Search Market Research Report

Cellulose Fiber Market Size, Share Global Analysis Report, 2022 – 2028

Cellulose Fiber Market Size, Share, Growth Analysis Report By Manufacturing (Natural Cellulose Fiber, Manufactured Cellulose Fiber, Semi-Synthetic, Synthetic), By Application (Cellulose Fiber for Textiles, Cellulose Fiber for Filtration, Cellulose Fiber for Composite Materials), and By Region - Global and Regional Industry Insights, Overview, Comprehensive Analysis, Trends, Statistical Research, Market Intelligence, Historical Data and Forecast 2022 – 2028

Industry Insights

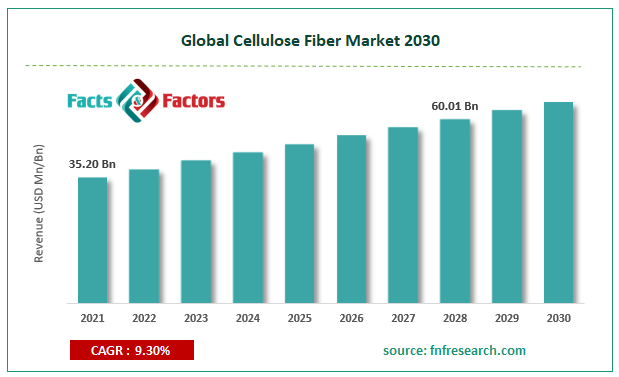

[222+ Pages Report] According to Facts and Factors,The global cellulose fiber market size was worth USD 35.20 billion in 2021 and is estimated to grow to USD 60.01 billion by 2028, with a compound annual growth rate (CAGR) of approximately 9.30% over the forecast period. The report analyzes the cellulose fiber market's drivers, restraints/challenges, and their effect on the demands during the projection period. In addition, the report explores emerging opportunities in the cellulose fiber market.

Market Overview

Market Overview

Cellulose fiber refers to synthetic fibers from plant stalks or the cellulose found in wood pulp. These fibers are naturally adaptable and have special qualities like moisture absorption and hydrophobicity, among others. Natural and artificial cellulose fibers are the two basic categories into which cellulose fibers are divided. Cotton, jute, and other natural fibers are examples of cellulose, whereas man-made cellulose fibers include viscose, lyocell, modal, and other materials. Synthetically produced man-made cellulose fibers are less expensive and more environmentally friendly than their synthetic counterparts. However, they need much more water and energy in processing than other things. Each type of fiber has certain beneficial properties that are acquired through a variety of chemical processes. The rise in per capita income and increase in consumer spending worldwide are driving the growth of the textile and clothing sector, which is anticipated to drive the growth of the cellulose fiber market during the forecast period. It is because cellulose fibers are widely used in the textile industry.

COVID-19 Impact:

COVID-19 Impact:

The ailment has spread to almost every nation on Earth since the COVID-19 infection flared up in December 2019, and the World Health Organization has declared it a global health catastrophe. The global repercussions of the Covid disease 2019 (COVID-19) are just starting to be realized, and they will largely affect the cellulose fiber industry in 2020. The COVID-19 flare-up has had positive effects, including flight cancellations, travel boycotts, isolation, café closures, and restrictions on all indoor and outdoor events. It has also caused a significant slowdown in production, increased market volatility, declining business confidence, rising populist hysteria, and future vulnerability in more than forty countries.

Key Insights

Key Insights

- As per the analysis shared by our research analyst, the global cellulose fiber market value is expected to grow at a CAGR of 9.30% over the forecast period.

- In terms of revenue, the global cellulose fiber market size was worth USD 35.20 billion in 2021 and is estimated to grow to USD 60.01 billion by 2028.

- The global focus on developing eco-friendly and biodegradable fiber is one of the main factors promoting the growth of the cellulose fiber market.

- By process of manufacturing, the natural cellulose fiber category dominated the market in 2021.

- By application, cellulose fiber for the textile segment dominated the market in 2021.

- The Asia Pacific dominated the cellulose fiber market in 2021.

Growth Drivers

Growth Drivers

- Increased focus on environmentally friendly and biodegradable fiber drives the market growth

One of the key elements supporting the growth of the global cellulose fiber market is the increasing focus on finding environmentally friendly and biodegradable fiber around the globe. An increasing number of companies are striving to shift away from conventionally used petrochemical-sourced fibers, which emit vast amounts of carbon into the environment, as the topic of climate change, environmental pollution, and sustainability has gained popularity.

As a result, the demand for cellulose fibers is rising. It is anticipated to do so further throughout the forecast period, supporting the expansion of the cellulose fiber market. For instance, the German Institutes for Textile and Fiber Research Denkendorf (DITF) developed PURCELL as an alternative for glass-fiber-reinforced polymers. The product is 100% recyclable because it is made entirely of cellulose. Demand for textiles and clothing is rising due to a change from need-based to aspiration-based purchases brought on by greater urbanization and consumer spending power.

Restraints

Restraints

- The high cost of cellulose fiber may hinder the market growth

The cost of cellulose fiber has severely constrained the global cellulose fiber industry's growth. Large-scale businesses are constrained in their utilization of raw materials because of how unstable and frequently changing their prices are.

The industry requires a considerable investment in knowledge and capital and is very capital-intensive. The industry's biggest obstacle is the significant investment in research and development needed to produce new technology or goods. Additional difficulties for the industry include:

- Regular variations in raw material prices.

- A decreasing supply of cotton.

- Governments impose strict environmental restrictions involving trees all over the world.

Manufacturing cellulose fiber, which is very hard to come by, requires skilled labor and specialized equipment. The problems above have emerged as roadblocks to the growth of the global market for cellulose fiber.

Segmentation Analysis

Segmentation Analysis

The cellulose fiber market has been segmented into the manufacturing, application, and region.

The global cellulose fiber market is divided into natural cellulose fiber, manufactured cellulose fiber, semi-synthetic and synthetic based on manufacturing. The natural cellulose fiber category dominated the market in 2021. Plants are harvested and processed to provide natural cellulose fibers as needed. They are separated from the remainder of the plant during processing, which is useless.

The global cellulose fiber market has been divided into cellulose fiber for textiles, cellulose fiber for filtration, and cellulose fiber for composite materials based on application. The cellulose fiber for textiles segment dominated the market in 2021. In the textile industry, fibers are mostly used to filter pollutants and strengthen composites. Consequently, fiber made from wood pulp is increasingly significant for the textile sector. The primary raw material used in the textile industry is cotton. However, the difficulties in growing cotton have led to a decline in production, significantly increasing the demand for cellulose fibers made from wood. These exhibit high performance and are used in industrial, domestic textile, garment, etc.

Recent Developments

Recent Developments

- In 2021: A Finnish company called Ioncell will introduce a patented method to enhance the durability and strength of fibers made of cellulose. Recycled textile fibers are converted into strong fibers utilizing water and a non-toxic ionic liquid through a series of dissolving and dry-jet wet spinning processes. Low environmental effect recycling of pulp, used textiles, and outdated newspapers. The ultimate product is a glossy, biodegradable, moisture-absorbing fabric that may be dyed, much like cotton and viscose.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2021 |

USD 35.20 billion |

Projected Market Size in 2028 |

USD 60.01 billion |

CAGR Growth Rate |

9.30% CAGR |

Base Year |

2021 |

Forecast Years |

2022-2028 |

Key Market Players |

Sappi Group, Tembec Inc., Birla Cellulose, Thai Rayon Public Co. Ltd., The Lenzing Group, Xingda Chemical Fiber Co. Ltd., Tangshan Sanyou Group, Ioncell, Fulida Group Holding Co. LTD., Bacterial Cellulose Solutions, Manasi Aoyang Technology Co. Ltd., and Others |

Key Segment |

By Manufacturing, Application, and Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East &, Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Regional Landscape

Regional Landscape

- The Asia Pacific dominated the cellulose fiber market in 2021

The Asia Pacific dominated the global cellulose fiber market in 2021 due to strong demand in the industrial and textile sectors. Due to the increase in demand from industrial, textile, and other application segments in the region, it is predicted to exhibit a similar growth trend over the expected period. The region's main markets include China, India, Japan, South Korea, Pakistan, Taiwan, and Indonesia. Fibers, utilized in various end-use sectors, are manufactured and traded in these nations. The product's prospective future markets are Bangladesh and Vietnam. However, over the next nine years, it is anticipated that strict forestry laws will impede the product's growth.

Competitive Landscape

Competitive Landscape

- Sappi Group

- Tembec Inc.

- Birla Cellulose

- Thai Rayon Public Co. Ltd.

- The Lenzing Group

- Xingda Chemical Fiber Co. Ltd.

- Tangshan Sanyou Group

- Ioncell

- Fulida Group Holding Co. LTD.

- Bacterial Cellulose Solutions

- Manasi Aoyang Technology Co. Ltd.

Global Cellulose Fiber Market is segmented as follows:

By Manufacturing:

By Manufacturing:

- Natural Cellulose Fiber

- Manufactured Cellulose Fiber:

- Semi-Synthetic

- Synthetic

By Application:

By Application:

- Cellulose Fiber for Textiles

- Cellulose Fiber for Filtration

- Cellulose Fiber for Composite Materials

By Regional Segment Analysis

By Regional Segment Analysis

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Nordic Countries

- Denmark

- Sweden

- Norway

- Benelux Union

- Belgium

- The Netherlands

- Luxembourg

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Southeast Asia

- Indonesia

- Thailand

- Malaysia

- Singapore

- Rest of Southeast Asia

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Industry Major Market Players

- Sappi Group

- Tembec Inc.

- Birla Cellulose

- Thai Rayon Public Co. Ltd.

- The Lenzing Group

- Xingda Chemical Fiber Co. Ltd.

- Tangshan Sanyou Group

- Ioncell

- Fulida Group Holding Co. LTD.

- Bacterial Cellulose Solutions

- Manasi Aoyang Technology Co. Ltd.

Frequently Asked Questions

Copyright © 2024 - 2025, All Rights Reserved, Facts and Factors