Search Market Research Report

Insurance Policy Administration Systems Software Market Size, Share Global Analysis Report, 2018 – 2025

Insurance Policy Administration Systems Software Market By Offerings (Standalone Software and Integrated Platform), By Deployment Mode (On-Premise and Cloud-Based), By Organization Size (Large Enterprises and Small & Medium-Sized Enterprises), and By End-User (Conventional Insurance Providers and Bancassurance Companies): Global Industry Perspective, Comprehensive Analysis, and Forecast 2018 – 2025

Industry Insights

The report covers the forecast and analysis of the Insurance Policy Administration Systems Software market on a global and regional level. The study provides historical data from 2015 to 2018 along with a forecast from 2019 to 2025 based on revenue (USD Million). The study includes drivers and restraints of the Insurance Policy Administration Systems Software market along with the impact they have on the demand over the forecast period. Additionally, the report includes the study of opportunities available in the Insurance Policy Administration Systems Software market on a global level.

In order to give the users of this report a comprehensive view of the Insurance Policy Administration Systems Software market, we have included a competitive landscape and an analysis of Porter’s Five Forces model for the market. The study encompasses a market attractiveness analysis, wherein all the segments are benchmarked based on their market size, growth rate, and general attractiveness.

The report provides company market share analysis to give a broader overview of the key players in the market. In addition, the report also covers key strategic developments of the market including acquisitions & mergers, new product & service launches, agreements, partnerships, collaborations & joint ventures, research & development, and regional expansion of major participants involved in the market on a global and regional basis.

The study provides a decisive view of the Insurance Policy Administration Systems Software market by segmenting the market based on offerings, deployment mode, organization size, end-user, and regions. All the segments have been analyzed based on present and future trends and the market is estimated from 2019 to 2025.

The growing utilization of the digital business model in the insurance sector to positively influence business expansion over the forecast period. The digital revolution has greatly influenced the business fraternity and insurance business is no exception to this. Moreover, the digital revolution has enabled the consumers to shift towards personalized insurance coverage encompassing usage-based, on-demand, and all-in-one insurance lifestyle items. This, in turn, is predicted to accentuate the expansion of the Insurance Policy Administration Systems Software market over the forecast period. However, data security concerns & stringent laws governing the use of the product will hinder the market growth over the forecast period.

Report Scope

Report Scope

Report Attribute |

Details |

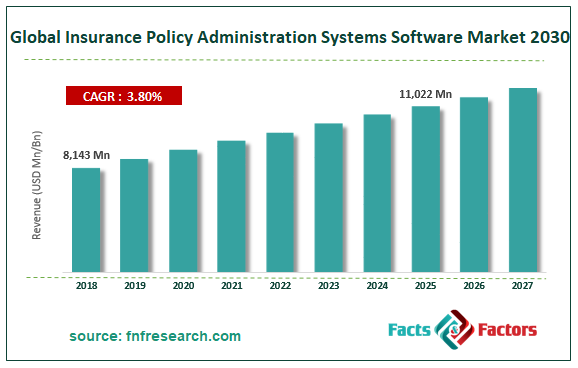

Market Size in 2018 |

USD 8,143 million |

Projected Market Size in 2025 |

USD 11,022 million |

CAGR Growth Rate |

3.8% CAGR |

Base Year |

2018 |

Forecast Years |

2019-2025 |

Key Market Players |

Andesa Services, Damco Group, DXC Technology Company, Ebix Inc., EXL, FINEOS, FIS, InsPro Technologies, Oceanwide Canada Inc., OneShield Inc., Oracle, Pegasystems Inc., Sapiens International, Scorto Inc., Solartis, and Target Group. |

Key Segment |

By Offerings, By Deployment Mode, By Organization Size, By End-User and By Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

The overall Insurance Policy Administration Systems Software industry is sectored based on offerings, deployment mode, organization size, and end-user. Based on the offerings, the market for Insurance Policy Administration Systems Software is divided into Standalone Software and Integrated Platform. On the basis of deployment mode, the industry is divided into On-Premise and Cloud-Based. Based on the organization size, the market is separated into Small & Medium-Sized Enterprises as well as Large Enterprises. Based on the end-user, the industry is divided into Conventional Insurance Providers and Bancassurance Companies.

Competitive Analysis

Competitive Analysis

- Andesa Services

- Damco Group

- DXC Technology Company

- Ebix Inc.

- EXL

- FINEOS

- FIS

- InsPro Technologies

- Oceanwide Canada Inc.

- OneShield Inc.

- Oracle

- Pegasystems Inc.

- Sapiens International

- Scorto Inc.

- Solartis

- Target Group.

Industry Major Market Players

- Andesa Services

- Damco Group

- DXC Technology Company

- Ebix Inc.

- EXL

- FINEOS

- FIS

- InsPro Technologies

- Oceanwide Canada Inc.

- OneShield Inc.

- Oracle

- Pegasystems Inc.

- Sapiens International

- Scorto Inc.

- Solartis

- Target Group

Frequently Asked Questions

Copyright © 2024 - 2025, All Rights Reserved, Facts and Factors