Search Market Research Report

Aircraft Manufacturing Market Size, Share Global Analysis Report, 2022 – 2028

Aircraft Manufacturing Market Size, Share, Growth Analysis Report By Product Type (Gliders, Helicopters, Ultra-Light Aircraft, Passenger Aircraft, Unmanned Aerial Vehicles & Drones, Blimps (Airship)), By Application (Military & Defense, Civil, Commercial (Freight), Others), and By Region - Global Industry Insights, Comparative Analysis, Trends, Statistical Research, Market Intelligence, and Forecast 2022 – 2028

Industry Insights

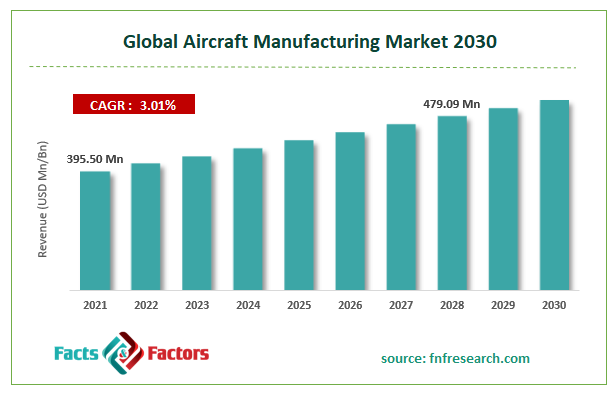

[222+ Pages Report] According to Facts and Factors, The global aircraft manufacturing market size was valued at USD 395.50 million in 2021 and is predicted to increase at a CAGR of 3.01% to USD 479.09 million by 2028. The study examines the market in terms of revenue in each of the major regions, which are classified into countries. The report analyses the global aircraft manufacturing market’s drivers and restraints, as well as the impact they have on-demand throughout the projection period. In addition, the report examines global opportunities in the aircraft manufacturing market.

Market Overview

Market Overview

The aircraft manufacturing market includes the production of airplanes as well as components such as engines, propulsion systems, and other components. The rising affluence of air travel as a result of rising global per capita income, increasing investments in aviation infrastructure, increasing initiatives to connect outlying cities with prime aviation hubs, and rising demand for planes from the commercial and military & defense sectors are expected to drive the growth of the airplane manufacturing industry. Furthermore, the growing emphasis on environmental pollution, as well as the growing need to improve fuel efficiency, is promoting the industry's growth. Growing technological developments to reduce manufacturing costs and improve fuel efficiency are expected to provide enormous industry growth opportunities.

Growth Drivers

Growth Drivers

Some of the important elements supporting the expansion of the worldwide aircraft manufacturing market size are favorable economic growth around the world, as well as government assistance for the development of the aviation industry. Since then, the aircraft sector has expanded dramatically in terms of design, utilization, and technology. Gliders, helicopters, ultra-light aircraft, passenger aircraft, unmanned aerial vehicles & drones, and blimps make up the majority of the aerospace industry today (airship). These planes are employed for a variety of purposes, including military and defense, civil and tourism, commercial (freight/air cargo), agriculture, and tests and prototypes.

The primary driver of increased demand for civil airplanes is an increase in the number of passengers. Air travel has benefited from continued robust consumer spending, and industrial production has recovered, lifting air cargo and some areas of corporate travel. The rise of the middle class, combined with an increase in travel and tourism, is a major element driving the worldwide aircraft manufacturing business.

COVID – 19 Impact

COVID – 19 Impact

The spread of COVID-19 reflects a slowing in the growth of the aircraft manufacturing market as a result of significant disruptions in the supply chain and a slowdown in manufacturing activities. Trade barriers and international border closures have hampered the entire manufacturing process. These supply chain disruptions, lockdown measures, and limited consumer and corporate spending are expected to stymie demand for airplane manufacturing. Furthermore, the decrease in flight activity is expected to stifle the industry's growth. However, as governments around the world lift lockdown restrictions, the demand for an aircraft manufacturing market is expected to rebound.

The complete research study looks at both the qualitative and quantitative aspects of the Aircraft Manufacturing market. Both the demand and supply sides of the market have been investigated. The demand side study examines market income in various regions before comparing it to all of the major countries. The supply side research examines the industry's top rivals, as well as their regional and global presence and strategies. Each major country in North America, Europe, Asia Pacific, the Middle East and Africa, and Latin America is thoroughly investigated.

Segmentation Analysis

Segmentation Analysis

The global Aircraft Manufacturing market is segregated based on Product Type and Application.

Based on Product type, the passenger aircraft category is expected to account for the largest market share in the global aircraft manufacturing market, owing to an increase in the number of passengers combined with growth in the travel and tourism industry. Unmanned aerial vehicles and drones are also expected to grow in popularity in the coming years as these aircraft are used for a variety of purposes in the defense sector. The civil category led the market in 2021, and it is expected to grow in the coming years due to rising consumer spending on air travel and an increase in the number of business travelers.

Based on Application, the commercial segment is expected to have the highest revenue share in 2021 and to lead the industry in the coming years. This large segment share can be attributed to increased passenger and freight traffic on a global scale. Furthermore, rising demand for cargo services, combined with increased global trade, is expected to drive the segment's growth. Furthermore, the emergence of LCC (low-cost carriers) is expected to provide significant growth opportunities for the segment. Following in the footsteps of LCCs, various airlines are developing similar business models in order to ensure their long-term viability in the face of increasing competition in the aircraft manufacturing industry. The military and defense sector is expected to grow at the fastest rate in the industry.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2021 |

USD 395.50 Million |

Projected Market Size in 2028 |

USD 479.09 Million |

CAGR Growth Rate |

3.01% CAGR |

Base Year |

2021 |

Forecast Years |

2022-2028 |

Key Market Players |

Airbus Group SE, The Boeing Company, Bombardier Inc., Commercial Aircraft Corporation of China, Ltd., Embraer S.A., Public Joint Stock Company United Aircraft Corporation, GE Aviation, United Technologies Corporation, Lockheed Martin Corporation, Leonardo-Finmeccanica S.p.a, and Others |

Key Segment |

By Product Type, Application, and Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Regional Landscape

Regional Landscape

In 2021, North America will account for the largest market revenue share in the global market. This massive market share can be attributed to the rising demand for new-generation airplanes. Furthermore, the presence of a major industry player in the region is expected to provide significant market growth opportunities. The participation of major aircraft and component manufacturers, such as Boeing, is expected to bring in investments. The modernization of airplane fleets, as well as the destination expansion plans of the region's airlines, are expected to drive the growth of the airplane manufacturing market. Furthermore, the high passenger traffic to and from the United States is expected to drive market growth. As a result, these factors are promoting industry growth throughout North America.

Competitive Landscape

Competitive Landscape

The report contains qualitative and quantitative research on the global aircraft manufacturing market, as well as detailed insights and development strategies employed by the leading competitors. The report also provides an in-depth analysis of the market's main competitors, as well as information on their competitiveness. The research also identifies and analyses important business strategies used by these main market players, such as mergers and acquisitions (M&A), affiliations, collaborations, and contracts. The study examines, among other things, each company's global presence, competitors, service offers, and standards.

List of Key Players in the Global Aircraft Manufacturing Market:

- Airbus Group SE

- The Boeing Company

- Bombardier Inc.

- Commercial Aircraft Corporation of China, Ltd.

- Embraer S.A.

- Public Joint Stock Company United Aircraft Corporation

- GE Aviation

- United Technologies Corporation

- Lockheed Martin Corporation

- Leonardo-Finmeccanica S.p.a

The global aircraft manufacturing market is segmented as follows:

By Product Type Segment Analysis

By Product Type Segment Analysis

- Gliders

- Helicopters

- Ultra-Light Aircraft

- Passenger Aircraft

- Unmanned Aerial Vehicles & Drones

- Blimps (Airship)

By Application Segment Analysis

By Application Segment Analysis

- Military & Defense

- Civil

- Commercial (Freight)

- Others

By Regional Segment Analysis

By Regional Segment Analysis

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Nordic Countries

- Denmark

- Sweden

- Norway

- Benelux Union

- Belgium

- The Netherlands

- Luxembourg

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Southeast Asia

- Indonesia

- Thailand

- Malaysia

- Singapore

- Rest of Southeast Asia

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Industry Major Market Players

- Airbus Group SE

- The Boeing Company

- Bombardier Inc.

- Commercial Aircraft Corporation of China Ltd.

- Embraer S.A.

- Public Joint Stock Company United Aircraft Corporation

- GE Aviation

- United Technologies Corporation

- Lockheed Martin Corporation

- Leonardo-Finmeccanica S.p.a

Copyright © 2024 - 2025, All Rights Reserved, Facts and Factors