Search Market Research Report

Financial Risk Management Software Market

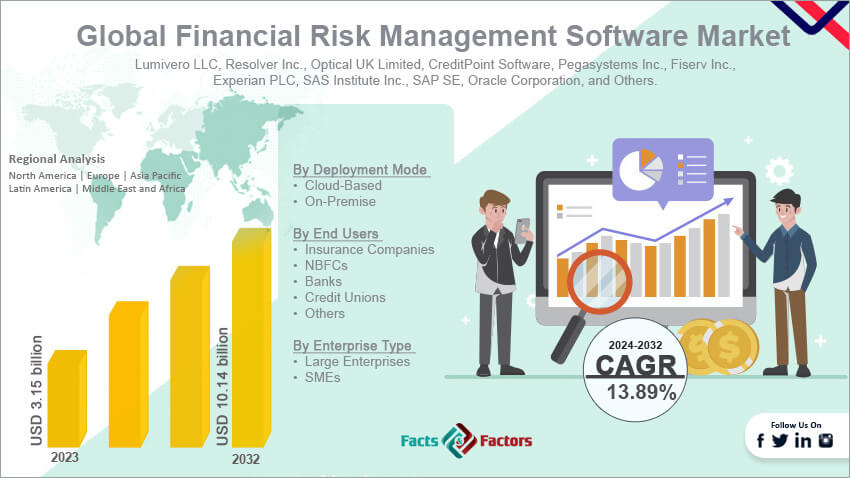

Financial Risk Management Software Market Size, Share, Growth Analysis Report By Deployment Modes (Cloud-Based And On-Premise), By End-Users (Insurance Companies, NBFCs, Banks, Credit Unions, And Others), By Enterprise Type (Large Enterprises And SMEs), And By Region - Global Industry Insights, Overview, Comprehensive Analysis, Trends, Statistical Research, Market Intelligence, Historical Data and Forecast 2024 – 2032

Industry Insights

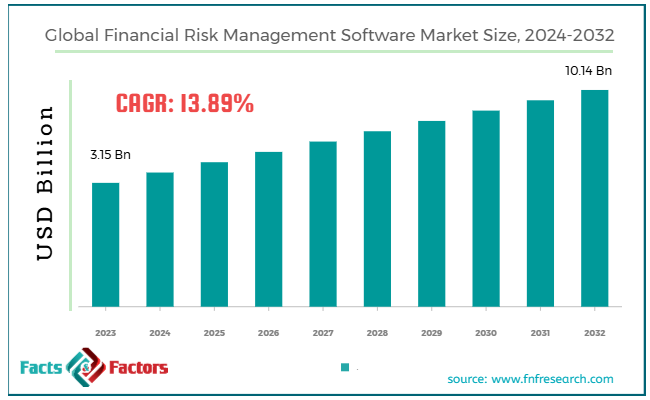

[223+ Pages Report] According to Facts & Factors, the global financial risk management software market size was valued at USD 3.15 billion in 2023 and is predicted to surpass USD 10.14 billion by the end of 2032. The financial risk management software industry is expected to grow by a CAGR of 13.89% between 2024 and 2032.

Market Overview

Market Overview

Financial risk management software refers to special software that helps organizations manage and mitigate financial risks. This software helps organizations evaluate financial risks like creditworthiness, fluctuations in the market, currency exchange, and many others. It also helps organizations identify potential risks and determine their financial impact.

This software helps organizations comply with regulatory requirements and generate accurate compliance reports to avoid any heavy penalties. It also offers advanced analytics and real-time reporting features, which help organizations predict and prevent potential issues beforehand.

Financial management software is also used in banking, share management, asset management, and other financial services to strengthen the financial stability of organizations.

Key Insights

Key Insights

- As per the analysis shared by our research analyst, the global financial risk management software market size is estimated to grow annually at a CAGR of around 13.89% over the forecast period (2024-2032).

- In terms of revenue, the global financial risk management software market size was valued at around USD 3.15 billion in 2023 and is projected to reach USD 10.14 billion by 2032.

- Growing complexity of financial products is driving the growth of the global financial risk management software market.

- Based on deployment modes, the cloud-based segment is growing at a high rate and is projected to dominate the global market.

- Based on end-users, the bank segment is anticipated to grow with the highest CAGR in the global market.

- Based on enterprise type, the large enterprises segment is projected to swipe the largest market share.

- Based on region, North America is expected to dominate the global market during the forecast period.

Growth Drivers

Growth Drivers

- Growing complexity of financial products is driving the growth of the global market.

The increasing complexity of financial instruments like derivatives poses a huge demand for advanced financial management software to navigate complications like accurate evaluation, monitor exposure, and complex calculations. The rising trend of cryptocurrency and other digital assets is also likely to positively influence the growth of the industry.

Also, financial institutions are under strict regulations like GDPR, Basel III, Dodd-Frank, and many others, pushing organizations to adopt such financial risk management software for data security, risk assessment, and reporting. These software are well integrated with cyber security features to help organizations mitigate potential losses and possible data risks.

The fast expansion of financial services into emerging markets like the Asia Pacific and Latin American markets is also likely to strengthen the demand for this software.

The increasing interest of people towards global investments and financial infrastructure is further expected to widen the scope of the global financial risk management software market in the coming years.

For instance, Temenos came up with a generative AI-powered banking platform in 2024. These solutions work with the company's Financial Crime Mitigation to revolutionize the interaction method and improve productivity.

Restraints

Restraints

- Complexity of integration with legacy systems is likely to hamper the growth of the global market.

Many financial institutions still work on their legacy systems, which makes the integration of these advanced financial risk management software difficult.

However, such a scenario poses the requirement of new IT infrastructure and custom solutions for connecting and integrating with existing systems, which leads to high cost and difficult implementation. Therefore, these factors are likely to hinder the growth of the financial risk management software industry.

Opportunities

Opportunities

- Increasing adoption of advanced technologies is expected to foster growth opportunities in the global market.

The emergence of advanced technologies like machine learning and artificial intelligence is likely to revolutionize the global financial risk management software market. These technologies are likely to improve the analytical and predictive capabilities of such software.

AI-powered algorithms improve decision-making capabilities, model potential financial scenarios, and perform real-time risk assessments.

However, the rising focus on operational risk management, like human errors, process flaws, system failures, and many others, is also likely to fuel the industry's growth. Risk management software mitigates these risks by offering comprehensive insights.

Also, there is a rising shift towards cloud-based software to help teams improve capability, flexibility, and cost affordability, which is also a crucial reason for the high growth rate of the market.

For instance, Riskonnect collaborated with OnSolve in 2023 to offer a Threat Intelligence module to monitor global threats in real-time.

Challenges

Challenges

- Resistance to change is a big challenge in the global market.

Many organizations have traditional risk management processes, and therefore, they resist adopting new software. However, this resistance to change is a big challenge in the financial risk management software industry.

Additionally, a lack of awareness among people regarding the benefits of advanced financial risk management software is also likely to negatively impact the growth of the industry.

Segmentation Analysis

Segmentation Analysis

The global financial risk management software market can be segmented into deployment modes, end-users, enterprise types, and regions.

On the basis of deployment modes, the market can be segmented into cloud-based and on-premise. The cloud-based segment accounts for the largest share of the financial risk management software industry during the forecast period. Cloud solutions are more scalable and flexible in nature.

Therefore, they can scale up or down the resources according to the requirements. Organizations prefer such a model because it helps them manage fluctuating volumes of data without investing in any expensive physical infrastructure or advanced software. This deployment model is affordable as it does not pose any need for huge upfront investment or maintenance costs.

Users pay on a subscription basis and, therefore, do not need any server or physical storage. Cloud-based software can help teams with easy accessibility and remote capabilities, which is also a crucial reason for the high growth rate of the segment.

This accessibility also facilitates efficient risk monitoring and management capabilities across different time zones and geographical regions.

Cloud solutions can access real-time data, which is crucial in risk management. Cloud-based solutions help businesses make informed, more accurate, and fast decisions by offering real-time insights on risk assessments.

On the basis of end-users, the market can be segmented into insurance companies, NBFCs, banks, credit unions, and others. Banks are the fastest-growing segment in the global financial risk management software market during the forecast period.

Banks are under strict regulatory requirements, which makes risk management practices important. Financial risk management software helps banks avoid penalties and ensure compliance & accurate reporting. Rising focus on cyber security is also an important factor driving the segment's growth.

Risk management software helps banks predict and mitigate these risks effectively. Such software can identify potential threats and deploy defense operations to protect against fraud, data breaches, and kinds of cyber-attacks.

Also, the growing adoption rate of advanced analytics and artificial intelligence in banking operations to work on risk assessments, creditworthiness, and fraud detection capabilities is likely to revolutionize the market.

On the basis of enterprise type, the market can be segmented into large enterprises and SMEs. The large enterprise segment is likely to dominate the financial risk management software industry during the forecast period.

Large enterprises operate across multiple markets and industries, which is a major reason for the higher growth rate of the segment. These require comprehensive risk management software to address the complexities of the market.

Large organizations are under strict regulations, particularly those in the healthcare, finance, and energy sectors, which further poses the need for such risk management software.

Large enterprises have ample resources and budgets to invest in advanced, high-end risk management solutions. Organizations deal with large data sets and, therefore, need sophisticated analytic tools to interpret, manage, and predict risk.

Financial risk management software is well integrated with advanced data analytics capabilities, which help in processing large volumes of data and offer valuable insights.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2023 |

USD 3.15 Billion |

Projected Market Size in 2032 |

USD 10.14 Billion |

CAGR Growth Rate |

13.89% CAGR |

Base Year |

2023 |

Forecast Years |

2024-2032 |

Key Market Players |

Lumivero LLC, Resolver Inc., Optical UK Limited, CreditPoint Software, Pegasystems Inc., Fiserv Inc., Experian PLC, SAS Institute Inc., SAP SE, Oracle Corporation, and Others. |

Key Segment |

By Deployment Mode, By End Users, By Enterprise Type, and By Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East &, Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Regional Analysis

Regional Analysis

- North America to dominate the global market.

North America is likely to account for the largest share of the global financial risk management software market during the forecast period.

The US and Canadian governments have imposed strict financial regulations like Canada’s Financial Consumer Agency, Basel III, Dodd-Frank Act, and many others, which is a major reason for the high growth rate of the segment.

Financial institutions in North America are also actively investing in risk management software to improve transparency, avoid fines, and ensure compliance in financial reporting.

However, the region is home to leading banks, asset managers, and insurance companies, which is also likely to support the growth trajectory of the regional market. Such giant companies invest heavily in risk management software to manage their liquidity risk, creditworthiness, and operational activity across their portfolio.

Companies in the region are adopting advanced technologies like big data analytics and AI to improve their risk management capabilities.

AI improves risk protection, fraud detection, and decision-making capabilities and, therefore, strengthens the demand for AI-powered financial risk management solutions in the market.

Asia Pacific is another major region in the financial risk management software industry that is likely to witness significant growth in the coming years. China is a leading country in APAC as it is a fintech hub that accounts for most regional revenue.

One of the crucial reasons for the high growth rate of the Chinese market is its extensive digital payment ecosystem, which includes WeChat Pay and AliPay.

Additionally, India is also emerging as a growing market with an exceeding CAGR because of the ongoing government initiatives for financial digitalization.

Many other Southeast Asian nations like South Korea and Japan are also adopting advanced risk management solutions because of the presence of mature banking infrastructure.

Therefore, all these factors are likely to accentuate the growth rate of the regional market in the coming years. For instance, LogicManager came up with its all-new portfolio in 2021 with AI capabilities to transform how users manage risks.

Competitive Analysis

Competitive Analysis

The key players in the global financial risk management software market include:

- Lumivero LLC

- Resolver Inc.

- Optical UK Limited

- CreditPoint Software

- Pegasystems Inc.

- Fiserv Inc.

- Experian PLC

- SAS Institute Inc.

- SAP SE

- Oracle Corporation

For instance, Ncontracts successfully took over Quantivate in 2023. The acquired company offers solutions ideal for credit unions and banks. Also, the company aims to strengthen its position as KaaS and SaaS vendors across US-based financial institutions.

The global financial risk management software market is segmented as follows:

By Deployment Mode Segment Analysis

By Deployment Mode Segment Analysis

- Cloud-Based

- On-Premise

By End Users Segment Analysis

By End Users Segment Analysis

- Insurance Companies

- NBFCs

- Banks

- Credit Unions

- Others

By Enterprise Type Segment Analysis

By Enterprise Type Segment Analysis

- Large Enterprises

- SMEs

By Regional Segment Analysis

By Regional Segment Analysis

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- Southeast Asia

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Industry Major Market Players

- Lumivero LLC

- Resolver Inc.

- Optical UK Limited

- CreditPoint Software

- Pegasystems Inc.

- Fiserv Inc.

- Experian PLC

- SAS Institute Inc.

- SAP SE

- Oracle Corporation

Frequently Asked Questions

Copyright © 2024 - 2025, All Rights Reserved, Facts and Factors