Search Market Research Report

Crude Sulfate Turpentine Market Size, Share Global Analysis Report, 2022 – 2028

Crude Sulfate Turpentine Market Size, Share, Growth Analysis Report By Type (Alpha-pinene, Beta-pinene, Delta-3-Carene, Camphene, Limonene, Others (Terpenes and P-cymene)), By Application (Aromatic Chemicals, Adhesives, Paints & Printing Inks, Camphor, Others (Metallurgy And Textile)), and By Region - Global and Regional Industry Insights, Overview, Comprehensive Analysis, Trends, Statistical Research, Market Intelligence, Historical Data and Forecast 2022 – 2028

Industry Insights

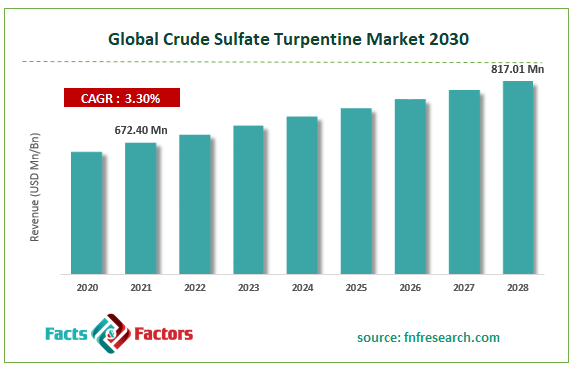

[224+ Pages Report] According to the report published by Facts Factors, the global crude sulfate turpentine market size was worth USD 672.40 million in 2021 and is estimated to grow to USD 817.01 million by 2028, with a compound annual growth rate (CAGR) of approximately 3.30% over the forecast period. The report analyzes the crude sulfate turpentine market's drivers, restraints/challenges, and their effect on the demands during the projection period. In addition, the report explores emerging opportunities in the crude sulfate turpentine market.

Market Overview

Market Overview

Sulfate wood turpentine is another name for crude sulfate turpentine. It is a turpentine derivative that is made by distilling resin from living trees, primarily pines. It is a flammable fluid soluble in some solvents but insoluble in water. Other names for turpentine include wood turpentine, oil of turpentine, and spirit of turpentine. Crude sulfate turpentine can be extracted annually or every six months for a fixed cost. It is a byproduct of the pulp manufacturing process. The producers deliver the products straight from the plants. It is a volatile amber liquid that contains key ingredients, including alpha- and beta-pinene, the foundation for many different flavors and scents found in nature. The crude sulfate turpentine market has increased the size of fragrance chemicals and personal & home care goods. Furthermore, the global crude sulfate turpentine market is predicted to increase due to its multiple end-user applications in the paint and coating industries, such as its use as binders or film formers in paints and coatings.

COVID-19 Impact:

COVID-19 Impact:

Many countries have suspended their normal activities while the world faces the unprecedented COVID-19 crisis, with lockdowns and other limitations to contain the virus. Additionally, it has changed consumer purchasing behavioral, and the scarce supply of raw commodities impacts the global economy. Aside from that, the disruption to the supply chain has also interfered with production, processing, distribution, and consumption operations. While the markets for cosmetics, aromatherapy, and fragrances are recovering, the paint and rubber industries have yet to recover from the consequences of disruptions. The veterinary drug, tire, and plastic sectors are all slowly growing.

Key Insights

Key Insights

- As per the analysis shared by our research analyst, the global crude sulfate turpentine market value is expected to grow at a CAGR of 3.30% over the forecast period.

- In terms of revenue, the global crude sulfate turpentine market size was valued at around USD 672.40 million in 2021 and is projected to reach USD 817.01 million by 2028.

- The crude sulfate turpentine market has increased the size of fragrance chemicals and personal and home care goods.

- By type, the alpha-pinene category dominated the market in 2021.

- By application, the aromatic chemicals category dominated the market in 2021.

- North America dominated the global crude sulfate turpentine market in 2021.

Growth Drivers

Growth Drivers

- Increased use of crude sulfate turpentine in the automobile industry to drive market growth

Due to its many benefits, including its superior chemical, solvent, abrasion, adhesion, flexibility, and scratch resistance, crude sulfate turpentine is frequently used in the automobile industry for car refinishing paints. Therefore, the expanding automobile industry is anticipated to increase crude sulfate turpentine demand and fuel the market's expansion. Additional factors anticipated to support the growth of the global crude sulfate turpentine market include increasing paper production, rising bio-friendly product demand across various industries, availability of affordable raw materials, and rising demand for fragrance ingredients, which previously primarily required crude sulfate turpentine.

Restraints

Restraints

- Fluctuation in the prices of crude materials may hamper the market growth

The supply of raw materials to manufacturers is impacted by the fluctuation in the price of crude raw materials, which forces the manufacturers to increase the price of their crude sulfate turpentine to make up for market losses. These main factors hinder the demand for crude sulfate turpentine and limit market expansion.

Segmentation Analysis.

Segmentation Analysis.

The global crude sulfate turpentine market is segregated based on type, application, and region.

The market is divided into alpha-pinene, beta-pinene, camphene, limonene, and others (terpenes and p-cymene) based on type. Among these, the alpha-pinene segment led the market in 2021 and is expected to maintain its dominance throughout the forecast period. Due to its cheaper manufacturing costs relative to those of other turpentine derivatives, alpha-pinene is the market leader.

Based on the application, the market is divided into aromatic chemicals, adhesives, paints & printing inks, camphor, and others (metallurgy and textile). Among these, the aromatic chemicals segment led the market in 2021 and is expected to maintain its dominance throughout the forecast period. They are widely utilized for personal care goods all over the world. Aromatic compounds are widely employed in fast-moving consumer items in populous nations like China and India.

Regional Landscape

Regional Landscape

- North America dominated the crude sulfate turpentine market in 2021

Due to the largest exporters' existence, North America emerged as the largest regional market in 2021. Throughout the forecasted years, it is expected that the region will continue to dominate the global crude sulfate turpentine market. Due to industries like paints and flavoring chemicals, which are the main consumers of turpentine sulfate, North America controls most of the global market. Raw sulfate turpentine is well-known in the United States and Canada as a producer and consumer.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2021 |

USD 672.40 Million |

Projected Market Size in 2028 |

USD 817.01 Million |

CAGR Growth Rate |

3.30% CAGR |

Base Year |

2021 |

Forecast Years |

2022-2028 |

Key Market Players |

Renessenz LLC, International Flavors & Fragrances Inc, Privi Organics Limited, Dujodwala Paper Chemicals Ltd., and Arizona Chemical Company LLC. Derives Resiniques et Terpeniqes, Lawter Inc, Harting S.A, Pine Chemical Group., and others. |

Key Segment |

By Type, Application, and Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East &, Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Competitive Landscape

Competitive Landscape

- Renessenz LLC

- International Flavors & Fragrances Inc

- Privi Organics Limited

- Dujodwala Paper Chemicals Ltd.

- Arizona Chemical Company LLC. Derives Resiniques et Terpeniqes

- Lawter Inc

- Harting S.A

- Pine Chemical Group.

Global Crude Sulfate Turpentine Market is segmented as follows:

By Type

By Type

- Alpha-pinene

- Beta-pinene

- Delta-3-carene

- Camphene

- Limonene

- Others (terpenes and p-cymene)

By Application

By Application

- Aromatic chemicals

- Adhesives

- Paints and printing inks

- Camphor

- Others (metallurgy and textile)

By Regional Segment Analysis

By Regional Segment Analysis

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Nordic Countries

- Denmark

- Sweden

- Norway

- Benelux Union

- Belgium

- The Netherlands

- Luxembourg

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Southeast Asia

- Indonesia

- Thailand

- Malaysia

- Singapore

- Rest of Southeast Asia

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Industry Major Market Players

- Renessenz LLC

- International Flavors & Fragrances Inc

- Privi Organics Limited

- Dujodwala Paper Chemicals Ltd.

- Arizona Chemical Company LLC. Derives Resiniques et Terpeniqes

- Lawter Inc

- Harting S.A

- Pine Chemical Group.

Frequently Asked Questions

Copyright © 2024 - 2025, All Rights Reserved, Facts and Factors