehensive Analysis, Trends, Statistical Research, Market Intelligence, Historical Data and Forecast 2024 – 2032

Industry Insights

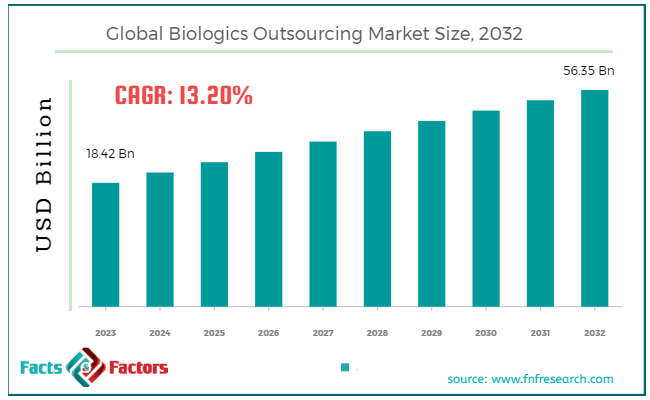

[229+ Pages Report] According to Facts & Factors, the global biologics outsourcing market size in terms of revenue was valued at around USD 18.42 billion in 2023 and is expected to reach a value of USD 56.35 billion by 2032, growing at a CAGR of roughly 13.2% from 2024 to 2032. The global biologics outsourcing market is projected to grow at a significant growth rate due to several driving factors.

Market Overview

Market Overview

Biologics outsourcing involves contracting third-party organizations to perform various functions related to the development, production, and testing of biologic drugs. Biologics are complex medicines derived from living organisms, including vaccines, blood components, gene therapies, and recombinant proteins. Outsourcing in this context can include services like research and development (R&D), clinical trials, manufacturing, and regulatory compliance.

The biologics outsourcing market has been experiencing substantial growth, driven by the increasing complexity of biologic drug development and the need for specialized expertise and infrastructure. Outsourcing allows pharmaceutical and biotechnology companies to leverage the capabilities of Contract Research Organizations (CROs), Contract Manufacturing Organizations (CMOs), and Contract Development and Manufacturing Organizations (CDMOs) to streamline their operations and reduce costs.

Key Highlights

Key Highlights

- The biologics outsourcing market has registered a CAGR of 13.2% during the forecast period.

- In terms of revenue, the global biologics outsourcing market was estimated at roughly USD 18.42 billion in 2023 and is predicted to attain a value of USD 56.35 billion by 2032.

- The biologics outsourcing market is poised for robust growth, driven by the increasing demand for biologic therapies, the need for cost-efficient production solutions, and advancements in biotechnology.

- Based on the source, the human segment is growing at a high rate and is projected to dominate the global market.

- On the basis of applications, the oncology segment is projected to swipe the largest market share and expected to dominate global market during forecast period.

- By region, North America is expected to dominate the global market.

Biologics Outsourcing Market: Growth Drivers

Biologics Outsourcing Market: Growth Drivers

- Rising Demand for Biologics: The increasing prevalence of chronic diseases and the growing focus on targeted therapies are driving demand for complex biologics like monoclonal antibodies and gene therapies. This fuels the need for specialized outsourcing expertise.

- Complexity of Biologics Development: Manufacturing biologics is a intricate process requiring advanced facilities, stringent quality control, and expertise in areas like cell line development and bioprocessing. Outsourcing allows companies to access this specialized knowledge.

- Cost-Effectiveness: Building and maintaining in-house biologics manufacturing capabilities is expensive. Outsourcing specific functions helps companies optimize costs and focus resources on core competencies.

- Increased Regulatory Requirements: The regulatory landscape for biologics is constantly evolving. Partnering with CMOs with expertise in navigating these complexities can streamline the approval process.

Restraints:

Restraints:

- Intellectual Property Concerns: Companies entrusting sensitive research and development to external partners face potential intellectual property (IP) risks. Clear contracts and robust confidentiality agreements are crucial.

- Quality Control Challenges: Maintaining consistent quality standards throughout the outsourcing process requires careful selection of partners and robust quality control measures at every stage.

- Limited Transparency: Some CMOs may lack complete transparency in their processes, making it difficult for companies to monitor progress and ensure quality. Open communication and clearly defined performance metrics are essential.

Opportunities:

Opportunities:

- Strategic Partnerships: Building strong, long-term partnerships with reliable CROs and CMOs allows for seamless collaboration and knowledge sharing, ultimately accelerating drug development.

- Technological Advancements: Emerging technologies like continuous manufacturing and artificial intelligence have the potential to revolutionize biologics outsourcing, leading to increased efficiency and reduced costs.

- Expanding Service Offerings: CMOs that offer a wider range of services, from early-stage development to commercial manufacturing, can create a one-stop shop for pharmaceutical companies, streamlining the process.

Challenges:

Challenges:

- Competition in the Outsourcing Market: As the market grows, competition among CROs and CMOs intensifies. This can lead to price pressures and challenges in securing the best partners with the right expertise.

- Supply Chain Disruptions: Global events can disrupt supply chains for critical materials and equipment needed for biologics manufacturing. Building robust contingency plans is essential.

- Talent Pool Shortage: The biologics industry requires a highly skilled workforce. Addressing potential talent shortages in specific areas like bioprocessing can be a challenge for both companies and CRO/CMOs.

Biologics Outsourcing Market: Segmentation Analysis

Biologics Outsourcing Market: Segmentation Analysis

The global biologics outsourcing market is segmented based on product, source, applications, end user, and region.

By Product Insights

By Product Insights

Based on Product, the global biologics outsourcing market is divided into vaccines, recombinant protein, antibody, others.

Vaccines are biological preparations that provide immunity to specific diseases. They are composed of attenuated or inactivated pathogens, or their components, to stimulate the body's immune response without causing the disease. Outsourcing in vaccine production includes R&D, clinical trials, manufacturing, and packaging. The growing prevalence of infectious diseases and the need for rapid vaccine development, as seen during the COVID-19 pandemic, drive the demand for outsourcing in this segment. The complexity of vaccine development and the need for specialized facilities further encourage biopharmaceutical companies to outsource these processes.

Recombinant proteins are produced through recombinant DNA technology, where genes encoding desired proteins are inserted into host cells to produce the proteins. These proteins are used in various therapeutic applications, including treatment of chronic diseases, hormone replacement therapies, and enzyme therapies. The rising demand for biologic therapies, advancements in genetic engineering, and the need for cost-effective production methods drive the growth of the recombinant protein segment. Outsourcing helps companies scale production and leverage specialized expertise and technologies.

Antibodies, or immunoglobulins, are proteins produced by the immune system to neutralize pathogens. Monoclonal antibodies (mAbs) are highly specific, engineered antibodies used in the treatment of various conditions, including cancers, autoimmune diseases, and infectious diseases. The demand for monoclonal antibodies is driven by their effectiveness in targeted therapies, the rise in chronic and autoimmune diseases, and advancements in antibody engineering technologies. Outsourcing allows for efficient production and helps manage the complex regulatory requirements associated with antibody development.

By Applications Insights

By Applications Insights

On the basis of Applications, the global biologics outsourcing market is bifurcated into stem cell research, vaccine development, oncology, blood related products development, tissue related products testing, cellular & gene therapy.

Stem cell research involves the study of stem cells and their potential to differentiate into various cell types, offering significant potential for regenerative medicine, tissue engineering, and the treatment of various diseases. The outsourcing of stem cell research is driven by the complexity and specialized nature of stem cell studies, which require advanced technology and expertise. Outsourcing helps companies leverage state-of-the-art facilities and reduce R&D costs.

Vaccine development includes the discovery, testing, and manufacturing of vaccines to prevent infectious diseases. This process involves various stages, from preclinical research to clinical trials and large-scale production. The need for rapid vaccine development, highlighted by the COVID-19 pandemic, drives the outsourcing of vaccine R&D and manufacturing. Outsourcing allows for scalability, access to specialized expertise, and compliance with regulatory standards.

Oncology focuses on the study and treatment of cancer. This application includes the development of biologic therapies such as monoclonal antibodies, vaccines, and gene therapies that target cancer cells. The rising incidence of cancer and the demand for targeted therapies drive the outsourcing of oncology-related biologics. Outsourcing provides access to cutting-edge research, advanced manufacturing techniques, and regulatory expertise.

Blood-Related Products Development segment includes the development of biologics such as clotting factors, plasma-derived therapies, and other blood-related products used to treat conditions like hemophilia, immune deficiencies, and other blood disorders. The need for effective treatments for blood disorders and the complexity of manufacturing blood-related biologics drive outsourcing in this segment. Specialized facilities and stringent regulatory requirements necessitate outsourcing to ensure product safety and efficacy.

Tissue Related Products Testing segment involves the development and testing of biologics used in tissue engineering and regenerative medicine. Products include tissue scaffolds, regenerative skin products, and other biomaterials designed to repair or replace damaged tissues. The growing field of regenerative medicine and the need for innovative treatments for tissue repair and replacement drive the demand for outsourcing in this area. Outsourcing helps leverage advanced technologies and ensures compliance with regulatory standards.

Cellular & Gene Therapy includes the development of therapies that modify or replace defective genes and cells to treat genetic disorders, cancers, and other diseases. Cellular and gene therapies represent a cutting-edge area of biologics. The potential to cure previously untreatable conditions and the complex manufacturing processes involved in cellular and gene therapies drive the need for outsourcing. Companies outsource to access specialized facilities and expertise in advanced biotechnologies.

By End User Insights

By End User Insights

Based on End User, the global biologics outsourcing market is categorized into biotechnology industries, pharmaceutical industries, contract development & manufacturing organization (CDMO).

Biotechnology industries involve companies that utilize biological processes, organisms, or systems to develop products and technologies for healthcare, agriculture, and industrial applications. These companies often engage in cutting-edge research and development of biologic drugs, including gene therapies, monoclonal antibodies, and vaccines. The outsourcing needs of biotechnology companies are driven by the requirement for specialized skills, advanced technologies, and compliance with stringent regulatory standards. Outsourcing helps these companies focus on innovation and core competencies while leveraging external expertise for manufacturing, clinical trials, and regulatory support.

Pharmaceutical industries encompass companies that research, develop, produce, and market drugs and treatments for various diseases. These companies often require biologics outsourcing to enhance their drug development processes, scale-up production, and ensure regulatory compliance. The pharmaceutical sector's reliance on biologics outsourcing is driven by the increasing complexity of drug development, the need to reduce time-to-market, and the cost benefits associated with outsourcing non-core activities. By outsourcing, pharmaceutical companies can access specialized technologies and expertise, improving efficiency and product quality.

Contract Development & Manufacturing Organizations (CDMOs) are third-party organizations that provide comprehensive services from drug development through manufacturing. They offer end-to-end solutions, including R&D, process development, clinical trial management, commercial production, and regulatory support. The growth of CDMOs is driven by the increasing trend of outsourcing among biotech and pharmaceutical companies seeking to streamline operations, reduce costs, and focus on core activities. CDMOs offer the expertise, infrastructure, and scalability required to support the entire lifecycle of biologic products.

Recent Developments:

Recent Developments:

- October 2022: SAB Biotherapeutics, a company specializing in developing antibody-based therapies, announced a collaboration with Emergent, a Contract Development and Manufacturing Organization (CDMO). This partnership leverages Emergent's expertise to produce SAB's unique polyclonal antibody products.

- September 2022: Abzena Ltd., a leader in biopharmaceutical contract research services, announced an upgrade to its R&D facilities in the UK. This investment focuses on implementing Berkley Lights' Beacon system, a cutting-edge technology that accelerates antibody discovery by isolating individual B cells from targeted immune responses.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2023 |

USD 18.42 Billion |

Projected Market Size in 2032 |

USD 56.35 Billion |

CAGR Growth Rate |

13.2% CAGR |

Base Year |

2023 |

Forecast Years |

2024-2032 |

Key Market Players |

Abbvie Inc., Abzena Ltd., Avid Bioservices Inc., Bionova Scientific Inc., Boehringer Ingelheim International GmbH., Catalent Inc., Curia Global Inc., EirGenix Inc., Emergent, Eurofins Scientific, Fujifilm Diosynth Biotechnologies, Genentech Inc., Genscript Biotech Corporation, GL Biochem Corporation, JSR Corporation, KBI Biopharma, Lonza Group AG, Merck KGaA, Rentschler Biopharma SE, STC Biologics., Thermo Fisher Scientific Inc., Wuxi Biologics, and Others. |

Key Segment |

By Product, By Source, By Applications, By End User, and By Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East &, Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Biologics Outsourcing Market: Regional Analysis

Biologics Outsourcing Market: Regional Analysis

- North America is projected to lead the global market

North America is the leading region in the biologics outsourcing market, primarily driven by the United States. This dominance is due to advanced healthcare infrastructure, significant investment in biopharmaceutical R&D, and the presence of numerous Contract Development and Manufacturing Organizations (CDMOs). The region also benefits from supportive regulatory frameworks and a high demand for biologics, including monoclonal antibodies, vaccines, and gene therapies.

Europe is another significant market for biologics outsourcing, with key contributions from countries like Germany, the United Kingdom, France, and Switzerland. The region's growth is driven by strong biopharmaceutical R&D activities, supportive government initiatives, and a well-established healthcare system. The adoption of advanced biomanufacturing technologies and increasing investment in the development of biosimilars also contribute to market expansion.

The Asia-Pacific region is the fastest-growing market for biologics outsourcing, with significant contributions from China, India, Japan, and South Korea. Factors driving this growth include the expansion of biopharmaceutical companies, cost-effective manufacturing capabilities, and increasing investments in healthcare infrastructure. The region also benefits from a growing number of clinical trials and regulatory support for biosimilar development.

Latin America is emerging as a promising market for biologics outsourcing, with Brazil and Mexico being major contributors. The region is experiencing growth due to improving healthcare infrastructure, rising demand for biologics, and increasing investment in the pharmaceutical sector.

The Middle East and Africa region is gradually adopting biologics outsourcing, driven by increasing healthcare investments, rising prevalence of chronic diseases, and efforts to improve healthcare infrastructure. South Africa and the Gulf Cooperation Council (GCC) countries are key markets in this region.

Biologics Outsourcing Market: List of Key Players

Biologics Outsourcing Market: List of Key Players

Some of the main competitors dominating the global biologics outsourcing market include;

- Abbvie Inc.

- Abzena Ltd.

- Avid Bioservices, Inc.

- Bionova Scientific, Inc.

- Boehringer Ingelheim International GmbH.

- Catalent Inc.

- Curia Global, Inc.

- EirGenix, Inc.

- Emergent

- Eurofins Scientific

- Fujifilm Diosynth Biotechnologies

- Genentech, Inc.

- Genscript Biotech Corporation

- GL Biochem Corporation

- JSR Corporation

- KBI Biopharma

- Lonza Group AG

- Merck KGaA

- Rentschler Biopharma SE

- STC Biologics.

- Thermo Fisher Scientific Inc.

- Wuxi Biologics

The global biologics outsourcing market is segmented as follows:

By Product Segment Analysis

By Product Segment Analysis

- Vaccines

- Recombinant Protein

- Antibody

- Monoclonal Antibody

- Bi-specific Antibody

- Antibody Drug Conjugates

- Others

By Source Segment Analysis

By Source Segment Analysis

- Microbial

- Human

- Others

By Applications Segment Analysis

By Applications Segment Analysis

- Stem Cell Research

- Vaccine Development

- Oncology

- Blood Related Products Development

- Tissue Related Products Testing

- Cellular & Gene Therapy

By End User Segment Analysis

By End User Segment Analysis

- Biotechnology Industries

- Pharmaceutical Industries

- Contract Development & Manufacturing Organization (CDMO)

By Regional Segment Analysis

By Regional Segment Analysis

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- Southeast Asia

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Industry Major Market Players

- Abbvie Inc.

- Abzena Ltd.

- Avid Bioservices, Inc.

- Bionova Scientific, Inc.

- Boehringer Ingelheim International GmbH.

- Catalent Inc.

- Curia Global, Inc.

- EirGenix, Inc.

- Emergent

- Eurofins Scientific

- Fujifilm Diosynth Biotechnologies

- Genentech, Inc.

- Genscript Biotech Corporation

- GL Biochem Corporation

- JSR Corporation

- KBI Biopharma

- Lonza Group AG

- Merck KGaA

- Rentschler Biopharma SE

- STC Biologics.

- Thermo Fisher Scientific Inc.

- Wuxi Biologics

Frequently Asked Questions

Copyright © 2024 - 2025, All Rights Reserved, Facts and Factors