Search Market Research Report

India Scotch Whiskey Market Size, Share Global Analysis Report, 2024 – 2032

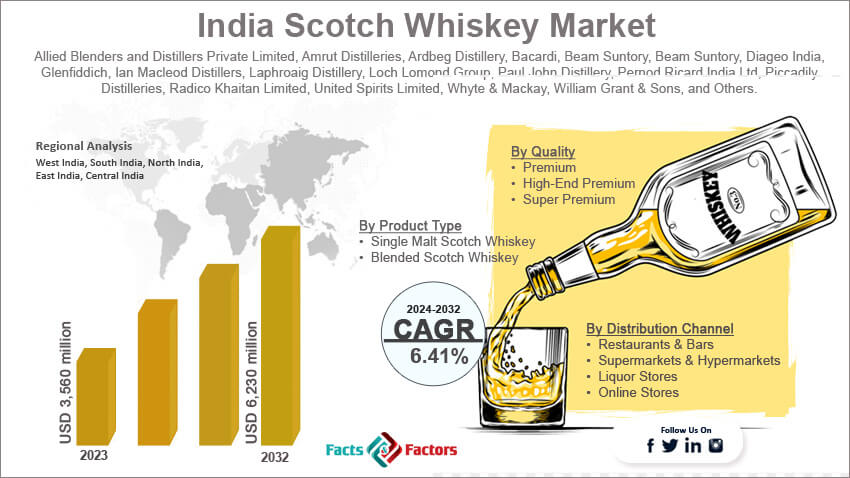

India Scotch Whiskey Market Size, Share, Growth Analysis Report By Product Type (Single Malt Scotch Whiskey and Blended Scotch Whiskey), By Quality (Premium, High-End Premium, and Super Premium), By Distribution Channel (Restaurants & Bars, Supermarkets & Hypermarkets, Liquor Stores, and Online Stores), and By State - Regional Industry Insights, Overview, Comprehensive Analysis, Trends, Statistical Research, Market Intelligence, Historical Data and Forecast 2024 – 2032

Industry Insights

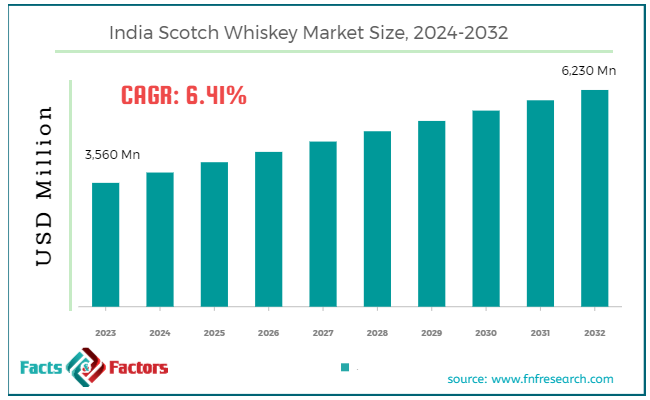

[211+ Pages Report] According to Facts & Factors, the India scotch whiskey market size in terms of revenue was valued at around USD 3,560 million in 2023 and is expected to reach a value of USD 6,230 million by 2032, growing at a CAGR of roughly 6.41% from 2024 to 2032. The India scotch whiskey market is projected to grow at a significant growth rate due to several driving factors.

Market Overview

Market Overview

India Scotch Whiskey refers to the segment of Scotch whiskey imported, distributed, and consumed in India. Scotch whiskey is a distilled alcoholic beverage made in Scotland from malted barley or grain, aged for at least three years in oak casks. In India, Scotch whiskey is highly popular and is considered a premium alcoholic beverage, often associated with luxury and high social status. The Indian Scotch whiskey market has seen significant growth over the years, driven by rising disposable incomes, changing consumer preferences, and increasing urbanization. The market is characterized by a strong demand for both single malt and blended Scotch varieties.

Major global brands have a strong presence in India, catering to a growing base of affluent and aspirational consumers. The market is also influenced by favorable trade policies and the popularity of Western lifestyles. As a result, the India Scotch whiskey market is poised for continued growth, supported by a burgeoning middle class and evolving consumption patterns.

Key Highlights

Key Highlights

- The India scotch whiskey market has registered a CAGR of 6.41% during the forecast period.

- In terms of revenue, the India scotch whiskey market was estimated at roughly USD 3,560 million in 2023 and is predicted to attain a value of USD 6,230 million by 2032.

- The growth of the India scotch whiskey market is being propelled by rising disposable incomes, affordable local alternatives, and innovation in flavors.

- Based on the product type, the blended scotch whiskey segment is growing at a high rate and is projected to dominate the market.

- By quality, the super premium segment is projected to swipe the largest market share.

- In terms of distribution channel, the liquor stores segment is expected to dominate the market.

- By region, the India Scotch whiskey market highlights West India, particularly Maharashtra, as the dominating region with the highest growth prospects, driven by its affluent population and vibrant urban centers like Mumbai.

Growth Drivers:

Growth Drivers:

- Enduring Consumer Preference: A historical legacy and enduring fondness for blended whiskies reminiscent of Scotch fuel market growth.

- Rising Disposable Incomes: As disposable incomes increase, consumers are willing to spend more on premium domestic "Scotch whiskies."

- Strong Brand Legacy: The "Scotch Whisky" label carries a connotation of prestige and quality, attracting consumers seeking a premium drinking experience.

- Marketing & Promotions: Strategic marketing campaigns and aggressive promotions by major players keep "Scotch whiskies" top-of-mind for consumers.

Restraints:

Restraints:

- Misleading Terminology: The use of "Scotch" can be misleading for some consumers who might expect a genuine Scotch whisky experience.

- High Tax Burden: Heavy excise duties and taxes on alcoholic beverages can inflate the final price, impacting affordability.

- Competition from Imported Spirits: The growing popularity of international whiskies and other premium alcoholic beverages poses a competitive threat.

Opportunities:

Opportunities:

- Premiumization Trend: A rising preference for premium and aged whiskies presents an opportunity for Indian producers to create high-end offerings.

- Evolving Online Retail: The growing e-commerce market offers new avenues for brand promotion and wider distribution of "Scotch whiskies."

- Export Potential: Indian "Scotch whiskies" can potentially find export markets in countries with similar preferences for blended whiskies.

Challenges:

Challenges:

- Maintaining Quality & Consistency: As production scales up, ensuring consistent quality across various "Scotch whisky" brands will be crucial.

- Countering Counterfeiting: Combating the sale of counterfeit "Scotch whiskies" is essential to protect brand reputation and consumer trust.

- Shifting Consumer Tastes: Evolving consumer preferences for different types of alcoholic beverages require Indian producers to be adaptable and innovative.

Segmentation Analysis Analysis

Segmentation Analysis Analysis

The India scotch whiskey market is segmented based on product type, quality, distribution channel, and region.

By Product Type Insights

By Product Type Insights

Based on Product Type, the India scotch whiskey market is divided into single malt scotch whiskey and blended scotch whiskey.

Single Malt Scotch Whiskey is gaining significant traction in India due to the increasing consumer preference for high-quality, premium alcoholic beverages. As more Indian consumers become knowledgeable about different types of Scotch whiskey, there is a growing demand for single malts. This growth is driven by rising disposable incomes, urbanization, and the expanding middle class that is willing to spend on luxury products. Single Malt Scotch Whiskey is made from malted barley at a single distillery and is aged for a minimum of three years in oak casks. Known for its distinct and rich flavors, Single Malt Scotch is often associated with premium quality and exclusivity. This segment appeals primarily to connoisseurs and affluent consumers who appreciate the craftsmanship and unique taste profiles of single malt varieties.

Blended Scotch Whiskey dominates the Indian market due to its affordability and widespread acceptance. It caters to a larger consumer base, including both entry-level whiskey drinkers and seasoned enthusiasts who appreciate its versatility. The segment's accessibility makes it a preferred choice for many occasions, from casual gatherings to formal events. This growth is supported by its broad market presence, competitive pricing, and the increasing availability of various brands and blends that cater to diverse consumer preferences. Blended Scotch Whiskey is a mix of single malt and single grain whiskeys from multiple distilleries, offering a balanced flavor profile that is often more accessible and affordable than single malts. This segment has a broad appeal, catering to a wide range of consumers from different socioeconomic backgrounds. Blended Scotch is particularly popular for its consistency in taste and smoother drinking experience.

By Quality Insights

By Quality Insights

On the basis of Quality, the India scotch whiskey market is bifurcated into premium, high-end premium, and super premium.

Premium Scotch whiskey represents the entry-level segment within the premium category, offering a balance of quality and affordability. These products are typically well-known brands that provide a consistent and enjoyable drinking experience without the higher price tag of more exclusive varieties. The Premium segment is a significant part of the India Scotch whiskey market, appealing to a broad consumer base that includes both occasional drinkers and regular consumers who seek quality without excessive cost. This segment is driven by rising disposable incomes and the increasing accessibility of premium spirits.

High-end Premium Scotch whiskey sits between the premium and super premium categories, offering enhanced quality, better aging processes, and more refined flavors. The High-End Premium segment attracts discerning consumers who are willing to pay more for superior quality and unique taste profiles. This segment benefits from the trend towards premiumization and the growing appreciation for fine spirits among Indian consumers. The growth is fueled by increasing disposable incomes, urbanization, and a rising middle class that values luxury and exclusivity in their beverage choices.

Super Premium Scotch whiskey represents the highest quality category, featuring rare, limited-edition, and exceptionally aged products. The Super Premium segment is the fastest-growing category in the India Scotch whiskey market, driven by affluent consumers who seek exclusivity, prestige, and unparalleled quality. This segment includes ultra-luxury brands and special editions that command high prices and offer unique experiences.

By Distribution Channel Insights

By Distribution Channel Insights

Based on Distribution Channel, the India scotch whiskey market is categorized into restaurants & bars, supermarkets & hypermarkets, liquor stores, and online stores.

Restaurants and bars play a crucial role in the Scotch whiskey market, offering consumers the opportunity to experience premium spirits in a social and relaxed setting. The Restaurants & Bars segment is expected to grow steadily, driven by the increasing number of dining and entertainment establishments in urban areas. The rising trend of social drinking and the popularity of premium cocktails and whiskey tastings further support this channel.

Supermarkets and hypermarkets provide a convenient shopping experience, offering a wide range of products under one roof. The Supermarkets & Hypermarkets segment is significant for Scotch whiskey sales due to its extensive reach and convenience. Consumers can easily compare different brands and make informed purchasing decisions. This channel is expected to grow at a CAGR of about 9% during the forecast period, supported by the expansion of modern retail outlets and increasing consumer preference for convenient shopping experiences.

The Liquor Stores segment dominates the Scotch whiskey market in India, catering to both casual buyers and connoisseurs. These stores are the preferred choice for purchasing premium and rare whiskey varieties, given their specialized inventory and knowledgeable staff. Liquor stores are specialized retail outlets focusing exclusively on alcoholic beverages. They offer a wide variety of products, from affordable options to high-end premium spirits, and often provide expert advice and personalized service.

The Online Stores segment is expected to be the fastest-growing distribution channel for Scotch whiskey. The growth is driven by increasing internet penetration, the expansion of e-commerce platforms, and changing consumer shopping habits.

Recent Developments:

Recent Developments:

- February 2024: A major boost for Indian whisky production came with the signing of a Memorandum of Understanding (MoU) between the Maharashtra government and Pernod Ricard India. This collaboration aims to establish one of the biggest malt spirit distilleries in the country.

- July 2023: Efforts to expand the reach of Indian whisky gained momentum as India and Australia initiated discussions to facilitate Indian whisky exports to the Australian market. A joint working group is exploring the possibility of a mutual recognition agreement (MRA) to streamline the process.

- June 2023: The Indian whisky market witnessed a celebrity entry with Bollywood actor Sanjay Dutt launching his own Scotch whisky brand, "The Glenwalk." The company has partnered with established distributors like Cartel & Bros and Living Liquidz, indicating a strategic approach to market entry.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2023 |

USD 3,560 Million |

Projected Market Size in 2032 |

USD 6,230 Million |

CAGR Growth Rate |

6.41% CAGR |

Base Year |

2023 |

Forecast Years |

2024-2032 |

Key Market Players |

Allied Blenders and Distillers Private Limited, Amrut Distilleries, Ardbeg Distillery, Bacardi, Beam Suntory, Beam Suntory, Diageo India, Glenfiddich, Ian Macleod Distillers, Laphroaig Distillery, Loch Lomond Group, Paul John Distillery, Pernod Ricard India Ltd, Piccadily Distilleries, Radico Khaitan Limited, United Spirits Limited, Whyte & Mackay, William Grant & Sons, and Others. |

Key Segment |

By Product Type, By Quality, By Distribution Channel, and By State |

Regions Covered in India |

North India, South India, East India, West India, Central India |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

State Analysis

State Analysis

The India Scotch whiskey market exhibits distinct regional variations, influenced by cultural preferences, economic conditions, and levels of urbanization.

- West India dominated the India Scotch whiskey market with a share of 42.8% in 2023

West India, particularly Maharashtra, emerges as the dominating region in this market. Mumbai, the financial hub of India, significantly drives this growth due to its affluent population and vibrant nightlife. The region benefits from high disposable incomes and a cosmopolitan culture that favors premium spirits. Additionally, Goa, known for its tourism-driven economy, contributes to the high demand for Scotch whiskey, especially among tourists and expatriates.

South India is another key region for Scotch whiskey consumption, with major urban centers like Bangalore, Chennai, and Hyderabad leading the market. The presence of IT hubs and a cosmopolitan workforce, along with rising disposable incomes, fuels the demand for premium alcoholic beverages in this region. The growth of South India is supported by the proliferation of modern retail outlets and high-end bars, which make Scotch whiskey more accessible to urban consumers.

North India, particularly states like Delhi, Punjab, and Haryana shows strong growth potential due to cultural inclinations towards premium alcoholic beverages and high disposable incomes. The region's demand is driven by social practices and festivities that encourage the consumption of high-quality spirits.

East India, with Kolkata as its primary urban center, is a developing market for Scotch whiskey. The region is gradually witnessing growth as awareness and acceptance of premium alcoholic beverages increase. Economic development and rising disposable incomes in urban areas are expected to drive growth in this region.

Central India, encompassing states like Madhya Pradesh and Chhattisgarh, represents a smaller market for Scotch whiskey. However, it is experiencing gradual growth driven by increasing urbanization and the entry of modern retail chains. Emerging urban centers play a key role in the growth of this region.

List of Key Players

List of Key Players

The analysis-intensive report provides key insights into companies and organizations operating in the India scotch whiskey market. The study further makes a relative examination of the organizations highlighting essential business parameters such as geographic presence, business overviews, product offerings, segment-based market share, operational strategies, and SWOT analysis. Recent enterprise developments including novel product launches, joint ventures, partnerships, strategic alliances, mergers & acquisitions, and product development are elaborated upon in the report. The in-depth study thus facilitates a comprehensive analysis of market competition.

Some of the main competitors dominating the India scotch whiskey market include;

- Allied Blenders and Distillers Private Limited

- Amrut Distilleries

- Ardbeg Distillery

- Bacardi

- Beam Suntory

- Beam Suntory

- Diageo India

- Glenfiddich

- Ian Macleod Distillers

- Laphroaig Distillery

- Loch Lomond Group

- Paul John Distillery

- Pernod Ricard India Ltd

- Piccadily Distilleries

- Radico Khaitan Limited

- United Spirits Limited

- Whyte & Mackay

- William Grant & Sons

The India scotch whiskey market is segmented as follows:

By Product Type

By Product Type

- Single Malt Scotch Whiskey

- Blended Scotch Whiskey

By Quality

By Quality

- Premium

- High-End Premium

- Super Premium

By Distribution Channel

By Distribution Channel

- Restaurants & Bars

- Supermarkets & Hypermarkets

- Liquor Stores

- Online Stores

By State

By State

- West India

- South India

- North India

- East India

- Central India

Industry Major Market Players

- Allied Blenders and Distillers Private Limited

- Amrut Distilleries

- Ardbeg Distillery

- Bacardi

- Beam Suntory

- Beam Suntory

- Diageo India

- Glenfiddich

- Ian Macleod Distillers

- Laphroaig Distillery

- Loch Lomond Group

- Paul John Distillery

- Pernod Ricard India Ltd

- Piccadily Distilleries

- Radico Khaitan Limited

- United Spirits Limited

- Whyte & Mackay

- William Grant & Sons

Frequently Asked Questions

Copyright © 2024 - 2025, All Rights Reserved, Facts and Factors