Search Market Research Report

Counter UAV Market Size, Share Global Analysis Report, V Market By System Type (Detection Systems, Detection and DisruptionSystems), By Product Type (Ground-based C-UAV, Hand-held C-UAV and UAV-based C-UAV), By End User (Military &Defense, Commercial, Government and Others), By Technology (Laser Systems, Kinetic Systems and Electronic Systems), By Platform (Air, Ground and Naval), By System Configuration (Portable, Vehicle-Mounted and Standalone): Global & Regional Industry Perspective, Comprehensive Analysis, and Forecast, 2021 – 2026

Counter UAV Market By System Type (Detection Systems, Detection and DisruptionSystems), By Product Type (Ground-based C-UAV, Hand-held C-UAV and UAV-based C-UAV), By End User (Military &Defense, Commercial, Government and Others), By Technology (Laser Systems, Kinetic Systems and Electronic Systems), By Platform (Air, Ground and Naval), By System Configuration (Portable, Vehicle-Mounted and Standalone): Global & Regional Industry Perspective, Comprehensive Analysis, and Forecast, 2021 – 2026

Industry Insights

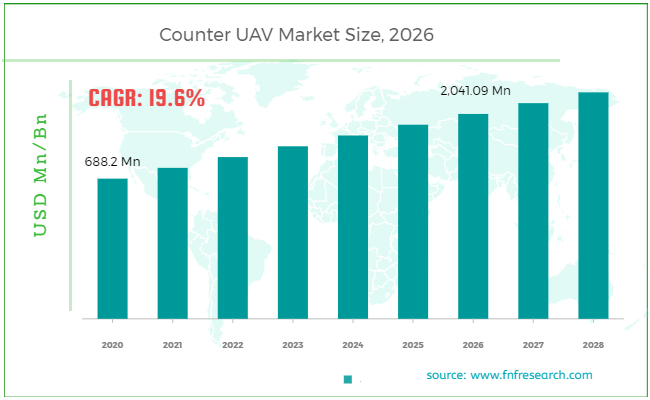

[219+ Pages Report] As per the Facts and Factors market research report, the global counter UAV market generated sales revenue of USD 688.2 Million in 2020. Further, the counter UAV sales are expected to generate revenue of USD 2,041.09 Million by the end of 2026, increasing at a CAGR of around 19.6 % from 2021 to 2026.

Market Overview

Market Overview

The counter unmanned aerial vehicle (UAV) market is rapidly increasing due to the unwanted misuse of drones throughout the world. It allocates with new emerging wrong activities of UAVs like terrorism, drug trafficking, and business surveillance. With the demanding use of drones, the number of security breaches by obscure drones at censorious infrastructure and peopled places has increased. This has stimulated the demand for countermeasures. The potential lawbreaker includes antinuclear groups, hobbyists, business and professional competitors, and terrorist organizations. At present, drones have become popular and readily available due to their cost-friendly. Logistics organizations use drones for express parcel delivery, while military groups use them for attacking suspected terrorists. Keeping view on past few years, there has been a fast growth in the all types of UAVs uses. In the United States, reports of unmanned aircraft sightings from pilots, citizens, and law enforcement have increased sharply. The FAA now records such reports more than 100 each month. This has concluded in security violations at some infrastructure which is critical and peopled places, which, in turn, is pushing the demand for anti-drone systems.

Anti-drone technology is relatively growing in the market, and technologies used to manufacture counter UAV systems are undergoing attentive R&D. Many market players bringing in these new technologies are planning to patent them. In addition to that, the value incurred in R&D is quite lofty considering the use of laser and other costly technologies. Hence, medium and small-sized market players cannot afford to develop and deploy anti-drone systems due to the requirement of the high initial investment.

Industry Growth Factors

Industry Growth Factors

The counter UAV or C-UAV market is propelling by the advancements in the potentialities of UAVs. Manufacturers providing counter UAV defense systems from militaries to other industries are heavily investing in it by developing newer ways to marker the threat from UAVs to ensure safety and security from terrorist activities. The growing use of UAVs in military forces will accelerate the growth of the C-UAV market. The counter UAV market is growing in terms of technological advancements. The rapidly rising demand for systems that come with radar, RFID scanners, electro-optical infrared for payload identification will drive the counter-UAV market in military applications.

The use of civil UAVs for agriculture and farming, weather and natural calamities monitoring, crude oil and gas inspection, aerial photography and filming industry, scientific research and power, and utility market identification, has increased worldwide. Since the utilization of such systems across various industries poses threats of hacking by terrorists and anti-social elements, the need for counter UAV defense and monitoring systems will significantly increase in this sector. The increasing hostile activities of UAVs flying close to commercial aircraft and airports create a vast demand for such systems for safety purposes. Categorization of such systems that do not hamper the normal functioning of the airport will drive the growth of the Counter UAV market.

Segmentation Analysis

Segmentation Analysis

The study provides a decisive view of the global counter UAV market by segmenting it based on system product type, end-user, technology, and platform. The system type segment is categorized into detection systems and detection & disruption systems. Ground-based C-UAV, Hand-held C-UAV, and UAV-based C-UAV are the product type segment of the global counter UAV market. To offers better target customer analysis, our analyst further bifurcates the end-user segment into military & defense, commercial, government, and others. In addition, to understand the technology landscape, our analyst classified the technology segment by laser systems, kinetic systems, and electronic systems. Moreover, our report also analyzed platform segment by air, ground, and naval

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2020 |

USD 688.2 Million |

Projected Market Size in 2026 |

USD 2,041.09 Million |

CAGR Growth Rate |

19.6% CAGR |

Base Year |

2020 |

Forecast Years |

2021-2026 |

Key Market Players |

SRC Inc., Lockheed Martin, Thales Group, Boeing, Airbus Defence and Space, Dedrone, Northrop Grumman, DroneShield, Battelle, Blighter Surveillance, Aaronia AG, Chess Dynamics, Enterprise Control Systems Ltd., CACI International Inc., Leonardo Spa, Raytheon Technologies Corp., Saab AB, Moog Inc., L-3 Communications Ltd., and Israel Aerospace Industries among others. |

Key Segment |

By System Type, Product Type, End User, Technology, Platform, System Configuration, and Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Global Counter UAV Market: Regional Analysis

Global Counter UAV Market: Regional Analysis

Based on regions, the global counter UAV market can be divided into five main regions namely North America, Europe, Latin America, Asia Pacific, and The Middle East and Africa.

North America held the largest counter UAV market share and the region is also expected to manifest the highest growth rate during the forecasted period. This is mainly due to the acquisition of counter-drone systems by the United States DoD. In the last few years, the US government has been investing a lot in the counter-drone program. In July 2020, the armored force made an announcement that it was awarding DRS sustainment systems USD 190 million to develop, produce, and deploy the Mobile-Low, Slow, Small Unmanned Aircraft System Integrated Defeat System (M-LIDS). Additionally, at the start of 2019, the US Army also awarded a USD 118 million contract to SRC Inc. of Cicero to co-develop moving systems that counter small, less speedy, and low-flying range drones. In the year 2019, the secretary of defense ministry devolved the army to lead an effort to minimize redundancy in the development and fielding of various C-sUAS solutions by the services.

Following the assigned work, the defense department may be narrowing the number of different counter-small UAV solutions deployed by the joint force from about 40 to eight. Said movement is anticipated to minimize redundancy and enrich the focus on the current systems. In April 2021, the United States air force released a request for proposals for the quick research, development, design and physical prototyping, actual demonstration, evaluation, and transition of technological things that can be used to counter small unmanned aerial systems. By the end of the year 2021, the United States air force may award the counter-UAV contract worth up to USD 500 million to provide the technologies to counter the threat of small, commercial purpose-made drones. The time period of performance for the contract is 06 years. On the contrary, illegitimate drone incursions at the airports and other critical infrastructure can result in safety issues, and they have raised concerns over the years, across several such sites in the US. Several trial tests were formed in the past years. With the technological advancement, counter-drone systems may be procured in large numbers by the US localized end users to protect critical infrastructure and assets of strategic importance over the upcoming years, which is too anticipated to drive the growth of the counter UAV market in the region in the future.

Global Counter UAV Market: Competitive Players

Global Counter UAV Market: Competitive Players

Some of the key players in the counter UAV market are :

- SRC Inc.

- Lockheed Martin

- Thales Group

- Boeinga

- Airbus Defence and Space

- Dedrone

- Northrop Grumman

- DroneShield

- Battelle

- Blighter Surveillance

- Aaronia AG

- Chess Dynamics

- Enterprise Control Systems Ltd.

- CACI International Inc.

- Leonardo Spa

- Raytheon Technologies Corp.

- Saab AB

- Moog Inc.

- L-3 Communications Ltd.

- Israel Aerospace Industries

The global Counter UAV Market is segmented as follows:

By System Type:

By System Type:

- Detection system

- Detection and disruption system

By Product Type:

By Product Type:

- Ground-based C-UAV

- Hand-held C-UAV

- UAV-based C-UAV

By End User:

By End User:

- Military & Defense

- Commercial

- Government

- Others

By Technology:

By Technology:

- Laser Systems

- Kinetic Systems

- Electronic Systems

By Platform:

By Platform:

- Air

- Ground

- Naval

By System Configuration:

By System Configuration:

- Portable

- Vehicle-Mounted

- Standalone

By Region:

By Region:

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Industry Major Market Players

- SRC Inc.

- Lockheed Martin

- Thales Group

- Boeinga

- Airbus Defence and Space

- Dedrone

- Northrop Grumman

- DroneShield

- Battelle

- Blighter Surveillance

- Aaronia AG

- Chess Dynamics

- Enterprise Control Systems Ltd.

- CACI International Inc.

- Leonardo Spa

- Raytheon Technologies Corp.

- Saab AB

- Moog Inc.

- L-3 Communications Ltd.

- Israel Aerospace Industries

Frequently Asked Questions

Copyright © 2024 - 2025, All Rights Reserved, Facts and Factors