Search Market Research Report

Data Center Deployment Spending Market Size, Share Global Analysis Report, 2022 – 2028

Data Center Deployment Spending Market Size, Share, Growth Analysis Report By Data Center Type (High-end, Mid-tier, Mega, Localized, Others), By End-User (Enterprise, Service Provider, Others), and By Region - Global and Regional Industry Insights, Overview, Comprehensive Analysis, Trends, Statistical Research, Market Intelligence, Historical Data and Forecast 2022 – 2028

Industry Insights

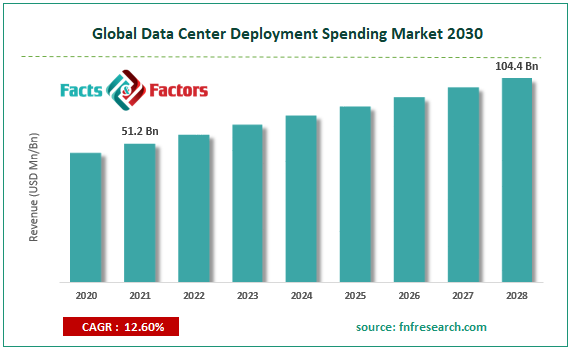

[226+ Pages Report] According to Facts and Factors, the global data center deployment spending market size was worth USD 51.2 billion in 2021 and is estimated to grow to USD 104.4 billion by 2028, with a compound annual growth rate (CAGR) of approximately 12.60% over the forecast period. The report analyzes the data center deployment spending market's drivers, restraints/challenges, and their effect on the demands during the projection period. In addition, the report explores emerging opportunities in the data center deployment spending market.

Market Overview

Market Overview

In a data center deployment, all Genesys web services (GWS) nodes are logically divided into several groups that utilize certain service resources such as StatServers, T-Servers, etc. The identical components are deployed in active mode across all data centers and can handle the entire traffic load while maintaining the same scalability. To assist you in managing enterprise-grade deployments more successfully, data center products provide advanced capabilities and services in several areas, including security & compliance, infrastructure automation, user management, reliability, and more. An organization must assess and modify its equipment investment in data centers as it grows. Transitioning from a small data center or colocation environment to a larger one is a common requirement for businesses. Datacenter deployment is difficult since it frequently calls for coordinating many hardware platforms and technologies. Integrating servers, networks, and storage traditionally demands meticulous design, flawless execution, and meticulous maintenance; despite being aware of the risks, most significant players in the data center deployment spending market view these opportunities as a new area to make investments. This is anticipated to significantly increase the market for expenditure on data center deployment over the anticipated term.

COVID-19 Impact:

COVID-19 Impact:

The advent of COVID-19 has considerably impacted the expansion of the data center deployment spending market in 2020. The market's growth, however, is being hampered by the rapid increase in demand for cloud computing network solutions. The lack of access to technological breakthroughs due to practical and total lockdown was one of several challenges that affected the market for data center deployment spending the hardest.

Key Insights

Key Insights

- As per the analysis shared by our research analyst, the global data center deployment spending market value is expected to grow at a CAGR of 12.60% over the forecast period.

- In terms of revenue, the global data center deployment spending market size was valued at around USD 51.2 billion in 2021 and is projected to reach USD 104.4 billion by 2028.

- Despite being aware of the risks, most significant players in the data center deployment spending market view these opportunities as a new area to make investments. This is anticipated to significantly increase the market for expenditure on data center deployment over the anticipated term.

- By data center type, the localized category dominated the market in 2021.

- By end user, the service provider category dominated the market in 2021.

- North America dominated the global data center deployment spending market in 2021.

Growth Drivers

Growth Drivers

- The development of IoT applications drives the market growth

The global data center deployment spending market is anticipated to grow over the next years due to the development of IoT applications and potential revenue generation opportunities through big data due to cloud technologies. The growing demand for servers and other hardware from small and medium-sized businesses, the emergence of the internet of things (IoT) and big data, and an increase in the number of interconnected smart devices are all factors contributing to the global expansion of the data center deployment spending market.

Restraints

Restraints

- Lack of knowledge and understanding of technological advancements may hinder the market growth

Market growth could be hampered by a lack of knowledge and understanding of technological advancements. Also, the requirement of large investments may hamper the expansion of the data center deployment spending market.

Segmentation Analysis

Segmentation Analysis

The global data center deployment spending market has been segmented into data center type, end users, and region.

Based on the data center type, the data center deployment spending market is segregated into high-end, mid-tier, mega, localized, and others. Among these, the localized segment led the market in 2021 and is expected to maintain its dominance throughout the forecast period considering that more small firms are utilizing these data centers. A single non-redundant link to physical equipment, such as cooling and power distribution, distinguishes these data centers from others. Small and medium-sized enterprises usually make the most economical decisions and have lower requirements for data availability.

Based on end users, the data center deployment spending market is segmented into enterprises, service providers, and others. Among these, the service provider segment led the market in 2021 and is expected to maintain its dominance throughout the forecast period. Through educational programs, training and development services assist businesses in improving the performance of their data centers. Additionally, by reducing expenses, these services support the evolution of corporate IT. As more consumers become aware of these advantages, the industry's service provider sector will continue to prosper. The service provider segment of the global datacenter deployment spending market will grow faster than any other segment during the forecast period.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2021 |

USD 51.2 Billion |

Projected Market Size in 2028 |

USD 104.4 Billion |

CAGR Growth Rate |

12.60% CAGR |

Base Year |

2021 |

Forecast Years |

2022-2028 |

Key Market Players |

Cisco Systems, Google Inc., Apple Inc., Equinix, IBM, Microsoft, Digital Reality, HP Company, NTT Communication Corporation, and Others |

Key Segment |

By Data Center Type, End-User, and Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East &, Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Regional Landscape

Regional Landscape

- North America dominated the data center deployment spending market in 2021

In 2021, North America dominated the global data center deployment spending market due to significant big data and IoT investments. Additionally, throughout the projected period, regional market demand would be fueled by the significant presence of many data centers in various sectors throughout developed economies like Canada and the United States. Additionally, it is projected that many businesses in the North American region would use AI-designed processors to automate more tasks, leading to the development of new data centers. The expansion of the regional market would be fueled, in addition, by a strong infrastructure for small and medium-sized firms, a sizable presence of research institutes, and reliable suppliers in North America throughout the predicted timeline.

Competitive Landscape

Competitive Landscape

- Cisco Systems

- Google Inc.

- Apple Inc.

- Equinix

- IBM

- Microsoft

- Digital Reality

- HP Company

- NTT Communication Corporation.

Global Data Center Deployment Spending Market is segmented as follows:

By Data center Type

By Data center Type

- High-end

- Mid-tier

- Mega

- Localized

- Others

By End-User

By End-User

- Enterprise

- Service Provider

- Others

By Regional Segment Analysis

By Regional Segment Analysis

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Nordic Countries

- Denmark

- Sweden

- Norway

- Benelux Union

- Belgium

- The Netherlands

- Luxembourg

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Southeast Asia

- Indonesia

- Thailand

- Malaysia

- Singapore

- Rest of Southeast Asia

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Industry Major Market Players

- Cisco Systems

- Google Inc.

- Apple Inc.

- Equinix

- IBM

- Microsoft

- Digital Reality

- HP Company

- NTT Communication Corporation.

Frequently Asked Questions

Copyright © 2024 - 2025, All Rights Reserved, Facts and Factors