Search Market Research Report

Blockchain in Retail Market Size, Share Global Analysis Report, 2022 – 2028

Blockchain in Retail Market Size, Share, Growth Analysis Report By Type (Public Blockchain, Private Blockchain, Consortium Blockchain), By Component (Platform/Solutions, Services), By Application (Supply Chain Management, Food Safety Management, Customer Data Management Identity Management, Compliance Management, Billing Transaction Processing, and Others), and By Region - Global and Regional Industry Insights, Overview, Comprehensive Analysis, Trends, Statistical Research, Market Intelligence, Historical Data and Forecast 2022 – 2028

Industry Insights

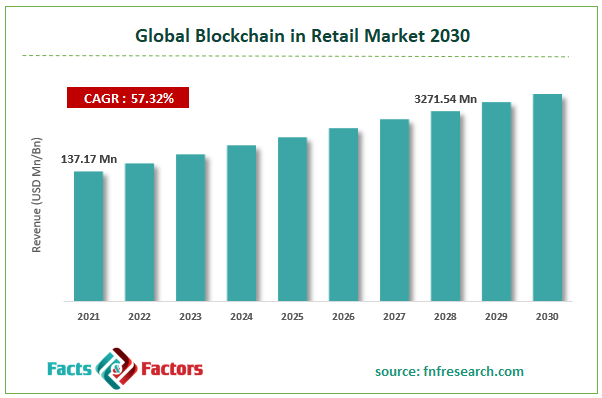

[241+ Pages Report] According to the report published by Facts & Factors, the global blockchain in retail market size was worth around USD 137.17 million in 2021 and is predicted to grow to around USD 3271.54 million by 2028 with a compound annual growth rate (CAGR) of roughly 57.32% between 2022 and 2028. The report analyzes the global blockchain in retail market’s drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the global blockchain in retail market.

Market Overview

Market Overview

Retailers may provide their customers features like record-breaking customer care, traceability, real-time information, and on-time delivery information thanks to blockchain in retail solutions. Furthermore, technology enables supply chain partners to know the precise location of their products as well as authenticity, product safety, quality, and reliability. It is projected that the growing demand for blockchain in retail from end users such as logistics and supply chain will fuel the market. Faster transactional methods and improved transaction transparency-based solutions in the logistics sector are a couple of the important elements that are anticipated to open up new markets for key participants. Additionally, businesses in the industry are concentrating on diversifying their company divisions internationally. For instance, the Nestle Group and OpenSC, a supplier of a distributed ledger technology platform, teamed up in July 2019. Nestlé hopes to create a distributed ledger technology system through this agreement that may stand alone and be distinct from its existing involvement with the IBM food trust blockchain.

Key Insights

Key Insights

- As per the analysis shared by our research analyst, the global blockchain in retail market is estimated to grow annually at a CAGR of around 57.32% over the forecast period (2022-2028).

- In terms of revenue, the global blockchain in retail market size was valued at USD 137.17 million in 2021 and is predicted to grow to around USD 3271.54 million by 2028. Due to a variety of driving factors, the market is predicted to rise at a significant rate.

- Based on type segmentation, the private blockchain was predicted to show maximum market share in the year 2021

- Based on component segmentation, the platform was predicted to show maximum market share in the year 2021

- Based on application segmentation, supply chain management was predicted to show maximum market share in the year 2021

- On the basis of region, North America was the leading revenue generator in 2021

Covid-19 Impact

Covid-19 Impact

Around the world, the COVID-19 pandemic has caused social unrest and economic turbulence. The global unemployment rate has increased as a result of the closure of industrial and manufacturing facilities. The pandemic's persistence has made it exceptionally difficult for end-use businesses to invest in blockchain-based retail solutions. Solutions are used by organizations to improve supply chain transparency and optimize current business processes. The retail sector were barely impacted by COVID-19. Additionally, a number of global industries have begun implementing distributed ledger technology and smart contracts, giving businesses of all sizes, including SMEs, the ability to safeguard supply chain records and increase supply chain transparency. Blockchain retail solutions are being developed by major organizations to improve the supply chain between different industries.

For instance, IBM Corporation and Moderna teamed up to create a smart supply chain for COVID-19 vaccinations in March 2021. This would make it easier for people, the government, and healthcare and life science providers to securely share information on COVID vaccines through programs like Digital Health Pass. The COVID-19 outbreak has had a minimal influence on blockchain investment in retail. For instance, according to the IDC blockchain spending estimate, trade finance and post-trade will receive 9.7% of investment in 2020, while goods and asset management will receive 8.4%. The money spent on managing assets and goods shows unequivocally how negatively COVID-19 has affected supply chain management throughout the pandemic. DLT is anticipated to acquire traction across a range of industries, including logistics, manufacturing, professional, customer services, and others, despite widespread disruption.

Growth Drivers

Growth Drivers

- Improved Transaction Transparency to Aid Market Growth

With the use of encrypted distributed ledger technology, the blockchain in retail enables low-cost, safe, and quick payment processing services. This enables real-time transaction verification without the involvement of middlemen like clearinghouses and banks. The demand for distributed ledger technology has been fueled by the dramatic increase in digital payments in the retail sector. The adoption of technology in the supply chain will also increase transparency, security, traceability, and efficiency. For instance, New Generation Computing Inc. and Loyalty Inc. introduced a supply chain traceability solution in December 2020 that enables owners and retailers to record the chain of custody from the point of origin to the importer of record. In a similar vein, Accenture introduced its procurement solution in January 2020. The solution brings suppliers’ and buyers’ teams together on the same platform to easily and securely share the data.

Restraints

Restraints

- Lack of technical understanding and blockchain technology to hinder market growth

Rapid industrial digitization has raised the number of cyberattacks and cyber threats. Businesses all across the world are having trouble finding qualified personnel to mitigate risk concerns. This has further slowed the adoption of technology and is likely to impede commercial expansion. Additionally, more and more sectors, like industry and healthcare, are using distributed ledger technology. Additionally, this has raised the demand for qualified workers globally. It is projected that a lack of skilled staff and distributed ledger technology will limit the global blockchain in retail market expansion.

Opportunity

Opportunity

- Rising investment to make technological advancements to bring up growth opportunities

In order to raise money for expanding their product portfolio and securing their market position, some industry participants in the blockchain in retail banking business are concentrating on venture capital investments. Over the course of the projection period, these investments are anticipated to open up new prospects for market expansion. For instance, in February 2021, new investors including Deutsche Bank, Intel Capital, and UBS helped blockchain infrastructure firm Axoni secure USD 31 million in a capital round. Participating in the investment round were a number of current investors, including Nyca Partners, HSBC, Goldman Sachs, J.P. Morgan, Wells Fargo, and Citi. The money will be used to broaden the company's network across various geographies and asset types.

Furthermore, Accenture, Cognizant, Microsoft, Axoni, and Bitfury Group Limited are some of the major competitors in the sector. To increase their market share, these market players are adopting a variety of growth tactics, including strategic alliances, mergers and acquisitions, and the creation of new products. For instance, in July 2019, Bitfury Group Limited announced a collaboration with Provident Bank, a bank based in the U.S. As part of the partnership, Bitfury Group Limited's Crystal blockchain analytics platform would be used by Provident Bank to provide anti-money laundering services. Additionally, the collaboration attempted to guarantee that Provident Bank's new clients have AML policies that were entirely compliant.

Challenges

Challenges

- Complex technology to pose a challenge for market expansion

Before online shopping became popular, many individuals had to get used to the idea of believing that online merchants would deliver their orders on time and in good condition. Regularly, the topic of financial transactions came up, and internet platforms had to offer their users safe ways to pay.

Segmentation Analysis

Segmentation Analysis

The global blockchain in retail market is segmented based on product type, application, end-user, and region.

On the basis of type, the market has been segmented into public blockchain, private blockchain, and consortium blockchain. The private blockchain segment dominated the global blockchain in retail market owing to the growing use of private solutions in retail as well as e-commerce. Furthermore, the low transaction charge of private blockchain is supporting industry expansion.

On the basis of application, the market has been segmented into supply chain management, food safety management, customer data management identity management, compliance management, billing transaction processing, and others. Due to a growing number of security concerns and the growing use of technology that enables data to be freely exchanged between firms, the supply chain management segment now dominates the worldwide blockchain in retail market. This trend is expected to fuel category growth. To better understand end users, supply chain management systems are utilized to collect, organize, and utilize customer data. Additionally, growing supply chain and logistics management will give key providers better market possibilities in the future.

On the basis of component, the market has been segmented into platform/solutions and services. Due to retailers' rising adoption of blockchain software and the need for safe and secure data transfer throughout the supply chain, the platform segment led the global blockchain in retail market. Furthermore, a significant reason driving up demand for blockchain systems across a variety of retailers is the availability of affordable solutions.

Recent Developments:

Recent Developments:

- In July 2019, a group of Australian financial services firms joined up with IBM and the owner of Scentre Group malls to establish a trial project that would put retail leasing bank guarantees on a secure blockchain.

- In July 2019, Nestlé collaborated with the blockchain platform OpenSC to create a distributed ledger system that will stand alone from its ongoing involvement with the IBM Food Trust blockchain.

- In June 2019, saw the adoption of blockchain technology in the corporate financial system of Dixy, the third-largest food retail company in Russia. The Moscow-based retailer has implemented blockchain in collaboration with suppliers and factoring companies, which serve as third parties and buy invoices from businesses at a discount to assist those businesses in raising capital.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2021 |

USD 137.17 Million |

Projected Market Size in 2028 |

USD 3271.54 Million |

CAGR Growth Rate |

57.32% CAGR |

Base Year |

2021 |

Forecast Years |

2022-2028 |

Key Market Players |

IBM, SAP, Microsoft, Oracle, AWS, Bitfury, Auxesis Group, Cegeka, BTL, Guardtime, CoinBase, Loyyal, Sofocle, BigchainDB, RecordsKeeper, BitPay, Abra, Reply, Provenance, ModulTrade, Blockverify, OGYDocs, Warranteer and Blockchain Foundary, and others. |

Key Segment |

By Type, Component, Application, and Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East &, Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Regional Analysis

Regional Analysis

- North America to lead the market growth during the projection period

Due to early adopters of cutting-edge technologies like smart payments, contracts, and others that have emerged as a result of the deployment of technology, the North American area currently holds a disproportionately large share of the global blockchain in retail market. Among the early adopters of retail technology, IBM Corporation, Oracle Corporation, and Accenture PLC are far ahead in terms of its implementation. The United States will dominate in technology investment in 2021 with USD 2.6 million, predicts IDC. For instance, IBM Corporation and Maersk collaborated to develop TradeLens, a technology shipping solution, in August 2019. The system aims to enhance safe and effective international trade by integrating DLT into the supply chain.

Competitive Analysis

Competitive Analysis

- IBM

- SAP

- Microsoft

- Oracle

- AWS

- Bitfury

- Auxesis Group

- Cegeka

- BTL

- Guardtime

- CoinBase

- Loyyal

- Sofocle

- BigchainDB

- RecordsKeeper

- BitPay

- Abra

- Reply

- Provenance

- ModulTrade

- Blockverify

- OGYDocs

- Warranteer

- Blockchain Foundary

The global blockchain in retail market is segmented as follows:

By Type

By Type

- Public Blockchain

- Private Blockchain

- Consortium Blockchain

By Component

By Component

- Platform/Solutions

- Services

By Application

By Application

- Supply Chain Management

- Food Safety Management

- Customer Data Management Identity Management

- Compliance Management

- Billing Transaction Processing

- Others

By Regional Segment Analysis

By Regional Segment Analysis

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Nordic Countries

- Denmark

- Sweden

- Norway

- Benelux Union

- Belgium

- The Netherlands

- Luxembourg

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Southeast Asia

- Indonesia

- Thailand

- Malaysia

- Singapore

- Rest of Southeast Asia

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Industry Major Market Players

- IBM

- SAP

- Microsoft

- Oracle

- AWS

- Bitfury

- Auxesis Group

- Cegeka

- BTL

- Guardtime

- CoinBase

- Loyyal

- Sofocle

- BigchainDB

- RecordsKeeper

- BitPay

- Abra

- Reply

- Provenance

- ModulTrade

- Blockverify

- OGYDocs

- Warranteer

- Blockchain Foundary

Frequently Asked Questions

Copyright © 2024 - 2025, All Rights Reserved, Facts and Factors