Search Market Research Report

Ionic Liquids Market Size, Share Global Analysis Report, 2022 – 2028

Ionic Liquids Market Size, Share, Growth Analysis Report By Application (Solvents & Catalysts, Process & Operating Fluids, Plastics, Batteries & Electrochemistry, And Bio-Refineries), and By Region - Global and Regional Industry Insights, Overview, Comprehensive Analysis, Trends, Statistical Research, Market Intelligence, Historical Data and Forecast 2022 – 2028

Industry Insights

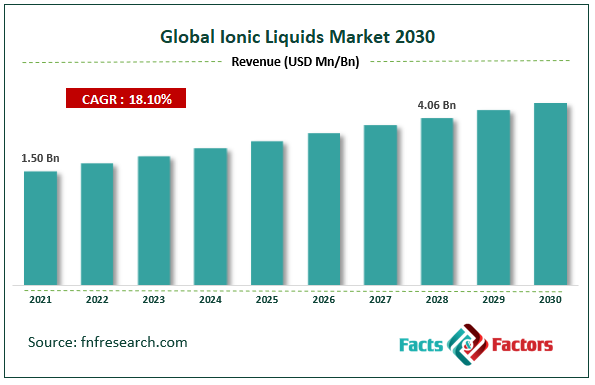

[229+ Pages Report] According to the report published by Facts & Factors, the global ionic liquids market size was worth USD 1.50 billion in 2021 and is estimated to grow to USD 4.06 billion by 2028, with a compound annual growth rate (CAGR) of approximately 18.10% over the forecast period. The report analyzes the ionic liquids market's drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the ionic liquids market.

Market Overview

Market Overview

Ionic liquids are compounds or salts of ions that remain liquid below 100°C or even at room temperature. This product is increasingly used in various products, including rare earth metal recycling, cleaner solvents, and safer batteries. Ionic liquids constantly find new applications, such as polymer additives, coolants, and lubricants. They are used as electrolytes in plating baths, supercapacitors, and lithium-ion batteries. In addition to their traditional uses as solvents in biomass processing and chemical processes, catalysts & auxiliaries in chemical synthesis, ionic liquids are also used in analytical instruments. Growing demand for processed foods, rising disposable incomes, and expanding supermarkets, especially in emerging markets such as China, India, Indonesia, and Brazil, should significantly expand the food sector, boosting the market share of ionic liquids. Increased acceptance of carotenoids in dietary supplements and growing consumer awareness of the health benefits of natural colorants, such as improved growth, immunity, and eye health, are driving increased acceptance of carotenoids in food processing and products.

Covid-19 Impact:

Covid-19 Impact:

The COVID-19 pandemic can have various impacts on market growth. Demand from all sectors is expected to increase due to people's growing awareness of health and safety. Using this liquid could prevent many environmental disasters that would ultimately benefit humanity. However, large companies must also consider the costs associated with industry-provided solutions. Large consumer goods companies are facing tough times, with most of their sales declining. As product sales are heavily dependent on B2B channels, sales in the markets studied may decline somewhat due to the crisis caused by the pandemic.

Key Insights

Key Insights

- As per the analysis shared by our research analyst, the global ionic liquids market value is expected to grow at a CAGR of 18.10% over the forecast period.

- In terms of revenue, the global ionic liquids market size was valued at around USD 1.50 billion in 2021 and is projected to reach USD 4.06 billion, by 2028.

- Growing environmental and health concerns and strong regulatory pressure drive the market’s growth.

- By application, the solvents and catalysts segment dominated the market in 2021.

- North America dominated the global ionic liquids market in 2021.

Growth Drivers

Growth Drivers

- Mergers & acquisitions, partnerships, and research & development activities to drive the market growth

The global ionic liquid market share is highly consolidated and includes various major players such as BASF, Tokyo Chemical Industry, Merck Chemicals, IOLITECH GmbH, and Solvay. Major manufacturers are mainly engaged in strategic initiatives such as mergers, acquisitions, and partnerships to improve their research capabilities and develop new technologies to expand the application range of ionic liquids. Various end-users of ionic liquids are increasingly turning to alkylation techniques. It demonstrates a huge market opportunity for products using ionic liquids as safer alternatives to strong acids to catalyze the production process of alkylates.

Growth Drivers

Growth Drivers

- High cost of the product hinders the market growth

High product costs is likely to limit the market growth in the coming years. These factors limit their use in applications such as biocatalysis, electroplating, and deposition. Key market players are looking to adopt alternative manufacturing processes to produce chemically more refined, purer, and cheaper products. Liquids are manufactured in small quantities, and as demand increases due to the commercialization of applications, prices are expected to drop, making their use in various processes economical and viable.

Segmentation Analysis

Segmentation Analysis

The global ionic liquids market has been segmented into applications, and regions.

Based on application, the market is classified into solvents & catalysts, process & operating fluids, plastics, batteries & electrochemistry, and bio-refineries. In 2021, the solvents & catalysts category dominated the global ionic liquids market. These products are widely used in various chemical reactions such as condensation of ketones and aldehydes with hydroxylamines, Michael addition of active methylene compounds, aza-Michael addition reactions, and synthesis of pyrroles and quinolines. The significant expansion of end-use industries such as automotive and consumer goods, largely due to economic growth and population growth, should stimulate the chemical sector, thereby increasing demand for catalysts and ionic liquids. Increased efforts in the manufacturing sector to achieve cost reduction, yield improvement, energy efficiency, and environmental compliance should drive the adoption of catalysts as they help reduce the activation energy of chemical reactions.

Recent Developments

Recent Developments

- April 2021: Honeywell and Chevron Corporation commissioned the world's first ISOALKYL plant to enable the cost-effective production of alkylates.

- March 2020: Proion has introduced an ionic liquid-based hydrogen storage technology that offers long-term stability and is highly safe and non-flammable.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2021 |

USD 1.50 Billion |

Projected Market Size in 2028 |

USD 4.06 Billion |

CAGR Growth Rate |

18.10% CAGR |

Base Year |

2021 |

Forecast Years |

2022-2028 |

Key Market Players |

BASF SE, Evonik Industries AG, Merck KGaA, Ionic Liquids Technologies GmbH, The Chemours Company, Proionic, Solvionic SA, CoorsTek Specialty Chemicals, Jinkai Chemical Co. Ltd., Reinste Nanoventure, Tatva Chintan Pharma Chem Pvt. Ltd., Strem Chemicals Inc., and Others |

Key Segment |

By Application, and Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East &, Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Regional Landscape

Regional Landscape

- North America dominated the ionic liquids market in 2021

North America is likely to maintain its dominant position in the global ionic liquids market during the projection period. Many prominent mining companies in the United States and other North American countries focusing on new product launches and development will drive the ionic liquids market during the forecast period in the North American region. Furthermore, government support is expected to be key in driving product demand. Numerous regional players in the US and Canada regions also fuel product growth during the forecast period.

Competitive Landscape

Competitive Landscape

- BASF SE

- Evonik Industries AG

- Merck KGaA

- Ionic Liquids Technologies GmbH

- The Chemours Company

- Proionic

- Solvionic SA

- CoorsTek Specialty Chemicals

- Jinkai Chemical Co. Ltd.

- Reinste Nanoventure

- Tatva Chintan Pharma Chem Pvt. Ltd.

- Strem Chemicals Inc.

Global Ionic Liquids Market is segmented as follows:

By Application

By Application

- Solvents & catalysts

- Process & operating fluids

- Plastics

- Batteries & electrochemistry

- Bio-refineries

By Regional Segment Analysis

By Regional Segment Analysis

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Nordic Countries

- Denmark

- Sweden

- Norway

- Benelux Union

- Belgium

- The Netherlands

- Luxembourg

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Southeast Asia

- Indonesia

- Thailand

- Malaysia

- Singapore

- Rest of Southeast Asia

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Industry Major Market Players

- BASF SE

- Evonik Industries AG

- Merck KGaA

- Ionic Liquids Technologies GmbH

- The Chemours Company

- Proionic

- Solvionic SA

- CoorsTek Specialty Chemicals

- Jinkai Chemical Co. Ltd.

- Reinste Nanoventure

- Tatva Chintan Pharma Chem Pvt. Ltd.

- Strem Chemicals Inc.

Frequently Asked Questions

Copyright © 2024 - 2025, All Rights Reserved, Facts and Factors