Search Market Research Report

EMI Shielding Market

EMI Shielding Market By Material (EMI Shielding Tapes & Laminates, Conductive Coatings & Paints, Metal Shielding, Conductive Polymers, and EMI/EMC Filters), By Method (Radiation, and Conduction), By Industry (Consumer Electronics, Telecom & IT, Automotive, Healthcare, Aerospace, and Others), and By Region - Global and Regional Industry Trends, Market Insights, Data analysis, Historical Information, and Forecast 2022–2028

Industry Insights

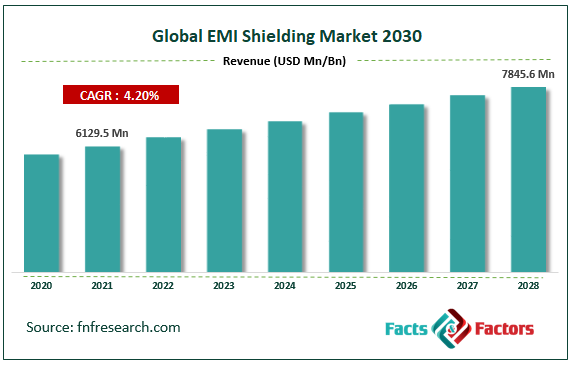

[221+ Pages Report] According to Facts and Factors, the Global EMI Shielding Market was worth around USD 6129.5 million in 2021 and is estimated to grow to about USD 7845.6 million by 2028, with a compound annual growth rate (CAGR) of approximately 4.2% over the forecast period. The report analyzes the EMI shielding market drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the EMI Shielding Market.

Market Overview

Market Overview

Electromagnetic interference shielding, often known as EMI shielding, is a method of preventing electromagnetic interference from harming sensitive electronic devices, systems, and equipment used in critical applications. EMI causes might range from momentary disruption and system failure to data loss and even death. The surge in demand for consumer electronics, rising electromagnetic pollution, fast industrialization, and continuing field trials and pilot testing demonstrating the viability of 5G technology are the major driving the expansion of the EMI shielding industry in the forecast period. In addition, the increased use of EMI shielding in consumer electronics is also boosting the market growth. To ensure low EMI and optimal operation of the equipment, EMI shielding is widely employed in this business in GPS navigation and infotainment systems, hands-free features, and Bluetooth devices.

The manufacturers are employing conductive coatings and paints that provide EMI shielding for non-metallic surfaces and plastics in cellphones, propelling the growth of the market in the upcoming years. The significant growth in the automobile industry is positively impacting the market growth. Moreover, the developments in 4G and 5G network technology, as well as the implementation of favorable government policies to reduce electromagnetic radiation in the environment, are expected to boost the market even further.

COVID-19 Impact

COVID-19 Impact

COVID-19 has had an influence on practically all industries throughout the world, affecting supply chains and impeding numerous industrial activities. Government-implemented COVID-19-response measures, including lockdown and social distancing, resulted in the closure of manufacturing plants during the pandemic's early stages. The disruption caused by the COVID-19 outbreak has resulted in lengthy lead times for the supply of goods and services. Authorities in several countries imposed limitations on imports and exports, making material mobility difficult for various countries. Furthermore, many producers were experiencing financial difficulties, which had a detrimental impact on the market. Such discoveries have an impact on the growth of the EMI shielding industry.

Before investing in new technologies and geographies, cash-rich firms perform data-driven research. The majority of enterprises have stopped or decreased their output to a bare minimum. Small and medium-sized businesses, on the other hand, are relying on government stimulus packages and BFSI initiatives to stay afloat during the ongoing pandemic. With virtually few manufacturing operations permitted, the consumer electronics and automotive industries are seeing a fall in product demand. The aforementioned causes have had an impact on the EMI shielding industry, as these industries are likely to deploy very few new EMI shielding solutions during the ongoing crisis.

Growth Driver

Growth Driver

- Consumer electronics are in high demand

Computers, cellphones, tablets, and laptops are examples of consumer electronics that are widely used by ordinary people for a variety of reasons such as communication, entertainment, and formal work. Voice-assisted personal infotainment systems, expanding acceptance of electronic appliances in automobiles, an increasing number of smartphones, the effect of AI, and the future deployment of 5G cellular networks all contribute to the global expansion of consumer electronics. Furthermore, as a result of the COVID-19 pandemic, working from home and studying from home has become the new normal for both working professionals and students. As a result, this trend is projected to sustain the rising demand for consumer electronics in the next years. EMI is produced by consumer electronics. With the global growth of electronic devices such as computers, mobile phones, and navigation systems, EMI shielding is becoming a growing concern.

Factors like the high potential for emissions generated by variable supply voltages, growing clock frequencies, quicker slew rates, and increased package density, as well as the high desire for smaller, lighter, cheaper, and lower-power devices, are all driving up demand for EMI shielding. As a result, various guidelines and legislation in favor of EMI shielding technologies and their providers have emerged. Reliable EMI shielding contributes considerably to machine reliability, making it a valuable selling point for producers of electric systems and equipment.

Restraint

Restraint

- EMI shielding is expensive

The cost of EMI shielding solutions typically includes the expense of checking the compliance of numerous operations, such as cleaning, loading and unloading, and masking, to the set requirements. This added expense raises the overall cost of the finished product. Many electronic product manufacturers consider EMI shielding during the design stage and subsequently manufacture goods that meet the criteria of the target market. If manufacturers are unable to accomplish the needed EMI shielding, they must seek other shielding options in order to make their product compliant with the target market without compromising the product design. This will raise the product's final cost and lengthen its time to market. As a result, the excessive costs of EMI shielding stifle industry expansion.

Opportunities

Opportunities

- Electric vehicle adoption is increasing

Power converters, electric motors, shielded and unshielded cables, wireless chargers, and batteries are common components of an electric drive system that are susceptible to EMI and electromagnetic radiation. Wireless charging for electric vehicles has grown in popularity in recent years. In contrast to internal combustion engine-powered automobiles, certain electric vehicles emit more electromagnetic waves while charging than while driving. In conventional cars, the power required by the electric drive system is greater than the power required by the entire electric system.

Other characteristics of an electric vehicle, including weight, size, and produced noise, need the use of specialist EMI shielding materials. As a result, the expansion of the electric vehicle market is likely to open up opportunities for the expansion of the EMI shielding and test equipment market.

Challenge

Challenge

- The trade-off between electronic device miniaturization and EMI shielding

Technological advancements in integrated circuits and power systems have significantly reduced the size of numerous electronic gadgets such as cellphones, cameras, televisions, and computers. Since the technology incorporates numerous components (transmitters, sensors, receivers, and others) in a single small container, the shrinking of such devices raises worries about signal interference within the device. The smaller the size of the components and their proximity, the more likely they will be exposed to EMI from adjacent components within the same device. The reduced dimension also limits the amount of space available for EMI shielding measures. It is quite difficult to detect EMI in such little electronics. While basic off-the-shelf shielding boxes have previously been utilized for shielding, their inability to fit into existing designs limits their application in these tiny devices. This, in turn, mandates the usage of specialized shielding technologies, which raises the overall cost of the product.

Segmentation Analysis

Segmentation Analysis

The EMI Shielding Market is segregated based on Material, Method, and Industry.

By Material, the market is classified into EMI shielding tapes & laminates, Conductive coatings & paints, Metal shielding, Conductive polymers, and EMI/EMC filters. During the projected period, conductive coatings and paints are expected to have the biggest market share, followed by conductive polymers. The incorporation of various electrical equipment and systems in cars is propelling the market for conductive coatings and paints forward. They are commonly utilized in automotive applications to offer EMI shielding because of their strong shielding performance and greater EMI resistance when compared to other materials. Electromagnetic shielding is provided by conductive coatings and paints on non-metal surfaces. Surface resistance in the conductive coating is inversely related to coating thickness. To prevent electromagnetic interference, materials like silver, nickel, graphite, and silver-coated copper are employed to build a conductive shield around the casing.

By Method, the market is classified into Radiation and Conduction. In the forecast period, the radiation category is predicted to dominate the EMI shielding market, accounting for the largest share. Electromagnetic signals are emitted by the majority of electrical and electronic devices. The growing use of consumer electronics causes a huge increase in electromagnetic pollution. As a result, these signals must be kept within certain parameters to minimize interference and damage to a device's electrical circuitry, as well as performance degradation.

By Industry, the market is categorized into Consumer Electronics, Telecom & IT, Automotive, Healthcare, Aerospace, and Others. During the forecast period, the automotive industry is expected to increase at a quick pace. The growing amount of electronic components and systems in freshly manufactured automobiles is predicted to stimulate demand for EMI shielding solutions in the automotive industry. Control area networks (CAN), safety systems, automatic climate control systems, ADAS, digital control systems, and entertainment systems are examples of automobile electronic systems that are used to improve a traveler's safety, convenience, and comfort. However, because they are installed in a restricted space, they generate electromagnetic interference.

Modern automobile manufacturers use IoT and vehicle-to-everything (V2X) communication technology to enhance power efficiency and safety, allowing vehicles to connect with smart traffic lights. Before releasing a car to the market, automakers must meet electromagnetic emission and immunity standards. All of these factors are projected to drive the EMI shielding market in the automobile industry.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2021 |

USD 6129.5 Million |

Projected Market Size in 2028 |

USD 7845.6 Million |

CAGR Growth Rate |

4.2% CAGR |

Base Year |

2021 |

Forecast Years |

2022-2028 |

Key Market Players |

PPG Industries (US), Parker-Hannifin (US), 3M (US), Henkel (Germany), Laird Performance Materials (UK), RTP Company (US), Schaffner (Switzerland), Tech-Etch (US)., and Others |

Key Segment |

By Material, Method, Industry, and Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Regional Landscape

Regional Landscape

APAC accounted for the largest market share in the forecast period because of factors such as increased demand for consumer electronic devices such as smartphones and home appliances, as well as the construction of modern telecom infrastructure. China, as a manufacturing hub for a variety of electronic gadgets, has contributed to the rapid rise in the demand for EMI shielding. On the other side, demand for electric and hybrid automobiles, as well as innovative consumer electronics, will boost the Japanese market in the coming years.

North America has a considerable revenue share of the EMI shielding market, owing to the presence of the highly advanced telecom industry. The region's growing popularity as a manufacturing hub for electronic equipment, as well as the rising demand for innovative electronic gadgets, are the primary factors driving the North American EMI shielding market. Increased defense spending and capability expansion may have an even greater impact on the adoption of EMI shielding solutions to safeguard weapons systems from interference from undesirable radio frequencies.

Recent Developments

Recent Developments

- In 2020, Softzorb MCS, a standard EMI absorber, was introduced by Laird Performance Materials. This flexible, conformable absorber eliminates unwanted signal noise while also acting as a gap filler to reduce coupling without harming sensitive components.

- In 2020, PPG Industries has released PPG TESLIN EMI/RF (electromagnetic interference/radio-frequency) shielding material for electronic passports (e-passports) and other electronic security documents. This EMI shielding material provides improved RF shielding.

Competitive Landscape

Competitive Landscape

Some of the main competitors dominating the EMI Shielding Market include -

- PPG Industries (US)

- Parker-Hannifin (US)

- 3M (US)

- Henkel (Germany)

- Laird Performance Materials (UK)

- RTP Company (US)

- Schaffner (Switzerland)

- Tech-Etch (US).

The global EMI shielding market is segmented as follows:

By Material Segment Analysis

By Material Segment Analysis

- EMI Shielding Tapes & Laminates

- Conductive Coatings & Paints

- Metal Shielding

- Conductive Polymers

- EMI/EMC Filters

By Method Segment Analysis

By Method Segment Analysis

- Radiation

- Conduction

By Industry Segment Analysis

By Industry Segment Analysis

- Consumer Electronics

- Telecom & IT

- Automotive

- Healthcare

- Aerospace

- Others

By Regional Segment Analysis

By Regional Segment Analysis

- North America

- The U.S.

- Canada

- Mexico

- Rest of North America

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Nordic countries

- Denmark

- Finland

- Iceland

- Sweden

- Norway

- Benelux Reunion

- Belgium

- The Netherlands

- Luxembourg

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- New Zealand

- Australia

- South Korea

- Southeast Asia

- Indonesia

- Thailand

- Malaysia

- Singapore

- Rest of Southeast Asia

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Industry Major Market Players

- PPG Industries (US)

- Parker-Hannifin (US)

- 3M (US)

- Henkel (Germany)

- Laird Performance Materials (UK)

- RTP Company (US)

- Schaffner (Switzerland)

- Tech-Etch (US)

Frequently Asked Questions

Copyright © 2024 - 2025, All Rights Reserved, Facts and Factors