Search Market Research Report

Artificial Intelligence AI in Oil and Gas Market Size, Share Global Analysis Report, 2024 – 2032

Artificial Intelligence AI in Oil and Gas Market Size, Share, Growth Analysis Report By Component (Software, Hardware, Services), By Function (Predictive Maintenance, Machinery Inspection, Material Movement, Production Planning, Field Services, Quality Control, Reclamation), By Application (Upstream, Midstream, Downstream), And By Region - Global Industry Insights, Overview, Comprehensive Analysis, Trends, Statistical Research, Market Intelligence, Historical Data and Forecast 2024 – 2032

Industry Insights

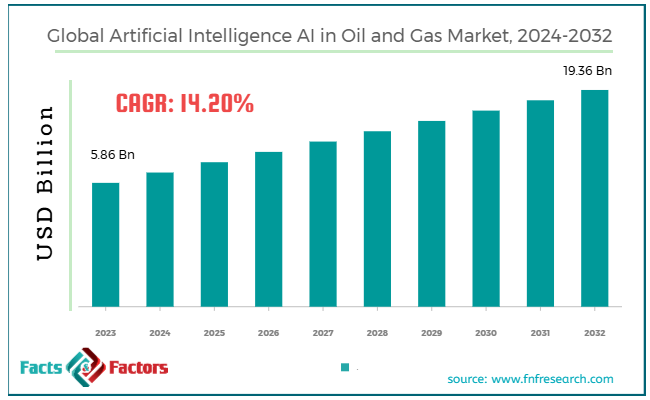

[228+ Pages Report] According to Facts & Factors, the global artificial intelligence AI in oil and gas market size was worth around USD 5.86 billion in 2023 and is predicted to grow to around USD 19.36 billion by 2032, with a compound annual growth rate (CAGR) of roughly 14.20% between 2024 and 2032.

Market Overview

Market Overview

Artificial intelligence AI in oil and gas remarkably transforms operations by reducing costs and improving efficiency and safety. It is prominently used in domains like predictive maintenance, wherein artificial intelligence predicts device and equipment failures, enhances production with the help of real-time data study, and optimizes exploration by studying geological information for wise decision-making.

Artificial intelligence also supports decreasing the ecological impact by simplifying resource extraction processes and monitoring emissions. Inclusively, it encourages data-based and smart decision-making during the entire value chain. The global market is propelled by factors like cost efficiency and operational efficiency.

AI notably reduces operational costs by automating repetitive tasks, boosting resource utilization, and forecasting equipment failure, resulting in more efficient workflows and less downtime.

AI also allows real-time operations monitoring, supporting companies in focusing on drilling processes, operational productivity, and production rates. Machine learning algorithms study data for decision-making, translating into better resource extraction.

However, despite growth, the global artificial intelligence AI in oil and gas market is witnessing growth barriers like high initial investment, data security, and privacy issues.

Implementing AI solutions in oil and gas operations demands major upfront spending on infrastructure, skilled labor, and AI software. Several smaller firms may struggle with the funding commitment needed to incorporate artificial intelligence in operations.

With the growing reliance on AI, the need for strong cybersecurity measures also increases. Sensitive and confidential data, mainly associated with operations, financial transactions, and safety protocols should be guarded against possible breaches. This could be a major barrier to implementing artificial intelligence securely.

Yet, the market is opportune for the growing use of AI in drilling operations and improved exploration and production. AI can assist in identifying novel oil & gas reserves by studying geological information, production, data, and seismic surveys. This curbs the cost and risk of exploration by offering more precise projections regarding where resources may be placed. AI can also enhance drilling factors by studying sensor data. This substantially helps improve drilling processes.

Key Insights:

Key Insights:

- As per the analysis shared by our research analyst, the global artificial intelligence AI in oil and gas market is estimated to grow annually at a CAGR of around 14.20% over the forecast period (2024-2032)

- In terms of revenue, the global artificial intelligence AI in oil and gas market size was valued at around USD 5.86 billion in 2023 and is projected to reach USD 19.36 billion by 2032.

- Artificial intelligence AI in oil and gas market is expected to witness growth owing to key benefits of artificial intelligence like availability of big data, risk and safety management, and operational efficiency.

- Based on the component, the software segment is the dominating segment, while the services segment is projected to witness sizeable revenue over the forecast period.

- Based on function, the predictive maintenance segment is expected to lead the market as compared to the production planning segment.

- Based on application, the upstream segment is expected to lead the market followed by the midstream segment.

- Based on region, North America is anticipated to dominate the global market over the forecast period, followed by the Asia Pacific.

Growth Drivers

Growth Drivers

- Big data analytics and data availability notably impact market growth

The global artificial intelligence AI in oil and gas market is witnessing substantial growth owing to data availability and big data. Sensors, along with IoT devices and several other sources, generate abundant data in the oil and gas industry. Adding to this excessive data, AI plays a crucial role in its ability to study and interpret. Artificial intelligence's potential to study these large datasets results in enhanced decision-making and highly efficient operational strategies.

AI technologies like deep learning and machine learning can effectively analyze huge data quantities of complicated data. This comprises seismic, geological, and operational data to enhance production, exploration, and refine the management of the supply chain. Using AI, real-time data be rightly processed for making wise decisions, enabling continuous enhancement of exploration, drilling, and production activities.

One of the leading companies, Equinor, declared in 2024 that it aptly implemented artificial intelligence to study seismic data. This notably decreased the time and cost of exploring the reservoir. Furthermore, TotalEnergies effectively used AI to study historical data, majorly boosting the precision of fueling efficiency and resource prediction in exploration activities.

- Sustainability and energy transition to be the key contributors to the industry growth

The drive for greener energy technologies has boosted the adoption of AI in enhancing operations for reducing emissions, sustainability, and improving carbon capture solutions. There are several AI tools that can reduce and monitor carbon footprint, enhance energy efficiency, and optimize processes to control and reduce wastage and surplus energy consumption.

In 2023, BP declared that it would use artificial intelligence in its present efforts to decrease emissions in its operations. By 2050, the company also aims to obtain net-zero emissions with AI playing a vital role in emission optimization and tracking.

Restraints

Restraints

- Lack of expertise and skilled labor to hinder the growth of the market

The artificial intelligence AI in oil and gas industry expansion is expected to be hampered as the use of AI in oil and gas needs expert knowledge that blends proficiency in AI technologies and industry-dedicated understanding. There is a lack of skilled workforce who do not possess an in-depth understanding of oil and gas and technical proficiency in AI for understanding of the oil & gas industry. This challenges companies to successfully adopt AI for diverse operations.

Moreover, the demand for AI professionals like machine learning engineers, data scientists, and AI programmers outshines supply, mainly those with domain proficiency in oil & gas. Companies mostly witness the challenge of training their workforce to manage and implement AI systems.

In 2023, Chevron declared that despite its efforts to implement AI, it had to recruit more AI engineers and data scientists to completely integrate AI systems into its operations. Hence, the company launched a talent initiative to train and educate its current workforce.

Opportunities

Opportunities

- Asset management and predictive maintenance spur the market progress

The artificial intelligence AI in oil and gas market growth is likely to boost in coming years as AI plays a key role in predictive maintenance by studying sensor data from equipment and machinery to project failures before occurrence. This lessens downtime, extends the life of costly equipment, and reduces repair costs.

AI can efficiently forecast machinery like compressors, pumps, and turbines to fail, thus allowing operators to plan maintenance before problems get critical. AI technologies can also constantly monitor critical health assets, allowing operations optimization and decreasing unplanned maintenance incidents.

In 2023, BP company implemented AI predictive maintenance systems in refining operations, which significantly reduced unanticipated shutdowns by nearly 25% and enhanced functioning time.

Furthermore, Chevron joined hands with Uptake to improve the reliability of its offshore rigs. Using AI to forecast failures, chevron has been successful in reducing its maintenance prices notably.

Challenges

Challenges

- ROI uncertainty and significant initial investment slow down the industry growth

Adopting AI technologies in oil & gas operations demands significant upfront funding for software, infrastructure, and skilled labor. There is also a doubt regarding the ROI in less time period, since AI implementation may take time to present noticeable results.

Arranging AI systems needs high investments in software, hardware, and cloud infrastructure, which demand a lot of capital. Given the intricacy of AI technologies, calculating returns on AI investment may offer a challenge. This could prevent oil and gas companies from adopting AI, mainly in times of changing oil costs, thereby challenging the growth of artificial intelligence AI in oil and gas industry.

In 2023, BP revealed that it is planning to invest in AI-based maintenance solutions witnessed internal resistance because of significant upfront costs. Nonetheless, BP still justifies its investments by highlighting long-term fund savings from AI uses in predictive maintenance.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2023 |

USD 5.86 Billion |

Projected Market Size in 2032 |

USD 19.36 Billion |

CAGR Growth Rate |

14.20% CAGR |

Base Year |

2023 |

Forecast Years |

2024-2032 |

Key Market Players |

ExxonMobil, Chevron, Shell, BP, TotalEnergies, ConocoPhillips, Halliburton, Schlumberger, Baker Hughes, Equinor, PetroChina, Sinopec, Saudi Aramco, Cognite, Uptake Technologies, and Others. |

Key Segment |

By Component, By Function, By Provider, and By Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East &, Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Segmentation Analysis

Segmentation Analysis

The global artificial intelligence AI in oil and gas market is segmented based on component, function, application, and region.

Based on component, the global artificial intelligence AI in oil and gas market is divided into software, hardware, and services. The software segment holds a significant share of the artificial intelligence AI in the oil and gas industry, while the services segment is projected to be the most lucrative segment. AI software tools like process optimization, predictive maintenance, and drilling automation systems are vital for allowing AI-based functions in oil and gas. This segment will present notable growth over the forecast period as companies are willing to spend on software platforms customized to the energy sector's dedicated needs.

This comprises AI consulting, maintenance services, and integration, which are essential for the optimization and implementation of AI technologies. The leading companies in the oil & gas industry are actively using AI technologies. They are mostly dependent on dedicated service providers for specialization in data analytics, system integration, and machine learning models.

Based on function, the global artificial intelligence AI in oil and gas industry is segmented as predictive maintenance, machinery inspection, material movement, production planning, field services, quality control, and reclamation. The predictive maintenance segment is the dominating segment among others.

The key reason for the growth of the segment is its major effect on maintaining costs and reducing downtime. Using artificial intelligence for predictive maintenance helps companies to recognize equipment failures beforehand. This ensures minimized accidental outages and smooth operations, thus improving lifespan and reliability.

Based on application, the global artificial intelligence AI in oil and gas market is segmented as upstream, midstream, and downstream. The upstream segment is anticipated to hold a notable share of the market over the coming years, followed by the midstream segment.

The upstream segment which comprises production and exploration of oil and gas, significantly benefits from artificial intelligence solutions. AI is broadly utilized for seismic data analysis, predictive maintenance of drilling machinery, reservoir modeling, and enhancing drilling operations. These applications improve exploration precision, enhance resource recovery, and reduce costs, which is essential in upstream activities.

Regional Analysis

Regional Analysis

- North America to hold significant growth during the estimated period

North America held a substantial share of the global artificial intelligence AI in oil and gas industry in 2023 and will continue its dominance in the future as well owing to the presence of majority players. Canada and the United States are home to numerous research institutes, fueling modernization. These companies have enhanced AI potential, which is increasingly used in the said sector. The region also holds strong financial markets that offer oil and gas firms with funding required to invest in AI solutions. The amalgamation of financial support and abundant resources boosts the adoption of AI in North America.

Asia Pacific region is projected to emerge as the second-leading region in the global artificial intelligence AI in oil and gas industry owing to the growing demand for energy and heavy investments in digital transformation and AI. Economies like Japan, India, and China have speedily accelerated energy demand. This fuels the AI adoption to enhance production, distribution process, and exploration. This improves efficiency and satisfies the increasing demand.

The leading oil and gas companies in the region like PetroChina and Sinopec are actively investing in AI for predictive maintenance, energy management, and exploration to enhance profitability and simplify operations. Governments are also heavily investing in AI-based technologies to reduce emission release and fuel efficiency.

Competitive Analysis

Competitive Analysis

The global artificial intelligence AI in oil and gas market is led by players like:

- ExxonMobil

- Chevron

- Shell

- BP

- TotalEnergies

- ConocoPhillips

- Halliburton

- Schlumberger

- Baker Hughes

- Equinor

- PetroChina

- Sinopec

- Saudi Aramco

- Cognite

- Uptake Technologies

Key Market Trends

Key Market Trends

- AI-based predictive maintenance:

Artificial intelligence is increasingly adopted to forecast machinery failures beforehand. This majorly reduces maintenance costs and downtime. Real-time data from AI algorithms and sensors allow early detection of errors, which enhances efficiency and reliability.

- AI in reservoir management and exploration:

AI is transforming exploration by enhancing seismic data analysis, improving reservoir management, and optimizing drilling activities. Machine learning models are assisting to identify and forecast unexplored reserves more precisely.

The global artificial intelligence AI in oil and gas market is segmented as follows:

By Component Segment Analysis

By Component Segment Analysis

- Software

- Hardware

- Services

By Function Segment Analysis

By Function Segment Analysis

- Predictive Maintenance

- Machinery Inspection

- Material Movement

- Production Planning

- Field Services

- Quality Control

- Reclamation

By Provider Segment Analysis

By Provider Segment Analysis

- Upstream

- Midstream

- Downstream

By Regional Segment Analysis

By Regional Segment Analysis

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- Southeast Asia

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Industry Major Market Players

- ExxonMobil

- Chevron

- Shell

- BP

- TotalEnergies

- ConocoPhillips

- Halliburton

- Schlumberger

- Baker Hughes

- Equinor

- PetroChina

- Sinopec

- Saudi Aramco

- Cognite

- Uptake Technologies

Copyright © 2024 - 2025, All Rights Reserved, Facts and Factors